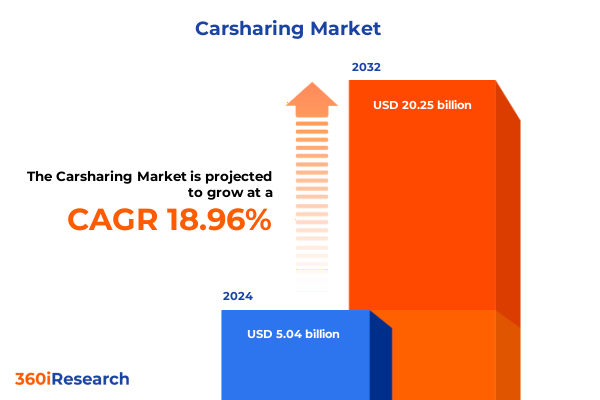

The Carsharing Market size was estimated at USD 6.00 billion in 2025 and expected to reach USD 7.14 billion in 2026, at a CAGR of 18.97% to reach USD 20.25 billion by 2032.

Discover How Consumer Behavior, Technology Innovations, and Urbanization Drivers Are Revolutionizing Carsharing Models and Redefining Urban Mobility Experiences

The landscape of urban mobility is undergoing a profound transformation as shared vehicle access emerges as a cornerstone of modern transportation strategies. With growing consumer demand for convenient, cost-effective alternatives to personal car ownership, mobility providers are reimagining service models to deliver seamless, on-demand access that caters to the diverse needs of both individual and corporate users. Urbanization trends, evolving workforce patterns, shifting lifestyle preferences, and heightened environmental awareness have all converged to propel carsharing into the mainstream of metropolitan travel solutions.

Against this backdrop, digital platforms and smartphone connectivity are driving unprecedented levels of user engagement and operational efficiency. Integrated telematics, real-time data analytics, and advanced reservation systems enable providers to optimize fleet utilization, dynamically adjust pricing, and enhance the user experience. As consumers increasingly expect personalized mobility ecosystems, providers that harness these digital capabilities can differentiate their offerings through intuitive interfaces, loyalty incentives, and seamless end-to-end journey management. Furthermore, the imperative to reduce carbon footprints and comply with stringent urban emission targets has intensified the shift toward electrified fleets, reinforcing the role of technology and alternative energy sources in shaping the future of shared mobility.

In this dynamic environment, stakeholders must remain vigilant of emerging consumer segments, regulatory developments, and competitive pressures. By understanding the intricate interplay between service innovation, urban policy, and customer expectations, industry participants can position themselves to capitalize on new growth opportunities while contributing to more sustainable, livable cities.

Examine the Pivotal Technological Advances, Sustainability Imperatives, and Policy Innovations Transforming Carsharing Dynamics Across Global Urban Ecosystems

In recent years, the carsharing sector has experienced a series of transformative shifts as technology advancement, environmental imperatives, and policy innovation intersect to reshape traditional mobility frameworks. The proliferation of connected vehicle platforms and over-the-air software updates has enabled providers to deploy new features at scale, from seamless keyless entry to AI-driven demand forecasting. These innovations support more efficient fleet repositioning, reduced downtime, and improved asset lifecycle management, ultimately enhancing profitability and user satisfaction.

Simultaneously, sustainability considerations have moved to the forefront of strategic decision-making. Providers are increasingly committing to fully electrified or hybrid fleets to meet both regulatory requirements and consumer preferences for greener travel options. This shift is supported by expanding charging infrastructure networks, partnerships with energy providers, and the adoption of vehicle-to-grid integration technologies. As a result, operators are achieving lower operating costs through reduced fuel consumption and maintenance needs, while also delivering on environmental targets that resonate with corporate clients and eco-conscious consumers.

Policy frameworks at the municipal and national levels are also catalyzing change by incentivizing shared mobility through dedicated parking zones, reduced access fees, and grant programs that support electrification. In parallel, data privacy regulations and insurance guidelines are evolving to address the unique risk profiles of shared fleets, prompting collaboration between providers, insurers, and regulators to establish robust compliance protocols. Together, these technological, environmental, and regulatory forces are elevating carsharing from a niche offering to a foundational component of integrated urban mobility systems.

Explore the Multifaceted Effects of New Trade Tariffs and Regulatory Shifts on Carsharing Fleet Costs, Vehicle Sourcing, and Lifecycle Management Strategies

On March 27, 2025, the United States government implemented a 25 percent tariff on all imported passenger vehicles, marking a significant departure from previous trade policies and directly affecting the cost structures of carsharing fleets that rely on international sourcing for new vehicles. This measure, which targets vehicles from key trading partners including Germany, Japan, and South Korea, introduces higher acquisition costs and potential supply chain delays for providers that have built their fleets around a mix of domestic and imported models. In the immediate term, these increased prices may be passed along to end users through elevated usage fees or surcharges, potentially dampening demand among price-sensitive segments.

In the short run, the imposition of auto tariffs is projected to reduce U.S. electric vehicle sales by approximately two to three percent, as higher sticker prices undercut the affordability advantage that has supported EV adoption within shared mobility fleets. Carsharing operators that have committed to electrified or hybrid models may face a strategic dilemma, balancing the desire to meet environmental goals against the need to maintain competitive pricing. Moreover, the proposed ten percent tariff on vehicles from the European Union and potential levies on auto parts threaten to further complicate fleet expansion plans and maintenance operations, elevating the importance of domestic manufacturing partnerships and local supply chain resilience.

Looking ahead, these trade measures could incentivize long-term investment in U.S.-based vehicle and battery production, provided that operators and manufacturers believe tariffs will remain in force. However, the associated uncertainty may delay procurement decisions and prompt fleet managers to explore alternative business models, such as peer-to-peer vehicle sharing or subscription-based services that minimize capital outlays. As the cost of imported vehicles and parts stabilizes under new tariff regimes, carsharing providers will need to reassess their sourcing strategies, renegotiate supplier agreements, and potentially accelerate the transition to smaller, more standardized EV platforms produced domestically.

Unveil Critical Insights on How Service Models, Vehicle Types, Trip Patterns, Pricing Structures, Payment Options, and User Profiles Shape Market Differentiation

The carsharing market exhibits remarkable diversity in service models, each with distinct operational and user engagement dynamics. Free-floating offerings enable on-demand pick-up and drop-off within a defined urban zone, catering to highly flexible, short-duration trips; peer-to-peer platforms leverage privately owned vehicles to expand network density without significant capital expenditure, while station-based systems, structured around one-way or round-trip use, optimize asset rotation and fleet visibility through designated hubs. Within these paradigms, station-based round-trip services tend to attract planning-oriented users seeking predictable scheduling, whereas station-based one-way solutions appeal to commuters desiring seamless end-point transitions without parking constraints.

Vehicle type also serves as a powerful differentiator, as operators select electric, hybrid, or internal combustion engine fleets to align with cost structures, infrastructure availability, and sustainability objectives. Electric models, supported by growing charging networks, resonate with environmentally focused customers and corporate sustainability mandates, while hybrid alternatives strike a balance between fuel efficiency and broader geographic operability. Internal combustion units, meanwhile, remain prevalent in markets where EV charging remains nascent or where trip lengths exceed current battery ranges.

Trip type segmentation-one-way versus round-trip-further informs fleet utilization and pricing models, influencing decisions around vehicle allocation and service area design. Pricing frameworks can follow distance-based structures, subdivided into per-kilometer or per-mile tariffs, subscription schemes offering annual or monthly commitments, or time-based fees calculated on daily or hourly usage. Payment models diverge between postpaid billing cycles, favored by corporate clients seeking expense consolidation, and prepaid alternatives that enhance transparency for occasional users. Finally, user type delineation between business and consumer segments drives tailored feature bundles, with enterprises prioritizing integration with expense management platforms and consumers gravitating toward user-friendly mobile applications and loyalty incentives.

This comprehensive research report categorizes the Carsharing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Vehicle Type

- Trip Type

- Pricing Model

- Payment Model

- User Type

Examine Regional Variations in Carsharing Adoption, Regulation, and Infrastructure Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Across the Americas, carsharing has matured into an essential urban mobility component, underpinned by robust digital infrastructure and public–private collaborations that allocate dedicated parking zones and regulatory incentives. North American markets demonstrate a strong appetite for station-based one-way services in densely populated cities, while Latin American hubs often leverage peer-to-peer models to maximize existing vehicle inventories and reduce capital barriers to entry. Throughout the region, evolving emissions regulations and sustainability targets are steering operators toward electrified fleets, supported by government grants for charging infrastructure deployment.

In Europe, the Middle East, and Africa, diverse regulatory landscapes yield a tapestry of carsharing implementations. Western European cities boast widespread adoption of free-floating electric fleets, bolstered by comprehensive urban planning strategies and carbon neutrality commitments. In emerging economies within the Middle East and Africa, strategic partnerships between mobility providers and real estate developers are catalyzing station-based solutions in new smart city initiatives, where integrated transportation ecosystems encompass shared vehicles, public transit, and micro-mobility offerings.

The Asia-Pacific region presents a dynamic blend of high-density urban centers and rapidly developing secondary cities, fueling demand for scalable, technology-driven carsharing models. In markets with strong government backing for electrification, such as China and South Korea, fleets are transitioning toward fully battery-electric vehicles at a rapid pace, aided by extensive charging networks and favorable policy frameworks. Meanwhile, South and Southeast Asian cities are experimenting with hybrid and internal combustion engine offerings as transitional solutions, reflecting infrastructure readiness and cost considerations. Collectively, these regional insights underscore the necessity for operators to tailor service models and fleet compositions to local regulatory, infrastructural, and cultural contexts.

This comprehensive research report examines key regions that drive the evolution of the Carsharing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlight Strategic Movements and Dynamics Among Leading Carsharing Operators, Technology Innovators Shaping the Future of Urban Mobility Services

The competitive landscape in carsharing is characterized by the coexistence of established global operators and agile local players, each staking claims on specialized niches. Traditional automotive OEM–backed services continue to leverage brand recognition and existing dealer networks to secure prime station locations and preferential vehicle pricing. Conversely, digital-native challengers are rapidly scaling peer-to-peer platforms, focusing on user acquisition through seamless app experiences and community incentives. At the intersection of these approaches, hybrid models are emerging, where providers combine proprietary fleets with privately owned vehicles to optimize network density and profitability.

Technological innovators are equally shaping market dynamics by offering turnkey fleet management solutions, including real-time telematics, predictive maintenance algorithms, and dynamic pricing engines that increase utilization rates and reduce operating expenses. Collaborations between software vendors and mobility providers are redefining traditional relationships, as companies integrate advanced analytics tools to better understand user behavior and fine-tune service offerings. In parallel, strategic alliances with energy companies and charging infrastructure specialists are becoming increasingly commonplace, fostering end-to-end electrification strategies that mitigate range anxiety and streamline charging operations.

As the market evolves, merger and acquisition activity continues to accelerate, reflecting the drive for consolidation and scale. Regional players with deep local knowledge are aligning with global brands to expand geographic footprints, while specialized technology firms are being absorbed to rapidly integrate new features and maintain a competitive edge. These strategic developments highlight the imperative for both established operators and emerging entrants to continually innovate service models, optimize partnerships, and leverage data-driven insights to anticipate shifting customer expectations and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carsharing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- cambio Mobilitätsservice GmbH & Co. KG

- Carshare Australia Pty Ltd

- Cityhop Ltd.

- Communauto Inc.

- DriveNow by BMW Group

- Ekar FZ LLC

- Enterprise Holdings, Inc.

- Europcar Mobility Group S.A.

- Evo by B.C.A.A. Holdings Ltd.

- Getaround Inc.

- Hertz Corporation

- Hertz Global Holdings, Inc.

- Karshare

- Lime by Neutron Holdings, Inc.

- Lyft Inc.

- MoboKey

- Orix Corporation

- Peg City Car Co op

- Poppy Mobility SA

- Regina Car Share Co-operative

- Ridecell, Inc.

- Share Now GmbH

- Sixt Rent a Car, LLC

- Sixt SE

- SnappCar

- Socar Mobility Malaysia Sdn. Bhd.

- Stellantis N.V.

- Turo Inc.

- Vulog

- Zipcar Inc.

Offer Actionable Guidance for Industry Leaders to Navigate Technological Disruption, Regulatory Flux, and Evolving Consumer Preferences in the Carsharing Landscape

To navigate the rapidly evolving carsharing landscape, industry leaders should prioritize investments in digital platforms that support AI-enabled demand forecasting and autonomous fleet management. By harnessing real-time data and machine learning algorithms, operators can optimize vehicle distribution, reduce empty miles, and enhance overall utilization rates. Concurrently, integrating flexible pricing structures that blend time-based, distance-based, and subscription options will cater to a broader spectrum of user preferences and increase customer retention.

Engaging proactively with policymakers and urban planners is equally crucial, as regulatory frameworks continue to adapt to emerging mobility models. Leaders in the space should advocate for supportive policies such as dedicated parking zones, congestion pricing exemptions, and EV charging incentives that lower operational costs and improve service accessibility. At the same time, forging strategic partnerships with local energy providers and infrastructure developers can accelerate the transition to electrified fleets, underpinning sustainability goals and reinforcing brand reputation among environmentally conscious consumers.

Finally, fostering a culture of continuous innovation through targeted R&D initiatives and cross-industry collaborations will enable long-term resilience. By piloting new vehicle technologies, exploring shared mobility integration with public transit, and testing novel user engagement tactics-such as gamified loyalty programs-operators can stay ahead of competitive pressures and emerging consumer trends. Implementing structured feedback loops with corporate and individual users will also reveal latent needs and inform iterative service enhancements that drive both growth and profitability.

Outline the Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Modeling Techniques To Ensure Robust Carsharing Market Insights

This research employs a multifaceted methodology designed to deliver robust and comprehensive insights into the carsharing market. Primary research encompassed in-depth interviews with senior executives from leading mobility providers, vehicle manufacturers, technology vendors, and regulatory bodies across key regions, providing firsthand perspectives on strategic priorities, operational challenges, and future roadmaps.

Secondary research involved rigorous analysis of industry publications, regulatory filings, governmental policy documents, and reputable news sources to contextualize primary findings and validate market dynamics. Publicly available data on vehicle registration trends, urban transportation plans, and infrastructure investments were cross-referenced against proprietary databases to ensure accuracy and consistency.

Quantitative modeling techniques, including scenario analysis and sensitivity testing, were applied to assess the impact of variables such as tariff adjustments, electrification rates, and user behavior shifts on fleet economics and service performance. Advanced statistical tools were employed to identify correlations, forecast demand patterns, and simulate operational outcomes under different regulatory and technological environments, ensuring that the resulting insights are actionable and empirically grounded.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carsharing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carsharing Market, by Service Model

- Carsharing Market, by Vehicle Type

- Carsharing Market, by Trip Type

- Carsharing Market, by Pricing Model

- Carsharing Market, by Payment Model

- Carsharing Market, by User Type

- Carsharing Market, by Region

- Carsharing Market, by Group

- Carsharing Market, by Country

- United States Carsharing Market

- China Carsharing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarize Key Findings and Strategic Imperatives That Will Define the Next Era of Sustainable, Tech Driven, and Customer Centric Carsharing Solutions

The convergence of technological innovation, environmental imperatives, and dynamic regulatory landscapes is redefining the carsharing sector, creating a wealth of opportunities for forward-thinking operators. Key findings highlight the critical role of digital platforms and AI in driving operational excellence, the strategic importance of electrified fleets in meeting sustainability targets, and the profound impact of trade policies on vehicle procurement and lifecycle costs. Furthermore, segmentation and regional analyses underscore the need for tailored service models that account for local infrastructure, regulatory contexts, and diverse customer preferences.

Strategic imperatives for the next phase of growth include deepening collaborations with energy and infrastructure partners, refining pricing architectures to address varied use cases, and harnessing data-driven decision-making to anticipate shifting mobility trends. By aligning organizational capabilities with the evolving demands of both business and consumer segments, carsharing providers can elevate their competitive positioning while delivering value-added services that enhance urban livability and environmental stewardship.

As the market continues to mature, agility and innovation will separate industry leaders from followers. Entities that proactively embrace emerging technologies, engage constructively with policymakers, and continuously adapt service offerings will be well-positioned to define the future of sustainable, tech-driven, and customer-centric mobility solutions.

Engage With Ketan Rohom to Unlock Comprehensive Carsharing Market Insights and Discover How Tailored Strategies Can Elevate Your Mobility Business Growth

We appreciate your interest in gaining an in-depth understanding of the carsharing market. To discuss how our comprehensive research can address your unique business challenges and deliver actionable insights tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the report’s detailed findings, methodologies, and recommendations, ensuring you can leverage this intelligence to optimize your fleet operations, refine your pricing strategies, and stay ahead of emerging competitive and regulatory trends. Connect today to explore customized solutions that will empower your organization to capitalize on the evolving mobility landscape and accelerate your growth trajectory.

- How big is the Carsharing Market?

- What is the Carsharing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?