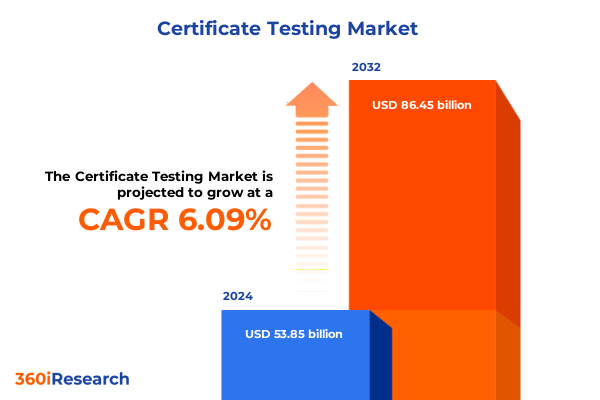

The Certificate Testing Market size was estimated at USD 56.93 billion in 2025 and expected to reach USD 60.24 billion in 2026, at a CAGR of 6.14% to reach USD 86.45 billion by 2032.

Setting the Stage for an In-Depth Exploration of the Certificate Testing Market’s Dynamics, Growth Drivers, and Strategic Industry Implications

The certificate testing market operates at the intersection of regulatory oversight, quality assurance, and technological innovation, making it a cornerstone of global product safety and performance. An introductory examination of this ecosystem reveals a complex network of laboratories, certification bodies, and industry stakeholders collaborating to verify that products meet stringent standards across safety, environmental impact, and functional performance. As industries evolve rapidly, the imperative for reliable testing has intensified, ensuring consumer trust, regulatory compliance, and supply chain resilience.

This report embarks on a detailed exploration of the certificate testing market’s multifaceted dimensions, shedding light on key drivers such as digital transformation, geopolitical shifts, and increasingly stringent regulatory frameworks. By mapping out the competitive landscape and segmenting market nuances, readers will gain a comprehensive understanding of how technological advancements-ranging from automated test equipment to advanced data analytics platforms-are reshaping service delivery models and operational efficiencies.

Through a blend of strategic analysis, expert perspectives, and forward-looking insights, this introduction establishes the foundational narrative for the journey ahead. It underscores the critical role of certificate testing in safeguarding end users while empowering organizations to launch products with confidence. This section sets the stage for an in-depth evaluation of transformative shifts, regional dynamics, segmentation trends, and actionable recommendations that collectively define the market’s trajectory.

Uncovering the Pivotal Technological, Regulatory and Market-Driven Inflection Points That Are Reshaping the Certificate Testing Industry Landscape

Over the past decade, the certificate testing industry has undergone profound transformation driven by rapid technological innovation and evolving regulatory paradigms. Digitalization of lab operations, powered by cloud-based data management systems, has accelerated throughput and enhanced traceability, enabling service providers to process higher testing volumes with greater precision. At the same time, the integration of artificial intelligence and machine learning into test protocols is ushering in predictive analytics capabilities, allowing laboratories to identify potential compliance risks before they manifest in final products.

Regulatory agencies worldwide are also converging on more harmonized frameworks, reducing redundant certification hurdles but raising the bar for data integrity and transparency. These regulatory shifts have catalyzed the emergence of risk-based testing models, where resources are strategically allocated toward areas of greatest safety or environmental concern. This approach not only optimizes operational costs but also aligns with sustainability mandates, further embedding environmental testing into mainstream service offerings.

Market-driven factors, such as the proliferation of IoT-enabled devices and the push for electrification in automotive and aerospace sectors, have intensified demand for specialized testing disciplines-ranging from electromagnetic compatibility to high-voltage endurance assessments. As a result, incumbent players and new entrants alike are forging strategic partnerships to bolster their technical capabilities. In parallel, the rise of on-site testing and mobile labs is diminishing geographic barriers, offering end users faster turnaround times and localized compliance support. Collectively, these transformative inflection points are redefining competitive differentiation and setting new standards for speed, accuracy, and service breadth in certificate testing services.

Analyzing the Amplified Effects of 2025 Tariff Policies on Certificate Testing Operations, Supply Chains, and Competitive Positioning Across Markets

In 2025, newly implemented United States tariffs targeting electronics components and industrial equipment have introduced pronounced ripple effects across certificate testing operations. Supply chain disruptions and elevated costs for imported raw materials have compelled testing laboratories to reassess pricing models and contractual terms, with many passing through increased fees to end users. Simultaneously, lead times have lengthened as certification bodies navigate imported equipment inspection, calibration, and validation under stricter customs protocols.

The cumulative impact of these tariff measures has also prompted a reevaluation of global sourcing strategies. Service providers are exploring partnerships with domestic equipment manufacturers to mitigate exposure to import duties and ensure uninterrupted access to critical test instruments. This strategic pivot has bolstered the resilience of local equipment ecosystems but has required significant capital investment and technical upskilling within laboratory teams.

Moreover, the tariff landscape has influenced competitive positioning among certificate testing firms. Those with diversified global footprints and in-house calibration capabilities have navigated cost pressures more effectively than smaller, regionally focused laboratories. To sustain margin integrity, many providers have also accelerated the adoption of digital test automation platforms, reducing reliance on high-cost manual processes. As the industry adapts, these tariff-induced dynamics underscore the importance of supply chain agility, strategic capital allocation, and advanced operational technology in maintaining service quality and competitive advantage.

Deriving Insights from Diverse Perspectives on Testing Services, Development Stages, Industry Applications, and End-User Requirements to Illuminate Market Nuances

Deriving insights from the breadth of testing service categories reveals that compliance testing continues to anchor market stability, driven by the persistent need to satisfy regulatory mandates. In parallel, the emergence of environmental testing as a core offering reflects heightened corporate sustainability commitments and the proliferation of green product standards. Performance testing remains indispensable for sectors demanding rigorous validation of mechanical and functional attributes, while quality testing endures as a universal requirement for product consistency and defect reduction. Safety testing has intensified in scope, especially for industries where end-user well-being is paramount, and specialized testing disciplines-such as cybersecurity assessments for connected devices-are gaining traction as new risk vectors emerge.

Examining the market through a stage-based lens highlights how prototype testing is critical for early design verification, enabling manufacturers to identify and rectify potential failure modes before full-scale production. Pre-certification testing serves as a preparatory phase, guiding product refinement for regulatory compliance. Once products enter the market, final product testing validates performance under real-world conditions, while post-certification testing ensures ongoing conformity as standards evolve and products undergo iterative updates.

The application of certificate testing varies significantly across industry verticals, with aerospace and defense prioritizing the highest levels of safety and performance assurance; automotive and transportation demanding rigorous durability and crashworthiness evaluations; construction and infrastructure emphasizing structural integrity and environmental resilience; electronics and electrical focusing on electromagnetic compatibility and fire safety; energy and utilities requiring high-voltage endurance and lifecycle performance testing; food and beverages centering on contamination prevention and shelf-life studies; IT and telecommunications leaning heavily on environmental stress and network reliability assessments; and medical and healthcare rigorously testing biocompatibility and sterilization protocols for patient safety.

From an end-user perspective, government and public sector agencies set regulatory benchmarks and often mandate third-party validation to safeguard public welfare. Large enterprises integrate testing services into their product development lifecycles, leveraging advanced analytics to drive continuous improvement. Private certification bodies offer scalable, specialized services to a wide range of clients, while small and medium enterprises increasingly outsource testing to access technical expertise and cost efficiencies without the need for in-house laboratories. Collectively, these segmentation lenses illuminate the nuanced demands and value drivers shaping strategic service offerings across the certificate testing ecosystem.

This comprehensive research report categorizes the Certificate Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Testing Service

- Stage

- Industry Application

- Deployment Mode

- End-User

- Organization Size

Evaluating Regional Dynamics to Reveal Opportunities, Regulatory Challenges, and Growth Trajectories Across the Americas, EMEA, and Asia-Pacific

Across the Americas, certificate testing providers benefit from mature regulatory frameworks in the United States and Canada that enforce stringent safety, environmental, and performance criteria. This regulatory rigor drives consistent demand for advanced testing capabilities, especially in aerospace, energy, and medical device sectors. Market participants in Latin America are also scaling their service portfolios, responding to burgeoning infrastructure projects and automotive manufacturing clusters that require local certification support.

In Europe Middle East Africa, the harmonization of standards under the European Union’s CE marking system has reduced barriers to cross-border trade, while simultaneously elevating the complexity of regional compliance requirements. Providers in Western Europe excel in specialized and environmental testing, supported by robust R&D collaborations, whereas emerging economies in the Middle East and Africa are accelerating lab accreditation and capacity-building initiatives to meet growing infrastructure and energy demands.

Asia-Pacific’s rapid industrialization and electronics manufacturing dominance have catalyzed exponential growth in testing services. China, Japan, South Korea, and Taiwan lead in high-throughput laboratories that cater to consumer electronics, automotive components, and telecommunications equipment. Meanwhile, Southeast Asian markets are investing in testing infrastructure modernization to capture share from global supply chains and support medical device growth in the region. The interplay of government incentives, local standards development, and private sector investment continues to drive a dynamic competitive landscape across Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Certificate Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Approaches and Competitive Differentiators of Leading Organizations Driving Innovation and Excellence in Certificate Testing Services

Leading organizations in the certificate testing domain distinguish themselves through strategic investments in cutting-edge laboratory infrastructure and digital integration. One prominent firm has expanded its footprint by establishing centers of excellence in automation and data analytics, enabling real-time reporting and predictive maintenance services. Another global player has pursued targeted acquisitions to acquire specialized capabilities in high-voltage and electromagnetic compatibility testing, strengthening its end-to-end service portfolio across critical sectors.

Strategic partnerships between certification providers and academic institutions have fostered the co-development of novel test methods for emerging materials and technologies. This collaboration has propelled advancements in battery safety testing for electric vehicles and enhanced the rigor of biocompatibility assessments for next-generation medical devices. Meanwhile, industry alliances with equipment manufacturers have facilitated seamless integration of hardware and software platforms, optimizing test protocols and reducing calibration downtime.

Investment in proprietary digital platforms is also a defining trend among key market players. These platforms consolidate test data, automate workflow orchestration, and deliver insights through intuitive dashboards, empowering clients to make data-driven decisions throughout their product lifecycles. Additionally, some companies have differentiated by offering mobile and on-site testing solutions, catering to industries where time-to-market and localized compliance checks are critical.

Competitive differentiation is further underscored by robust training programs and technical support services, ensuring that clients not only receive test reports but also gain the expertise to interpret results and implement corrective actions. By combining operational excellence, technological innovation, and client-centric service models, these leading organizations continue to set benchmarks for quality and reliability in certificate testing services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Certificate Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALS Limited

- Apave Group

- Applus Services, S.A.

- AsureQuality Ltd.

- Babcock International Group PLC

- British Standards Institution

- Bureau Veritas SA

- CSA Group

- DEKRA SE

- DNV AS

- Element Materials Technology

- Eurofins Scientific SE

- Fime SAS

- FoodChain ID Group, Inc.

- Helmut Fischer Group

- Intertek Group PLC

- Kiwa N.V.

- LRQA Group Limited

- MISTRAS Group, Inc.

- Nemko Group AS

- QIMA Limited

- SGS S.A.

- TUV SUD AG

- TÜV Rheinland AG

- UL LLC

Empowering Industry Leaders with Practical Strategies to Navigate Market Complexities, Embrace Innovations, and Accelerate Sustainable Growth in Testing Services

To thrive amid evolving market complexities, industry leaders should prioritize the digital transformation of their laboratory operations by integrating cloud-based data management and AI-driven analytics. This will enhance throughput, improve data integrity, and streamline compliance workflows. Concurrently, firms must invest in expanding specialized testing capabilities-particularly in areas such as cybersecurity and sustainability assessments-to meet the emerging needs of connected and environmentally conscious products.

Risk-based testing frameworks should be adopted to allocate resources efficiently, focusing on high-impact test scenarios and reducing redundant evaluations. By leveraging predictive maintenance and real-time monitoring of test equipment, laboratories can minimize downtime and optimize operational costs. Moreover, forging strategic alliances with upstream equipment manufacturers and research institutions can accelerate the co-creation of innovative test methods and facilitate access to advanced instrumentation.

A region-specific service strategy is essential for capitalizing on local market opportunities. Tailoring service offerings to align with regional regulatory nuances and industry growth drivers will position providers to capture incremental market share. At the same time, strengthening workforce competencies through targeted training programs will ensure that technical teams remain proficient in the latest test standards and methodologies.

Finally, embedding sustainability and environmental stewardship into service portfolios will resonate with clients seeking to demonstrate corporate responsibility. Offering lifecycle environmental impact assessments and carbon footprint verification can open new revenue streams while reinforcing the lab’s role as a strategic partner in clients’ sustainability journeys.

Detailing Rigorous Methodological Frameworks, Data Collection Approaches, and Analytical Techniques Underpinning the Certificate Testing Market Assessment

The research underpinning this certificate testing market analysis employed a rigorous, multi-phased methodology to ensure comprehensiveness and accuracy. Initial secondary research involved extensive review of regulatory documents, industry standards, and technical publications to map the landscape of testing disciplines and service models. Proprietary databases were then leveraged to collect historical and contemporary case studies, operational metrics, and service adoption rates.

Primary research followed, comprising in-depth interviews with senior executives from certification bodies, laboratory managers, and end-user organizations spanning key industry verticals. These discussions provided qualitative insights into strategic priorities, operational challenges, and emerging demand drivers. To validate and triangulate findings, survey data was collected from a broad cross-section of stakeholders, quantifying service preferences, pricing sensitivities, and investment trends.

Quantitative analysis techniques-such as regression modeling and scenario testing-were applied to assess the impact of external factors including tariff policies, digitalization trends, and regional regulatory shifts. Data triangulation exercises ensured that divergent data points converged toward coherent conclusions, while expert panel reviews offered critical validation of analytical assumptions and interpretations.

Throughout the study, strict quality assurance protocols were maintained, encompassing data cleansing, consistency checks, and peer reviews at each stage. This methodological rigor ensures that the insights and recommendations presented are robust, actionable, and reflective of the current dynamics in the certificate testing market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Certificate Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Certificate Testing Market, by Testing Service

- Certificate Testing Market, by Stage

- Certificate Testing Market, by Industry Application

- Certificate Testing Market, by Deployment Mode

- Certificate Testing Market, by End-User

- Certificate Testing Market, by Organization Size

- Certificate Testing Market, by Region

- Certificate Testing Market, by Group

- Certificate Testing Market, by Country

- United States Certificate Testing Market

- China Certificate Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings and Strategic Takeaways to Equip Stakeholders with Actionable Knowledge in the Evolving Certificate Testing Ecosystem

This analysis has uncovered the intricate interplay between technological innovation, regulatory evolution, and market dynamics shaping the certificate testing landscape. From the catalytic role of AI and digital platforms to the strategic ramifications of 2025 tariff policies, the industry is defined by its capacity to adapt and innovate. Segmentation by testing service, developmental stage, application sector, and end-user highlights the specialized requirements driving service portfolios, while regional insights emphasize the importance of localized strategies.

Leading companies set benchmarks through infrastructure investments, collaborative research initiatives, and digital integration, underscoring the competitive advantage of agility and technical expertise. Actionable recommendations-including the adoption of risk-based frameworks, strategic partnerships, and sustainability-focused offerings-provide a roadmap for organizations aiming to strengthen market positioning and operational resilience.

Overall, the confluence of data-driven decision-making, methodological rigor, and strategic foresight delineated in this report equips stakeholders with the knowledge necessary to navigate complexities and seize emerging opportunities within the certificate testing ecosystem.

Engaging with Associate Director Ketan Rohom to Secure Tailored Market Intelligence and Support Strategic Planning and Growth Initiatives

To obtain the full depth of analysis, exclusive data sets, and customized advisory support, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive certificate testing market report can align with your strategic priorities. Engage in a personalized briefing to delve into granular insights, validate your business assumptions, and harness robust intelligence designed to accelerate your market positioning and competitive edge. Investing in this tailored research will equip your organization with the clarity and confidence to navigate regulatory complexities and capitalize on emerging opportunities.

- How big is the Certificate Testing Market?

- What is the Certificate Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?