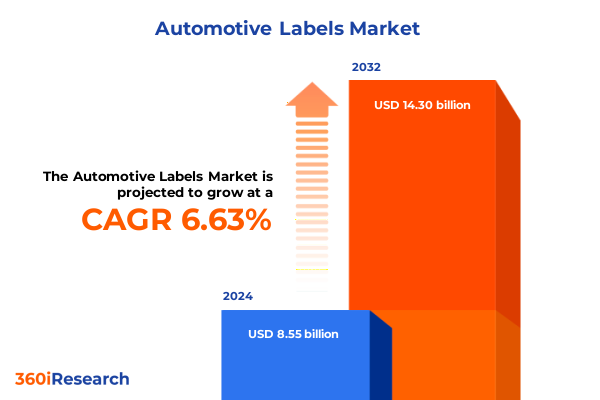

The Automotive Labels Market size was estimated at USD 9.11 billion in 2025 and expected to reach USD 9.68 billion in 2026, at a CAGR of 6.64% to reach USD 14.30 billion by 2032.

Unveiling the Evolving Automotive Label Market Landscape Driven by Technology, Regulation, and Sustainability Imperatives

The automotive label industry stands at a pivotal juncture, shaped by rapid technological advancements and evolving consumer expectations. In recent years, labels have transcended their traditional roles of simply marking parts; they now serve as critical enablers of branding, safety compliance, and functional integrity. As vehicles become increasingly connected, lightweight, and electrified, the demand for labels that can withstand extreme temperatures, environmental stressors, and regulatory scrutiny has surged.

Against this backdrop, stakeholders across the value chain are reassessing their strategies to address these multifaceted demands. Manufacturers are investing in innovative materials and printing technologies to deliver high-resolution, durable labels, while OEMs and aftermarket suppliers are redefining specifications to meet stringent industry standards. Moreover, rising sustainability mandates are compelling the adoption of recyclable and low-VOC substrates, further complicating the development roadmap.

This section provides a foundational overview of the market’s driving forces, challenges, and emergent opportunities. By establishing the context of technological breakthroughs, regulatory shifts, and sustainability imperatives, readers will gain a clear understanding of the critical factors shaping the automotive label landscape today.

Examining the Industry’s Major Technological, Regulatory, and Material Innovations That Have Redefined Automotive Labeling

Over the past decade, the automotive label sector has undergone transformative shifts that have reshaped competitive dynamics and product requirements. Initially, the emphasis rested on exterior and interior badges designed primarily for aesthetic appeal and brand identity. As vehicles incorporated more advanced systems, functionality moved under the hood, creating demand for labels capable of withstanding temperatures exceeding 150°C and exposure to oils, fuels, and solvents.

Concurrently, printing technologies have evolved from traditional flexographic and offset presses to digital inkjet and laser systems that allow for shorter runs, variable data printing, and rapid prototyping. This transition has enabled manufacturers to respond to customization requests from automakers, facilitating the production of limited-edition and regionally tailored designs without prohibitive tooling costs.

Regulatory and safety standards have also intensified, with global agencies imposing stricter requirements for warning and instructional labels. Innovations in polyvinyl chloride, coated polyester, and pet-film materials have emerged to address adhesion, durability, and recyclability criteria. These combined shifts underscore the industry’s rapid progression toward more versatile, robust, and environmentally conscious label solutions.

Analyzing the Complex Effects of Recent United States Tariff Adjustments on Material Sourcing, Pricing, and Supply Chain Resilience

In 2025, the United States implemented a series of tariff adjustments that have exerted a significant cumulative impact on the automotive label market. Tariffs on imported raw materials such as acrylic resins, polyester films, and specialty adhesives have increased by 10 to 15 percent, prompting manufacturers to reassess sourcing strategies. As a result, many suppliers have accelerated domestic partnerships or shifted production to lower-cost regions to mitigate margin erosion.

These tariff measures have also triggered a reconfiguration of supply chains, with downstream players absorbing higher input costs or renegotiating contracts. The increased cost of paper-based substrates and polyvinyl chloride films has forced label producers to evaluate material substitutions and explore biopolymers for cost relief and sustainability benefits. Simultaneously, OEMs have become more receptive to reformulating design specifications to accommodate alternative materials without compromising performance.

Overall, the tariff-driven landscape has catalyzed a wave of innovation and collaboration. Companies are investing in advanced compounding processes to produce hybrid substrates that offer both cost efficiency and regulatory compliance. The result is a more resilient label ecosystem that prioritizes supply chain diversification and material agility to withstand policy-induced disruptions.

Deriving Insights from Multifaceted Segment Analyses Spanning Product, Application, Material, Vehicle, Adhesive, Technology, and Channel Dimensions

A granular review of market segmentation reveals distinct performance patterns across multiple axes. When categorizing by product type, exterior labels continue to lead adoption due to their high visibility and branding significance, followed by interior labels that emphasize tactile quality and premium finishes, and under hood labels that prioritize durability under severe conditions. Application segmentation highlights the robustness of emblem and branding uses in driving margins, while functional and structural labels increasingly benefit from lightweight, high-adhesion materials. Warning and instructional labels, though lower in volume, demand uncompromising compliance to safety standards and film resilience.

Turning to material segmentation, acrylic and paper substrates maintain foundational roles, whereas polyester variants-particularly coated polyester and pet-film-are gaining traction for their superior temperature and chemical resistance. The growth of polyvinyl chloride persists in budget-sensitive segments, though environmental considerations are prompting gradual shifts toward recyclable alternatives. Vehicle type dynamics illustrate that passenger vehicles represent the largest share, spurred by luxury and EV segments. Commercial vehicles rely heavily on high-temperature adhesives and structural labels, and two-wheelers emphasize compact, high-strength adhesives for space-limited applications.

Assessing adhesive and printing technology segmentation, high-temperature adhesives dominate under hood and commercial applications. Permanent adhesives, whether acrylic-based or rubber-based, offer reliable bonding across diverse substrates, while removable and repositionable options support aftermarket customization. In printing, digital methods like inkjet and laser are enabling low-volume and personalized runs alongside established flexographic, offset, and screen processes. Sales channel analysis reveals that the original equipment manufacturer stream commands the majority share, but the aftermarket segment is expanding as customization and replacement services gain momentum.

This comprehensive research report categorizes the Automotive Labels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Adhesive Type

- Printing Technology

- Material

- Application

- Vehicle Type

- Sales Channel

Highlighting Regional Market Variations Influenced by Regulatory Standards, Manufacturing Strengths, and Consumer Demand Trends

Regional dynamics in the automotive label market are defined by a blend of production capabilities, regulatory environments, and consumer preferences. In the Americas, the United States and Mexico have strengthened their manufacturing ecosystems, driven by nearshoring trends and tariff mitigation strategies. These developments have bolstered the local supply of acrylic and polyethylene films, reducing lead times and enhancing responsiveness to OEM design cycles.

Across Europe, Middle East & Africa, stringent environmental regulations and ambitious electrification targets have incentivized the deployment of recyclable substrates and low-VOC adhesives. German and Scandinavian manufacturers are at the forefront of material innovation, with advanced coated polyester and pet-film solutions that meet rigorous compliance benchmarks. Meanwhile, emerging markets in the Middle East and North Africa are leveraging affordable polyvinyl chloride options to support burgeoning commercial vehicle fleets.

In the Asia-Pacific region, robust automotive hubs in China, Japan, and South Korea continue to drive demand for high-volume label production, particularly for passenger and two-wheeler segments. Localized material sourcing and vertical integration are prevalent, enabling cost-effective polystyrene and paper-based solutions. At the same time, India’s expanding two-wheeler market is stimulating growth in compact, high-temperature labeling solutions. Together, these regional nuances shape the global competitive landscape and inform strategic investment decisions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Labels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Market Leaders Are Accelerating Growth through Capacity Expansion, Strategic Alliances, and Technology Integration

Leading stakeholders in the automotive label arena are investing strategically to secure long-term growth. Established material suppliers are expanding capacity for coated polyester and pet-film lines to capitalize on demand for high-performance substrates. At the same time, adhesive specialists are refining formulations to balance bond strength with recyclability under evolving environmental regulations.

On the printing side, equipment manufacturers are rolling out advanced digital presses capable of seamless integration with Industry 4.0 data platforms, enabling real-time quality control and variable data printing at scale. Collaborative partnerships between label converters and OEM design teams are accelerating co-development of bespoke solutions for next-generation electric and autonomous vehicles.

Moreover, several vertically integrated players are streamlining supply chains by acquiring regional converters or forging long-term procurement agreements with raw material producers. These moves aim to reduce exposure to tariff fluctuations and raw material shortages. Collectively, these initiatives underscore a market in which innovation, partnership, and supply chain optimization are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Labels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Accutech Packaging Pvt Ltd.

- Avery Dennison Corporation

- Barcode International (India) Pvt Ltd.

- Brady Corporation

- CCL Industries Inc

- Etisoft Sp. z o.o.

- Identco International Company LLC

- Integral Labels Pvt Ltd.

- JK Labels Pvt Ltd.

- LINTEC Corporation

- myLabels GmbH

- Polyonics Inc

- Resource Label Group LLC

- SATO Holdings Corporation

- Swati Polypack Pvt Ltd.

- System Label Ltd

- Tesa SE

- UPM‑Kymmene Oyj

- Weber Packaging Solutions

Implementing Strategic Sourcing, Technology Adoption, Sustainability Integration, and Collaborative Innovation for Competitive Advantage

To thrive in the evolving automotive label landscape, industry leaders should prioritize a multifaceted strategic agenda. First, establishing robust dual-sourcing frameworks for critical materials will mitigate tariff and geopolitical risks while maintaining cost discipline. Simultaneously, investing in in-house compounding capabilities for coated polyester and pet-film can create proprietary substrates that command premium positioning.

Second, integrating digital printing technologies within existing flexographic and offset lines will yield operational flexibility and support just-in-time production models. Leaders should pursue collaborative pilots with printing equipment vendors to tailor solutions that align with customer-specific design requirements and variable data demands.

Third, embedding sustainability criteria into product roadmaps-such as end-of-life recyclability and low-emission adhesives-will position companies ahead of tightening global regulations. By partnering with environmental certification bodies and recycling networks, stakeholders can substantiate green claims and preempt compliance hurdles.

Finally, forging deeper alliances with OEMs and aftermarket distributors through co-innovation programs will unlock new revenue streams. These initiatives should focus on developing smart labels embedded with sensors or RFID capabilities, enabling advanced vehicle diagnostics and enhanced user experiences. By executing these recommendations, industry players can capitalize on emerging opportunities and fortify competitive advantage.

Outlining the Comprehensive Multi-Source Research Approach That Involves Executive Interviews, Regulatory Analysis, and Quantitative Data Synthesis

The research underpinning this report employs a rigorous methodology designed to ensure comprehensive market insights and actionable recommendations. Primary research consisted of in-depth interviews with senior executives at label converters, raw material suppliers, OEM procurement managers, and distribution channel partners. These qualitative engagements provided nuanced perspectives on material performance, regulatory impacts, and evolving application requirements.

Secondary research included a systematic review of industry journals, patent filings, regulatory bulletins, and corporate disclosures to validate material innovations and tariff developments. Databases covering trade flows, customs data, and key performance indicators were leveraged to identify supply chain shifts and cost implications tied to recent U.S. tariff adjustments.

Quantitative analysis synthesized shipment volumes, pricing trends, and production capacities across product types, materials, and regions. Advanced statistical techniques were applied to detect growth drivers and segmentation patterns. Finally, triangulation across data sources and cross-functional expert reviews ensured the robustness and reliability of the findings, equipping decision-makers with a solid foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Labels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Labels Market, by Product Type

- Automotive Labels Market, by Adhesive Type

- Automotive Labels Market, by Printing Technology

- Automotive Labels Market, by Material

- Automotive Labels Market, by Application

- Automotive Labels Market, by Vehicle Type

- Automotive Labels Market, by Sales Channel

- Automotive Labels Market, by Region

- Automotive Labels Market, by Group

- Automotive Labels Market, by Country

- United States Automotive Labels Market

- China Automotive Labels Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Technological, Regulatory, and Supply Chain Insights to Illuminate Strategic Pathways for Future Market Success

The automotive label market is undergoing a profound evolution driven by technological breakthroughs, regulatory pressures, and shifting supply chain dynamics. As exterior, interior, and under hood labels assume increasingly specialized roles, material science and printing advances are at the forefront of competitive differentiation. Meanwhile, the ramifications of U.S. tariff adjustments have underscored the importance of supply chain diversity and in-house innovation.

Segmentation analysis reveals clear strategic pathways: high-performance polyester films for critical applications, digital printing for customization and efficiency, and sustainable adhesives that meet environmental mandates. Regional insights highlight the need to navigate local regulations in Europe, leverage nearshoring opportunities in the Americas, and adapt to high-volume manufacturing demands in Asia-Pacific.

Key players are responding through capacity expansion, technology integration, and strategic partnerships, laying the groundwork for the next wave of growth. By embracing actionable recommendations focused on sourcing resilience, digital transformation, sustainability, and co-innovation, industry leaders can secure a resilient and profitable future in an ever-evolving market.

Drive Informed Decisions with Customized Market Research Support and Expert Guidance from 360iResearch’s Associate Director for Enhanced Competitiveness

Ready to take your strategic analysis to the next level? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, and secure comprehensive insights that will empower your organization’s decisions. Discover how detailed data on automotive label product innovations, tariff impacts, and segmentation dynamics can sharpen competitive positioning and accelerate growth. By partnering with Ketan, you’ll gain access to tailored guidance, exclusive market intelligence, and actionable recommendations that translate research into revenue-driving initiatives. Don’t wait-equip your leadership team with the clarity and foresight needed to navigate an evolving industry landscape with confidence. Contact Ketan today to purchase the full market research report and unlock a wealth of strategic opportunity.

- How big is the Automotive Labels Market?

- What is the Automotive Labels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?