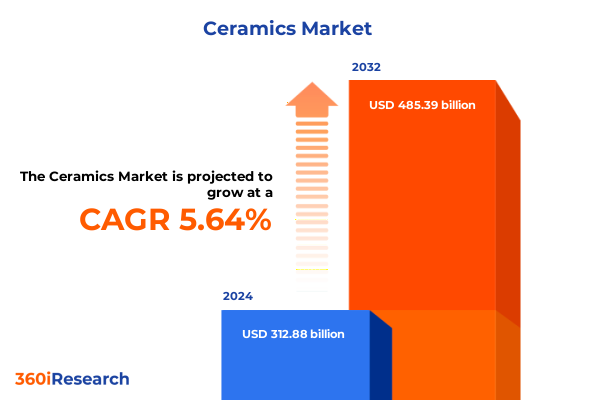

The Ceramics Market size was estimated at USD 330.58 billion in 2025 and expected to reach USD 347.62 billion in 2026, at a CAGR of 5.64% to reach USD 485.39 billion by 2032.

Discovering the Multifaceted World of Advanced and Traditional Ceramics Through Innovation, Tradition, Sustainable Solutions, and Emerging Global Market Dynamics

The ceramics sector has evolved into a dynamic landscape where historical craftsmanship converges with cutting-edge technological advancements. This report opens by contextualizing ceramics’ dual lineage: a legacy industry rooted in centuries-old traditions and a rapidly advancing domain driven by modern engineering. As materials science breakthroughs fuel demand for composite ceramics, non-oxide ceramics, and advanced oxide formulations, traditional categories such as earthenware, porcelain, and stoneware continue to hold cultural and commercial significance.

In parallel, the supply of raw materials ranging from alumina and zirconia to clay and kaolin underpins both innovation and enduring practices, while manufacturing processes including 3D printing, injection molding, and isostatic pressing redefine production efficiencies. Surface treatments-whether glazed for aesthetic appeal, polished for precision applications, or left unglazed for functional uses-play a critical role in differentiating end products across sectors. Driven by diverse end-user industries, from aerospace & defense thermal barrier coatings to high-performance automotive brake discs and medical orthopedic implants, the ceramics market presents complex interdependencies.

Against this backdrop, this executive summary offers a concise yet comprehensive overview of transformative shifts, tariff influences, key segmentation insights, and regional dynamics. By charting these trends, we establish the foundation for informed strategic planning that aligns with both the technological momentum and traditional market undercurrents shaping ceramics today.

Unprecedented Technological and Supply Chain Innovations Reshaping Ceramics Manufacturing and Accelerating Specialized Applications Globally

Over the past decade, the ceramics industry has witnessed transformative shifts that have redefined both production paradigms and market expectations. Technological advancements in additive manufacturing, particularly 3D printing of ceramic composites, have catalyzed the emergence of complex geometries and rapid prototyping that were previously unattainable. Concurrently, the maturation of non-oxide ceramics has opened doors to extreme-temperature and wear-resistant applications, propelling growth in high-stress sectors such as aerospace engines and automotive exhaust systems.

Supply chain innovations are further enhancing efficiency and sustainability, with recycling initiatives and alternative raw materials reducing dependence on traditional clay and kaolin sources. Surface engineering techniques, including advanced polishing methods and eco-friendly glazes, are elevating product longevity and functional performance. These shifts are complemented by the migration of manufacturing capabilities to regions offering cost-effective production paired with quality assurance, intensifying competition and encouraging strategic partnerships.

As customer expectations evolve toward tailored solutions, the market is gravitating away from one-size-fits-all products toward specialized offerings in medical implants, radar components, and high-voltage insulators. In essence, these transformative forces are converging to create a ceramics industry that is increasingly defined by precision engineering, sustainable sourcing, and agile production methods.

Analyzing the Strategic and Financial Repercussions of the 2025 United States Ceramics Tariff Adjustments Across the Entire Value Chain

The introduction of 2025 United States tariff measures has had a cumulative impact that reverberates across the entire ceramics value chain. Tariff adjustments on imported technical ceramics and traditional wares have prompted manufacturers to reassess sourcing strategies, driving a renewed focus on domestic production capabilities. This shift has heightened capital investments in local facilities, stimulated by the imperative to mitigate cost pressures associated with cross-border trade. Consequently, companies have accelerated automation upgrades and leaned into additive manufacturing to shore up competitive positioning.

These tariff-driven dynamics have had a cascading effect on pricing strategies and customer negotiations, with distributors seeking clarity on landed costs amid fluctuating duties. In response, suppliers are exploring tariff exclusion requests and leveraging free trade agreements to secure preferential treatment for critical raw materials like alumina and zirconia. Moreover, long-term contracts and hedging mechanisms have become integral to managing cost volatility, especially for end-use segments such as aerospace thermal barrier coatings and medical ceramic implants where material purity is paramount.

Ultimately, the cumulative effect of these tariff policies has underscored the importance of supply chain resilience and strategic agility. By understanding the interplay between duties, domestic capacity, and alternative sourcing pathways, industry players can anticipate cost trajectories and adapt procurement models to safeguard margins in a shifting trade environment.

Deep Dive into Ceramic Market Segmentation Reveals Targeted Opportunities Across Product Types, Processes, Materials, and End Applications

A nuanced understanding of market segmentation reveals critical pathways to differentiated value creation and competitive advantage. By product type, the market bifurcates into technical ceramics-spanning composite ceramics prized for their high strength-to-weight ratios, non-oxide ceramics engineered for extreme environments, and oxide ceramics delivering stability and dielectric performance-and traditional ceramics characterized by earthenware’s versatility, porcelain’s refined properties, and stoneware’s resilience.

Shifting focus to raw materials, segments such as alumina and zirconia serve as cornerstones for advanced applications, while clay and kaolin maintain their status as indispensable inputs for conventional wares. Manufacturing process segmentation highlights 3D printing’s agility in prototyping, injection molding’s precision for complex components, dry and isostatic pressing’s efficiency in high-volume runs, and slip casting’s cost-effectiveness for standardized products. Surface treatment considerations extend the value chain through polished finishes for semiconductor substrates, glazed interfaces for sanitaryware, and unglazed textures for industrial insulators.

End-user industry segmentation delineates growth pockets within aerospace and defense for engine and radar components, automotive for brake discs and sensors, construction and infrastructure for tiles and sanitaryware, electrical and electronics for capacitors and piezoelectric devices, and medical for bone substitutes and surgical instruments. By weaving these segmentation layers into strategic frameworks, organizations can pinpoint investment opportunities, drive R&D focus, and tailor go-to-market strategies that resonate with specific application demands.

This comprehensive research report categorizes the Ceramics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- Manufacturing Process

- Surface Treatment

- End User Industry

Examining Divergent Regional Trends and Growth Drivers in Ceramics to Inform Tailored Strategies Across Key Global Markets

Regional dynamics in ceramics production and consumption reflect a complex interplay of industrial capabilities, regulatory landscapes, and end-user demands. In the Americas, longstanding expertise in technical ceramics is augmented by robust domestic research institutions and defense contracting ecosystems, positioning local players to innovate in thermal barrier coatings and high-voltage insulators. Simultaneously, demand for traditional earthenware and stoneware remains stable, supported by residential construction and infrastructure refurbishment trends.

Across Europe, the Middle East, and Africa, regulatory emphasis on sustainability and emissions reductions is incentivizing the adoption of eco-friendly surface treatments and recycled raw materials. European manufacturers are pioneering bio-based glazes, while Middle Eastern facilities are expanding capacity for specialized ceramic tiles to meet booming construction needs. The region’s diverse market maturities necessitate adaptive strategies that balance high-end technical offerings with cost-sensitive traditional products.

In the Asia-Pacific, rapid urbanization and industrial expansion continue to drive demand in both established and emerging markets. China and Japan lead in oxide and non-oxide innovations, supported by vertically integrated supply chains, whereas Southeast Asia is evolving into a hub for cost-optimized production and export. Across these geographies, the confluence of infrastructure development, technological adoption, and policy incentives signals sustained growth potential and underscores the need for regionally tailored go-to-market approaches.

This comprehensive research report examines key regions that drive the evolution of the Ceramics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into Leading Ceramics Firms’ Strategies Highlighting Integration, Innovation, and Sustainability Initiatives Driving Market Leadership

Leading companies in the ceramics domain are leveraging diverse strategies to solidify their market positions and catalyze innovation. Major participants have embraced vertical integration, aligning upstream raw material extraction with downstream manufacturing to ensure quality consistency and supply security. Strategic acquisitions and joint ventures have further expanded capabilities in specialized segments such as non-oxide ceramic composites and biomedical implants.

In parallel, investments in advanced manufacturing platforms, including robotics-enabled injection molding lines and pilot 3D printing centers, are enabling rapid iteration of complex component designs. Collaborative research alliances with universities and national laboratories are accelerating the commercialization of next-generation materials, particularly those tailored for extreme temperature or biocompatible applications. Moreover, digitalization efforts around process monitoring and data analytics are enhancing yield, reducing scrap, and improving traceability across production batches.

To maintain differentiation, companies are also exploring sustainable practices, such as closed-loop recycling of porcelain and stoneware, and developing eco-friendly surface treatments that meet stringent environmental regulations. These multifaceted approaches underscore the competitive imperative to integrate innovation, operational excellence, and sustainability across the entire ceramics value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Active Enterprises

- AGC Group

- Ants Ceramics

- Applied Ceramics Inc.

- Blasch Precision Ceramics Inc.

- Ceramitec Industries

- CeramTec GmbH

- COI Ceramics Inc.

- Compagnie de Saint-Gobain S.A.

- CoorsTek Inc.

- Corning Incorporated

- Elan Technology

- Ferrotec (USA) Corporation

- Grupo Pamesa Cerámica S.A.

- IMERYS Ceramic

- Kyocera Corporation

- MARUWA Co., Ltd.

- Materion Corporation

- McDanel Advanced Ceramic Technologies LLC

- Morgan Advanced Materials plc

- Rauschert GmbH

- Resonac Holdings Corporation

- Villeroy & Boch AG

- Wonik QnC Corporation

Actionable Strategies for Ceramics Industry Leaders to Leverage Innovation, Supply Chain Resilience, and Sustainability for Competitive Advantage

Industry leaders seeking to navigate the evolving ceramics landscape must adopt a proactive stance that aligns with technological, regulatory, and market forces. First, prioritizing investment in additive manufacturing capabilities and digital process controls will accelerate product development cycles and enhance customization potential. Concurrently, forging strategic partnerships with academic and research institutions can de-risk R&D and provide early access to novel materials formulations.

Second, diversifying raw material sourcing and pursuing tariff exclusion opportunities will mitigate cost inflation triggered by trade policy shifts. Establishing joint procurement agreements and localizing critical supply chains for key inputs such as alumina and zirconia will fortify resilience. Third, tailoring product portfolios to high-growth end-user industries-particularly aerospace thermal barrier systems, medical orthopedic implants, and advanced automotive sensors-will drive differentiation and margin expansion.

Finally, embedding sustainable practices throughout the value chain-from recycled material content in traditional wares to low-emission surface treatment technologies-will not only satisfy regulatory demands but also resonate with increasingly eco-conscious customers. By integrating these recommendations, organizations can position themselves to capitalize on emerging opportunities, manage risks effectively, and maintain a competitive edge in a dynamic market.

Comprehensive Research Approach Combining Primary Qualitative Interviews and Secondary Data Triangulation to Deliver Authoritative Ceramics Market Intelligence

This report’s methodology integrates rigorous primary and secondary research to ensure robust and reliable insights. Primary research encompassed in-depth interviews with key stakeholders across the value chain, including raw material suppliers, process technology providers, and end-user decision-makers in aerospace, automotive, construction, electronics, and medical sectors. These qualitative discussions were designed to capture first-hand perspectives on innovation drivers, pricing dynamics, and regulatory impacts.

Complementing primary inputs, secondary research drew on a wide spectrum of authoritative sources, including industry journals, patent filings, trade association publications, and government tariff documentation. Data triangulation techniques were applied to reconcile discrepancies and validate emerging trends. Segmentation frameworks were developed based on standard criteria-product type, raw material composition, manufacturing process, surface treatment, and end-use application-to facilitate granular analysis.

Analytical models incorporated scenario analyses to assess tariff implications and regional demand variations. The synthesis of quantitative and qualitative evidence produced actionable insights, while peer review sessions with subject matter experts ensured accuracy and credibility. This comprehensive approach provides a clear and defensible basis for strategic decision-making in the ceramics market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramics Market, by Product Type

- Ceramics Market, by Raw Material

- Ceramics Market, by Manufacturing Process

- Ceramics Market, by Surface Treatment

- Ceramics Market, by End User Industry

- Ceramics Market, by Region

- Ceramics Market, by Group

- Ceramics Market, by Country

- United States Ceramics Market

- China Ceramics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Ceramics Market Insights to Enable Strategic Alignment and Proactive Decision-Making in a Dynamic Global Environment

As the ceramics industry advances into an era defined by rapid technological innovation, supply chain realignment, and evolving trade policies, stakeholders are presented with both challenges and opportunities. This report has illuminated how segmentation across product types, raw materials, processes, surface treatments, and end-user industries creates a multi-dimensional market landscape. Simultaneously, regional nuances and 2025 tariff adjustments underscore the criticality of localized strategies and supply chain diversification.

The collective insights into leading company initiatives reveal that success hinges on integrating digital manufacturing, sustainable practices, and strategic partnerships. By aligning organizational capabilities with high-growth application areas such as aerospace components, medical implants, and electronic substrates, companies can future-proof their offerings. Furthermore, proactive risk management around trade policy impacts and raw material availability will safeguard operational continuity.

Ultimately, this executive summary condenses vital intelligence that empowers decision-makers to refine their strategic roadmaps, optimize product portfolios, and capture emerging opportunities. The next phase of growth in ceramics will be shaped by those who adeptly balance innovation, resilience, and market responsiveness.

Unlock Premium Market Insights and Strategic Guidance Through a Direct Consultation with Ketan Rohom to Accelerate Your Ceramics Business Growth

The ceramics market stands at a pivotal crossroads where actionable insights can propel strategic growth and foster sustained competitive advantage. Engaging with our in-depth research will equip you with the nuanced understanding required to navigate shifting market forces, identify high-potential segments, and optimize supply chain strategies. Reach out to Ketan Rohom, Associate Director of Sales and Marketing, to discuss tailored solutions and secure comprehensive access to global market intelligence that will inform your decision-making and drive business outcomes.

- How big is the Ceramics Market?

- What is the Ceramics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?