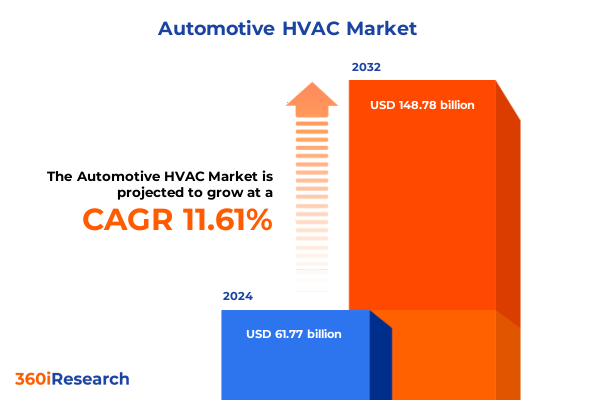

The Automotive HVAC Market size was estimated at USD 67.88 billion in 2025 and expected to reach USD 74.59 billion in 2026, at a CAGR of 11.86% to reach USD 148.78 billion by 2032.

Discover the critical drivers and emerging trends shaping the automotive HVAC market through a concise overview of industry dynamics and value propositions

The automotive HVAC sector stands at a pivotal juncture where evolving technological advancements, shifting consumer priorities, and dynamic regulatory frameworks converge to reshape the landscape. This executive summary provides a concise yet comprehensive overview of the core drivers and market forces influencing the design, manufacturing, and deployment of heating, ventilation, and air conditioning systems in modern vehicles. In framing this introduction, the aim is to equip stakeholders with an understanding of the underlying themes that will be elaborated upon in the following sections, including transformative trends, the impact of tariff policies, segmentation nuances, regional variations, competitive positioning, and strategic imperatives.

By initiating the discourse with a high-level lens, industry leaders can trace the lineage of key developments-from incremental efficiency gains in compressor technology to the integration of vehicle-to-infrastructure connectivity for smart climate control. Attention to macro drivers such as increasing electrification of powertrains, heightened regulatory emphasis on refrigerant management, and upgraded consumer expectations for cabin comfort sets the stage for a deeper analysis of market segmentation and competitive dynamics. This introduction also underscores the importance of synthesizing data from both established and emerging sources, ensuring that decision-makers are armed with a holistic perspective on where the sector is heading and why targeted action is essential.

Explore the transformative technological advances regulatory changes and evolving consumer expectations that are redefining automotive HVAC and innovation

Innovation in the automotive HVAC domain is being propelled by a confluence of technological breakthroughs, regulatory tightening, and shifts in consumer behavior. Advanced compressor architectures, such as scroll and rotary designs optimized for electric vehicles, are increasingly displacing traditional reciprocating systems. At the same time, electronics-enabled expansion devices have begun to offer precise superheat control, reducing energy consumption and improving overall system responsiveness.

Regulatory bodies across major markets have accelerated the phase-down of high-global-warming-potential refrigerants, prompting suppliers to adopt next-generation blends and insulation techniques for coils and hoses. This regulatory pressure not only ensures environmental sustainability but also drives manufacturers to invest in research on low-GWP refrigerants and alternative cooling cycles. Parallel to these technical developments, consumers are demanding seamless cabin experiences, integrating air quality sensors and automated climate zones that can be personalized via in-car connectivity platforms.

Consequently, the automotive ecosystem is witnessing a transformative redefinition of HVAC performance metrics. Efficiency is no longer measured solely by fuel savings or battery range impact; it must also account for real-time air purification effectiveness, noise reduction, and system resilience under diverse environmental extremes. This multi-dimensional progress illustrates how the interplay of innovation, regulation, and user experience is revolutionizing what was once a purely mechanical subsystem into an intelligent, integrated component of the modern vehicle.

Examine the cumulative effects of United States tariff implementations on automotive HVAC supply chains procurement costs and strategic partnerships

Tariff measures enacted by the United States in 2025 have imposed new layers of complexity on the automotive HVAC supply chain. Import duties on key modules such as condensers and specialized coils have driven up procurement costs for both original equipment manufacturers and aftermarket providers. In response, several Tier 1 suppliers have reevaluated their sourcing strategies, shifting higher-value production closer to end markets or negotiating long-term supply agreements with domestic partners to mitigate exposure.

In particular, tariffs on critical raw materials used in evaporator coil fabrication have led to renegotiations of supplier contracts and, in some cases, temporary bottlenecks as manufacturers scrambled to secure compliant components. These dynamics have triggered a reassessment of total landed cost calculations, urging OEMs to reexamine the balance between offshore manufacturing efficiencies and onshore supply stability. Moreover, upstream exposure to fluctuating duties on electronic expansion valves has underscored the importance of flexible production architectures capable of reallocating volumes across multiple geographies.

Strategic partnerships have emerged as a key mechanism for absorbing tariff-related shocks. Companies with integrated manufacturing footprints that span the Americas have leveraged cross-border assembly networks to reallocate volumes and optimize internal transfers. This adaptive strategy, combined with localized inventory buffers for high-duty parts, has proven essential for sustaining production continuity while preserving margin thresholds. Ultimately, the cumulative impact of 2025 tariff actions underscores the need for resilient supply chain models that can withstand policy volatility.

Delve into component vehicle type technology sales channel application segmentation insights to reveal automotive HVAC performance and market dynamics

Analysis across core HVAC components reveals that compressors remain the linchpin of performance, with scroll and rotary compressor variants gaining prominence in electric and hybrid powertrain applications. These technologies deliver quieter operation and higher volumetric efficiency compared to reciprocating alternatives, while the evolution of high-strength, lightweight receiver/drier assemblies has enhanced system reliability under rigorous duty cycles. Meanwhile, innovations in condenser coil geometries and plate-fin evaporator designs driven by electronic expansion valves continue to unlock incremental gains in thermal management efficiency.

Looking through the lens of system architecture, automatic HVAC controls have rapidly ascended as the preferred standard, replacing manual and semi-automatic variants in mid- and high-tier vehicle segments. Advanced sensor integration and model-based control algorithms allow for precise temperature regulation and adaptive defogging sequences, elevating the user experience while minimizing energy draw from battery packs or alternators.

When considering vehicle classes, passenger cars exhibit strong uptake of advanced HVAC technologies-particularly in SUVs and sedans-driven by consumer expectations for comfort and health-oriented features such as air quality control. At the same time, heavy commercial vehicles increasingly incorporate robust temperature control subsystems for engine cooling and interior climate in long-haul operations. Light commercial vehicles are following suit with aftermarket retrofits that enhance cabin comfort for urban delivery fleets.

Within sales channels, original equipment manufacturers remain focused on embedding next-generation climate control modules into production lines, while aftermarket providers capitalize on opportunities to upgrade legacy systems with high-efficiency condensers and digital expansion valves. Application segmentation underscores the dual importance of automotive climate control for occupant comfort and engine cooling for powertrain longevity, with specialized solutions for battery thermal management playing a growing role in electric vehicle portfolios.

This comprehensive research report categorizes the Automotive HVAC market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Vehicle Type

- Sales Channel

- Application

Highlight regional market trends in the Americas Europe Middle East Africa and Asia Pacific to uncover localized automotive HVAC challenges and opportunities

Regional dynamics in the Americas are influenced heavily by diverse climatic extremes-from subarctic conditions in the northernmost territories to scorching heat in southwestern regions-necessitating HVAC systems that balance rapid cooling capacity with efficient defogging capabilities. The United States market has seen greater emphasis on refrigerant alternatives that comply with domestic environmental mandates, alongside strong aftermarket demand for retrofit kits optimized for rising temperatures.

In Europe Middle East and Africa, stringent energy efficiency regulations and phased refrigerant bans have compelled manufacturers to adopt next-generation compressor designs and low-GWP refrigerants ahead of other regions. Luxury passenger vehicles in Western Europe frequently showcase multi-zone climate control and advanced air purification modules, while commercial vehicle OEMs in the Middle East prioritize rugged thermal management systems capable of enduring desert heat.

The Asia Pacific region stands out for its rapid industrialization and surging vehicle ownership rates, particularly in China and India. Cost sensitivity in these markets is counterbalanced by a growing adoption of automatic HVAC systems and compact, tube-type evaporator coils in mass-market passenger cars. High ambient humidity levels have also driven interest in integrated defogging and humidity control features, with battery cooling becoming a critical application as electric vehicle penetration accelerates across major metropolitan centers.

This comprehensive research report examines key regions that drive the evolution of the Automotive HVAC market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncover strategic company developments product innovations and partnerships shaping the competitive landscape of automotive HVAC manufacturers and suppliers

Major players in the automotive HVAC space are differentiating through strategic alliances and targeted product rollouts. Leading suppliers have formed joint ventures with OEMs to co-develop electric vehicle–optimized compressors, ensuring seamless integration within next-generation powertrain architectures. Others have expanded their thermal management portfolios by acquiring niche providers of microchannel condensers and high-precision electronic valves, broadening their end-to-end solution offerings.

Partnerships with software developers are also reshaping the competitive landscape, as companies embed IoT-enabled sensors and cloud-based analytics into climate control modules. These innovations enable predictive maintenance alerts and remote diagnostics, creating new value streams for fleet operators and passenger vehicles alike. Furthermore, collaborations between HVAC specialists and battery management system vendors are yielding integrated thermal management units that simultaneously regulate cabin comfort and battery temperature, improving both energy efficiency and component longevity.

Supply chain consolidation trends continue to influence market dynamics, as several top-tier suppliers consolidate component manufacturing under regional hubs to streamline logistics and reduce lead times. This vertical integration strategy enhances margin control and supports just-in-time delivery models for high-volume OEM assembly plants. In parallel, aftermarket players are forging alliances with distributors to broaden their reach, offering tailored upgrade kits that meet evolving regulatory standards and performance expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive HVAC market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air International Thermal Systems, Inc.

- ASPINA Group

- Bergstrom Inc.

- BorgWarner Inc.

- Brose Fahrzeugteile SE & Co. KG

- Denso Corporation

- Eberspächer Gruppe GmbH & Co. KG

- ELKE S.r.l.

- ESTRA Automotive Systems Co., Ltd.

- Gentherm Incorporated

- Hanon Systems Co., Ltd.

- Hitachi, Ltd.

- LU-VE Group

- MAHLE GmbH

- Marelli Holdings Co., Ltd.

- Mitsubishi Heavy Industries Ltd.

- Motherson Group

- Red Dot Corporation

- Sanden Corporation

- Sensata Technologies, Inc.

- STMicroelectronics N.V.

- Subros Limited

- Texas Instruments Incorporated

- Valeo Group

- Webasto Group

Recommend targeted strategic initiatives for industry leaders to capitalize on emerging automotive HVAC trends and accelerate sustainable innovation

Industry leaders can derive significant value by prioritizing the development of HVAC systems tailored for electric and hybrid vehicles, incorporating lightweight compressor designs and digital expansion valves that minimize energy draw. By establishing modular manufacturing platforms with geographically distributed production nodes, companies can better insulate themselves from tariff fluctuations and supply chain disruptions.

Investing in advanced simulation tools and digital twin technologies will accelerate product validation cycles and reduce time-to-market. This capability not only streamlines R&D efforts but also supports rapid iteration of system designs to meet evolving regulatory benchmarks. Additionally, forging deeper partnerships with software firms can unlock next-generation cabin comfort features-such as personalized microclimate control-and enable data-driven service models for fleet operators.

To fortify aftermarket revenue streams, companies should develop comprehensive service portfolios that include predictive maintenance subscriptions and retrofittable component upgrades. Such offerings enhance customer retention and provide a buffer against downturns in new vehicle production. Finally, cultivating collaborative relationships with standards bodies and regulatory agencies will ensure early visibility into upcoming refrigerant and efficiency mandates, allowing for proactive product roadmap adjustments.

Detail the rigorous research approach data sources and validation techniques employed to ensure comprehensive insights into automotive HVAC industry dynamics

The research underpinning this executive summary draws upon a rigorous methodology combining primary and secondary data sources. Primary research included in-depth interviews with senior executives at leading OEMs, Tier 1 suppliers, and aftermarket specialists, along with consultations with regulatory and certification authorities to gain firsthand insights into compliance trajectories.

Secondary research encompassed a comprehensive review of industry white papers, patent filings, technical standards, and publicly available company disclosures. Financial filings were analyzed to identify capital allocation trends and R&D investment patterns, while trade data was examined to quantify shifts in import-export flows associated with recent tariff implementations.

Data validation techniques such as cross-referencing interview findings with market intelligence databases and triangulating performance claims with laboratory test results were employed to ensure accuracy. Advisory panels composed of automotive engineering experts and independent analysts provided peer review at key milestones, corroborating the analysis and refining interpretive frameworks. This robust approach underpins the credibility and depth of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive HVAC market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive HVAC Market, by Component

- Automotive HVAC Market, by Technology

- Automotive HVAC Market, by Vehicle Type

- Automotive HVAC Market, by Sales Channel

- Automotive HVAC Market, by Application

- Automotive HVAC Market, by Region

- Automotive HVAC Market, by Group

- Automotive HVAC Market, by Country

- United States Automotive HVAC Market

- China Automotive HVAC Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesize the vital takeaways from executive analysis emphasizing strategic imperatives technological advancements and future readiness in the automotive HVAC domain

The synthesis of this executive analysis highlights the convergence of electrification trends, regulatory evolution, and consumer expectations as the primary catalysts reshaping automotive HVAC systems. Key implications include the growing prominence of scroll compressors and electronic expansion valves, the strategic imperative to localize manufacturing footprints, and the emergence of intelligent climate control modules enabled by software integration.

Forward-looking players will need to navigate tariff-related headwinds through agile supply chain configurations and collaborative partnerships that mitigate cost volatility. Simultaneously, differentiation will hinge on the ability to deliver personalized, health-oriented cabin experiences while adhering to increasingly stringent emissions and refrigerant standards. In essence, the modern automotive HVAC supplier must be as adept at software development and data analytics as it is at thermofluid engineering.

Ultimately, the readiness of an organization to embrace modular production, invest in digital validation tools, and cultivate ecosystem alliances will determine its ability to capture the next wave of growth in this rapidly evolving segment. The insights presented here serve as a foundation for strategic planning, enabling stakeholders to align product roadmaps with the demands of tomorrow’s vehicle architectures.

Engage with associate director sales and marketing to purchase the comprehensive automotive HVAC market research report and unlock strategic insights

To explore how these insights can transform your strategic approach and secure a competitive advantage, connect with Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. Ketan brings deep expertise in automotive HVAC market dynamics and will guide you through the process of acquiring the complete market intelligence report. By engaging with Ketan, you’ll gain tailored advice on integrating cutting-edge research into your planning cycle, optimizing product roadmaps, and strengthening customer engagement strategies. Reach out today to unlock the full breadth of analysis and ensure your organization capitalizes on the most pertinent opportunities in the automotive HVAC arena.

- How big is the Automotive HVAC Market?

- What is the Automotive HVAC Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?