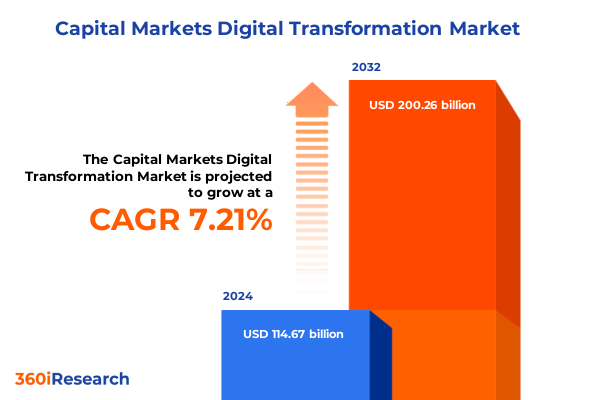

The Capital Markets Digital Transformation Market size was estimated at USD 120.76 billion in 2025 and expected to reach USD 130.14 billion in 2026, at a CAGR of 7.49% to reach USD 200.26 billion by 2032.

Setting the Stage for a Digital Transformation Revolution in Capital Markets Amid Technological Disruption and Strategic Imperatives Ahead

The capital markets landscape is undergoing an unprecedented metamorphosis driven by the convergence of technological innovation, evolving investor expectations, and rigorous regulatory imperatives. Institutions are prioritizing digital transformation initiatives to enhance operational resilience, accelerate time to market, and deliver seamless, omnichannel client experiences. According to a recent C-Suite Survey by the Thomson Reuters Institute, 85% of executives believe artificial intelligence will have a transformational or high impact on their business within the next five years, while 82% rank digital transformation as a top organizational priority, marking a decisive shift away from traditional metrics toward technology-led growth and efficiency enhancements. Simultaneously, a Morgan Stanley AI Adopter survey underscores the tangible business value being realized, with financial services firms increasing AI adoption from 66% to 73% since January 2025, translating hype into measurable cost savings and revenue uplift.

Against this backdrop, market participants must reconcile the promise of cutting-edge capabilities-such as cloud-native architectures, machine learning-driven analytics, and distributed ledger technologies-with the complexity of legacy systems, siloed data environments, and evolving compliance requirements. This dynamic environment necessitates a strategic, phased approach that balances quick wins in areas like robotic process automation for regulatory reporting with long-term investments in data platforms and AI governance. As firms embark on this transformative journey, they face a pivotal moment: those that cultivate an agile, data-centric culture and embrace cross-functional collaboration will emerge as leaders, while laggards risk being outpaced by more nimble, digitally native challengers. This executive summary distills the critical trends reshaping the industry, the strategic segmentation frameworks that illuminate market opportunities, and the actionable insights to guide informed decision-making in an era defined by rapid technological change.

Uncovering the Most Pivotal Technological and Regulatory Shifts Redefining Capital Markets in a Rapidly Evolving Digital Ecosystem

The capital markets industry is experiencing a series of transformative shifts that are redefining traditional operating models and value chains. The transition to a shorter T+1 settlement cycle in North America has already yielded meaningful reductions in counterparty risk and collateral requirements, prompting European and Asia-Pacific regulators to accelerate their own settlement timeline assessments. Concurrently, the maturation of distributed ledger technology and tokenization is unlocking new efficiencies in clearing and settlement, with pilot programs demonstrating the ability to streamline post-trade processing and reduce reconciliation overhead. These innovations are not isolated; they form part of a broader pivot toward real-time, transparent, and frictionless marketplaces.

At the same time, the proliferation of cloud computing in capital markets, although initially limited to targeted workloads, is gaining traction for core trading, risk management, and post-trade applications. A leading professional services firm reports that only 5% to 10% of capital markets technology solutions are truly public cloud-based today, yet momentum is building around infrastructure investments to support scalable, secure, and high-performance cloud deployments. Moreover, the integration of AI and machine learning into algorithmic trading, predictive risk analytics, and compliance monitoring is shifting from proof-of-concept to enterprise-grade implementations, creating a competitive divide between early adopters and those still grappling with data quality and talent constraints. As regulatory scrutiny intensifies and competitive pressures mount, firms must navigate these interconnected shifts to achieve sustainable differentiation and operational excellence.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariffs on Technology Infrastructure and Capital Markets Digital Strategies

The cumulative impact of evolving U.S. tariff policies in 2025 has introduced significant cost pressures and supply chain complexities for capital markets technology infrastructure. Since early 2025, tariffs on critical electronic components and imported semiconductors have climbed as high as 145%, prompting concerns over input cost inflation and procurement lead-time extensions. Enforcement measures aimed at curbing transshipment through intermediary nations such as Vietnam and Indonesia have further tightened rules of origin, creating uncertainty for firms reliant on global hardware and network equipment suppliers.

Independent analysis by the Information Technology and Innovation Foundation highlights the broader economic repercussions of blanket semiconductor tariffs, estimating that a sustained 25% duty on chip imports could reduce ICT consumption by 25.4%, resulting in an $11.8 billion decline in spending on essential digital infrastructure in the first year alone. The downstream effects on data center expansion, AI model training, and cloud service delivery capacity are considerable, as many financial firms depend on high-performance computing environments and low-latency networking to support algorithmic trading and risk analytics. These cost increases and procurement risks compel institutions to reassess sourcing strategies, diversify supplier ecosystems, and explore onshoring or regionalized manufacturing partnerships to mitigate tariff-driven inflation.

Despite short-term disruptions, these policy shifts are accelerating broader strategic conversations around supply chain resilience and technology sovereignty. Firms that proactively adapt their procurement frameworks, invest in modular infrastructure designs, and strengthen vendor risk management practices will be better positioned to absorb tariff volatility and maintain continuity of service. However, stakeholders should remain vigilant as negotiations continue between the U.S. and key trading partners, with potential tariff reprieves or further escalations capable of reshaping the digital transformation roadmap for capital markets.

Illustrating Critical Segmentation Dimensions That Drive Differentiated Adoption Patterns in Capital Markets Digital Transformation

An effective segmentation framework is indispensable for understanding the multifaceted landscape of capital markets digital transformation. Component segmentation reveals that services and solutions represent distinct domains, each with its own evolutionary trajectory. Within services, managed offerings such as maintenance and support coexist alongside professional engagements encompassing consulting and implementation, reflecting an expanding ecosystem of third-party expertise. In parallel, the solutions dimension covers hardware platforms and software suites, with middleware, development platforms, and analytical tools forming the core of software innovation.

Examining end-user segmentation highlights the divergent requirements of asset managers, banks, broker-dealers, and insurance companies. Asset management firms, including hedge funds, mutual funds, and pension funds, prioritize data-driven portfolio optimization and predictive analytics, whereas banks-ranging from commercial to investment and retail institutions-emphasize scalability, security, and regulatory compliance. Broker-dealers, whether discount or full-service, focus on seamless execution and client engagement platforms. Insurance carriers, spanning life and property & casualty, are increasingly investing in risk modeling and fraud detection capabilities.

Deployment mode further differentiates offerings, with cloud and on-premises solutions serving complementary roles. The rise of hybrid architectures and private cloud environments underscores the need for flexibility and data sovereignty. Organizational size segmentation distinguishes the scalability needs of large enterprises from those of small and medium-sized firms, which often seek cost-effective, modular platforms. Application segmentation-covering portfolio management, regulatory compliance, risk management, and trading optimization-maps directly to specific use cases such as asset allocation, anti-financial crime, credit risk assessment, and algorithmic trading. Finally, technology segmentation frames the discussion around AI & ML, blockchain, cloud computing, and IoT, each bringing unique innovation pathways from computer vision and distributed ledgers to IaaS, PaaS, and device management.

This comprehensive research report categorizes the Capital Markets Digital Transformation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment Mode

- Organization Size

- Application

- End User

Examining Region-Specific Dynamics Shaping Digital Transformation Journeys Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping digital transformation priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, North American institutions are capitalizing on regulatory enhancements such as the T+1 settlement cycle, leveraging cloud-native infrastructures and AI-infused analytics to optimize trade execution and risk management. Canadian and Latin American markets are also accelerating digital adoption, with a focus on regulatory reporting platforms and cybersecurity frameworks driven by evolving privacy standards.

Within Europe, Middle East & Africa, the convergence of regulation and innovation is pronounced. European markets are progressing toward real-time settlement initiatives and unified compliance platforms to address regulatory fragmentation. The Middle East is investing heavily in fintech hubs and digital exchanges as part of national economic diversification strategies, while African markets are leapfrogging legacy infrastructures through mobile-enabled trading applications and open banking frameworks, reflecting a drive toward financial inclusion and cross-border capital flows.

In Asia-Pacific, diverse market maturity levels are driving differentiated transformation journeys. Established financial centers such as Singapore and Hong Kong are pioneering digital asset frameworks and cloud-first trading ecosystems, whereas emerging markets are prioritizing core infrastructure modernization and regulatory sandboxes to foster innovation. Across the region, central bank digital currency pilots, blockchain-based settlement trials, and regional cloud data residency mandates are converging to create a dynamic environment where technology sovereignty and cross-border interoperability are at the forefront of strategic planning.

This comprehensive research report examines key regions that drive the evolution of the Capital Markets Digital Transformation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning and Innovation Priorities of Leading Firms Advancing Capital Markets Digital Frameworks

Leading companies are charting diverse strategies to capture value in the capital markets digital transformation journey. Technology titans such as Amazon Web Services, Microsoft Azure, and Google Cloud are intensifying investments in specialized financial services offerings, collaborating with trading venues and data providers to deliver low-latency, high-throughput infrastructure. AWS’s recent enhancements in GPU-accelerated computing for machine learning workloads and Microsoft’s advancements in secure confidential computing exemplify how hyperscale providers are tailoring solutions for real-time trading and risk analytics.

Meanwhile, specialized electronic trading platforms are innovating to deepen market penetration. Tradeweb, for instance, has achieved record average daily volumes of $2.5 trillion by expanding into emerging markets and integrating AI-driven execution capabilities through strategic hires and acquisitions such as r8fin. The firm’s push into blockchain-enabled settlement and tokenized asset trading highlights a broader industry trend toward distributed ledger integrations that promise reduced counterparty risk and accelerated transaction finality.

Fintech firms like Bloomberg and SS&C Technologies are differentiating through unified compliance architectures and cloud-native data analytics platforms. Bloomberg’s real-time market data distribution via its Terminal API and SS&C’s investment in AI-based portfolio analytics illustrate the competitive imperative to offer holistic, platform-based solutions. Additionally, emerging challengers are leveraging modular, API-first designs to address niche use cases, from real-time credit risk monitoring to dynamic collateral optimization, underscoring the importance of open ecosystems in driving innovation across the capital markets value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Capital Markets Digital Transformation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4most Group Ltd.

- Accenture plc

- Broadridge Financial Solutions, Inc.

- Capgemini SE

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- FactSet Research Systems Inc.

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- HCL Technologies Ltd.

- IBM Corporation

- Infosys Ltd.

- International Business Machines Corporation

- LTIMindtree Ltd.

- Maveric Systems Ltd.

- Microsoft Corporation

- Oracle Corporation

- PA Consulting Group Ltd.

- SAP SE

- SS&C Technologies Holdings, Inc.

- Tata Consultancy Services Ltd.

- Temenos AG

- West Monroe, LLC

- Wipro Ltd.

- Zinkworks Ltd.

Essential Strategic and Operational Recommendations to Guide Capital Markets Leaders Through Digital Transformation Challenges and Opportunities

Industry leaders seeking to stay ahead of the digital transformation curve should adopt a multi-pronged strategy centered on flexibility, data orchestration, and risk management. First, organizations must prioritize the establishment of a unified data platform that consolidates fragmented sources across trading, risk, and regulatory domains. This foundational layer enables advanced analytics and AI-driven decision support while reducing integration complexity.

Second, firms should develop modular, microservices-based architectures paired with open APIs to facilitate rapid experimentation and third-party integration. Such an approach empowers business units to pilot new capabilities-such as AI-enabled trading algorithms and blockchain-based settlement workflows-without incurring the delays associated with monolithic system upgrades.

Third, given the ongoing evolution of U.S. tariff policies and supply chain risks, procurement teams must expand supplier diversification and incorporate tariff risk modeling into technology roadmaps. Digital transformation strategies should account for potential cost escalations and lead-time volatility by evaluating local and regional sourcing options and co-investment partnerships with infrastructure providers.

Finally, executive sponsorship and cross-functional governance are essential to navigate regulatory complexity and organizational change. A designated digital transformation steering committee can ensure alignment across business, technology, and compliance functions while tracking progress against strategic milestones. By embedding continuous monitoring and iterative feedback loops, leaders can accelerate adoption, manage risk proactively, and maximize return on transformation investments.

Detailing the Comprehensive Research Methodology and Analytical Framework Underpinning Our Capital Markets Digital Transformation Analysis

This analysis is grounded in a rigorous mixed-methods research methodology that combines primary and secondary sources to ensure comprehensive insight. Primary research included in-depth interviews with C-Suite executives, technology leaders, and compliance officers at global financial institutions, providing qualitative context on transformation drivers and challenges. These interviews were supplemented by proprietary survey data capturing technology adoption rates, strategic priorities, and investment drivers across market segments.

Secondary research encompassed a systematic review of public disclosures, regulatory filings, industry reports, and reputable news sources. Major industry surveys and whitepapers from independent think tanks and professional services firms informed trend validation, while peer-reviewed studies were leveraged to assess technology efficacy and case studies. The segmentation framework was developed through an iterative process, aligning stakeholder input with observed market behaviors.

Data triangulation was applied at each stage to reconcile diverse perspectives and ensure analytical robustness. Findings were further vetted through expert advisory panels comprising academic researchers, policymakers, and technology vendors. This layered approach underpins the report’s credibility and offers a transparent foundation for the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Capital Markets Digital Transformation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Capital Markets Digital Transformation Market, by Component

- Capital Markets Digital Transformation Market, by Technology

- Capital Markets Digital Transformation Market, by Deployment Mode

- Capital Markets Digital Transformation Market, by Organization Size

- Capital Markets Digital Transformation Market, by Application

- Capital Markets Digital Transformation Market, by End User

- Capital Markets Digital Transformation Market, by Region

- Capital Markets Digital Transformation Market, by Group

- Capital Markets Digital Transformation Market, by Country

- United States Capital Markets Digital Transformation Market

- China Capital Markets Digital Transformation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 4293 ]

Concluding Insights Highlighting the Imperative of Strategic Digital Transformation in Capital Markets for Sustainable Competitive Advantage

In an era defined by relentless technological advancement and market volatility, capital markets firms face both unprecedented challenges and transformative opportunities. The convergence of AI, cloud computing, blockchain, and evolving regulatory mandates is driving a fundamental reimagination of how trading, risk management, and compliance activities are orchestrated. Those organizations that proactively embrace data-centric architectures, agile operating models, and inclusive governance will be best positioned to capitalize on these shifts and deliver enhanced client value.

The interplay between external forces-such as the impact of tariffs on technology supply chains-and internal imperatives-such as the need for unified data platforms-demand a holistic, strategic response. By leveraging the insights and recommendations outlined in this summary, industry leaders can craft actionable roadmaps that balance immediate performance gains with long-term innovation objectives. Ultimately, sustained competitive advantage will accrue to those firms that integrate emerging technologies with disciplined execution, fostering a resilient, adaptable, and future-ready capital markets ecosystem.

Take the Next Step Toward Informed Decision-Making by Engaging with Expert Research and Insights to Empower Your Capital Markets Strategy

Elevate your strategic advantage in capital markets by securing access to our in-depth market research report. Engaging with this comprehensive analysis will equip your leadership team with the actionable intelligence and strategic foresight necessary to navigate complex digital transformation challenges, regulatory shifts, and competitive dynamics. To explore tailored insights and receive personalized guidance on integrating these findings into your organization’s roadmap, schedule a consultation with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Let us support your journey toward robust, data-driven decision-making and sustainable growth through our expert research and industry expertise.

- How big is the Capital Markets Digital Transformation Market?

- What is the Capital Markets Digital Transformation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?