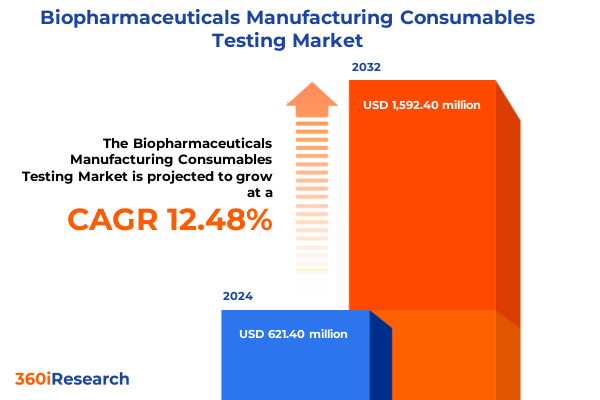

The Biopharmaceuticals Manufacturing Consumables Testing Market size was estimated at USD 696.93 million in 2025 and expected to reach USD 788.40 million in 2026, at a CAGR of 12.52% to reach USD 1,592.40 million by 2032.

Exploring the Critical Role of Advanced Consumables Testing in Ensuring Biopharmaceutical Manufacturing Quality and Compliance Across Multiple Production Stages

The biopharmaceutical manufacturing sector has witnessed an unprecedented emphasis on consumables testing as a fundamental pillar of quality assurance and regulatory adherence. Companies across the industry are recognizing that every component introduced during production, from filtration membranes to single-use assemblies, plays a decisive role in defining the safety, efficacy, and consistency of therapeutic products. With regulatory frameworks becoming more stringent and end users demanding higher levels of process transparency, the discipline of consumables testing has evolved beyond a routine compliance checkpoint into a strategic imperative that underpins competitive differentiation.

In this context, manufacturers and quality stakeholders are investing in advanced analytical methodologies and robust testing protocols to preemptively identify potential sources of contamination, variability, or failure. The integration of testing operations into broader quality management systems has accelerated, reflecting a shift toward real-time monitoring, rapid data sharing, and cross-functional collaboration. Furthermore, as biologics pipelines expand to encompass complex molecules, personalized therapies, and cell or gene therapies, the complexity of consumables testing grows in tandem, demanding both technical sophistication and agility in implementation.

Ultimately, the introduction sets the stage for understanding how modern testing paradigms are reshaping process validation, product lifecycle management, and supply chain strategies. As we delve deeper into transformative shifts, trade impacts, segmentation patterns, regional dynamics, and actionable guidance, this foundational overview underscores the critical intersection of innovation, compliance, and operational excellence in biopharmaceutical consumables testing.

Navigating Fundamental Shifts Driving Innovation in Consumables Testing Through Digital Integration Automation and SingleUse Technologies

Over recent years, the landscape of consumables testing has undergone a pronounced metamorphosis driven by the convergence of digital instrumentation, automation, and novel materials science. Laboratory workflows are progressively incorporating automated sampling systems and robotics to reduce human error and improve reproducibility, which, in turn, accelerates throughput for high-volume assessments such as bioburden and endotoxin testing. Additionally, cloud-connected analytical platforms now offer remote monitoring capabilities, enabling quality teams to track critical parameters across geographically dispersed manufacturing sites in near real-time.

Simultaneously, the rise of single-use technologies has necessitated new validation strategies, since the polymeric materials used in bags, tubing, and connectors can interact differently with biomolecules compared to traditional stainless steel systems. This shift has compelled organizations to refine their extractables and leachables testing protocols, ensuring compatibility with sensitive modalities such as monoclonal antibodies and cell therapies. Moreover, digital data analytics and machine learning algorithms are increasingly applied to testing datasets, surfacing subtle performance trends and predictive indicators of consumable degradation or process drift.

Collectively, these transformative trends are redefining the operational paradigms of quality assurance and testing laboratories. As digital integration, automation, and advanced data insights become the new standard, biopharmaceutical manufacturers are better equipped to mitigate risks, maintain compliance, and sustain the rigorous validation cycle necessary for next-generation therapeutics.

Assessing the Combined Effects of Newly Implemented United States Regulatory Tariffs on Biopharmaceutical Testing Consumables Supply Chains

The implementation of new United States tariffs on imported raw materials and consumable components in 2025 has introduced a multifaceted challenge for manufacturers relying on global supply networks. Initially, sourcing costs for critical inputs such as chromatography media, filtration membranes, and specialized reagents experienced an uptick, prompting procurement teams to re-evaluate supplier contracts and consider near-shoring options. This reactive sourcing shift, while mitigating immediate cost pressures, also required companies to validate alternative materials under stringent regulatory guidelines, extending qualification timelines and consuming valuable resources.

Furthermore, compliance obligations intensified as documentation requirements expanded to capture the tariff-induced origin changes of testing consumables. Quality managers now face greater scrutiny during regulatory audits, where traceability of every component back through the supply chain has become integral to demonstrating adherence to Current Good Manufacturing Practices. In response, organizations have invested in digital batch records and electronic quality management systems to maintain end-to-end visibility.

In parallel, the cumulative effect of these tariffs has accelerated collaborative dialogue between industry and policymakers to alleviate pressure on essential biopharma inputs. As tariff schedules evolve, stakeholders remain vigilant, advocating for exemptions or streamlined compliance pathways. Ultimately, the evolving tariff landscape underscores the necessity of resilient sourcing strategies and agile quality systems to ensure uninterrupted availability of testing consumables vital for product safety and patient welfare.

Unveiling Targeted Insights into Biopharma Testing Consumables through Product Type Technology Application and EndUser Perspectives

Insight emerges when examining how different product typologies intersect with specialized testing requirements. Chromatography media, encompassing affinity resins, ion exchange resins, protein A resins, and size exclusion substrates, demands rigorous validation of binding capacities and selectivity, particularly as antibodies and fusion proteins become more structurally complex. Filtration consumables, from cartridge filters to depth filters and membrane filters, must be evaluated for retention efficiency and flow rates to ensure consistent removal of particulates and potential viral contaminants. Sampling assemblies introduce another dimension, where the sterility of connectors, valves, and tubing becomes a focal point while single-use bags and assemblies-ranging from bioreactor bags to mixing and storage variants-require thorough extractables profiling to safeguard product integrity throughout the process.

In parallel, the spectrum of testing modalities plays a critical role in guaranteeing environmental and product safety. Bioburden testing and endotoxin assays are complemented by pH assessments and comprehensive sterility evaluations, including direct inoculation and membrane filtration methodologies. Advanced technologies further elevate these analyses: enzyme-linked immunosorbent assays in competitive, indirect, and sandwich formats, coupled with high-resolution flow cytometry, mass spectrometry, and real-time PCR, deliver multidimensional insights into both product and process attributes.

Layered onto these technical capabilities are the diverse application contexts spanning cell culture monitoring, affinity, ion exchange, and size exclusion chromatography for protein purification, as well as viral clearance operations essential for biovaccine and gene therapy production. Behind these workflows are end users ranging from academic and research institutes to biosimilar manufacturers, large and mid-size pharmaceutical firms, contract manufacturing organizations, and contract research organizations. Each stakeholder’s unique requirements, from exploratory research to commercial-scale release, shape the selection, validation, and lifecycle management of consumables testing solutions.

This comprehensive research report categorizes the Biopharmaceuticals Manufacturing Consumables Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Testing Type

- Technology

- Application

- End User

Examining Regional Dynamics Shaping the Adoption of Consumables Testing Practices Across the Americas EMEA and AsiaPacific Biopharma Hubs

The Americas region anchors much of the demand for consumables testing, driven by a robust pipeline of novel biologics and strong regulatory oversight from agencies such as the U.S. Food and Drug Administration and Health Canada. In this context, advanced testing laboratories in the United States, Canada, and Brazil serve as innovation hubs, often pioneering modular facilities and contract testing services that offer scale and flexibility. Manufacturers across North and South America benefit from evolving trade agreements and harmonized quality standards, although regional supply imbalances occasionally necessitate strategic inventory buffers and dual-sourcing models.

Contrastingly, Europe, the Middle East, and Africa collectively present a mosaic of regulatory frameworks, each influencing how testing consumable protocols are designed and validated. In leading markets such as Germany, the United Kingdom, and France, producers leverage state-of-the-art cleanroom capabilities and detailed pharmacopoeial guidelines to support high-throughput biologic production. Emerging biotech clusters in the Middle East and South Africa are investing in localized testing infrastructures, with partnerships between government entities and private sector labs aiming to reduce dependence on external contract services.

Asia Pacific stands out as a rapidly expanding center for both development and manufacturing, particularly in China, India, Japan, and Australia. A mix of government incentives for biopharmaceutical R&D, growing domestic demand, and an expanding base of contract service providers has sparked investments in automated testing platforms, single-use system validation labs, and reagent manufacturing facilities. Together, these regional dynamics underscore the importance of tailored approaches to testing strategy, supply chain design, and regulatory alignment in diverse global markets.

This comprehensive research report examines key regions that drive the evolution of the Biopharmaceuticals Manufacturing Consumables Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Driving Advances in Biopharmaceutical Consumables Testing Technologies and Partnerships

Leading life science companies continue to expand their footprints in consumables testing through strategic acquisitions, portfolio diversification, and technology partnerships. Several established instrument and consumable providers have bolstered their offerings with specialized testing services for endotoxin, bioburden, pH, and sterility assessment, embedding digital analytics tools to enhance service delivery. Others have pursued collaborations with software innovators to integrate laboratory information management systems and cloud-based dashboards that streamline compliance documentation and real-time monitoring.

In parallel, certain biotechnology firms have developed proprietary single-use components and resins calibrated to specific molecule classes, while forging alliances with contract research and contract manufacturing organizations to co-develop validation protocols. These initiatives not only reinforce technical credibility but also foster co-innovation, as feedback from end users informs subsequent product iterations. Meanwhile, emerging players are carving out niches in high-sensitivity testing modalities, such as next-generation sequencing for viral contaminant screening and microfluidic-enabled pH sensors for continuous in-process monitoring.

Across the board, these corporate maneuvers reflect a competitive landscape where agility, depth of expertise, and the ability to deliver end-to-end testing solutions-encompassing consumable design, analytical execution, and data management-are key differentiators. As companies vie for leadership positions, their strategic investments in technology, talent, and collaborative networks continue to shape the evolution of consumables testing capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biopharmaceuticals Manufacturing Consumables Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Alcami Corporation

- Almac Group Limited

- ALS Limited

- ASTM International

- Avance Biosciences, Inc.

- Becton, Dickinson and Company

- BioConvergence LLC

- BioLife Solutions Inc.

- bioMérieux SA

- Boston Analytical, Inc.

- Bureau Veritas SA

- Catalent, Inc

- Charles River Laboratories International, Inc.

- Curia Global, Inc.

- DEKRA SE

- EM Topco Limited

- Eurofins Scientific SE

- Intertek Group PLC

- Laboratory Corporation of America

- LGM Pharma, LLC

- Life Technologies (India) Pvt Ltd.

- Merck KGaA

- MISTRAS Group, Inc.

- Neopharm Labs Inc.

- Ortho-Clinical Diagnostics, Inc.

- Pace Analytical Services, LLC

- Pacific BioLabs, Inc.

- ProtaGene, GmbH.

- Sartorius AG

- SGS SA

- Sotera Health Company

- STERIS PLC

- Tentamus Group GmbH

- Thermo Fisher Scientific Inc.

- TÜV SÜD ELAB GmbH

- WuXi AppTec, Inc.

Strategic Imperatives for Industry Leaders to Optimize Consumables Testing Protocols Embrace Innovation and Strengthen Supply Chain Resilience

To stay ahead in an environment of rapid technological progress and evolving regulatory demands, industry leaders should prioritize the adoption of automated sampling and digital data integration platforms. Embedding connectivity between laboratories, production sites, and quality management teams can expedite decision making and reduce batch release timelines. At the same time, fostering strategic partnerships with suppliers of single-use systems and advanced materials will enable more predictable validation cycles and lower risks associated with raw material substitutions.

Additionally, diversifying the supply base through near-shoring or multi-vendor strategies can insulate operations from tariff-related disruptions, ensuring consistent availability of critical components. Leaders should also invest in workforce upskilling, arming quality assurance personnel with expertise in the latest testing modalities-from real-time PCR to mass spectrometry-and in data analytics techniques that translate complex datasets into actionable insights.

From a governance perspective, engaging proactively with regulatory authorities to advocate for harmonized guidelines on new materials and testing approaches can streamline approval pathways. Similarly, developing internal centers of excellence for method development and validation will centralize best practices, accelerate technology transfer, and support scalable expansion of testing capacity. By combining technological foresight with supply chain resilience and regulatory collaboration, organizations can fortify their quality assurance frameworks and maintain a competitive edge in the dynamic biopharmaceutical landscape.

Detailing the Rigorous Multistage Research Approach Employed to Analyze Testing Consumables and Underpin Reliable Biopharmaceutical Insights

The findings presented in this summary derive from a rigorous multistage research approach designed to capture the complex interplay of technology, regulation, and market dynamics. Initially, an extensive review of peer-reviewed journals, patent literature, and regulatory filings established the scientific and compliance context for consumables testing. This secondary research was complemented by analysis of technical whitepapers and standards from recognized bodies to ensure alignment with existing quality frameworks.

In the primary research phase, structured interviews and roundtables with key opinion leaders-ranging from quality assurance directors at manufacturing organizations to product managers at consumables suppliers-provided real-world perspectives on operational challenges and adoption drivers. These qualitative insights were reinforced through a quantitative survey of industry professionals, who detailed their experiences with specific testing modalities, supplier relationships, and digital platforms.

To validate and enrich the analysis, a Delphi method was employed, engaging subject matter experts in iterative feedback sessions that refined the key themes and identified emerging opportunities. Data triangulation across these research streams ensured consistency and mitigated biases. Finally, the aggregated insights underwent thorough editorial and methodological review to confirm transparency, reproducibility, and adherence to best practices in market research.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biopharmaceuticals Manufacturing Consumables Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biopharmaceuticals Manufacturing Consumables Testing Market, by Product Type

- Biopharmaceuticals Manufacturing Consumables Testing Market, by Testing Type

- Biopharmaceuticals Manufacturing Consumables Testing Market, by Technology

- Biopharmaceuticals Manufacturing Consumables Testing Market, by Application

- Biopharmaceuticals Manufacturing Consumables Testing Market, by End User

- Biopharmaceuticals Manufacturing Consumables Testing Market, by Region

- Biopharmaceuticals Manufacturing Consumables Testing Market, by Group

- Biopharmaceuticals Manufacturing Consumables Testing Market, by Country

- United States Biopharmaceuticals Manufacturing Consumables Testing Market

- China Biopharmaceuticals Manufacturing Consumables Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Core Discoveries to Illuminate the Future Trajectories of Consumables Testing in Biopharmaceutical Manufacturing Excellence

The collective exploration of technological advancements, tariff impacts, segmentation intricacies, regional dynamics, and corporate strategies reveals a landscape undergoing profound transformation. Digital integration, automation, and single-use innovations are reshaping testing paradigms, while regulatory and tariff considerations drive strategic supply chain decisions. Segmentation insights underscore the nuanced requirements of diverse product types, testing modalities, applications, and end users, highlighting areas for targeted investment and method optimization.

Regionally, the Americas continue to lead in capacity and innovation, EMEA presents a heterogeneous but mature environment, and Asia Pacific offers high growth potential supported by government and private investments. Leading companies are leveraging acquisitions, collaborations, and proprietary technologies to strengthen their market positions. Against this backdrop, actionable recommendations emphasize connectivity, supply chain resilience, workforce development, and regulatory engagement as pillars for sustained excellence.

Taken together, these insights form a cohesive blueprint for stakeholders aiming to navigate the complexities of consumables testing. By synthesizing best practices, aligning with regulatory demands, and adopting forward-looking technologies, the industry is poised to deliver safer, more effective therapies with the consistency that modern patients and healthcare systems demand.

Connect Directly with Ketan Rohom to Acquire a Comprehensive Report and Propel Your Biopharmaceutical Consumables Testing Strategy Forward

To explore detailed analyses of testing protocols, supply chain dynamics, regional nuances, segmentation insights, and strategic trends, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engaging him will enable your organization to secure immediate access to the full market research report and benefit from tailored guidance on enhancing quality assurance, optimizing procurement strategies, and driving innovation in consumables testing. By partnering with Ketan Rohom, you will gain a comprehensive understanding of the competitive landscape, learn from actionable recommendations, and empower your team to make data-driven decisions that strengthen operational resilience. Connect with Ketan Rohom to lock in your copy of the research report and unlock the strategic intelligence necessary to navigate the complexities of the biopharmaceutical manufacturing consumables testing arena.

- How big is the Biopharmaceuticals Manufacturing Consumables Testing Market?

- What is the Biopharmaceuticals Manufacturing Consumables Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?