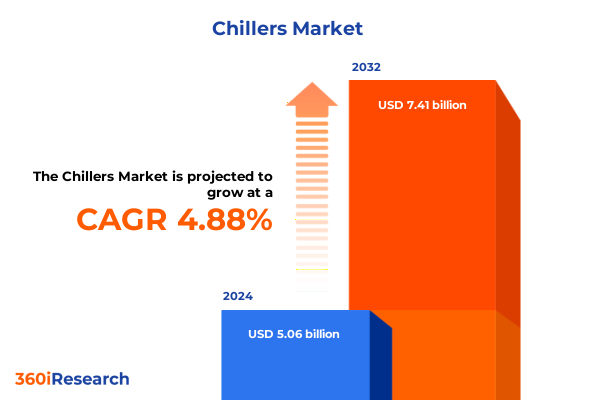

The Chillers Market size was estimated at USD 5.29 billion in 2025 and expected to reach USD 5.54 billion in 2026, at a CAGR of 4.91% to reach USD 7.41 billion by 2032.

Unveiling the Critical Role of Chillers in Modern Industrial and Commercial Applications as Sustainability Accelerates Through Advanced Cooling Solutions

The evolution of industrial and commercial cooling solutions has elevated chillers from auxiliary equipment to mission-critical assets in a myriad of sectors. Advances in energy efficiency, driven by tighter sustainability mandates and rising electricity costs, have placed chillers at the forefront of corporate decarbonization strategies. At the same time, rapid urbanization and expansion of data center capacity worldwide underscore the imperative for reliable, high-performance cooling systems. As organizations seek to balance operational excellence with environmental stewardship, chillers have emerged as a central pillar in the pursuit of sustainable, cost-effective thermal management.

This report opens with a comprehensive overview of the chiller ecosystem, charting its progression from conventional mechanical units toward intelligent, digitally enabled platforms. By exploring the convergence of modern refrigerants, advanced materials, and real-time monitoring technologies, readers will gain a holistic understanding of why chillers represent both an immediate operational necessity and a long-term competitive differentiator. Through the lens of recent case studies and industry benchmarks, this section sets the stage for the deeper insights that follow, illuminating how strategic investments in cooling infrastructure drive resilience and unlock new efficiencies.

Examining the Transformative Technological Regulatory and Demand Driven Shifts Redefining the Chiller Market and Driving Innovation Across Sectors

The chiller landscape is undergoing a period of profound transformation underpinned by technological breakthroughs, regulatory realignments, and evolving end-user demands. Internet of Things integration has accelerated the shift toward predictive maintenance and remote performance optimization, enabling operators to anticipate failures and fine-tune system output in real time. Concurrently, the phase-down of high-global-warming-potential refrigerants has compelled original equipment manufacturers to innovate around low-GWP blends and natural refrigerants, redefining the performance benchmarks for environmental compliance and safety.

Regulatory bodies across North America, Europe, and Asia have introduced stringent efficiency standards, incentivizing the adoption of variable-speed drives and magnetic-bearing compressors that achieve unprecedented part-load efficiencies. Meanwhile, burgeoning applications-from high-density data centers to bio-pharmaceutical process cooling-are pushing chiller specifications toward extreme reliability and precision. As a result, traditional vendor relationships are evolving into strategic partnerships, with integrated service offerings and outcome-based contracts emerging as critical value propositions. This section dissects these transformative shifts to illustrate how each factor is reshaping market dynamics and setting new expectations for performance, sustainability, and total cost of ownership.

Analyzing the Cumulative Impact of Recent United States Tariffs on Chiller Manufacturing Supply Chains Energy Costs and Competitive Strategies

The introduction of new United States tariffs in early 2025 has reverberated across global supply chains, affecting the availability and cost structure of chiller components such as heat exchanger coils, specialized steel alloys, and high-precision compressor elements. Manufacturers with heavy reliance on imported materials have experienced upward pricing pressures, prompting a reevaluation of supplier portfolios and logistics networks. In response, several leading OEMs have accelerated reshoring initiatives and forged strategic alliances with domestic steel and fabrication partners to mitigate raw material volatility.

These tariff‐induced cost escalations have also incentivized the acceleration of modular design principles, allowing end users to customize equipment configurations with locally sourced subassemblies. As a result, total lead times have decreased and aftermarket service parts have become more accessible, supporting rapid turnarounds and reducing downtime risk. Moreover, engineering teams are revisiting heat transfer technologies to enhance coil durability and allow for thinner, lighter materials that deliver equivalent performance at lower cost. This section unpacks the cumulative impact of the 2025 tariff regime, highlighting how manufacturers and end users alike are adapting procurement, design, and service strategies to navigate new trade environments.

Unlocking Actionable Insights Across Function Compressor Technology Power Range Application and End Use to Guide Strategic Chiller Investments

Insight into market segmentation reveals nuanced demand patterns across a spectrum of chiller configurations. Air cooled chillers dominate environments where simplicity and minimal water use are paramount, whereas evaporative coolers gain traction in regions with water-efficient infrastructure and favorable climatic profiles. Water-cooled chillers continue to hold sway where higher efficiency thresholds and stable operating conditions justify centralized cooling plants. Within these functions, centrifugal chillers serve large-scale installations such as industrial process cooling and district energy systems; screw chillers balance capital expenditure and energy performance for mid-range demands; and scroll chillers address smaller commercial applications with compact footprints and lower noise thresholds.

Power requirements further stratify market dynamics: systems below 100 kW fulfill localized comfort cooling and small laboratory mandates, while the 101 to 350 kW and 351 to 700 kW tiers represent the bulk of commercial building HVAC and mid-sized food and beverage operations. Projects demanding over 700 kW typically align with hyperscale data centers, petrochemical plants, and pharmaceutical manufacturing that require precise temperature control at scale. Across applications-from chemical and petrochemical processing to medical and pharmaceutical facilities-end users in commercial, industrial, and residential settings each prioritize distinct performance attributes, ranging from rapid temperature ramp-up to turnkey maintenance plans. Understanding these segmentation vectors enables suppliers to tailor product roadmaps and service models to evolving end-user expectations.

This comprehensive research report categorizes the Chillers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Function

- Compressor Technology

- Power Range

- Application

- End Use

Revealing Regional Trends and Emerging Opportunities Across the Americas Europe Middle East Africa and Asia Pacific Chiller Markets

Regional markets display divergent growth trajectories based on infrastructure maturity, regulatory stringency, and end-user profiles. In the Americas, robust data center expansions in the United States and ongoing industrial modernization in Brazil are fueling demand for high-efficiency water-cooled and centrifugal chillers. Local incentives targeting energy efficiency upgrades have accelerated retrofits and encouraged modular system deployments, particularly in the commercial building sector. Meanwhile, smaller operators are increasingly attracted to contract-based service models that reduce capital exposure and shift performance risk onto vendors.

Across Europe, the Middle East, and Africa, Europe’s stringent F-gas regulations are spurring a wave of equipment replacement and refrigerant conversion projects, creating opportunities for low-GWP and natural refrigerant chillers. The Middle East’s rapid urban growth and luxury hospitality developments are driving premium scroll and screw chiller installations, while African markets are at an earlier stage of adoption, focusing on modular air-cooled solutions to support infrastructure expansion. In Asia-Pacific, China’s aggressive industrial consolidation and renewable energy integration have established it as a hotbed for large-capacity centrifugal chillers, whereas India’s burgeoning pharmaceutical and data center investments are increasing demand across the 101 to 700 kW segments. Australia and Southeast Asia continue to prioritize evaporative and air-cooled solutions due to water constraints and tropical climates.

This comprehensive research report examines key regions that drive the evolution of the Chillers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Product Innovations and Competitive Dynamics Among Leading Global Chiller Manufacturers and Emerging Disruptors

The competitive landscape in the chiller industry features a blend of established multinationals and agile local innovators. Leading players have fortified their positions through strategic acquisitions of control systems startups and post-sales service providers, enhancing digital offerings and lifecycle management capabilities. They have also invested heavily in R&D centers to refine magnetic-bearing compressors, integrate advanced refrigerant blends, and optimize tubeless heat exchanger designs.

At the same time, mid-tier manufacturers and regional specialists are capitalizing on niche applications and cost-sensitive segments. By offering tailored service agreements, cloud-based performance monitoring platforms, and flexible financing options, these challengers are steadily eroding traditional share held by global incumbents. Moreover, partnerships between OEMs and IoT platforms have introduced new subscription-based cooling as a service models, redefining value propositions and intensifying competition across equipment sales, maintenance, and upgrades. This section profiles the strategic moves, innovation roadmaps, and partnership ecosystems that are shaping the industry’s competitive dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chillers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.C.M. Kälte Klima S.r.l.

- Aermec UK Ltd.

- Afinox Srl

- Airedale International Air Conditioning Ltd. by Modine Manufacturing Company

- Ait-Deutschland GmbH

- Atlas Copco Group

- Blue Star Limited

- Carrier Global Corporation

- Century Corporation

- Cold Shot Chillers

- Daikin Industries, Ltd.

- Drycool Systems India Private Limited

- EBARA CORPORATION

- Flamingo Chillers

- Geson Refrigeration Equipment CO., Ltd.

- Glen Dimplex Group

- Gree Electric Appliances Co., Ltd.

- HYDAC International GmbH

- Hyundai Climate Control.Co.Ltd.

- Johnson Controls International PLC

- Kawasaki Heavy Industries, Ltd.

- LG Electronics Inc.

- Mitsubishi Heavy Industries, Ltd.

- Nanjing TICA Environmental Technology Co., Ltd.

- Reynold India Private Limited

- Rinac India Limited

- Robur SpA

- Shuangliang Eco-energy Systems Co., Ltd.

- Thermax Limited

- Trane Technologies PLC

- World Energy

- Yazaki Corporation

Delivering Pragmatic and Impactful Recommendations to Help Industry Leaders Navigate Market Disruptions and Capitalize on Evolving Cooling Demands

Industry leaders should adopt a multi-pronged strategy to thrive amid intensifying competition and regulatory change. First, restructuring supply chains to integrate regional sourcing hubs will mitigate tariff impacts and enhance agility in parts replacement. Second, accelerating the development of low-GWP and natural refrigerant systems will align product portfolios with evolving environmental regulations and corporate sustainability targets. Third, embedding advanced sensors and predictive analytics into standard offerings will augment service revenue streams and strengthen customer retention through outcome-based contracts.

Furthermore, companies should explore collaborative R&D partnerships with universities and research institutes to stay ahead of breakthroughs in compressor design, heat transfer media, and digital twins. Finally, refining go-to-market strategies to include flexible financing, lease-to-own structures, and cooling-as-a-service models will lower entry barriers for price-sensitive end users and cultivate long-term recurring revenue. By implementing these recommendations, manufacturers and service providers can differentiate their offerings, optimize total cost of ownership for customers, and position themselves for sustained growth.

Detailing Rigorous Primary and Secondary Research Methodologies Ensuring Data Integrity and Comprehensive Analysis in Chiller Market Investigation

This analysis integrates insights from a rigorous blend of primary and secondary research. Primary inputs were gathered through structured interviews with senior executives at equipment manufacturers, end-user facility managers, and leading service providers, ensuring first-hand perspectives on emerging challenges and strategic priorities. Complementary surveys of procurement specialists and engineering consultants provided quantitative validation of adoption trends across key regions and applications.

Secondary research encompassed a thorough review of industry whitepapers, technical journals, and regulatory filings from environmental agencies, offering context on refrigerant phase-down schedules and efficiency standards. Data triangulation techniques were applied to reconcile discrepancies between sources, while iterative expert reviews ensured analytical rigor and relevance. The final deliverable reflects a convergence of empirical data, market intelligence, and thought-leadership insights designed to support informed decision making and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chillers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chillers Market, by Function

- Chillers Market, by Compressor Technology

- Chillers Market, by Power Range

- Chillers Market, by Application

- Chillers Market, by End Use

- Chillers Market, by Region

- Chillers Market, by Group

- Chillers Market, by Country

- United States Chillers Market

- China Chillers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Insights and Strategic Imperatives to Empower Decision Makers with a Clear Vision of the Future Evolution of the Chiller Market

In an era dominated by sustainability imperatives and digital transformation, the chiller market stands at a pivotal juncture. This report has illuminated how technological innovation, regulatory frameworks, and shifting end-user priorities converge to redefine cooling solutions across the globe. By dissecting supply chain adaptations prompted by tariff regimes, unraveling detailed segmentation dynamics, and contrasting regional growth patterns, decision makers now possess a panoramic view of the forces shaping market trajectories.

Looking ahead, the successful players will be those that embrace modular system architectures, decarbonized refrigerant technologies, and integrated service models. The transition toward predictive maintenance and outcome-based contracts will not only enhance operational reliability but also foster deeper customer partnerships. As energy efficiency and environmental compliance ascend corporate agendas, the insights presented here offer a strategic compass for navigating an increasingly complex competitive landscape.

Engage with Our Expert Associate Director to Secure Comprehensive Chiller Market Intelligence and Propel Your Organization Ahead of Market Dynamics

For a deeper dive into the dynamics, drivers, and disruptive forces shaping the global chiller industry, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your copy of the comprehensive market research report and empower your organization with the insights needed to drive growth and innovation

- How big is the Chillers Market?

- What is the Chillers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?