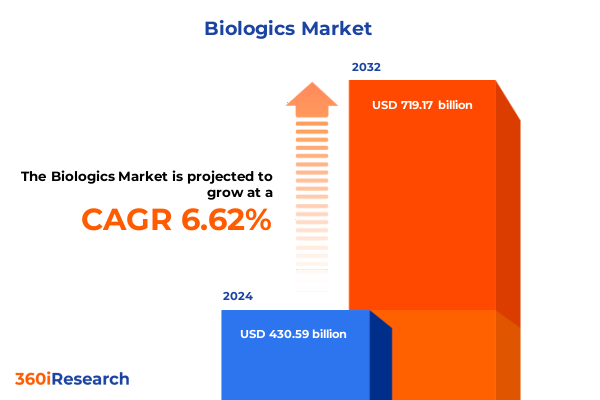

The Biologics Market size was estimated at USD 459.45 billion in 2025 and expected to reach USD 486.37 billion in 2026, at a CAGR of 6.61% to reach USD 719.17 billion by 2032.

Unveiling the Dynamic Evolution of the Global Biologics Landscape in 2025 as Industry Forces Converge to Shape Future Therapeutic Frontiers

The global biologics sector has witnessed an unprecedented evolution in 2025, driven by groundbreaking scientific breakthroughs, shifting regulatory frameworks, and intensified international partnerships. Trendsetting advances in cell and gene therapies have expanded the horizon of treatment possibilities, enabling personalized interventions that were mere concepts a decade ago. Meanwhile, established modalities such as monoclonal antibodies and recombinant proteins continue to deliver clinical value in areas ranging from oncology to autoimmune disorders, underscoring the maturation of biotherapeutic platforms and the growing confidence of healthcare stakeholders in these modalities.

Innovation pipelines have grown both in breadth and depth, bolstered by strategic investments from pharmaceutical powerhouses and nimble biotech players alike. A recent analysis highlights a surge in licensing deals with Chinese biotechnology firms, marking a record in cross-border collaborations that now account for a substantial share of global R&D initiatives. These partnerships reflect an industry-wide recognition that no single geography holds a monopoly on scientific talent or patient populations, positioning biologics as a truly global enterprise with multifaceted innovation hubs driving the next wave of discovery.

From a technological standpoint, the sector is rapidly integrating artificial intelligence, advanced cell culture platforms, and novel manufacturing approaches to accelerate development timelines and enhance process scalability. Regulatory agencies have responded with adaptive frameworks, exemplified by the U.S. FDA’s recent elimination of REMS requirements for approved CAR-T therapies-an acknowledgment of the matured safety profiles of these products and a catalyst for broader clinical adoption. As the landscape continues to adapt, stakeholders must navigate a complex interplay of scientific promise, policy evolution, and competitive dynamics to capitalize on the transformative potential of biologics.

Charting the Transformative Shifts in Biologics Development and Manufacture Driven by Innovation, Regulation, and Global Market Forces in 2025

The biologics sector in 2025 stands at the precipice of transformative shifts, where legacy treatment modalities intersect with pioneering therapeutic technologies. Immuno-oncology has transcended early proof-of-concept studies, giving rise to CAR-T and T-cell receptor therapies that are penetrating new indications beyond hematologic malignancies. This migration into solid tumors and autoimmune diseases signals a pivotal moment, as biotherapeutics redefine the boundaries of what is clinically achievable and continue to weave a more personalized fabric of patient care.

Simultaneously, pricing and reimbursement landscapes are undergoing realignment under third-party payers and national health systems that demand clear evidence of value. Innovative contracting models-ranging from outcomes-based agreements to risk-sharing partnerships-are emerging as critical levers to ensure patient access while preserving economic sustainability. By proactively engaging payers and aligning evidence generation with real-world performance metrics, companies are charting new commercial pathways that reduce entry barriers and support the long-term viability of high-cost therapies.

Supply chain resiliency has become paramount, as geopolitical tensions and evolving trade policies compel biologics manufacturers to diversify production footprints. The accelerated adoption of single-use bioreactors and modular facility designs is enabling faster scale-up and regionalized manufacturing, reducing lead times and buffering against localized disruptions. This strategic dispersion of capacity not only safeguards critical product availability but also provides a foundation for responsive market expansions and tailored patient support programs.

Assessing the Far Reaching Cumulative Impact of United States Tariff Measures on Biologics Supply Chains, Innovation Costs, and Strategic Manufacturing

The cumulative impact of U.S. tariff measures in 2025 has introduced new cost considerations across the biologics value chain, influencing raw material sourcing, equipment procurement, and final product pricing. Beginning April 5, 2025, a global tariff of 10% on all goods entering the United States has applied to key inputs such as active pharmaceutical ingredients, laboratory consumables, and specialized manufacturing equipment. This adjustment has elevated production costs for all manufacturers operating within or exporting to the U.S., compelling companies to reassess their global supply strategies in order to maintain margin integrity and manage price sensitivities within healthcare budgets.

Moreover, the prospect of targeted levies-some proposals suggest tariffs of up to 200% on imports from strategic regions-has accelerated reshoring initiatives. Industry leaders, including Biogen, AstraZeneca, Roche, and Merck, have pledged multi-billion-dollar investments to expand domestic manufacturing footprints. Biogen’s recent announcement of a $2 billion investment to enhance its North Carolina operations illustrates this trend, which seeks to mitigate tariff exposure while reinforcing supply chain sovereignty and national security priorities. These strategic investments underscore a broader industry consensus that localized capacity is integral to future resilience and uninterrupted patient access.

The heightened cost environment has also catalyzed discussions around regulatory incentives, as stakeholders lobby for tax credits, expedited inspections, and grant programs to counterbalance tariff-induced burdens. Collaborative dialogues between industry associations and federal agencies are underway to explore policy mechanisms that encourage domestic production while preserving the affordability of biologic therapies. As these conversations mature, the interplay of trade policy and regulatory frameworks will remain a defining factor in shaping the global competitiveness of U.S. biologics manufacturing.

Deriving Key Segmentation Insights Revealing How Product Types, Technologies, Administration Routes, Therapeutic Areas, End Users, and Channels Define Biologics Markets

In analyzing segmentation dynamics within the biologics market, product type distinctions reveal divergent trajectories and investment priorities. Cell therapies, particularly CAR-T and stem cell-based approaches, are capturing disproportionate attention due to their potential to deliver curative outcomes for blood cancers, while gene therapies are unlocking novel treatment avenues across rare genetic disorders. Monoclonal antibodies and recombinant proteins remain foundational, delivering robust pipelines in oncology, autoimmune, and infectious disease indications, and vaccines continue to underscore public health imperatives.

Technological segmentation further illuminates the evolving competitive landscape. Gene editing, with tools such as CRISPR, TALENs, and zinc finger nucleases, is redefining target validation and enabling precision corrections within patient genomes. Cell culture and recombinant DNA technologies continue to underpin large-scale production, while hybridoma systems facilitate the rapid discovery of therapeutic antibodies. Each technology domain demands specialized expertise and infrastructure, driving strategic alliances between platform providers and therapeutic developers.

Route of administration serves as a critical differentiator in patient-centric design, with intravenous and subcutaneous formats dominating high-volume biologics, while intramuscular delivery is gaining traction for next-generation vaccines and certain gene therapies. Therapeutic area segmentation highlights oncology’s prominence, supported by robust investment and regulatory momentum, while autoimmune, cardiovascular, infectious, metabolic, and neurological disorders represent fertile grounds for pipeline diversification.

End users span clinical and institutional settings, where hospitals and research institutes anchor high-complexity biologic administration, complemented by growing utilization within clinics and home healthcare programs that prioritize patient convenience and cost efficiency. Distribution channels-including hospital pharmacies, retail pharmacies, and online platforms-reflect the convergence of traditional and digital models, demanding seamless logistics, robust cold-chain capabilities, and integrated patient support services.

This comprehensive research report categorizes the Biologics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Route Of Administration

- Therapeutic Area

- End User

- Distribution Channel

Examining Key Regional Insights to Uncover Growth Patterns and Strategic Opportunities across the Americas, EMEA, and Asia-Pacific Biologics Sectors

Regional analysis of the biologics market uncovers distinct growth drivers and strategic imperatives across the Americas, EMEA, and Asia-Pacific. In the Americas, the United States leads in R&D investment, clinical trial density, and manufacturing capacity, bolstered by a favorable reimbursement environment and a mature biotech ecosystem. Canada, while smaller in scale, benefits from targeted government incentives and a streamlined regulatory framework that attracts early-stage collaborations.

Across Europe, the Middle East, and Africa, multilateral regulatory harmonization efforts-led by EMA initiatives-are facilitating pan-regional trial designs and expedited approvals, particularly for advanced therapies. Western European markets prioritize value-based reimbursement, driving real-world evidence generation, while emerging markets in Eastern Europe and the Middle East are rapidly scaling infrastructure investments to address growing demand for innovative treatments.

Asia-Pacific is characterized by a delicate balance between local market potential and cross-border collaboration. China’s biotech sector, having received strategic prioritization since 2011, now leads in clinical trial registrations and venture capital deployment, while Japan’s regulatory reforms and accelerated review pathways have positioned it as a key gateway for cell and gene therapies. Australia and South Korea complement this dynamic, with robust academic capacities and specialized manufacturing clusters that attract global partnerships.

This comprehensive research report examines key regions that drive the evolution of the Biologics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Synthesizing Key Companies Insights Highlighting Strategic Investments, R&D Partnerships, and Manufacturing Expansions by Leading Biologics Players

Leading biopharmaceutical companies are redefining competitive benchmarks through landmark investments and strategic collaborations. AstraZeneca’s commitment to a $50 billion U.S. expansion underscores the trend of reshoring as a hedge against trade uncertainties and as a commitment to local innovation ecosystems. Similarly, Roche and Novartis have announced multi-billion-dollar projects to enhance domestic production, emphasizing next-generation modalities and scale-up capabilities for high-complexity biologics.

Biogen’s targeted investment in North Carolina highlights the importance of bolstering regional manufacturing hubs ahead of tariff implementation, while Pfizer’s strategic partnerships with U.S. contract development and manufacturing organizations reflect a hybrid approach that balances in-house and outsourced capacity. Eli Lilly’s portfolio of new facilities demonstrates a parallel focus on cell-based therapies and advanced fill-finish operations, addressing the logistical nuances of personalized treatments.

Emerging players are making their mark through nimble alliances and specialized platform technologies. Gene therapy specialists are forging partnerships with leading research institutes to accelerate translational pipelines, while innovative CDMOs are expanding service offerings to include end-to-end process development, emphasizing automation, digital twin modeling, and AI-driven quality control. This collaborative fabric is enabling a more distributed innovation network that complements traditional pharma giants and fosters a vibrant ecosystem of specialized expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biologics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Catalent Inc.

- Celltrion Inc.

- CSL Limited

- Eli Lilly and Company

- Gilead Sciences Inc.

- GlaxoSmithKline plc

- Johnson & Johnson

- Lonza Group AG

- Merck & Co. Inc.

- Moderna Inc.

- Novartis AG

- Novo Nordisk A/S

- Pfizer Inc.

- Roche Holding AG

- Samsung Biologics Co. Ltd.

- Sanofi SA

- Takeda Pharmaceutical Company Limited

Formulating Actionable Recommendations to Guide Industry Leaders in Optimizing Biologics Supply Chains, R&D Strategies, and Market Positioning

To navigate the complexities of the evolving biologics landscape, industry leaders must adopt a holistic strategy that integrates supply chain resilience, regulatory alignment, and innovation agility. First, prioritizing diversified manufacturing footprints-leveraging modular plant designs and flexible single-use technologies-can mitigate geopolitical and tariff-related risks while enabling rapid capacity adjustments in response to market demands.

Second, aligning evidence generation with payer expectations through real-world data and outcomes-based contracts will be critical to sustaining premium pricing for high-value therapies. Companies should establish cross-functional teams comprising clinical, health economics, and market access experts to develop robust value dossiers that resonate with payers globally.

Third, fostering cross-sector collaborations-spanning biotech startups, academic centers, and CDMOs-can accelerate platform development and share risks. Structured alliance frameworks that outline clear governance, milestone definitions, and data-sharing protocols will streamline joint innovation efforts and optimize resource utilization.

Lastly, investing in digital transformation initiatives-such as AI-enabled process control, supply chain analytics, and patient engagement platforms-will enhance operational efficiency and strengthen stakeholder connectivity. By embedding digital tools across the R&D and commercial continuum, organizations can unlock actionable insights, reduce time-to-market, and elevate patient experiences.

Detailing the Rigorous Research Methodology Employed to Ensure Robust Data Collection, Analysis, and Insight Generation in Biologics Market Research

This research employed a rigorous multi-phase methodology to ensure comprehensive coverage and analytical depth. Primary research included in-depth interviews with senior executives across leading biopharma companies, technology platform providers, and key opinion leaders in regulatory affairs. These dialogues provided nuanced perspectives on emerging trends, strategic priorities, and operational challenges within the biologics ecosystem.

Secondary research encompassed a meticulous review of public filings, regulatory databases, scientific literature, and industry news sources. Data triangulation techniques were applied to validate findings, with cross-verification against proprietary databases and reputable news outlets. Quantitative insights were enriched through synthesis of reported investment figures, clinical trial activity, and manufacturing capacity announcements.

To ensure regional relevance, the study incorporated input from local market specialists across the Americas, EMEA, and Asia-Pacific, capturing the distinct policy frameworks, reimbursement environments, and infrastructure capabilities shaping biologics adoption. All data points were subjected to quality checks and peer reviews, upholding the highest standards of analytical integrity and actionable insight generation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biologics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biologics Market, by Product Type

- Biologics Market, by Technology

- Biologics Market, by Route Of Administration

- Biologics Market, by Therapeutic Area

- Biologics Market, by End User

- Biologics Market, by Distribution Channel

- Biologics Market, by Region

- Biologics Market, by Group

- Biologics Market, by Country

- United States Biologics Market

- China Biologics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives Emphasizing the Strategic Imperatives and Future Directions for Biologics Industry Stakeholders in an Evolving Landscape

In an era defined by rapid technological advances and shifting trade dynamics, the biologics sector remains a beacon of innovation and collaboration. The convergence of next-generation therapies, adaptive regulatory frameworks, and strategic investment initiatives is reshaping the industry’s value chain, from discovery to patient delivery. Stakeholders who proactively embrace supply chain diversification, evidence-driven market access strategies, and digital transformation will be best positioned to capitalize on emerging opportunities and mitigate future disruptions.

As global biologics markets continue to evolve, the interplay of policy, science, and commercial strategy will define the pace of therapeutic breakthroughs and patient impact. The insights presented herein offer a strategic compass for leaders seeking to navigate complex market forces and drive sustainable growth. By harnessing the collective strengths of industry partnerships, technological innovations, and robust research methodologies, organizations can chart a course toward long-term success in the biologics domain.

Engage with Ketan Rohom to Access the Comprehensive Biologics Market Research Report and Empower Your Strategic Decision Making

To explore the full breadth of insights and equip your organization with the competitive edge required in today’s fast-evolving biologics market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can provide detailed guidance on how this comprehensive market research report can be tailored to your strategic priorities. Engage with Ketan to unlock access to proprietary data, benchmark your initiatives against industry best practices, and drive informed decision-making that accelerates growth and innovation.

- How big is the Biologics Market?

- What is the Biologics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?