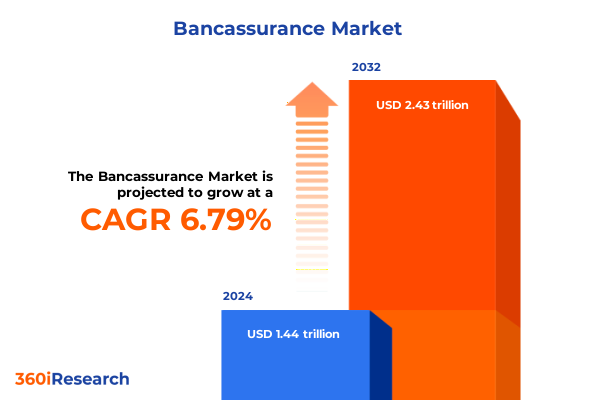

The Bancassurance Market size was estimated at USD 1.53 trillion in 2025 and expected to reach USD 1.63 trillion in 2026, at a CAGR of 6.84% to reach USD 2.43 trillion by 2032.

Unveiling the Power of Bancassurance as a Strategic Catalyst for Sustainable Growth and Enhanced Customer Engagement in Today’s Financial Ecosystem

Bancassurance stands at the forefront of financial innovation, seamlessly integrating banking and insurance services to create a unified customer experience. In an era defined by heightened digital engagement and evolving regulatory frameworks, the convergence of these two sectors offers unprecedented opportunities for growth and customer loyalty. This report delves into the dynamics that have propelled bancassurance from a niche partnership concept to a cornerstone strategy for forward-looking financial institutions.

Beginning with a review of industry catalysts-ranging from technological advancements and shifting consumer preferences to regulatory harmonization-this introduction establishes the context for understanding why bancassurance is more relevant than ever. As banks seek to diversify revenue streams and insurers aim to expand distribution channels, the bancassurance model emerges as a mutually beneficial pathway that leverages existing customer bases and trust relationships. By setting the stage for the detailed analyses that follow, this section outlines the purpose and scope of the report, highlighting its focus on strategic implications rather than numerical market projections.

Exploring Pivotal Industry Disruptions Reshaping Distribution Channels and Customer Expectations Across Innovative Bancassurance Partnerships

The bancassurance landscape has undergone transformative shifts that extend far beyond conventional distribution partnerships. Digital platforms, mobile applications, and embedded insurance offerings now redefine how customers interact with both banking and insurance products. This convergence has elevated customer expectations, demanding seamless omnichannel experiences and personalized risk solutions at the point of sale.

Moreover, the rise of insurtech and fintech collaborations has spurred innovative distribution agreements and strategic alliances that challenge traditional mixed models. Banks are increasingly leveraging data analytics and artificial intelligence to underwrite risks more accurately and tailor coverage options in real time. Consequently, insurers are partnering with financial services groups to integrate white-label solutions into core banking applications, thereby enhancing cross-sell potential and operational efficiency.

Furthermore, regulatory developments-such as enhanced data privacy mandates and evolving capital requirements-have prompted joint ventures that share risk more equitably and ensure compliance across jurisdictions. These structural evolutions, coupled with customer demand for transparency and convenience, underscore a paradigm shift in how bancassurance alliances are conceived and executed. This section illuminates the driving forces that are reshaping distribution channels, redefining partnership models, and elevating customer expectations across the bancassurance ecosystem.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Policies on Cross-Border Insurance Distribution and Strategic Partnerships

The introduction of new tariff measures in the United States during 2025 has exerted a substantial influence on cross-border bancassurance strategies. Heightened import duties on technology components have increased the cost of digital infrastructure enhancements, compelling banks and insurers to reassess their IT investments and partnership agreements. As a result, many institutions have turned to domestic technology providers to maintain agility while mitigating tariff-driven expenses.

In addition, the tariffs on financial service imports have led to a reevaluation of joint venture structures and distribution agreements with international insurers. Firms are negotiating more flexible contractual terms to absorb additional cost pressures and to optimize service delivery within the revised regulatory context. Consequently, the initial expectations for seamless cross-border product distribution have been recalibrated to account for tariff-induced lead times and cost escalations.

Furthermore, these policy changes have accelerated the adoption of mixed models. By combining local underwriting capabilities with global product expertise, financial institutions can preserve competitive positioning despite increased trade friction. Banks and insurers are also exploring strategic alliances that prioritize in-country data centers and localized claims processing to circumvent tariff constraints. This section evaluates how 2025 U.S. tariff policies have compelled stakeholders to pivot their cross-border bancassurance frameworks, driving cost optimization and strategic realignment.

Deep Dive into Insurance, Contract, Model, and Customer Segmentation Revealing Strategic Opportunities for Personalized Bancassurance Solutions

Segmentation analysis reveals differentiated growth avenues across insurance type, contract type, bancassurance model, and customer type. Within insurance type, life insurance continues to command attention through its subsegments of endowment, term, and unit-linked plans, each appealing to distinct risk appetites and savings objectives. Non-life products such as health, key man, marine, and property insurance are also gaining traction as customers seek comprehensive protection solutions.

Contract type segmentation highlights the strategic importance of aligning product tenors with customer needs. Long-term contracts, typically favored by high-net-worth individuals and corporates seeking stability, contrast with medium-term arrangements that balance flexibility and commitment. Short-term contracts increasingly serve as entry points for younger demographics and smaller businesses, providing granular coverage without extended obligations.

Examining bancassurance models uncovers the nuanced benefits of distribution agreements, financial services group structures, joint ventures, mixed models, and strategic alliances. Distribution agreements offer straightforward market entry with minimal resource sharing, whereas joint ventures and financial services groups facilitate deeper integration and shared governance. Mixed models and strategic alliances emerge as adaptive frameworks that blend the agility of partnerships with the governance controls of traditional ventures.

Finally, customer type segmentation underscores divergent engagement strategies. Corporate and business clients prioritize risk management solutions and bespoke coverage, while individual customers demand intuitive digital interfaces and value-added wellness programs. Understanding these segmentation layers enables industry participants to tailor their offerings, optimize product portfolios, and refine channel strategies for maximum relevance and impact.

This comprehensive research report categorizes the Bancassurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insurance Type

- Contract Type

- Bancassurance Models

- Customer Type

Mapping Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Identify Critical Bancassurance Growth Pathways

Regional dynamics exhibit distinct bancassurance maturity levels and growth drivers across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the evolution of digital banking platforms has spurred embedded insurance offerings, enabling financial institutions to cross-sell protection products within existing digital ecosystems. Regulatory frameworks in key markets encourage bancassurance collaborations by providing clear guidelines on product distribution and data sharing.

Moving to Europe, the Middle East & Africa, established bancassurance partnerships benefit from extensive branch networks and high brand trust. Strategic alliances in this region frequently leverage group purchasing power to negotiate favorable reinsurance terms, while joint ventures drive localized underwriting capabilities to address complex regional risks. The regulatory environment continues to evolve, requiring agile governance structures that balance consumer protection with innovation incentives.

In Asia-Pacific, rapid economic growth and rising insurance awareness underpin expansion opportunities. Financial services groups capitalize on large unbanked populations, using mobile wallets and micro-insurance models to reach underserved customers. Mixed models that integrate global product innovation with local distribution expertise have proven particularly effective in markets with diverse regulatory landscapes and cultural preferences.

These regional insights illustrate how geographic nuances influence partnership structures, product design, and distribution strategies. By adapting to local regulatory climates, customer behaviors, and digital adoption trends, bancassurance stakeholders can unlock sustainable growth pathways and competitive differentiation across territories.

This comprehensive research report examines key regions that drive the evolution of the Bancassurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Bancassurance Collaborations and Strategic Moves by Key Insurers and Financial Institutions Driving Industry Transformation

The bancassurance sector is characterized by an array of strategic collaborations that exemplify innovation and market leadership. Leading global banks have aligned with top-tier insurers to launch white-label products integrated into core banking platforms, delivering seamless customer journeys at the point of sale. Meanwhile, premier life insurers have formed joint ventures with regional banking groups to co-underwrite and distribute retirement and savings solutions tailored to local demographics.

In parallel, strategic alliances between digital neobanks and insurtech startups are reshaping the distribution paradigm by embedding protection products in mobile-first experiences. These partnerships leverage advanced underwriting algorithms and real-time data analytics to offer personalized coverage recommendations. Financial services groups have also leveraged distribution agreements to expand non-life insurance portfolios, focusing on health and property products that complement existing wealth management services.

Additionally, several mixed-model collaborations illustrate the value of combining global product expertise with localized risk assessment capabilities. By co-investing in data infrastructure and compliance frameworks, these alliances ensure agility in new markets while maintaining rigorous governance standards. Corporate bancassurance initiatives have likewise gained prominence, with specialized key man and employee benefit schemes designed through integrated bank-insurer platforms.

These company-level strategies highlight how leading players are harnessing collaborative frameworks to optimize customer acquisition, diversify revenue streams, and enhance operational resilience. The convergence of digital innovation, shared governance, and tailored product portfolios underscores the evolution of bancassurance partnerships into multifaceted growth engines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bancassurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABN AMRO Bank N.V.

- AIA Group

- Allianz SE

- Amana Takaful Insurance

- AXA S.A.

- BNP Paribas S.A.

- City Bank PLC

- Credit Agricole SA

- FWD Group

- Generali Group

- GIE BNP Paribas Cardif

- HSBC Holdings plc

- ING Group

- Intesa Sanpaolo

- MAPFRE S.A.

- MetLife, Inc.

- Nippon Life Insurance Company

- Ping An Insurance (Group) of China

- Prudential plc

- Standard Chartered PLC

- Talanx AG

- Wells Fargo & Co.

- Zurich Insurance Group

Actionable Strategies for Banking and Insurance Executives to Harness Emerging Trends, Optimize Distribution, and Strengthen Market Positioning

To capitalize on emerging trends, industry leaders must prioritize investment in digital integration and data analytics. Enhancing IT infrastructure to support real-time underwriting and policy administration will streamline customer journeys and reduce operational friction. Moreover, forging flexible distribution agreements that accommodate shared governance and agile decision-making can accelerate time-to-market for innovative insurance offerings.

Furthermore, stakeholders should refine product design by leveraging segmentation insights. Tailoring contract tenors and coverage features to the distinct needs of life and non-life customers enables higher engagement and retention. In parallel, expanding strategic alliances with insurtech and fintech partners will infuse traditional bancassurance models with fresh capabilities, such as predictive risk scoring and embedded claims processing.

Additionally, companies must adopt a regionally attuned approach to partnership structures. Aligning joint ventures and mixed-model frameworks with local regulatory nuances and consumer behaviors ensures compliance while maximizing market penetration. Elevating customer experience through unified digital platforms, omnichannel support, and value-added services like wellness programs will differentiate offerings in competitive landscapes.

Finally, industry leaders should establish continuous feedback loops with regulators and industry associations to shape conducive policy environments. By proactively engaging in dialogue and sharing best practices, banks and insurers can influence standards that balance consumer protection with innovation incentives. These actionable steps will empower organizations to harness the full potential of bancassurance and secure a sustainable competitive edge.

Rigorous Methodological Framework Combining Qualitative and Quantitative Approaches to Deliver Robust Insights for Bancassurance Stakeholders

The research methodology underpinning this analysis integrates both qualitative and quantitative approaches to ensure credibility and depth. Primary research involved structured interviews with senior executives from global banks, leading insurers, and technology partners, providing firsthand perspectives on partnership models, regulatory challenges, and customer engagement strategies. Additionally, expert roundtables and in-depth case studies enriched the qualitative insights by examining real-world implementations across multiple regions.

Secondary research encompassed a comprehensive review of industry white papers, regulatory filings, and publicly available corporate disclosures. This desk research facilitated a granular understanding of bancassurance frameworks, tariff policy impacts, and product segmentation trends. Data triangulation techniques were employed to cross-verify findings, ensuring consistency and reliability across sources.

Furthermore, analytical models were developed to map the interdependencies among tariff policies, partnership structures, and customer segmentation. Scenario analysis assessed potential shifts in cross-border distribution strategies in response to evolving trade regulations. Qualitative thematic coding of interview transcripts identified recurring patterns, while strategic benchmarking against leading collaborations highlighted critical success factors.

Ethical considerations, including data privacy compliance and the anonymization of proprietary information, were rigorously maintained throughout the research process. This multifaceted methodology ensures that the insights presented are both actionable and grounded in robust evidentiary standards, offering stakeholders a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bancassurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bancassurance Market, by Insurance Type

- Bancassurance Market, by Contract Type

- Bancassurance Market, by Bancassurance Models

- Bancassurance Market, by Customer Type

- Bancassurance Market, by Region

- Bancassurance Market, by Group

- Bancassurance Market, by Country

- United States Bancassurance Market

- China Bancassurance Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Perspectives on Bancassurance Evolution Emphasizing Strategic Imperatives and Future Pathways for Sustainable Collaboration

Bancassurance has evolved into a transformative mechanism for banks and insurers seeking to unlock synergies, enhance customer value, and diversify revenue streams. The convergence of digital innovation, regulatory alignment, and strategic partnerships has created a fertile environment for embedding protection products into everyday financial transactions. Moreover, the pressure of tariff adjustments and shifting customer expectations underscores the need for agile frameworks and localized execution.

Key insights reveal that segmentation strategies tailored to insurance type, contract duration, distribution models, and customer demographics are critical to achieving differentiation and sustained engagement. Regional dynamics further emphasize the importance of adaptive governance structures that respect local regulatory climates while harnessing global expertise. Leading market players demonstrate that success hinges on digital integration, collaborative governance, and continuous innovation.

Looking ahead, the bancassurance ecosystem will likely witness deeper insurtech alliances, novel embedded insurance use cases, and refined joint venture models. However, stakeholders must remain vigilant to regulatory developments and evolving consumer behaviors to maintain relevance. By adopting the actionable recommendations outlined in this report-centered on digital enhancement, product personalization, and strategic partnership frameworks-industry participants can position themselves at the vanguard of bancassurance transformation.

In conclusion, the fusion of banking and insurance through thoughtfully designed partnerships offers a compelling pathway for growth, customer loyalty, and competitive advantage. The strategic imperatives detailed herein provide a roadmap for navigating the complexities of the modern financial landscape and for capitalizing on the inherent synergies of bancassurance.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Bancassurance Market Intelligence and Catalyze Strategic Decision-Making Today

To explore the comprehensive insights, strategic analyses, and actionable recommendations within this bancassurance market research report, reach out to Associate Director Ketan Rohom. Engage in a tailored discussion to uncover how these findings can inform your next growth initiatives, optimize distribution frameworks, and strengthen customer engagement across your organization’s bancassurance activities. Connect today to secure full access to the report and collaborate on leveraging market intelligence that drives competitive differentiation and lasting value.

- How big is the Bancassurance Market?

- What is the Bancassurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?