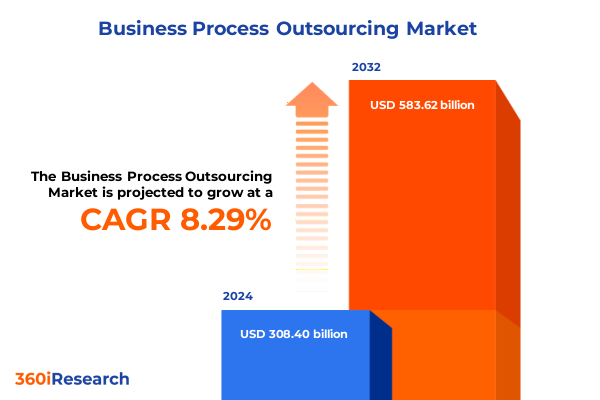

The Business Process Outsourcing Market size was estimated at USD 332.67 billion in 2025 and expected to reach USD 358.85 billion in 2026, at a CAGR of 8.36% to reach USD 583.62 billion by 2032.

Unveiling the Strategic Landscape of Business Process Outsourcing Amid Rapid Technological Evolution and Shifting Global Dynamics

Business Process Outsourcing has become a strategic lever that enables organizations to drive efficiency, scale operations, and focus on core competencies in an increasingly competitive global environment.

Industry leaders are pivoting from traditional call center and back-office functions to specialized offerings, leveraging robotic process automation (RPA), conversational artificial intelligence, and predictive analytics to deliver robust decision-support solutions and regulatory compliance services. S&P Global reported that the U.S. services PMI rose to 55.2 in July 2025, underscoring robust activity in service-oriented sub-sectors.

The growing emphasis on customer experience and omnichannel engagement has prompted outsourcers to integrate digital platforms, real-time analytics, and personalized support frameworks that enhance client satisfaction and foster loyalty. According to the WTO, rising trade uncertainty and tariffs have begun to influence service demand patterns, prompting providers to fortify resilience through technological investments.

As reported by BusinessWorld Online, BPO associations are closely monitoring broader economic and investment impacts of policy shifts to safeguard long-term operational continuity.

Navigating Digital Disruption and Strategic Realignment That Are Redefining Global Business Process Outsourcing Models for Enhanced Efficiency and Innovation

Enterprises are embracing transformative digital disruption as a catalyst for comprehensive realignment of their outsourcing strategies. Robotic process automation tools and generative AI platforms are being deployed to automate repetitive tasks and elevate decision-making processes, reducing operational bottlenecks while enhancing accuracy across finance, HR, and legal functions. Meanwhile, experts warn that overreliance on legacy offshoring models can expose firms to geopolitical risks and tariff volatility.

In response, companies are diversifying delivery footprints to include nearshore centers in Latin America and onshore hubs in North America and Europe, balancing cost efficiency with proximity to key stakeholders and cultural affinity.

Concurrently, tightening regulations around data privacy and cross-border information flows are reshaping the compliance landscape. Providers are implementing end-to-end encryption, localized data storage, and rigorous audit frameworks to align with regulations such as GDPR and CCPA, ensuring that outsourced operations remain both innovative and secure.

Examining How 2025 United States Tariff Measures Are Cascading Across Global Service Providers and Reshaping Outsourcing Cost Dynamics

New tariff measures instituted by the United States in 2025 have introduced significant indirect cost pressures on service providers, as higher duties on hardware and technology imports cascade through cloud-based platforms and analytics infrastructure. Stakeholders across industries report that elevated input prices for servers, networking equipment, and software components are compelling firms to reassess long-term outsourcing contracts and operational budgets.

Moreover, the World Trade Organization has cautioned that sustained tariff escalation could dampen growth in global services trade, reducing business confidence and investment flows. The WTO projects that continued imposition of duties may slow the expansion of cross-border digital services and accelerate demand for tariff-neutral delivery models.

In this context, outsourcing partners are increasingly adopting cost mitigation tactics, including supply chain diversification, predictive price indexing, and collaborative procurement strategies with clients. These adaptive measures aim to inoculate service delivery against tariff volatility while preserving the quality and responsiveness that clients expect.

Uncovering Critical Insights into Service Type Diversity Outsourcing Models Industry Verticals and Organization Sizes Shaping BPO Market Strategies

Segmentation by service type reveals the multifaceted nature of outsourced offerings. Core customer support operations encompass feedback management, multi-channel assistance, and technical troubleshooting, while finance and accounting functions span bookkeeping and payroll processing. Human resources services integrate benefits administration, employee training programs, and recruitment drives, complemented by knowledge process outsourcing, legal services-from contract drafting to litigation support-and procurement and supply chain optimization.

When viewed through the lens of outsourcing models, the market delineates distinct pathways: offshore centers that offer cost arbitrage, nearshore facilities that balance geographical proximity with labor flexibility, and onshore or onsite engagements that deliver direct control and regulatory alignment. Similarly, the industry vertical segmentation underscores the reach across sectors such as banking, financial services, and insurance; education; energy and utilities; government and public sector; healthcare and life sciences; IT and telecommunications; manufacturing; media and entertainment; retail and e-commerce; transportation and logistics; and travel and hospitality. Finally, organization size segmentation differentiates between small enterprises, medium and large-scale corporations, and very large entities, each presenting unique operational complexities and outsourcing imperatives.

This comprehensive research report categorizes the Business Process Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Type

- Outsourcing Model

- Industry Vertical

- Organization Size

Exploring Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific That Influence Outsourcing Patterns and Competitive Advantages

The Americas region continues to represent a mature outsourcing hub, driven by established infrastructures in the United States and emerging nearshore centers in Mexico, Colombia, and Costa Rica that offer linguistic alignment and favorable time zones. Within Europe, Middle East, and Africa, service providers are leveraging regulatory harmonization and multilingual capabilities to serve diverse markets, while capitalizing on onshore models that resonate with strict data sovereignty requirements. In the Asia-Pacific zone, countries such as the Philippines, India, and Vietnam maintain their prominence as high-volume talent pools, augmented by government incentives and robust digital ecosystems that facilitate advanced analytics and AI-driven outsourcing services.

This comprehensive research report examines key regions that drive the evolution of the Business Process Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players and Their Strategic Initiatives Powering Growth Innovation and Competitive Edge in the BPO Sector

Accenture continues to set benchmarks in digital business process outsourcing through its substantial investments in AI and automation. In 2025, the firm recorded $41 billion in BPO revenue, representing approximately 10.24% of the global market. Its integrated myWizard platform automates over 60% of repetitive tasks for major clients like Citibank, driving significant gains in operational efficiency.

Teleperformance maintains its leadership in customer experience management, achieving full-year 2024 revenues of €10.28 billion and launching a €100 million AI partnerships program to scale agentic AI solutions across call centers and back-office services. The firm has deployed over 200 new AI projects and completed 62,000 manager training programs in AI and emotional intelligence, underscoring its commitment to reinvention through technology.

Genpact has demonstrated consistent growth in its advanced services portfolio, generating adjusted net revenues of $4.77 billion in 2024, with Data-Tech-AI services contributing 47% of total revenue. The company’s strategic focus on industry-specific domain expertise and agentic solutions has driven record new bookings of $5.7 billion, positioning it at the forefront of AI-driven transformation.

Cognizant sustained momentum in Q1 2025 with revenues of $5.12 billion, a 7.5% year-over-year increase, and an operating margin expansion of 210 basis points. Its investments in AI and platform capabilities have supported four large deals exceeding $100 million each, while the firm authorized a $2 billion expansion of its share repurchase program to enhance shareholder returns.

This comprehensive research report delivers an in-depth overview of the principal market players in the Business Process Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Acquire BPO

- ADP, Inc.

- Amdocs Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Concentrix Corporation

- Conduent Inc.

- Dell Technologies Inc.

- ExlService Holdings, Inc.

- Genpact Limited

- HCL Technologies Limited

- Helpware Inc.

- Hinduja Global Solutions Limited

- Infinx Healthcare

- Infosys Limited

- International Business Machines Corporation

- INTERSA

- NTT DATA Group Corporation

- Octopus Tech Solutions Pvt. Ltd.

- Oracle Corporation

- Sutherland Global Services, Inc.

- Tata Consultancy Services Limited

- TD Synnex Corporation

- Tech Mahindra Limited

- Teleperformance

- Telus International Inc.

- Transcom

- TTEC Holdings, Inc.

- Unity Communications

- Vensure Employer Services, Inc.

- Wipro Limited

- WNS (Holdings) Limited

Implementing Forward Looking Actionable Recommendations to Drive Operational Excellence and Sustainable Growth in Outsourced Business Services

To thrive amid evolving global dynamics, outsourcing providers should intensify investments in advanced automation and AI frameworks, integrating generative models and machine learning pipelines that streamline high-volume processes and elevate strategic capabilities. Organizations that embed intelligent automation within both front-office and back-office operations can achieve resilience against tariff-driven cost fluctuations and competitive disruptions.

Leaders are advised to diversify their delivery footprints by balancing offshore, nearshore, and onshore centers, thereby mitigating geopolitical and regulatory risks. Strategic partnerships with local providers and joint ventures in emerging nearshore markets can unlock new talent pools and reduce dependency on any single region.

Finally, companies must prioritize robust data governance and compliance frameworks to navigate complex regional regulations. Establishing standardized audit protocols, end-to-end encryption, and localized data management practices will safeguard service continuity and uphold client trust in an era of heightened privacy expectations.

Detailing a Robust Research Methodology That Ensures Data Integrity Insightful Analysis and Reliable Conclusions for Outsourcing Market Assessment

Our research methodology combines comprehensive primary and secondary data collection to deliver a nuanced assessment of the outsourcing market landscape. Primary efforts included in-depth interviews with senior executives at leading service providers and major enterprise clients, as well as targeted surveys to capture sentiment around digital transformation, geographic diversification, and tariff impacts. Secondary research incorporated a rigorous review of industry publications, financial disclosures, trade association reports, and international trade data to validate market dynamics.

Quantitative analysis leveraged data triangulation techniques and statistical modeling to ensure robustness across segmentation parameters, while qualitative insights were distilled through thematic analysis of expert interviews and focus groups. The methodology emphasizes transparency and reproducibility, with iterative validation workshops conducted alongside subject-matter experts to refine findings and ensure reliability of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Business Process Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Business Process Outsourcing Market, by Service Type

- Business Process Outsourcing Market, by Type

- Business Process Outsourcing Market, by Outsourcing Model

- Business Process Outsourcing Market, by Industry Vertical

- Business Process Outsourcing Market, by Organization Size

- Business Process Outsourcing Market, by Region

- Business Process Outsourcing Market, by Group

- Business Process Outsourcing Market, by Country

- United States Business Process Outsourcing Market

- China Business Process Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding with Strategic Reflections on Key Trends Challenges and Opportunities Shaping the Future Landscape of Business Process Outsourcing

In conclusion, the business process outsourcing industry stands at a pivotal juncture defined by technological innovation, shifting geopolitical landscapes, and evolving client expectations. Digital enablers such as AI, automation, and cloud services are redefining value propositions and operational benchmarks, while U.S. tariff policies and regulatory frameworks continue to influence cost structures and sourcing strategies. Segmentation insights underscore the necessity of tailoring offerings across service types, delivery models, and industry verticals to maximize strategic alignment.

Regional dynamics also play a critical role, with mature markets in the Americas, regulatory hubs in Europe, Middle East & Africa, and talent-rich centers in Asia-Pacific each contributing unique competitive advantages. Leading providers are expanding capabilities through targeted investments in AI partnerships, strategic acquisitions, and rigorous governance frameworks, demonstrating a proactive approach to market uncertainties. As the sector advances, the integration of advanced analytics and data-driven decision-making will further elevate service quality and client outcomes, setting the stage for sustainable growth and differentiation.

Engage with Ketan Rohom to Secure Comprehensive Outsourcing Market Research Insights for Strategic Decision Making and Competitive Advantage

For detailed insights and bespoke advisory on leveraging these market dynamics, connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive outsourcing research report can inform your strategic planning and drive actionable outcomes. Secure your copy today to gain an authoritative perspective on the trends, drivers, and competitive imperatives shaping the future of business process outsourcing.

- How big is the Business Process Outsourcing Market?

- What is the Business Process Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?