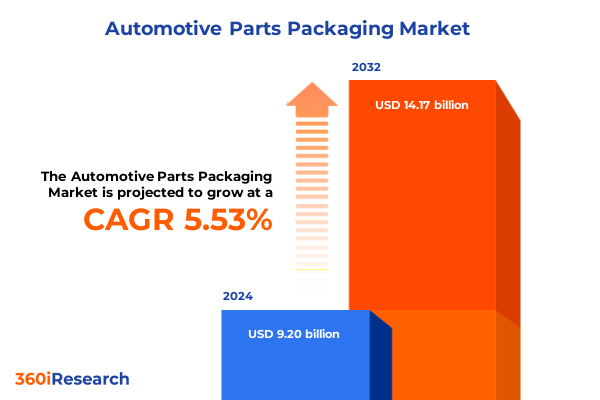

The Automotive Parts Packaging Market size was estimated at USD 9.68 billion in 2025 and expected to reach USD 10.19 billion in 2026, at a CAGR of 5.58% to reach USD 14.17 billion by 2032.

Unveiling the Transformative Role of Packaging Innovations in the Automotive Parts Industry in an Era of Heightened Performance and Sustainability

In today’s fast-evolving automotive landscape, packaging has transcended its traditional role as a simple protective barrier to become a strategic enabler of both operational efficiency and brand reputation. Rapid advancements in vehicle electrification, lightweight materials, and global supply chain complexity have intensified the demands on packaging solutions. Manufacturers must now navigate a web of performance expectations, regulatory mandates, and sustainability goals, requiring packaging designs that not only safeguard critical components but also contribute to broader organizational objectives.

Against this backdrop, the introduction of innovative materials and modular configurations has unlocked new pathways for differentiation. From advanced foam inserts that mitigate vibration stress in sensitive sensors to reusable crates optimized for high-throughput assembly lines, packaging strategies are at the forefront of value creation. As the industry confronts pressures such as carbon footprint reduction and localized production, the role of packaging specialists has never been more pivotal in shaping product reliability, lifecycle management, and total cost performance.

Navigating a Landscape of Digitalization, Sustainability Mandates, and Supply Chain Resilience Reshaping Automotive Parts Packaging Strategies

The convergence of digitalization, sustainability mandates, and geopolitical shifts has catalyzed sweeping changes in automotive parts packaging. Connected sensors enable real-time monitoring of environmental conditions during transit, while predictive analytics optimize carton design to reduce dimensional weight charges. Concurrently, extended producer responsibility regulations are accelerating the shift toward closed-loop systems, prompting packaging engineers to rethink material choices and end-of-life processes.

Moreover, the resilience of global logistics networks is being reassessed in response to trade frictions and natural disasters, driving the adoption of multi-modal packaging platforms that can adapt to rail, sea, and road transitions without compromising part integrity. In parallel, the emergence of additive manufacturing is reshaping supply chains by enabling on-demand production of specialized packaging fixtures, further enhancing responsiveness to fluctuating volume demands and localized assembly requirements.

Assessing the Multifaceted Consequences of 2025 United States Tariff Policies on Cost Structures and Competitive Dynamics in Automotive Packaging

The cumulative impact of the United States’ 2025 tariff adjustments on key packaging materials has introduced a new layer of cost and complexity for automotive suppliers. Elevated duties on imported aluminum and steel have increased the price basis for corrugated reinforcements and metal strapping, while levies on plastic resin feedstocks have driven up expenses for polyethylene, polypropylene, and polyvinyl chloride variants. These shifts have led to heightened collaboration between packaging teams and strategic sourcing to identify alternative domestic suppliers or material substitutions that maintain performance standards.

In response, a growing number of automotive original equipment manufacturers and aftermarket suppliers have pursued nearshoring initiatives to mitigate exposure to tariff volatility. This reconfiguration of supply networks is complemented by value engineering efforts, where packaging designs are streamlined to reduce material usage without sacrificing protective capabilities. Collectively, these adaptations underscore the necessity for integrated cost-management frameworks that account for both current duty structures and potential future trade policy changes.

Unpacking Critical Segmentation Dimensions Revealing Diverse Product, Material, and Application Profiles Driving Automotive Packaging Decisions

A nuanced understanding of packaging type preferences reveals that custom packaging solutions are increasingly favored for high-value components, whereas disposable formats provide cost-effective protection for bulk shipments destined for assembly plants. In parallel, the selection of product type-from bags and sacks for lightweight filters to blister packs for electrical modules and robust corrugated boxes for engine parts-reflects the diversity of handling and storage requirements across supply chain stages. Specialized crates and pallets equipped with foam inserts are employed for delicate lighting components, while trays and tubes ensure safe transport of underbody parts and sophisticated cooling system elements.

Material type choices further shape packaging strategies, as sustainable paper and cardboard substrates gain traction against traditional plastic options like polyethylene terephthalate and polypropylene. Aluminum fixtures and steel frames offer structural support for heavy batteries, whereas emerging bio-foam inserts and textile wraps cater to anti-static and thermal packaging needs. Component type segmentation highlights unique demands for automotive filters, electrical assemblies, and engine modules, driving tailored packaging configurations. Applications such as anti-corrosion treatments, void fill cushioning, and stacking protocols address specific damage-mitigation challenges, while end-user distinctions between aftermarket suppliers and original equipment manufacturers influence procurement specifications and returnable packaging schemes.

This comprehensive research report categorizes the Automotive Parts Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Product Type

- Material Type

- Component Type

- Application

- End User

Discovering Regional Nuances Highlighting Variations in Demand Patterns Across Americas, EMEA, and Asia-Pacific Automotive Packaging Markets

Regional developments underscore the varied strategies adopted across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In North America, a concentration of legacy OEM manufacturing hubs has fostered collaborative packaging innovation centers that integrate additive manufacturing and just-in-time delivery models. Latin American aftermarket channels emphasize cost containment and simplified packaging formats to navigate transportation infrastructure challenges, reinforcing the need for multi-layered moisture protection and stacking efficiency.

Meanwhile, in Europe, Middle East & Africa, stringent environmental regulations and ambitious circular economy targets are driving rapid adoption of reusable crates and recyclable fiber-based materials. Middle Eastern assembly plants leverage high-temperature resistant packaging for desert logistics, while African distributors prioritize modular designs capable of accommodating mixed-modal transit. In Asia-Pacific, the prevalence of high-volume production facilities in China, India, and Southeast Asia underscores the pursuit of low-cost packaging solutions, yet the surge in electric vehicle component exports from Japan and South Korea is elevating demand for high-precision protective packaging.

This comprehensive research report examines key regions that drive the evolution of the Automotive Parts Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Strategic Investments Shaping Innovation and Operational Excellence in Automotive Parts Packaging

Leading companies in the automotive packaging arena are investing in next-generation materials, from plant-based polymers to high-density foam innovations that deliver enhanced shock absorption. Strategic alliances between global packaging specialists and automotive tier-one suppliers are accelerating the development of smart packaging platforms that integrate RFID and blockchain for end-to-end traceability. In parallel, corporate ventures and targeted acquisitions are expanding in-house capabilities in digital design simulation, allowing rapid prototyping of packaging geometries and drop-test validation.

Operational excellence initiatives, such as six-sigma process standardization and total productive maintenance, are being extended to packaging lines to reduce defect rates and optimize changeover times. Sustainability leadership is exemplified by commitments to achieve net-zero packaging waste through improved material recovery and vendor take-back programs. Collectively, these strategic moves underscore how industry frontrunners leverage cross-functional collaboration to enhance both cost efficiency and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Parts Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Corplex

- Greif, Inc.

- Griff Paper & Film

- Holostik

- International Paper Company

- Knauf Group

- Mil-Spec Packaging of GA, Inc.

- Mondi plc

- Nefab AB

- Orlando Products

- Pacific Packaging Products, Inc.

- Packaging Corporation of America

- Peoria Production Solutions, Inc.

- PM PACKAGING

- Pratt Industries, Inc.

- Primex Plastics Corp. by ICC Industries Inc.

- Sealed Air Corporation

- Specialised Packaging Group

- Stephen Gould

- Storopack Hans Reichenecker GmbH

- The Royal Group

- The Smurfit Kappa Group plc

- Veritiv Corporation

- WestRock Company

- Wisconsin Foam Products

Proposing Practical Strategic Initiatives to Enhance Sustainability, Efficiency, and Cost Competitiveness in Automotive Packaging Operations

To capitalize on evolving performance criteria and regulatory pressures, packaging leaders should pursue material diversification strategies that blend recycled fibers, bio-derived plastics, and modular metal frames. Implementing end-to-end traceability solutions, including embedded sensors and machine-vision inspection, will enable real-time visibility into package integrity and environmental exposures. Cross-functional design for circularity workshops can accelerate the transition to reusable and returnable packaging ecosystems, driving down waste handling costs and reinforcing corporate sustainability commitments.

Furthermore, establishing regional innovation hubs in proximity to key assembly clusters will streamline collaboration with OEMs and expedite the adoption of localized sourcing models. Operational teams are advised to integrate advanced analytics into packaging performance dashboards, aligning damage incident data with supplier scorecards to foster continuous improvement. By embedding these strategic initiatives within broader digital transformation roadmaps, organizations can enhance supply chain resilience, adapt more nimbly to tariff shifts, and maintain a competitive edge in an increasingly demanding automotive landscape.

Detailing Rigorous Analytical Frameworks and Data Collection Techniques Ensuring Robust Insights Into Automotive Packaging Trends

This analysis is underpinned by a multi-stage research framework combining primary interviews with packaging engineers, supply chain directors, and sustainability leads from both original equipment manufacturers and aftermarket suppliers. Complementary secondary research drew upon industry white papers, regulatory publications, and technical journals to capture the latest material science breakthroughs and legislative developments. In-depth case studies illustrate real-world applications of advanced packaging solutions, while patent landscape reviews highlight emerging intellectual property trends.

The study employs robust analytical tools, including porters competitive forces to assess supplier dynamics, PESTEL analysis to map regulatory and economic influences, and SWOT evaluations to benchmark organizational strengths and vulnerabilities. Segmentation analyses were validated through feedback workshops with senior industry stakeholders, ensuring alignment with current operational realities. Quality assurance protocols, including data triangulation and methodological audits, guarantee the reliability and relevance of the insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Parts Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Parts Packaging Market, by Packaging Type

- Automotive Parts Packaging Market, by Product Type

- Automotive Parts Packaging Market, by Material Type

- Automotive Parts Packaging Market, by Component Type

- Automotive Parts Packaging Market, by Application

- Automotive Parts Packaging Market, by End User

- Automotive Parts Packaging Market, by Region

- Automotive Parts Packaging Market, by Group

- Automotive Parts Packaging Market, by Country

- United States Automotive Parts Packaging Market

- China Automotive Parts Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Critical Findings and Strategic Implications for Stakeholders Navigating the Evolving Automotive Packaging Ecosystem

In conclusion, packaging innovation has emerged as a strategic imperative for automotive stakeholders seeking to balance performance demands, cost pressures, and sustainability targets. The integration of digital technologies, modular material systems, and regional adaptation strategies underscores the sector’s commitment to enhancing supply chain agility and environmental responsibility. Tariff-driven cost complexities continue to prompt nearshoring and value engineering initiatives, while segmentation depth across packaging, product, and application dimensions offers a pathway to differentiated solutions.

By examining leading company practices, regional market nuances, and regulatory landscapes, this report provides a comprehensive foundation for informed decision-making. The recommended strategic initiatives, from circular design protocols to advanced traceability deployments, are designed to equip industry leaders with actionable roadmaps. As the automotive ecosystem evolves amid electrification and global trade shifts, packaging will remain at the forefront of ensuring part integrity, operational efficiency, and competitive advantage.

Engage with Associate Director of Sales & Marketing to Secure Exclusive Insights and Empower Decision Making with a Comprehensive Automotive Packaging Report

By engaging with Ketan Rohom, Associate Director of Sales & Marketing, stakeholders gain direct access to tailored consultations that translate technical intelligence into strategic actions. This collaborative dialogue ensures that procurement, operations, and product development teams align on priorities ranging from material selection to supply chain resilience, unlocking faster time to market and stronger competitive positioning. Through this personalized engagement, organizations can leverage exclusive frameworks, case studies, and proprietary insights to refine their roadmaps and respond proactively to evolving regulatory and industry pressures.

Securing this comprehensive automotive packaging report empowers decision-makers with a consolidated repository of best practices, emerging technology overviews, and granular segmentation analyses. The partnership with the Associate Director of Sales & Marketing facilitates a seamless pathway from insight to implementation, enabling rapid adoption of sustainable materials, digital traceability solutions, and cost optimization methodologies. To capitalize on this opportunity and drive measurable improvements in packaging performance, quality assurance, and total cost management, connect with Ketan Rohom today to obtain your copy of the market research report and schedule a bespoke briefing.

- How big is the Automotive Parts Packaging Market?

- What is the Automotive Parts Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?