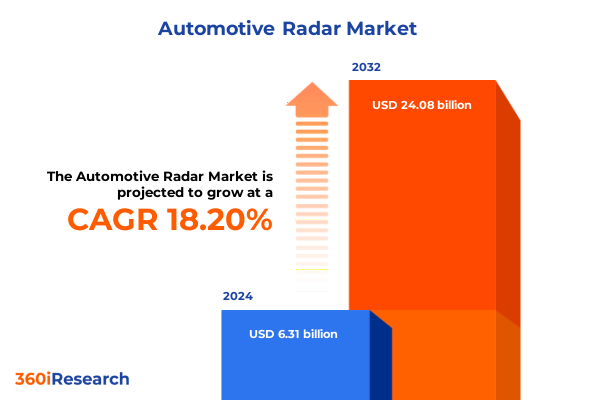

The Automotive Radar Market size was estimated at USD 7.41 billion in 2025 and expected to reach USD 8.71 billion in 2026, at a CAGR of 18.33% to reach USD 24.08 billion by 2032.

Navigating the Rise of Automotive Radar Technologies Amidst Rapid Shifts in Mobility and Safety Requirements While Charting Future Trajectories as Autonomous Driving and ADAS Integration Accelerate

The convergence of advanced driver assistance systems, increasingly stringent safety regulations, and the accelerated path to autonomous mobility has placed automotive radar at the forefront of modern vehicle intelligence. Radar sensors, with their robust performance in adverse weather and low-visibility conditions, are now recognized as indispensable enablers of features ranging from adaptive cruise control to collision avoidance. Their capacity to deliver accurate distance, speed, and positional data even under fog, rain, or darkness has driven OEMs and Tier-1 suppliers to prioritize radar integration as a central pillar of vehicle architecture.

As the autonomous vehicle roadmap advances from Level 2 automation toward full autonomy, radar’s role continues to expand beyond basic sensing. Innovations in imaging radar, digital beamforming, and frequency modulated continuous wave (FMCW) techniques are enhancing resolution and detection range, enabling finer object classification and 3D mapping capabilities. At the same time, system-level integration of radar with LiDAR, cameras, and ultrasonic sensors through sophisticated sensor fusion frameworks is delivering unparalleled situational awareness. Through this holistic approach, automotive manufacturers are crafting safer, more reliable driving experiences that meet evolving consumer expectations and regulatory mandates.

Revolutionary Technological and Regulatory Turning Points Redefining the Automotive Radar Landscape Across Global Value Chains

The automotive radar landscape is undergoing transformative shifts driven by breakthroughs in semiconductor technologies and evolving regulatory imperatives. Recent advancements in solid-state radar, including digital beamforming and multiple-input multiple-output (MIMO) architectures, are delivering higher angular resolution and multi-target tracking in compact form factors. This progress is further amplified by the migration from traditional 77 GHz bands to higher 79 GHz frequencies, which offer improved clutter suppression and finer spatial discrimination, empowering radar systems to detect smaller objects at greater distances and under complex environments.

Concurrently, global safety regulations and consumer testing protocols have raised the bar for active safety performance. Initiatives such as the European New Car Assessment Programme’s (Euro NCAP) advanced driver assistance credit requirements and the National Highway Traffic Safety Administration’s (NHTSA) emphasis on automated emergency braking have incentivized OEMs to integrate multi-sensor solutions. These regulatory drivers, coupled with growing consumer demand for higher safety ratings, have accelerated collaborative innovation across the value chain. Partnerships between radar chipset manufacturers, software vendors, and OEMs are proliferating, creating an ecosystem in which open standards and interoperability frameworks streamline development cycles and reduce time to market.

Moreover, supply chain realignments and consolidation trends are reshaping how radar components are sourced and assembled. The semiconductor shortage has highlighted vulnerabilities, prompting strategic investments in domestic fabrication capacity and vertical integration by leading suppliers. These developments are fostering resilience while positioning the automotive radar sector for sustained innovation as new material technologies and packaging techniques promise further miniaturization and cost efficiency.

Assessing the Compounding Effects of 2025 United States Tariffs on Automotive Radar Supply Chains Costs and Market Dynamics

The introduction of sweeping tariff measures by the United States in 2025 has imposed significant cost pressures on automotive radar supply chains. A presidential proclamation issued on March 26, 2025, established a 25% tariff on all imported passenger vehicles and light trucks, effective April 2, 2025, marking a pivotal moment for sensor integration strategies and procurement planning. Shortly thereafter, on May 3, 2025, the administration extended a 25% duty to critical auto components, including engines, transmissions, and electrical systems-a category encompassing radar sensors and related modules.

In the radar segment specifically, these levies are projected to drive production cost increases of approximately 4–6% as manufacturers navigate tariff pass-through and supply chain realignment challenges. This uptick in input costs has reverberated across the ADAS ecosystem, affecting hardware prices, software licensing fees, and the economics of sensor fusion architectures. In response, many OEMs and Tier-1 suppliers are accelerating localization efforts for radar component manufacturing, evaluating near-shore assembly hubs, and renegotiating supplier agreements to mitigate margin erosion and preserve competitive pricing.

While temporary exemptions under the United States–Mexico–Canada Agreement (USMCA) provide some relief for compliant parts, the underlying uncertainty surrounding eligibility criteria and long-term policy direction has underscored the need for scenario planning. Industry leaders are enhancing visibility into regional supply networks and expanding strategic inventories to cushion against potential disruptions. As a result, companies that proactively adapt their sourcing strategies and invest in resilient logistics frameworks are better positioned to absorb the cumulative tariff impacts and maintain delivery commitments.

Decoding Automotive Radar Market Segmentation Across Types Components Ranges Frequencies Applications Vehicle Types and Channels

A nuanced understanding of the automotive radar market emerges when viewed through multiple segmentation lenses. By type, radar solutions range from frequency modulated continuous wave units optimized for long-range object detection to highly detailed imaging radar modules that enable precise environmental mapping. Millimeter-wave radars, pulse-Doppler variants, and ultra-wideband designs further diversify the technological toolkit available to OEMs, each addressing specific performance requirements and integration constraints.

Component segmentation reveals the critical interplay between hardware and software. Antennae arrays, digital signal processing units, radar sensor modules, receivers, and transmitters comprise the tangible assets of radar systems, while embedded firmware and advanced analytics software orchestrate signal interpretation, target identification, and false-alarm mitigation. The division between hardware and software underscores the need for holistic co-development approaches that align electronic design with algorithmic innovation.

Range classification splits radar applications into long-range setups for high-speed functions, medium-range configurations for lane-change and cross-traffic alerts, and short-range designs that support blind spot monitoring and parking assistance. Frequency band choices-including 24 GHz, 77 GHz, and 79 GHz-further influence detection fidelity, interference resilience, and regulatory compliance across global markets.

Beyond these technical distinctions, application segmentation highlights the integral role of radar in advanced safety systems such as adaptive cruise control, autonomous emergency braking, blind spot detection, collision avoidance, cross-traffic alert, lane departure warning, and parking assistance. Vehicle type segmentation spans commercial vehicles, passenger cars, and two-wheelers, with further delineation into heavy and light commercial vehicles, as well as hatchbacks, sedans, and SUVs. Distribution channels, split between offline dealerships and online platforms-both via company websites and eCommerce portals-reflect evolving buyer behaviors and digital retail strategies.

This comprehensive research report categorizes the Automotive Radar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Range

- Frequency Band

- Application

- Vehicle Type

- Distribution Channel

Unearthing Regional Nuances Shaping Automotive Radar Adoption and Investment Trends Across Americas EMEA and Asia-Pacific

Regional dynamics play a decisive role in shaping the automotive radar landscape. In the Americas, a combination of stringent safety regulations, strong OEM investment commitments, and an extensive aftermarket network drives widespread adoption. The United States leads in radar integration, propelled by federal and state incentives for advanced safety systems, while Canada’s growing electric vehicle segment further amplifies demand for seamless sensor fusion architectures.

Europe, Middle East & Africa (EMEA) exhibits a diverse adoption curve, with Western Europe’s rigorous Euro NCAP protocols and national road safety targets incentivizing cutting-edge radar solutions. Simultaneously, key markets in the Middle East are investing in smart highway pilot projects that leverage radar-based traffic monitoring, while Africa’s emerging automotive sectors present long-term growth potential driven by urbanization and infrastructure modernization.

In Asia-Pacific, China stands at the epicenter of radar innovation, backed by strong governmental support, expansive R&D funding, and domestic champions pursuing global partnerships. South Korea and Japan remain at the technological vanguard, with semiconductor leaders and automotive conglomerates collaboratively refining radar chipset capabilities and production processes. Southeast Asia’s rapidly expanding passenger and commercial vehicle markets also signal robust uptake of radar-enabled ADAS features, underpinned by evolving safety regulations and rising consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the Automotive Radar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Advances in Automotive Radar Technologies and Ecosystems

A handful of global players and nimble challengers are steering the course of automotive radar innovation. Robert Bosch GmbH continues to expand its solid-state radar portfolio and invest in digital beamforming research, while Continental AG is advancing its imaging radar modules with enhanced signal processing algorithms that improve clutter suppression. Denso Corporation leverages its extensive automotive heritage to optimize MIMO antenna configurations for cost-effective, high-volume applications, and Valeo SAS integrates radar with ultra-compact LiDAR-radar fusion units tailored for premium vehicle segments.

Emerging participants such as Aptiv PLC focus on software-defined radar platforms, offering over-the-air update capabilities that evolve system performance post-deployment. Semiconductors remain a linchpin, with NXP Semiconductors NV and Infineon Technologies AG delivering specialized radar front-end chips, and Texas Instruments Inc. advancing high-frequency mixed-signal processing solutions optimized for automotive safety and autonomy. In parallel, strategic alliances between OEMs and technology partners continue to proliferate, reflecting a shift toward collaborative ecosystems that blend hardware excellence with proprietary analytics and machine-learning expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Radar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acconeer AB

- Analog Devices, Inc

- Aptiv PLC

- Arbe Robotics Ltd.

- Autoliv, Inc.

- Calterah Semiconductor Technology (Shanghai) Co., Ltd.

- Continental AG

- Delphi Automotive, PLC

- DENSO Corporation

- Echodyne Corp.

- HELLA GmbH & Co. KGaA

- Hitachi, Ltd.

- Infineon Technologies AG

- InnoSenT GmbH

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- s.m.s, smart microwave sensors GmbH

- Texas Instruments Incorporated

- Valeo S.A.

- Veoneer, Inc.

- ZF Friedrichshafen AG

Strategic Imperatives for Industry Leaders to Navigate Technological Complexity Supply Chain Volatility and Competitive Disruption

Industry leaders must embrace a set of strategic imperatives to navigate the complex and rapidly evolving radar landscape. Prioritizing research and development in digital beamforming and MIMO architectures will not only enhance detection performance but also create differentiated value propositions in safety-critical applications. At the same time, diversifying frequency band utilization and securing spectrum allocations are essential to mitigate interference risks and comply with shifting regulatory frameworks.

Supply chain resilience emerges as a critical success factor. By establishing near-shore manufacturing hubs and forging partnerships with semiconductor foundries, companies can attenuate tariff exposures and counteract logistics volatility. Additionally, integrating advanced analytics into procurement and inventory management processes will improve demand forecasting and optimize component allocation across global production networks.

Collaborative standardization efforts and active participation in industry consortia are equally important, as they foster interoperability and accelerate time to certification. Finally, investing in talent development-especially in embedded software engineering, sensor fusion, and data science-will build the human capital required to harness next-generation radar platforms. These recommendations collectively offer a roadmap for securing competitive advantage and delivering reliable, high-performance radar solutions at scale.

Robust Research Framework Combining Primary Interviews Secondary Data and Triangulation for Comprehensive Automotive Radar Market Analysis

This analysis is underpinned by a rigorous research methodology designed to deliver comprehensive and reliable insights. Primary research consisted of in-depth interviews with OEM technology leads, Tier-1 supplier executives, radar chipset architects, and regulatory experts, providing forward-looking perspectives on product roadmaps, investment priorities, and standardization challenges. Secondary research included systematic reviews of technical white papers, industry journals, patent filings, and regulatory documentation from bodies such as the Federal Communications Commission (FCC) and the European Telecommunications Standards Institute (ETSI).

Quantitative data was collected from publicly disclosed shipment reports, trade association statistics, and aftermarket installation figures, ensuring a robust empirical basis. To enhance credibility, data triangulation techniques were applied, cross-validating findings from distinct sources to reconcile discrepancies and confirm emerging patterns. This multi-layered approach underlies the strategic recommendations and segmentation insights presented herein, equipping stakeholders with a reliable knowledge foundation for decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Radar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Radar Market, by Type

- Automotive Radar Market, by Component

- Automotive Radar Market, by Range

- Automotive Radar Market, by Frequency Band

- Automotive Radar Market, by Application

- Automotive Radar Market, by Vehicle Type

- Automotive Radar Market, by Distribution Channel

- Automotive Radar Market, by Region

- Automotive Radar Market, by Group

- Automotive Radar Market, by Country

- United States Automotive Radar Market

- China Automotive Radar Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Evolutionary Trajectory and Strategic Imperatives of the Global Automotive Radar Ecosystem

The automotive radar sector stands at a strategic inflection point, driven by technological breakthroughs, regulatory evolution, and shifting macroeconomic dynamics. As sensor performance continues to ascend-anchored by advanced signal processing and high-frequency applications-OEMs and suppliers must adapt swiftly to sustain differentiation and meet rising safety expectations.

Regional market nuances and the impact of tariff policies underscore the importance of agile supply chain design and localized manufacturing strategies. Meanwhile, segmentation insights reveal the necessity of tailored solutions across vehicle classes, application functions, and distribution channels. In this landscape of accelerating change, companies that align deep technical expertise with collaborative innovation frameworks will capture the greatest value.

Looking forward, the path to fully autonomous mobility will further elevate radar’s role within multi-sensor ecosystems. By integrating actionable recommendations with disciplined scenario planning, industry participants can navigate short-term disruptions, capitalize on emerging opportunities, and position themselves as leaders in the next era of vehicle intelligence.

Engage with Ketan Rohom to Unlock In-Depth Strategic Intelligence and Propel Automotive Radar Market Success

To unlock in-depth strategic insights and gain a competitive edge in the rapidly evolving automotive radar market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By engaging directly with Ketan Rohom, you will receive tailored guidance on how the market research report can support your organizational objectives, inform your technology roadmaps, and refine your go-to-market strategies. Schedule a personalized discussion today to explore exclusive data, expert analysis, and actionable recommendations designed to accelerate your growth. Secure your copy of the comprehensive automotive radar market research report and harness the full spectrum of intelligence needed to drive innovation, optimize investments, and capitalize on emerging opportunities throughout the entire value chain.

- How big is the Automotive Radar Market?

- What is the Automotive Radar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?