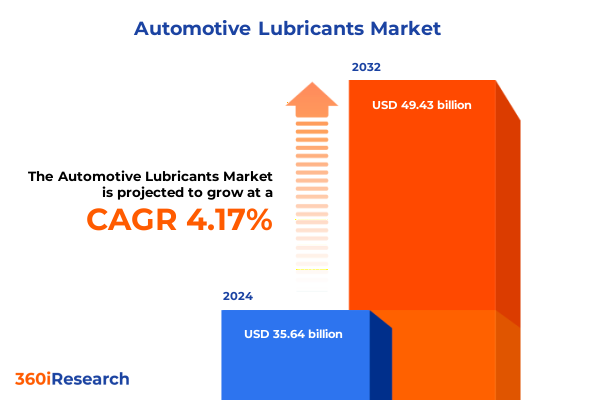

The Automotive Lubricants Market size was estimated at USD 36.52 billion in 2025 and expected to reach USD 37.42 billion in 2026, at a CAGR of 4.41% to reach USD 49.43 billion by 2032.

Unraveling the Dynamics of the Global Automotive Lubricants Market Amid Technological Advancements, Regulatory Challenges, and Shifting Demand Patterns

The automotive lubricants domain stands at the confluence of engineering innovation, shifting regulatory landscapes, and evolving consumer expectations. As vehicle powertrains diversify beyond traditional internal combustion engines into hybrid and electric variants, lubricants specialists must address novel frictional challenges and thermal management requirements. Simultaneously, environmental regulations are tightening permissible emissions and demanding low-viscosity formulations that deliver energy efficiency without compromising component durability.

Against this backdrop, market participants must navigate supply chain complexities surrounding base oil procurement and blending additives while responding to global industry alliances and tiered distribution networks. The rise of digital platforms is redefining purchasing behaviors, prompting lubricant manufacturers and distributors to adapt marketing strategies and enhance aftersales service offerings. Embedded within this dynamic ecosystem, stakeholders seek clear guidance on leveraging emerging technologies, aligning with sustainability mandates, and optimizing product portfolios for diverse vehicle applications.

Bridging technical expertise with market intelligence, this executive summary elucidates transformative industry shifts and strategic imperatives. It provides a foundational overview for decision makers aiming to refine their commercial approaches, strengthen supplier partnerships, and anticipate regulatory developments. By synthesizing segmentation, regional, and competitive insights, this document equips both established and emerging players with the conceptual frameworks required to navigate a rapidly evolving automotive lubricants landscape.

Examining Pivotal Shifts Transforming the Automotive Lubricants Sector via Digital Disruption, Electrification Advances and Sustainability Focus

The automotive lubricants sector is in the midst of profound reinvention driven by digital disruption, electrification advances and sustainability focus. Cutting-edge sensor integration and predictive analytics platforms are enabling real-time condition monitoring of oils and greases, unlocking proactive maintenance protocols that extend component life. Concurrently, the acceleration of electric vehicle adoption is reshaping lubricant formulation priorities: thermal conductivity and dielectric stability are now as critical as lubricity.

Beyond product innovation, circular economy principles are gaining traction. Industry leaders are piloting used oil collection networks and closed-loop recycling processes to reclaim base oil fractions and reduce environmental impact. This push toward resource efficiency is complemented by collaborative partnerships between traditional lubricant suppliers, OEMs and technology providers, creating cross-functional ecosystems designed to co-develop high-performance formulations and intelligent lubrication systems.

At the same time, digital channels are transforming distribution models. E-commerce platforms offering customized formulation selection tools and automated replenishment services are emerging alongside legacy dealer networks. These shifts underscore the imperative for manufacturers and distributors to adopt omnichannel strategies that blend digital convenience with technical expertise. As a result, the sector is witnessing a strategic convergence of chemistry, data science and sustainability, heralding a new era of value creation.

Assessing the Impact of 2025 United States Tariff Revisions on Raw Material Supply Chains, Cost Structures and Competitive Dynamics in Automotive Lubricants

The introduction of revised United States tariffs in 2025 has exerted a notable influence on automotive lubricant value chains. Heightened duties on select base oil imports have prompted formulators to reassess sourcing strategies, pivoting toward domestic production and alternative oil grades that balance performance with cost considerations. This recalibration has ripple effects throughout supply networks, with blending facilities adapting inventory management protocols to mitigate price volatility.

Manufacturers reliant on mineral and semi-synthetic base oils have encountered increased procurement costs, leading to marginal adjustments in fuel economy claims and service interval recommendations. In response, some industry players have accelerated investments in synthetic oil production capabilities, recognizing the dual benefits of superior performance and reduced exposure to international tariff fluctuations. Importantly, these strategic shifts have underscored the resilience of vertically integrated operations that can seamlessly transition between base oil streams.

Looking ahead, the cumulative impact of these trade measures extends beyond immediate price escalation. OEMs and fleet operators are reexamining total cost of ownership metrics, placing renewed emphasis on lubricant longevity and maintenance automation. Additionally, downstream distributors are reevaluating contractual terms to share tariff-induced cost burdens more equitably, fostering collaborative mitigation strategies. Overall, the 2025 tariff landscape has catalyzed a strategic introspection across the industry, driving a deeper focus on supply chain agility and product innovation.

Deciphering Segmentation Insights Across Product Types, Base Oil Categories, Viscosity Grades, Packaging Styles, Vehicle Types and Distribution Channels

Insights derived from segmentation analysis illuminate divergent growth trajectories and strategic priorities across product categories and customer channels. Engine oils remain the cornerstone of formulation portfolios, yet gear oils and hydraulic fluids are gaining prominence as industrial mobility solutions converge with commercial vehicle requirements. Greases continue to find specialized applications in electric and hybrid powertrain assemblies, where precise lubrication is critical for efficiency and noise reduction.

Base oil selection has emerged as a key determinant of performance differentiation. While mineral oils retain relevance in cost-sensitive markets, semi-synthetic blends are securing footholds by offering balanced protection, and fully synthetic variants are commanding premium positioning through enhanced thermal stability and extended drain intervals. Viscosity grade preferences vary by use case, with multi-grade oils favored in passenger vehicles for year-round versatility, whereas single-grade fluids maintain strong demand in heavy-duty applications requiring robust film strength under extreme loads.

Packaging formats underscore evolving distribution dynamics. Bottled products dominate retail channels, whereas drum and bulk packaging solutions cater to high-volume end users and commercial fleets. Sachets and pouches have carved out opportunities in emerging markets and service chains prioritizing convenience and minimal waste. Vehicle segmentation further refines strategy, as heavy commercial vehicles and light commercial vehicles demand specialized lubricant formulations, while the passenger segment spans hatchbacks, sedans and SUVs each with unique performance requirements. Finally, the growth of digital marketplaces has complemented established offline channels, prompting lubricant suppliers to harmonize inventory, logistics and customer engagement across both arenas.

This comprehensive research report categorizes the Automotive Lubricants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Base Oil Type

- Viscosity Grade

- Packaging Type

- Vehicle Type

- Distribution Channel

Highlighting Regional Market Nuances and Growth Drivers Across the Americas, Europe Middle East and Africa and the Asia Pacific Automotive Lubricants Landscape

Geographic analysis reveals distinct vectors of demand and strategic focus across major regions. In the Americas, regulatory emphasis on fuel efficiency and emissions reduction is propelling adoption of low-SAP additive packages and ultra-low viscosity grades. The expansion of light and medium commercial vehicle fleets in North America has stimulated demand for robust gear and axle oils engineered for high torque and extended service intervals.

Meanwhile, the Europe, Middle East and Africa region presents a tapestry of market maturities and environmental standards. Western European nations are intensifying restrictions on PAO and group II base oils, incentivizing bio-based and recycled alternatives. In contrast, emerging markets within Africa are embracing sachet-packaged lubricants to penetrate informal automotive service networks. The Middle East, buoyed by petrochemical integration, offers unique synergies for synthetic oil production, positioning regional suppliers as cost-competitive exporters.

Asia-Pacific remains the largest and most heterogeneous landscape. Rapid urbanization and escalating vehicle ownership in South and Southeast Asia are driving volume sales of multi-grade engine oils. In tandem, China’s aggressive EV rollout is creating a paradigm shift toward dielectric fluids for traction motors and high-voltage gearboxes. Japan and South Korea continue to lead with high-performance synthetic formulations designed for premium automotive OEM partnerships. These regional nuances underscore the necessity for tailored go-to-market approaches and adaptive formulation strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Lubricants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Initiatives, Competitive Postures and Innovation Trajectories of Leading Automotive Lubricant Manufacturers and Industry Disruptors

Leading industry players are executing differentiated strategies to maintain market leadership and capture new growth avenues. Global integrated energy companies are leveraging refining by-products to bolster synthetic blend capacity, while independent specialty producers focus on bespoke additive technologies that deliver measurable engine protection and lifecycle extension. Collaborative research alliances between formulators, equipment manufacturers and academic institutions are accelerating the development of next-generation eco-friendly lubricants.

Competitive posturing extends to digital engagement, where top-tier suppliers have launched customer portals offering real-time inventory visibility, technical support chatbots and maintenance forecasting modules. These platforms not only streamline aftermarket ordering but also facilitate data-driven insights into usage patterns and performance outcomes. At the same time, emerging disruptors are introducing modular refill cartridges and subscription-based delivery models aimed at urban mobility service providers and micro-fleet operators.

Innovation trajectories across the segment emphasize circularity and electrification readiness. Companies with investments in chemical recycling technologies are capturing used oil streams to reclaim base oil fractions, thereby reducing raw material dependence. Simultaneously, leading formulators are optimizing heat transfer fluids and gear greases to meet the stringent dielectric and viscosity requirements of electric drivetrains. This dual focus on sustainability and future-proof performance exemplifies the evolving playbook of market frontrunners.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Lubricants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMSOIL Inc.

- Bharat Petroleum Corporation Limited

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Gazprom Neft PJSC

- Gulf Oil Lubricants India Limited

- Hindustan Petroleum Corporation Limited

- Illinois Tool Works Inc.

- Indian Oil Corporation Ltd.

- Lukoil Oil Company

- Motul S.A.

- Oscar Lubricants LLC

- PETRONAS Lubricants International Sdn. Bhd.

- Petróleo Brasileiro S.A.

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol S.A.

- Royal Dutch Shell PLC

- Saudi Arabian Oil Company

- Savsol Lubricants

- SK Lubricants Co. Ltd

- TotalEnergies SE

- Valvoline Inc.

- Veedol International Limited

- Freudenberg SE

Formulating Actionable Recommendations to Strengthen Supply Chain Resilience, Accelerate Product Innovation and Optimize Market Positioning

To thrive in an environment characterized by regulatory tightness and technical complexity, organizations should fortify supply chain resilience by diversifying base oil sources and forging strategic alliances with domestic and regional producers. Embracing advanced analytics for demand forecasting will mitigate inventory fluctuations caused by tariff adjustments and geopolitical uncertainties. Equally important is the rapid scaling of research and development programs aimed at low-viscosity synthetic formulations that deliver enhanced fuel economy and extended service life.

Investments in digital platforms can differentiate customer engagement by offering predictive maintenance insights and seamless ordering experiences. Combining online configurators with expert support channels enables more precise product recommendations tailored to specific engine architectures and operating conditions. Furthermore, developing sustainable packaging solutions-such as recyclable drums and lightweight refill sachets-addresses environmental concerns and appeals to eco-conscious consumers and fleet operators alike.

Finally, fostering collaborative pilot projects with OEMs, fleet management firms and environmental agencies will facilitate the validation of next-generation lubricants under real-world operating scenarios. Such partnerships not only accelerate product certifications but also generate compelling case studies that reinforce regulatory compliance achievements and performance credentials. By integrating these recommendations, industry leaders can position themselves for sustained growth and competitive differentiation.

Detailing a Multi-Method Research Methodology Integrating Primary Engagements, Secondary Analysis, Data Triangulation and Validation Protocols

This research leverages a robust methodology combining primary and secondary sources to ensure the integrity and applicability of findings. Primary engagements include in-depth interviews with lubricant formulators, OEM powertrain engineers, distribution channel executives and regulatory authority representatives. These qualitative conversations provide nuanced perspectives on formulation challenges, compliance roadmaps and emerging demand drivers.

Complementing this, secondary analysis draws upon trade association publications, patent filings and sustainability reports to map technological trajectories and regulatory frameworks. Data triangulation techniques reconcile insights from multiple sources-such as customs databases, industry journals and public financial disclosures-to construct a holistic view of supply chain dynamics and competitive landscapes. Rigorous validation protocols ensure consistency between quantitative datasets and expert testimony, underpinning the credibility of segmentation and regional analyses.

Throughout the process, thematic coding and cross-functional workshops distilled key trends and strategic imperatives. The resulting synthesis reflects a balanced integration of empirical evidence and forward-looking expert judgment. This methodological rigor provides stakeholders with confidence that the strategic recommendations and market narratives are grounded in the latest industry realities and poised to inform high-stakes decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Lubricants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Lubricants Market, by Product Type

- Automotive Lubricants Market, by Base Oil Type

- Automotive Lubricants Market, by Viscosity Grade

- Automotive Lubricants Market, by Packaging Type

- Automotive Lubricants Market, by Vehicle Type

- Automotive Lubricants Market, by Distribution Channel

- Automotive Lubricants Market, by Region

- Automotive Lubricants Market, by Group

- Automotive Lubricants Market, by Country

- United States Automotive Lubricants Market

- China Automotive Lubricants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Market Observations and Strategic Implications to Provide Clear Guidance for Stakeholders in the Evolving Automotive Lubricants Arena

The automotive lubricants arena is defined by a convergence of technology transitions, regulatory evolution and shifting end-user requirements. Synthesizing observations across segmentation, regional dynamics and competitive strategies reveals a market in pursuit of both performance advancement and environmental stewardship. Stakeholders who adeptly blend synthetic base oil development, digital service platforms and supply chain agility are best positioned to capture rising demand from hybrid and electric powertrains as well as traditional combustion fleets.

Strategic implications point to the value of holistic portfolio management that balances mineral, semi-synthetic and fully synthetic formulations according to application and regional policy settings. Equally, nurturing omnichannel distribution capabilities-ranging from traditional service centers to sophisticated e-commerce ecosystems-will be critical for sustaining market share. Collaboration among manufacturers, OEMs and aftermarket providers emerges as a recurrent theme for validating new formulations and streamlining market entry processes.

In conclusion, the overriding narrative emphasizes proactive innovation, partnerships and sustainability integration as the pillars of success. Companies that harness these strategic levers will unlock incremental efficiency gains, strengthen customer loyalty and navigate regulatory headwinds with confidence. This synthesis equips decision makers with the contextual clarity required to align product roadmaps, commercial strategies and R&D investments with the evolving automotive lubricants landscape.

Connect with Ketan Rohom Associate Director Sales and Marketing to Purchase the Automotive Lubricant Market Intelligence Report and Elevate Decision Making

For organizations poised to capitalize on the momentum within automotive lubricants, direct engagement with industry experts can catalyze strategic decision making. By reaching out to Ketan Rohom, Associate Director of Sales and Marketing, stakeholders gain tailored access to the full suite of market intelligence designed to address unique business imperatives. This comprehensive report synthesizes competitive dynamics, technological innovations, and regulatory influences into actionable insights, enabling companies to refine product portfolios, optimize supply chains, and seize emerging opportunities.

Initiating dialogue with Ketan Rohom not only secures the definitive research asset but also unlocks bespoke consultation aligned with organizational challenges. Whether the objective is to deepen understanding of base oil sourcing strategies or to benchmark product performance across packaging formats, this engagement promises to elevate decision making. We invite decision makers across OEMs, lubricant formulators, and distribution channels to connect with Ketan Rohom and purchase the automotive lubricant market intelligence report today to set a course for sustainable growth and competitive advantage.

- How big is the Automotive Lubricants Market?

- What is the Automotive Lubricants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?