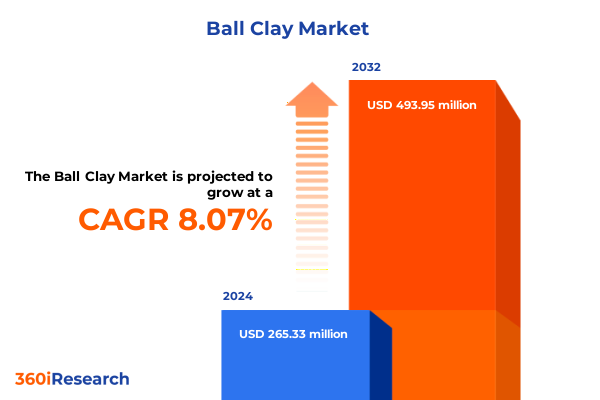

The Ball Clay Market size was estimated at USD 284.81 million in 2025 and expected to reach USD 310.52 million in 2026, at a CAGR of 8.18% to reach USD 493.95 million by 2032.

Unveiling the Strategic Importance of Ball Clay as a Multifaceted Mineral Driving Cutting-Edge Ceramics, Adhesives, Polymers, and Beyond

Ball clay is a fine-grained kaolinitic sedimentary clay commonly composed of between 20 and 80 percent kaolinite, 10 to 25 percent mica, and 6 to 65 percent quartz, along with small amounts of organic matter. Its exceptional plasticity and unfired strength derive from this unique mineralogical blend, making it an indispensable raw material in diverse industrial processes and product formulations

The term “ball clay” traces its origins to 18th-century England, where explorers discovered grayish cubes of clay in Dorset and Devon. These cubes, rounded into balls during waterborne transport, gave the material its distinctive name. Purbeck ball clay, in particular, rose to prominence after the pioneering orders of Josiah Wedgwood in the 1770s, catalyzing local mining operations and innovative tramway transport solutions that laid the groundwork for modern extraction and processing techniques

Today, ball clay underpins some of the most advanced ceramic, adhesive, and polymer formulations, prized for its rheological stability, workability, and light firing color. In ceramic whiteware and sanitaryware production, its high plasticity ensures product uniformity, while its fine particle size and controlled residue profiles make it an ideal rheology modifier in adhesives, sealants, rubbers, plastics, and even specialized agricultural applications such as fertilizers and insecticide carriers

Navigating the Transformational Trends Redefining Ball Clay Applications and Supply Dynamics in a Rapidly Evolving Industrial Ecosystem

The ball clay sector is undergoing a profound shift toward sustainability, as manufacturers embrace water conservation, energy-efficient processing, and waste minimization to align with global environmental mandates and stakeholder expectations. Innovative firing techniques and dry processing methods are reducing kiln fuel consumption and water usage, while closed-loop recycling systems for ceramic waste are transforming byproducts into feedstock, significantly curbing landfill contributions and raw material extraction footprints. This transition not only strengthens corporate social responsibility profiles but also enhances operational resilience by lowering exposure to resource price volatility and regulatory risk

Simultaneously, the adoption of digitalization is revolutionizing supply chain transparency and operational control. Specialized Manufacturing Execution Systems tailored for ceramics integrate with existing equipment to provide real-time data acquisition across clay processing, batching, pressing, and firing stages. These platforms enable hyperconnected, “smart” factories that optimize throughput, minimize downtime, and automate quality reporting. By leveraging clear production indicators and ERP interoperability, industry participants are harnessing data-driven insights to streamline workflows and rapidly respond to market fluctuations

The integration of IoT sensors and predictive analytics further accelerates this transformation, offering real-time kiln monitoring, moisture control, and equipment health diagnostics. With continuous tracking of temperature profiles and energy consumption patterns, facilities are shifting from reactive maintenance to proactive interventions, significantly reducing unplanned downtime and extending asset lifecycles. These data-driven strategies not only enhance product consistency and yield but also deliver strategic value by uncovering previously hidden efficiency gaps and enabling precision management of critical process parameters

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Ball Clay Imports and the Implications for Domestic Value Chains

In May 2025, the United States International Trade Commission implemented Revision 11 of the Harmonized Tariff Schedule, introducing an additional 25 percent duty on ball clay imports originating from China under HTS code 2508.40.01.10. This measure, enacted pursuant to Executive Order 14289, represents a significant escalation in trade policy aimed at addressing strategic supply chain vulnerabilities and fostering domestic alternative sourcing options

The immediate effect of these tariff adjustments has been an uptick in landed costs for end-users reliant on low-cost imports, prompting many to reassess their supply agreements and renegotiate long-term contracts. Importers and processors that previously benefited from China’s low production costs must now absorb higher input prices or identify non-Chinese sources, eroding traditional margins. Meanwhile, domestic and allied producers have seen increased interest as buyers seek to mitigate tariff-related disruptions by diversifying supplier portfolios and accelerating qualification of new deposits in North America and Europe

Looking forward, industry stakeholders are evaluating strategic responses to preserve competitiveness. Efforts include investing in processing automation to offset higher raw material expenses, engaging in cross-border partnerships to secure preferential tariff treatment, and exploring contract manufacturing agreements in tariff-exempt jurisdictions. These adaptive strategies will be crucial for maintaining reliability of supply while managing the cost pressures introduced by the 2025 tariff revisions.

Unlocking Actionable Insights from Form, Grade, Composition, and Application Dimensions to Drive Informed Decision Making in the Ball Clay Market

When analyzing the market through the lens of form, powder clays retain a commanding presence due to their ease of homogenization in blending operations and compatibility with high-speed mixing equipment. Shredded clays are increasingly favored for specialized refractories and custom components where controlled fiber-like textures enhance mechanical interlocking, while stone or lump clays serve niche applications demanding minimal particle disruption, such as high-temperature insulation and heavy ceramic composites.

Grade type segmentation offers further clarity. Coarse-grained ball clay variants are embraced by producers of robust ceramic bodies and refractory mixes, where enhanced structural stability during green forming is essential. Conversely, fine-grained grades, prized for their ultra-smooth consistency, are the material of choice for ultra-high-whiteness sanitaryware and fine porcelain formulations. Medium-grained clays bridge these categories, balancing plasticity and firing behavior for general purpose whiteware.

The chemical composition dimension underscores the value of high-kaolinite content clays for applications demanding superior whiteness and low thermal expansion. Meanwhile, low iron oxide clays have become a critical input for digital printing tile bodies and electrical porcelain, where purity safeguards color fidelity and dielectric performance. Application segmentation reveals the centrality of ceramic substrates-encompassing refractories, sanitary ware, tableware, wall and floor tiles-in driving clay demand, alongside growing uses in adhesives and sealants, fertilizers, insecticides, and rubber and plastic formulations seeking rheology modification and reinforcement.

This comprehensive research report categorizes the Ball Clay market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade Type

- Chemical Composition

- Application

Dissecting Regional Dynamics Across the Americas, EMEA, and Asia-Pacific to Reveal Critical Drivers Shaping the Global Ball Clay Landscape

Within the Americas, the United States remains a pivotal hub for ball clay consumption, driven by robust ceramic, automotive, and construction sectors. Favorable infrastructure and logistical networks support rapid distribution across North America, while the onset of renewable energy ceramics and advanced composites in Mexico and Canada has stimulated region-wide collaboration on raw material sourcing and processing innovations. This dynamic environment fosters opportunities for new deposit developments and strategic partnerships to meet growing demand for both traditional whiteware and industrial applications

Europe, Middle East, & Africa (EMEA) presents a complex tableau of mature markets and emerging economies. Western European ceramics giants continue to leverage high-purity Purbeck and Devon ball clays for premium tile and sanitaryware production, while Eastern European and North African manufacturers are expanding capacity to serve rapidly urbanizing populations. Concurrently, Middle Eastern refractories and specialty polymers end-users are diversifying sourcing to include both European and Asian origins, balancing quality with cost amid evolving trade agreements and regulatory landscapes

Asia-Pacific exhibits the strongest growth trajectory, underpinned by large-scale infrastructure investments in China, India, and Southeast Asia. Rapid expansion of tile and sanitaryware capacities in these markets has driven demand for both local and imported ball clays, fostering strategic collaborations between multinational producers and regional distributors. Emphasis on digital printing and advanced ceramic applications is further catalyzing investment in low-iron, high-kaolinite feedstocks to meet stringent color and performance standards in emerging premium segments

This comprehensive research report examines key regions that drive the evolution of the Ball Clay market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ball Clay Producers and Innovators to Illuminate Competitive Strategies, Technological Advances, and Growth Trajectories

Key players dominate the ball clay industry through vertically integrated operations and global distribution networks. Imerys S.A., a leading industrial minerals group, leverages its extensive Dorset, Kentucky, and Indian assets to supply high-quality clays to ceramics, polymers, and oilfield sectors. Sibelco maintains a diversified portfolio of clay extraction and processing sites, emphasizing tailored blends and specialty grades for regional markets. J.M. Huber Corporation and Quarzwerke Gruppe complement these global leaders with targeted offerings in North America and Europe, focusing on innovation in rheological control and product consistency. Emerging specialists such as Old Hickory Clay Company and Ashapura Minechem round out the competitive landscape, distinguished by agile supply chains and niche expertise in fine-grain and low-impurity materials. This constellation of producers underscores a market shaped by both scale economies and differentiation strategies to serve evolving end-use requirements

This comprehensive research report delivers an in-depth overview of the principal market players in the Ball Clay market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashapura Minechem Ltd.

- Ashok Alco-Chem Limited

- G&W Mineral Resources

- Gujarat Mineral Development Corporation Ltd.

- Imerys SA

- KaMin LLC

- Keramost a.s.

- Lhoist Group

- Minerals Technologies Inc.

- Mota Ceramic Solutions

- Old Hickory Clay Company, Inc.

- Potterycrafts Ltd.

- Quarzwerke GmbH

- Sibelco NV

- Spinks H C Clay Co Inc

- Stephan Schmidt KG

- Thiele Kaolin Company

Charting Proactive Strategic Pathways for Industry Leaders to Capitalize on Emerging Ball Clay Opportunities and Navigate Market Volatility

Industry leaders should prioritize diversification of raw material sources to mitigate tariff and geopolitical risks, forging partnerships with alternative suppliers in North America, Europe, and Asia-Pacific. Investing in advanced processing platforms, including automated quality control and digital traceability, will be essential to uphold product consistency and demonstrate compliance with environmental and safety standards. Companies can further differentiate by developing high-purity, low-iron grades tailored for digital printing and advanced ceramic applications, unlocking premium segment value.

Concurrently, collaboration on sustainability initiatives-from closed-loop waste recycling to energy-efficient firing technologies-will not only reduce operational costs but also fortify corporate reputation among stakeholders. Strategic engagement with policymakers to seek favorable tariff adjustments and expedite trade facilitation agreements will help stabilize input costs. Lastly, leveraging predictive analytics and IoT-enabled predictive maintenance will optimize asset utilization, minimize downtime, and enable data-driven decision making, positioning organizations to capture emerging growth opportunities across end-use sectors.

Exploring Rigorous Research Methodologies and Analytical Frameworks Underpinning the Comprehensive Ball Clay Market Study

This research employed a rigorous multi-stage methodology combining secondary and primary data collection with advanced analytical frameworks. A comprehensive review of publicly available literature, industry reports, and regulatory filings established the foundational market context. Primary interviews with key stakeholders, including producers, end-users, and trade associations, provided qualitative insights into operational challenges and strategic priorities. Quantitative data was triangulated across trade databases and company disclosures to validate supply-demand dynamics. Segmentation analyses were performed across form, grade, chemical composition, application, and regional dimensions to uncover granular trends. Insight synthesis leveraged cross-tabulation and scenario planning to identify strategic imperatives and risk mitigation pathways for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ball Clay market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ball Clay Market, by Form

- Ball Clay Market, by Grade Type

- Ball Clay Market, by Chemical Composition

- Ball Clay Market, by Application

- Ball Clay Market, by Region

- Ball Clay Market, by Group

- Ball Clay Market, by Country

- United States Ball Clay Market

- China Ball Clay Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Articulate the Strategic Outlook and Long-Term Implications for Stakeholders in the Ball Clay Sector

In synthesizing these findings, it is clear that ball clay remains a cornerstone material for a multitude of industrial applications, with its unique mineralogical properties indispensable for high-performance ceramic, polymer, and refractory formulations. The convergence of sustainability imperatives, digital transformation, and trade policy shifts is reshaping supply chains and redefining competitive dynamics. Stakeholders equipped with actionable segmentation insights, regional intelligence, and strategic guidance will be best positioned to navigate evolving market conditions and unlock new growth avenues. Ultimately, a balanced focus on operational excellence, innovation, and strategic risk management will determine long-term success in the ball clay ecosystem.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your Comprehensive Ball Clay Market Research Report and Gain Exclusive Insights for Competitive Advantage

Engaging directly with Ketan Rohom will unlock tailored insights, enabling your team to navigate the complexities of the ball clay market with confidence. Drawing on comprehensive research, custom data segmentation, and in-depth analysis, you’ll gain a nuanced understanding of evolving trends, risk factors, and emerging opportunities across the value chain. By securing the full market research report, you can harness expert guidance on supply chain strategies, regulatory impacts, and competitive dynamics that will inform high-impact decisions and accelerate growth. Take the next step toward strengthening your market position by contacting Ketan today to obtain this critical resource and drive sustained competitive advantage.

- How big is the Ball Clay Market?

- What is the Ball Clay Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?