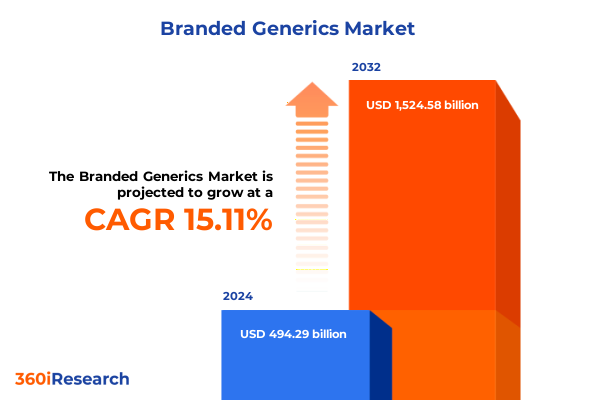

The Branded Generics Market size was estimated at USD 567.75 billion in 2025 and expected to reach USD 652.14 billion in 2026, at a CAGR of 15.15% to reach USD 1,524.58 billion by 2032.

Understanding the Strategic Evolution and Market Dynamics Shaping Branded Generics in the Pharmaceutical Landscape Amid Regulatory and Competitive Pressures

Branded generics occupy a pivotal position at the intersection of affordability and differentiation within the pharmaceutical sector. As original patents expire, pharmaceutical companies are increasingly shifting from commoditized generic offerings to value-added branded alternatives that combine cost savings for healthcare systems with enhanced brand recognition. This evolution is driven by rising global demand for accessible medicines alongside intensifying competitive pressures that compel manufacturers to innovate beyond price points.

Over the past decade, advancements in regulatory frameworks and quality standards have raised the bar for market entry and sustained brand integrity. Companies investing in lifecycle management strategies, such as novel formulations, extended-release technologies, and differentiated packaging, have been able to carve out premium segments even within generic categories. Consequently, branded generics have emerged as a key revenue driver for organizations seeking to balance price sensitivity with product differentiation.

Furthermore, reimbursement reforms and value-based care models are reshaping purchasing decisions across public and private payers. Stakeholders now weigh not only the unit cost but also real-world evidence of adherence, patient outcomes, and supply reliability. In this complex environment, successful branded generic initiatives require an integrated approach that aligns regulatory prowess, marketing acumen, and operational resilience. This introduction sets the stage for a deeper exploration of the transformative shifts and strategic considerations shaping the branded generics landscape.

Analyzing the Major Transformative Shifts Redefining Supply Chain, Pricing Structures, and Competitive Landscape in Branded Generics

The branded generics landscape has undergone a series of transformative shifts that are redefining supply chains, competitive positioning, and cost structures. Most notably, supply chain resilience has become a strategic imperative as companies confront geopolitical instability and raw material bottlenecks. Manufacturers are increasingly adopting dual-sourcing models and localized production hubs to mitigate disruptions and ensure continuity of supply, thereby safeguarding product availability and brand reputation.

Simultaneously, digital manufacturing technologies such as continuous processing and advanced analytics are accelerating time to market while enhancing quality assurance. These innovations enable more agile scale-up of branded generic products and foster closer alignment with regulatory requirements, supporting faster approval cycles and reducing development timelines.

On the market side, competitive consolidation has intensified, with strategic mergers and alliances allowing established players to expand portfolios and leverage shared commercialization platforms. At the same time, the rise of biosimilar analogues is extending the branded generics playbook into complex molecules, prompting traditional generics manufacturers to invest in biomanufacturing capabilities and specialized distribution networks.

Moreover, value-based contracting and patient-centric service models are reshaping pricing negotiations. Branded generics providers are now expected to demonstrate differentiators such as adherence support programs, digital patient engagement tools, and outcome-based rebates. These cumulative shifts underscore the necessity for companies to adopt multifaceted strategies that balance efficiency with innovation in a rapidly evolving sector.

Evaluating the Cumulative Impact of United States 2025 Tariff Measures on Branded Generics Supply Chains, Pricing and Market Accessibility

The introduction of enhanced tariff measures by the United States in 2025 has had a cumulative impact on the branded generics supply chain, influencing cost structures, sourcing strategies, and market accessibility. While many active pharmaceutical ingredients continue to be sourced from established markets, the application of additional duties on select intermediates and raw materials has heightened procurement costs and compelled manufacturers to reassess supplier relationships.

These tariff adjustments have incentivized pharmaceutical companies to accelerate onshore production of key precursors or to establish strategic partnerships with domestic chemical manufacturers. Although domestic vertical integration can entail significant upfront capital investment, it offers long-term benefits by reducing exposure to fluctuating duty rates and streamlining quality oversight. In parallel, some organizations have expanded toll-manufacturing agreements in tariff-exempt jurisdictions to balance cost efficiency with regulatory compliance.

Pricing negotiations with payers have also been affected, as incremental duty-related costs are often passed through in tender bids or reimbursement filings. Branded generics providers have responded by optimizing formulation strategies and leveraging differentiated packaging to justify premium positioning. Furthermore, enhanced supply chain transparency has become more critical, with traceability initiatives helping to demonstrate cost drivers and secure payer confidence.

Overall, the cumulative impact of 2025 tariffs underscores the importance of a resilient, flexible supply model and a strategic approach to cost absorption. Companies that proactively adapt to evolving duty structures are better positioned to maintain competitive pricing and uninterrupted market access.

Uncovering Critical Segmentation Insights Across Dosage Forms, Therapeutic Areas, Applications and Distribution Channels Driving Branded Generics Strategies

Critical segmentation insights reveal the multifaceted nature of the branded generics market and guide strategic portfolio decisions. Within dosage forms, the market spans injections-comprising intramuscular, intravenous, and subcutaneous delivery methods-liquids available as suspensions and syrups, solid oral doses in extended-release and immediate-release tablet and capsule formats, and topicals including creams, gels, and ointments. Each formulation category reflects distinct manufacturing complexities, regulatory pathways, and patient administration considerations, informing targeted investments in process technology and quality controls.

Therapeutic area segmentation further underscores opportunities for specialization. Anti-infectives are partitioned into antibiotics, antifungals, and antivirals, while cardiovascular products are distinguished by anti-dyslipidemics and anti-hypertensives. Central nervous system offerings encompass anti-depressants, anti-epileptics, and anti-psychotics, whereas gastrointestinal treatments include antacids and laxatives, and pain management solutions range from non-opioid analgesics to opioid formulations. These differentiated groups command unique clinical data requirements and payer evaluation criteria, driving tailored clinical support and outcomes tracking initiatives.

Application-based segmentation bifurcates the market between animal health and human health. In the animal health segment, branded generics for companion animals-specifically cats and dogs-and for livestock exhibit divergent regulatory standards, distribution channels, and prescribing behaviors. Human health branded generics, by contrast, navigate complex reimbursement frameworks and higher volumes, emphasizing the need for scale and robust pharmacovigilance.

Distribution channels also present critical insights. Drug stores and hospital pharmacies remain core outlets, while online pharmacies-delivered through mobile apps and websites-are capturing market share by enhancing convenience and access. Retail pharmacies, both chain-based and independent, continue to provide broad geographic reach and patient counseling, underscoring the importance of omnichannel distribution strategies.

This comprehensive research report categorizes the Branded Generics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Dosage Form

- Therapeutic Area

- Application

- Distribution Channel

Highlighting Key Regional Insights Spanning the Americas, Europe Middle East & Africa and Asia Pacific to Drive Branded Generics Expansion

Regional dynamics in the branded generics market are shaped by distinct regulatory environments, healthcare infrastructure, and economic priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, the United States stands out for its emphasis on value-based procurement and stringent quality standards, prompting manufacturers to invest in advanced manufacturing technologies and robust compliance frameworks. Latin American markets present opportunities for mid-tier pricing strategies and local partnerships to broaden reach in environments where public procurement rules and private out-of-pocket expenditures vary significantly.

Across Europe, Middle East & Africa, diverse healthcare funding models-from multi-payer systems in Western Europe to emerging frameworks in the Gulf Cooperation Council-have created niches for branded generics that can demonstrate both therapeutic equivalence and cost predictability. Regulatory harmonization efforts within the European Union are reducing barriers to entry, while supply chain volatility in certain African markets underscores the need for resilient logistics networks and local distribution alliances.

Meanwhile, the Asia-Pacific region continues to be a growth engine driven by rapid urbanization, expanding middle-class populations, and government initiatives to enhance generic substitution rates. Markets such as India and China serve dual roles as major production hubs for active pharmaceutical ingredients and as increasingly competitive domestic markets for branded generics. Manufacturers active in Asia-Pacific are prioritizing regulatory registrations across multiple jurisdictions and leveraging local partnerships to navigate complex approval processes and optimize pricing under national reimbursement schemes.

This comprehensive research report examines key regions that drive the evolution of the Branded Generics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Innovative Strategies, Partnerships and Product Portfolios of Leading Global Branded Generics Companies Shaping Market Competitiveness

Leading companies in the branded generics arena are deploying a spectrum of strategies to solidify market positions and drive differentiation. Teva, with its expansive global footprint, is leveraging integrated supply chains and digital patient support initiatives to enhance adherence and brand loyalty. Meanwhile, Sandoz has prioritized biosimilar integrations alongside its core generics portfolio, reinforcing its position in complex molecule segments and fostering partnerships to expand its market access.

In North America, Viatris (formed through the Mylan-Pfizer generics merger) has capitalized on scale advantages and an extensive product catalog, focusing on therapeutic areas with high volume demand such as cardiovascular and central nervous system treatments. In India, Sun Pharmaceutical Industries has pursued acquisitions and strategic alliances to broaden its branded generics offerings in emerging markets, while Dr. Reddy’s Laboratories has emphasized differentiated formulations, including extended-release and pediatric liquids, to capture niche segments.

Other notable players such as Lupin are enhancing their product pipelines through targeted R&D investment and localized manufacturing for key markets. These companies are also forging commercial collaborations with regional distributors to reinforce last-mile delivery and build stronger relationships with healthcare providers. Across the board, the emphasis on value creation, regulatory compliance, and innovative customer engagement reflects a dynamic competitive landscape in which strategic agility is paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Branded Generics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amneal Pharmaceuticals LLC

- Apotex Inc.

- Aspen Pharmacare Holdings Limited

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Bausch Health Companies Inc.

- Cipla Limited

- Dr. Reddy’s Laboratories Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Endo International PLC

- Eris Lifesciences Limited

- Eva Pharma

- Fresenius Kabi AG

- GlaxoSmithKline PLC

- Glenmark Pharmaceuticals Limited

- Hetero Drugs Limited

- Lupin Limited

- Mylan N.V. by Viatris Inc.

- Sandoz International GmbH by Novartis Group

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Developing Actionable Recommendations for Industry Leaders to Capitalize on Evolving Branded Generics Trends Through Strategic Investments and Partnerships

Industry leaders must adopt a multi-pronged approach to capture emerging opportunities in the branded generics segment. First, supply chain diversification remains essential; forging partnerships with alternative API suppliers and investing in onshore or nearshore production capacities can mitigate tariff and geopolitical risks, ensuring supply continuity and pricing stability. Concurrently, targeted investments in continuous manufacturing and digital quality management systems will accelerate time-to-market and enhance regulatory alignment.

Second, product differentiation through advanced formulations and value-added services is critical. Companies should prioritize the development of extended-release oral dosage forms and patient-friendly formats such as transdermal gels or mobile-app supported delivery systems. Embedding digital adherence tools and outcomes monitoring within the product portfolio can strengthen value propositions and support favorable reimbursement negotiations.

Third, fostering strategic alliances and licensing partnerships-particularly in biosimilars and specialty therapeutic areas-will expand portfolios and distribute development risks. Collaborations with technology providers, contract development and manufacturing organizations, and digital health innovators can drive synergies across R&D, regulatory, and commercial functions.

Finally, adopting an omnichannel distribution strategy that integrates brick-and-mortar pharmacies with online platforms and hospital formulary channels will maximize market reach. Combining high-touch patient services with streamlined digital ordering processes presents a compelling model for differentiation in an increasingly competitive branded generics market.

Detailing the Robust Research Methodology Combining Primary, Secondary and Quantitative Techniques to Ensure Comprehensive Branded Generics Market Analysis

The insights presented in this report derive from a rigorous methodology combining comprehensive secondary research, primary qualitative interviews, and quantitative data modeling. Secondary research encompassed analysis of industry publications, regulatory filings, patent landscapes, and company annual reports to map competitive positioning and market drivers. Peer-reviewed literature and policy documents were evaluated to capture evolving regulatory frameworks and tariff developments.

Primary research involved in-depth interviews with key stakeholders across the value chain, including C-suite executives, procurement leaders, regulatory specialists, and distribution partners. These conversations provided nuanced perspectives on emerging trends, supply chain challenges, and strategic priorities. In addition, expert focus groups and advisory panel sessions were convened to validate findings and ensure alignment with real-world dynamics.

Quantitative modeling techniques were applied to triangulate data from multiple sources, enabling cross-validation of segmentation and regional trends. Data integrity was assured through dual-entry validation and continuous reconciliation against public and proprietary datasets. The combination of primary and secondary inputs facilitated an iterative analysis process, refining hypotheses and enhancing the robustness of conclusions.

This methodological framework ensures that the report delivers reliable, unbiased, and actionable intelligence tailored to the strategic needs of branded generics stakeholders across global markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Branded Generics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Branded Generics Market, by Dosage Form

- Branded Generics Market, by Therapeutic Area

- Branded Generics Market, by Application

- Branded Generics Market, by Distribution Channel

- Branded Generics Market, by Region

- Branded Generics Market, by Group

- Branded Generics Market, by Country

- United States Branded Generics Market

- China Branded Generics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Summarizing the Strategic Imperatives and Key Takeaways to Guide Decision Making in the Fast Evolving Branded Generics Environment

The strategic exploration of branded generics reveals a landscape defined by complexity, innovation, and opportunity. Companies that integrate advanced manufacturing technologies, diversify supply chains, and differentiate through value-added formulations will be best positioned to navigate regulatory shifts and competitive pressures. The cumulative effects of 2025 tariff changes underscore the importance of resilient sourcing models and dynamic pricing strategies, while segmentation insights highlight the need for tailored approaches across dosage forms, therapeutic areas, applications, and distribution channels.

Regional nuances-from stringent quality standards in North America to evolving reimbursement frameworks in EMEA and rapid growth trajectories in Asia-Pacific-require nuanced market entry and commercialization plans. Furthermore, the strategic trajectories of leading companies underscore the value of partnerships, targeted acquisitions, and patient-centric services in building brand equity and securing market share.

As the landscape continues to evolve with biosimilar expansions and digital health integrations, industry leaders must remain agile and forward-thinking. By leveraging the research insights and actionable recommendations provided herein, stakeholders can drive sustainable growth and maximize the impact of their branded generics portfolios in a dynamic global environment.

Engage with Ketan Rohom to Unlock Comprehensive Branded Generics Market Insights and Drive Growth through Tailored Research Solutions Today

For tailored insights into branded generics dynamics and to accelerate strategic decision making, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure you secure the comprehensive market research report needed to inform product positioning, pricing strategies, supply chain optimization, and competitive intelligence. Engage today to harness data-driven recommendations, actionable intelligence, and in-depth analysis that can empower your organization to capture growth opportunities and mitigate emerging risks in the complex branded generics landscape.

- How big is the Branded Generics Market?

- What is the Branded Generics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?