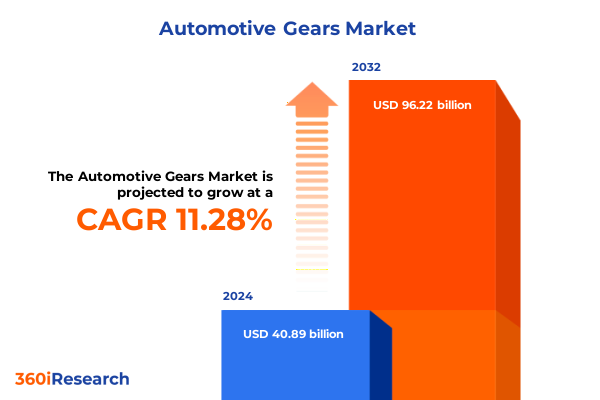

The Automotive Gears Market size was estimated at USD 44.88 billion in 2025 and expected to reach USD 49.25 billion in 2026, at a CAGR of 11.51% to reach USD 96.22 billion by 2032.

Setting the Stage for a New Era in Automotive Gears by Highlighting Critical Drivers, Emerging Challenges, Electrification Imperatives, and Industry Opportunities

The global automotive gear landscape is undergoing unprecedented transformation as emerging technologies and shifting value chains redefine traditional manufacturing paradigms. In this dynamic context, stakeholders across the supply chain are compelled to assess how macroeconomic pressures, regulatory mandates, and rapid technological advances intersect to shape future opportunities. By understanding these interplay factors, decision-makers can prioritize investments that align with both short-term resilience and long-term strategic positioning.

In recent years, the electrification of propulsion systems has emerged as a pivotal driver of change, compelling gear specialists to innovate for higher torque densities, reduced noise-vibration-harshness (NVH), and improved efficiency. Simultaneously, digital manufacturing platforms are enabling real-time quality monitoring and predictive maintenance, reducing downtime and streamlining cost structures. Against this backdrop, conventional gear applications must adapt to serve next-generation powertrain architectures and connected vehicle ecosystems.

Furthermore, material science advancements-particularly in lightweight alloys and high-performance composites-are unlocking new performance thresholds, enabling gear components to deliver on the dual imperatives of weight reduction and durability. These developments, coupled with evolving trade dynamics, are creating a multifaceted landscape in which agility and innovation are paramount. As the industry navigates these converging trends, a clear comprehension of underlying drivers will inform proactive strategies and unlock sustainable competitive advantages.

Unveiling Transformative Shifts in Automotive Gear Manufacturing Driven by Electrification Trends, Advanced Materials Adoption, and Digitalized Production Platforms

Over the past decade, the automotive gear sector has witnessed transformative shifts propelled by a confluence of technological and market forces. Electrification of vehicles is demanding redesigned gear profiles that accommodate higher torque and endure more stringent NVH targets, thus prompting manufacturers to recalibrate design paradigms. Moreover, the integration of additive manufacturing techniques is enabling complex geometries previously unattainable through conventional machining, fostering customization and light-weighting at scale.

In tandem, digitalization initiatives-ranging from IoT-enabled production lines to advanced analytics in quality assurance-are redefining operational efficiencies and delivery times. By embedding smart sensors and leveraging machine learning algorithms, gear producers can proactively identify wear patterns, optimize maintenance schedules, and ensure consistent performance under variable load conditions. Consequently, production footprints are evolving toward flexible manufacturing cells that can adapt to shifting demand profiles swiftly.

Material innovation further amplifies this transformation, with high-strength aluminum alloys, titanium, and advanced composites being adopted to balance weight reduction with fatigue resistance. This trend is supported by novel surface treatments and coatings that extend component life while maintaining precision under extreme operating conditions. Collectively, these shifts underscore a broader industry evolution toward more resilient, adaptive, and high-performance gear solutions.

Examining the Cumulative Impact of United States 2025 Tariff Adjustments on Automotive Gear Supply Chains, Cost Structures, and Strategic Sourcing Decisions

The implementation of revised United States tariff measures in 2025 has precipitated notable ripple effects across automotive gear supply chains. Steel and aluminum levies introduced under trade policy adjustments have accelerated cost pressures for raw metal inputs, prompting manufacturers to re-evaluate supplier partnerships and material sourcing strategies. As a result, many suppliers are exploring nearshoring alternatives to mitigate shipping expenses and lead-time uncertainties.

In addition, the extension of Section 301 tariffs on key intermediate goods has elevated the imperative for localized value creation, with tiered suppliers investing in regional production hubs to circumvent punitive duties. This strategic pivot not only alleviates tariff burdens but also enhances supply chain transparency, enabling closer collaboration with OEMs on gear design integration and just-in-time delivery protocols. Despite short-term capital outlays, the long-term benefits include reduced tariff exposure and improved responsiveness to market fluctuations.

Conversely, higher duty structures have incentivized advances in material substitution and process optimization, encouraging gear designers to pursue alternative alloys and refined machining techniques that minimize waste. These innovations contribute to leaner manufacturing footprints and reinforce sustainability objectives. Consequently, the tariff environment of 2025 is shaping a more resilient and adaptive gear ecosystem that prioritizes regional agility and continuous improvement.

Decoding Key Segmentation Insights by Product Type, Propulsion, Material Composition, Usage Scenarios, Applications, and Vehicle Architecture Dynamics

Insights derived from segmenting the automotive gear market reveal differentiated dynamics across product typologies, vehicle propulsion systems, materials, applications, vehicle categories, and usage channels. Within the product spectrum, bevel gears-including hypoid, spiral, and straight variations-demonstrate nuanced performance trade-offs between torque transmission and packaging constraints, while helical and spur gear designs continue to serve high-volume, cost-sensitive applications. Meanwhile, planetary systems are gaining traction in electrified drivetrains for their compact design and high power density, complemented by worm gear sets-ranging from single to double throated variants-for precise motion control in steering assemblies.

Propulsion-based segmentation highlights that battery electric and plug-in hybrid powertrains demand specialized materials and coatings to address elevated thermal loads under regenerative braking and high torque peaks. In parallel, hybrid electric configurations necessitate hybridized gear architectures that integrate seamlessly with both combustion and electric power sources, whereas traditional internal combustion engine vehicles maintain reliance on well-established spur and helical gear solutions within transmissions.

From a materials standpoint, metal compositions such as aluminum alloys, brass and bronze, cast iron, steel, and titanium are carefully selected to balance strength-to-weight ratios, corrosion resistance, and manufacturability. Non-metal alternatives-comprising composite, plastic, and rubber components-are increasingly leveraged in secondary gear assemblies where noise dampening and weight savings take precedence. Application-driven segments span differential systems, powertrain and drivetrain assemblies, steering modules, and transmission architectures, the latter encompassing both automatic and manual configurations, each imposing distinct tolerance and surface finish requirements.

Vehicle-type differentiation illustrates that passenger car segments-including convertible, hatchback, sedan, SUV, and van platforms-prioritize NVH performance and weight efficiency, while commercial vehicles, subdivided into heavy and light classes, emphasize load-carrying capacity and durability under sustained high-torque conditions. Finally, usage channels reveal that original equipment manufacturers focus on integration with broader vehicle platforms, whereas aftermarket providers target serviceability, retrofit compatibility, and cost-effectiveness for maintenance operations.

This comprehensive research report categorizes the Automotive Gears market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Propulsion

- Material

- Application

- Vehicle Type

- Usage

Revealing Key Regional Insights by Analyzing the Divergent Growth Patterns, Innovation Hubs, and Supply Chain Networks across the Americas, EMEA, and Asia-Pacific

A regional lens uncovers divergent growth pathways and strategic priorities across the Americas, EMEA, and Asia-Pacific zones. In North America and South America combined, the automotive gear sector is influenced by robust OEM investments in next-generation assembly plants and a resurgence in domestic manufacturing spurred by policy incentives. This environment fosters partnerships between traditional gear specialists and emerging electric vehicle start-ups, driving cross-industry innovation.

Across Europe, the Middle East, and Africa, stringent emissions regulations and advanced mobility initiatives are catalyzing demand for lightweight, high-efficiency gear solutions. As European OEMs accelerate shifts toward modular EV platforms, gear suppliers are capitalizing on localized R&D centers to co-develop purpose-built drivetrains. In parallel, Middle Eastern nations are channeling sovereign wealth funds into automotive diversification programs, while African markets exhibit early-stage growth in commercial vehicle fleets, necessitating durable, cost-optimized gear products.

The Asia-Pacific region remains the largest hub for automotive gear production, underpinned by expansive manufacturing capacities in China, Japan, South Korea, and India. Here, rapid adoption of electric and hybrid vehicles, coupled with highly integrated supply chains, continues to drive volume growth. Local suppliers leverage economies of scale to innovate in both metal and non-metal gear technologies, catering to a broad spectrum of consumer vehicle segments and commercial transport needs. Collectively, these regional dynamics underscore the importance of tailored strategies that align with localized market drivers and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Automotive Gears market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Automotive Gear Market Participants through Strategic Partnerships, Technological Innovations, and Competitive Positioning Practices

Leading participants in the automotive gear landscape are distinguishing themselves through a blend of strategic alliances, technological differentiation, and global footprint optimization. Major players are forging collaborations with OEMs and tier-one integrators to co-engineer gear systems aligned with next-generation powertrain architectures. These partnerships often center on high-precision manufacturing capabilities, advanced surface treatments, and proprietary gear-grade materials that deliver competitive performance advantages.

Simultaneously, companies are investing in Industry 4.0 implementations to digitize end-to-end operations, encompassing real-time monitoring, predictive maintenance algorithms, and automated quality verification. Such initiatives not only reduce defect rates but also enable scalable production for both conventional and electric powertrain components. In parallel, selective acquisitions of specialized gear boutiques and additive manufacturing pioneers are enhancing portfolios, ensuring rapid access to niche capabilities and accelerating time to market.

Geographically, leading gear manufacturers maintain a balanced presence across major automotive clusters, leveraging regional engineering centers and distribution nodes to meet local content requirements while optimizing logistics. This strategic positioning allows for nimble responses to tariff shifts, localized regulations, and emergent propulsion trends. By continuously refining their technology roadmaps and supply chain resilience, these companies are well-positioned to capture evolving revenue streams and fortify their leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Gears market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Asar Engineering Pvt. Ltd.

- Atlas Gear Company by Vector Companies

- AVTEC Limited by CK Birla Group

- Bharat Gears Limited

- Cummins Inc.

- G.G. Automotive Gears Limited

- Garg Engineering Co.

- Gear Motions

- GKN Automotive Limited by Dowlais Group PLC

- GNA Gears

- HIM Teknoforge Limited

- Hota Industrial Mfg. Co., Ltd.

- igus GmbH

- IMS Gear SE & Co. KGaA

- JTEKT Corporation

- NER GROUP CO.,LIMITED

- Parkash Industrial Gears

- RACL Geartech Limited

- Robert Bosch GmbH

- RSB Group

- Schaeffler AG

- Shanghai Belon Machinery Co., Ltd.

- Shanghai Michigan Mechanical Co., Ltd.

- Univance Corporation

- VE Commercial Vehicles Ltd.

- WEBER Verzahnungstechnik GmbH

- ZF Friedrichshafen AG

- Zhejiang Dafa Gear Co., Ltd.

- Zhuzhou Gear Co., Ltd. by Weichai Power

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Technological Disruptions, Supply Chain Resilience, and Market Diversification Opportunities

Industry leaders should prioritize the integration of lightweight materials and advanced coatings to meet escalating efficiency and NVH standards in both conventional and electrified applications. By adopting high-strength aluminum alloys, polymer composites, and bi-metallic formulations, gear systems can achieve substantial weight reductions without compromising performance, thereby enhancing overall vehicle efficiency.

Moreover, executives are advised to invest in digital manufacturing platforms that enable predictive diagnostics and real-time quality control. Deploying IoT sensors throughout production lines will facilitate rapid identification of wear anomalies, reducing scrap rates and improving first-pass yields. In this way, organizations can drive lean operations and sustain margins amid cost pressures associated with tariff environments and material volatility.

To further strengthen market positioning, companies should cultivate strategic alliances across the value chain-linking with raw material providers, R&D institutes, and OEM labs. Such collaborations can expedite the commercialization of next-generation gear designs and surface treatments optimized for electric drivetrains. In addition, diversifying regional production capabilities through nearshore expansions will mitigate geopolitical risks and shorten lead times for critical components.

Finally, leadership teams must embed sustainability metrics within product development and supply chain frameworks. By establishing clear environmental benchmarks-such as carbon footprint targets for manufacturing processes and end-of-life recyclability goals-organizations will align with regulatory imperatives and customer expectations, reinforcing brand equity and long-term viability.

Outlining a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, Expert Validation, and Triangulation for Comprehensive Market Intelligence

This study employed a rigorous research methodology combining both primary and secondary data sources to ensure comprehensive market intelligence. Primary research involved in-depth interviews with senior executives at OEMs, tier-one suppliers, and industry experts, supplemented by on-site factory visits to observe manufacturing processes and quality control protocols firsthand. These qualitative insights provided nuanced perspectives on technological adoption, procurement strategies, and competitive dynamics.

Concurrently, secondary research leveraged proprietary databases, academic journals, patent filings, and regulatory filings to validate market trends and corroborate supplier capabilities. Detailed analyses of trade data and tariff schedules informed the assessment of geopolitical impacts on supply chains. Additionally, case studies of pioneering gear deployments in electric and hybrid vehicles were examined to identify performance benchmarks and best practices.

Triangulation of findings from primary and secondary sources ensured data reliability and minimized biases. Quantitative inputs-such as material cost indices, production lead times, and quality defect rates-were analyzed alongside qualitative feedback to deliver balanced insights. The research was further refined through expert validation rounds, where key assumptions and conclusions were reviewed by independent consultants and academic specialists to confirm robustness.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Gears market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Gears Market, by Product Type

- Automotive Gears Market, by Propulsion

- Automotive Gears Market, by Material

- Automotive Gears Market, by Application

- Automotive Gears Market, by Vehicle Type

- Automotive Gears Market, by Usage

- Automotive Gears Market, by Region

- Automotive Gears Market, by Group

- Automotive Gears Market, by Country

- United States Automotive Gears Market

- China Automotive Gears Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Key Takeaways on Market Dynamics, Strategic Imperatives, and Future-Proofing Automotive Gear Manufacturing Ecosystems in a Rapidly Evolving Industry

The automotive gear sector is at a pivotal juncture where electrification mandates, digital manufacturing, and material innovations converge to redefine traditional powertrain components. Stakeholders who proactively embrace advanced alloys, additive manufacturing capabilities, and integrated digital platforms will be best positioned to deliver high-performance gear systems that meet evolving market and regulatory requirements.

Simultaneously, the 2025 tariff landscape underscores the critical importance of supply chain agility and regional diversification strategies. Organizations that cultivate nearshore production hubs and foster deep partnerships with local suppliers will mitigate risks and maintain competitive cost structures. Moreover, decoding nuanced segmentation dynamics-from product typologies to propulsion platforms-will enable more targeted product development and market penetration.

Consequently, companies that align their R&D roadmaps with emergent customer demands, legislative imperatives, and sustainability goals will unlock enduring value. By synthesizing insights from regional market patterns and leading industry practices, decision-makers can chart a strategic course that balances innovation with operational resilience.

In summary, the interplay of technological disruption, trade dynamics, and segmentation complexities demands an integrated approach. Leaders who adopt holistic strategies-spanning material science, digitalization, and supply chain optimization-will navigate the next phase of automotive gear evolution with confidence and success.

Engage with Ketan Rohom to Unlock Access to In-Depth Automotive Gear Market Insights and Propel Your Strategic Decision-Making with the Definitive Report

To explore the comprehensive findings detailed in this report and gain a competitive edge in the evolving automotive gear market, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at our firm. By engaging directly with Ketan, you will receive tailored guidance on how these market insights can inform your strategic planning, supply chain optimization, and product development roadmaps. His expertise will empower your organization to navigate complexities such as tariff fluctuations, emerging propulsion demands, and material innovations with confidence and clarity.

Secure your access to the full report today by scheduling a personalized briefing that highlights the most relevant opportunities and challenges for your specific market segment. This collaboration will ensure that you capitalize on advanced industry intelligence, strengthen stakeholder alignment, and accelerate decision-making processes. Reach out to Ketan Rohom now to initiate this strategic partnership and unlock actionable insights that drive your automotive gear initiatives toward sustainable growth and profitability.

- How big is the Automotive Gears Market?

- What is the Automotive Gears Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?