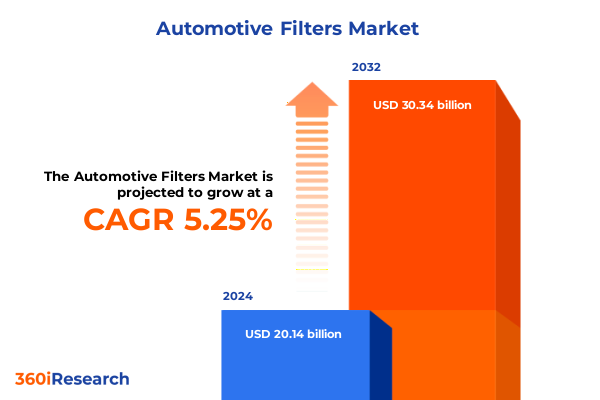

The Automotive Filters Market size was estimated at USD 20.93 billion in 2025 and expected to reach USD 21.75 billion in 2026, at a CAGR of 5.44% to reach USD 30.34 billion by 2032.

Introduction to the Critical Role of Automotive Filters in Enhancing Vehicle Performance, Environmental Compliance, and Driving Industry Innovation

Automotive filtration systems serve as the unsung guardians of vehicle performance and durability, quietly ensuring that engines breathe clean air, fuel systems remain uncontaminated, and hydraulic circuits operate without compromise. As internal combustion engines continue to coexist with electric drivetrains, the fundamental need for effective filtration sustains its critical relevance. An optimally designed filter not only prolongs component life but also minimizes maintenance downtime and fosters compliance with tightening environmental regulations around particulate emissions.

Against this backdrop of evolving powertrain architectures and heightened sustainability mandates, the filtration landscape is witnessing a surge of innovation. Original equipment manufacturers and aftermarket suppliers alike are investing in research to enhance material efficiency and strengthen contaminant capture without impeding fluid or air flow. This introduction sets the stage for a deep dive into the shifts, challenges, and strategic considerations that define the modern automotive filters sector.

Exploring the Technological Breakthroughs and Supply Chain Evolutions Reshaping the Automotive Filters Marketplace and Defining Future Competitive Advantages

At the heart of recent transformations in the automotive filters arena lie breakthroughs in materials science and digital integration. Advanced nanofiber membranes and multifunctional composite media now promise filtration efficiencies once deemed unattainable. These engineered materials facilitate finer particulate retention for cabin and engine air filters while enabling lower pressure drops, directly translating into fuel savings and reduced emissions footprints. Concurrently, heightened adoption of composite media for fuel and oil filtration reflects a broader industry push toward sustainable resource utilization and component recyclability.

Moreover, the digitization of supply chains and the advent of predictive maintenance platforms have ushered in a new era of proactive asset management. Smart filtration housings equipped with sensor arrays can monitor flow rates, differential pressures, and particle loads in real time. By transmitting this data to centralized analytics engines, fleet operators and service providers can schedule interventions on demand, thereby avoiding unscheduled downtime and extending service intervals. As these technological leaps continue to converge, the competitive landscape is being reshaped by players capable of offering end-to-end filtration solutions underpinned by both materials excellence and digital acuity.

Assessing the Comprehensive Effects of 2025 United States Tariff Policies on the Automotive Filters Sector Supply Chain Cost Structures and Strategic Planning

United States tariff adjustments enacted in early 2025 have introduced a complex overlay to the global filters supply chain, particularly affecting imports of specialized media and finished filtration assemblies. The newly imposed duties on certain non-domestic filter components have resulted in an immediate recalibration of landed costs for key raw materials, challenging suppliers to absorb or pass through additional expenses. For manufacturers reliant on cross-border supply networks, this has underscored the urgency of reassessing procurement strategies and negotiating revised terms with both domestic and international partners.

In response, a growing number of filter producers are exploring near-shoring options and fostering collaborations with regional material innovators to mitigate tariff exposure. These strategic shifts are accompanied by simultaneous investments in R&D aimed at optimizing native feedstocks and streamlining production workflows. While some cost headwinds are likely to persist in the near term, the collective focus on regional resilience and product adaptability is expected to yield new synergies across the filter value chain.

Unveiling Market Segmentation Dynamics across Product Types Media Variants Structural Designs Vehicle Categories and Application Channels for Strategic Planning

Delving into product type segmentation reveals distinct growth dynamics across air, fuel, and oil filters. Cabin air filters, tasked with ensuring a clean passenger environment, diverge from engine air filters, which prioritize optimal combustion conditions. Inline fuel filters are engineered for ease of maintenance and rapid contaminant screening, whereas in-tank fuel filters focus on particulate prevention within fuel storage systems. Meanwhile, engine oil filters play a central role in lubricity preservation, and hydraulic oil filters support stability and wear reduction in fluid power circuits.

Beyond product typology, the choice of media exerts a profound influence on applicability and performance. Cellulose-based materials remain prevalent for cost-sensitive programs, while composite media are increasingly favored in high-performance and long-life applications. Structural configurations further refine this landscape, with panel designs offering streamlined installation in constrained geometries and pleated layouts boosting surface area for enhanced contaminant loading. The segmentation by vehicle type underscores divergent priorities: heavy and light commercial vehicles demand robust duty cycles and extended service intervals, while hatchbacks, sedans, and SUVs each draw on differentiated packaging and airflow requirements. Finally, filters destined for aftermarket channels must cater to diverse replacement intervals and standards, whereas original equipment applications adhere to stringent OEM specifications and validation protocols.

This comprehensive research report categorizes the Automotive Filters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Media Type

- Structure Type

- Vehicle Type

- Application

Mapping Regional Growth Patterns and Demand Drivers across the Americas Europe Middle East Africa and Asia Pacific Automotive Filters Ecosystems

Regional demand patterns for automotive filters reflect a confluence of fleet demographics, environmental standards, and infrastructure maturity. In the Americas, the combination of an aging vehicle population and accelerating regulatory emphasis on emissions control has fueled robust aftermarket activity. Latin American nations present incremental opportunities, driven by expanding commercial transport networks and retrofitting programs targeting particulate reduction.

Across Europe, Middle East, and Africa, stringent European Union directives on air quality are complemented by emerging retrofit mandates in key Middle Eastern markets and infrastructural modernization in sub-Saharan Africa. These diverse drivers have steered both OEM and aftermarket stakeholders toward advanced filter technologies with validated performance credentials. Meanwhile, the Asia-Pacific region stands as a growth epicenter, where surging passenger vehicle sales, rapid industrialization, and acute air pollution challenges have heightened the relevance of both cabin and engine filtration solutions. Partnerships between regional OEMs and global filter suppliers are increasingly common, aimed at tailoring designs to local environmental and operational conditions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Filters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Filter Manufacturers and Technology Innovators Shaping Competitive Dynamics and Driving Product Evolution

A review of leading industry participants highlights a trend toward integrated solutions that combine material innovation, digital monitoring, and aftermarket service excellence. One key player has leveraged decades of filter media expertise to introduce next-generation pleated composite formats, optimizing both flow efficiency and contaminant capacity. Another global supplier has invested heavily in sensor-equipped filter housings, enabling real-time condition monitoring and automated maintenance alerts for fleet managers.

Concurrently, established automotive OEM affiliates and independent filter manufacturers are forging strategic alliances to co-develop applications that meet evolving emission and sustainability benchmarks. Such collaborations often involve joint testing facilities and shared supply agreements designed to accelerate new product validation. On the corporate front, recent acquisitions have broadened product portfolios to encompass adjacent fluid handling and air management domains, reinforcing the competitive edge of companies that can offer end-to-end filtration and conditioning platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Filters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.J. Dralle, Inc.

- A.L Group Ltd.

- ADR Group

- Ahlstrom Holding 3 Oy

- Airmatic Filterbau GmbH

- ALCO Filters Ltd.

- APC Filtration Inc. by Rensa Filtration

- Arun Associates

- Atmus Filtration Technologies Inc

- B&S Group

- Dale Filter Systems Pvt. Ltd.

- Denso Corporation

- Donaldson Company, Inc.

- Elofic Industries Limited

- Eurogielle srl

- Fildex Filters Canada Corporation

- Filters Plus

- Filtrak BrandT GmbH

- Freudenberg Filtration Technologies GmbH & Co. KG

- Hengst SE

- Hollingsworth & Vose Co. Inc.

- K&N Engineering Inc.

- Lucas TVS Limited

- Luman Industries Ltd.

- Lydall Inc. by Unifrax Holding Co.

- Mahle GmbH

- MANN+HUMMEL International GmbH & Co. KG

- MZW Motor

- Naveen Filters Private Limited

- Parker Hannifin Corp.

- Robert Bosch GmbH

- Ryco Group Pty Ltd.

- Sogefi S.p.A.

- Steelbird International

- Toyota Motor Corp

- UFI FILTERS S.p.A.

- UNO Minda Limited

- Valeo SA

- Zenith Auto Industries (P) Ltd

Strategic Roadmap for Industry Leaders to Harness Innovation Optimize Supply Chains and Capitalize on Emerging Opportunities in the Automotive Filters Space

To capitalize on the evolving landscape, industry leaders should prioritize investment in high-efficiency media formulations that address both current and forthcoming regulatory requirements. Establishing collaborative frameworks with material science institutions and specialty chemical firms can accelerate the development of sustainable, bio-derived media alternatives. In parallel, integrating smart monitoring capabilities into filtration assemblies will unlock value through predictive maintenance services and enhanced customer engagement.

Furthermore, supply chain diversification remains imperative in a tariff-sensitive environment. Decision-makers should evaluate strategic partnerships with regional compounders and converters to localize critical component production. Finally, cultivating close alliances with both OEMs and aftermarket networks will enable product roadmaps that align with evolving vehicle architectures, ensuring that filter portfolios remain synchronized with broader powertrain electrification and hybridization initiatives.

Comprehensive Research Methodology Combining Primary Expert Interviews Secondary Industry Publications and Rigorous Data Validation for Credible Insights

This report synthesizes insights gleaned through a robust research framework that combines primary and secondary data sources. Comprehensive interviews were conducted with senior executives from filter manufacturing firms, vehicle OEMs, aftermarket distributors, and material suppliers to capture firsthand perspectives on technological trends, regulatory impacts, and competitive strategies. These qualitative findings were augmented by an extensive review of industry publications, patent filings, technical whitepapers, and regulatory filings, providing a multi-dimensional view of market dynamics.

To ensure data integrity, key assumptions were cross-validated through triangulation across trade data, customs databases, and company financial disclosures. Quantitative analyses employed descriptive statistical techniques to identify adoption patterns and performance benchmarks, while scenario-based modeling illuminated potential outcomes of tariff shifts and regional policy changes. Throughout the process, rigorous quality checks and internal peer reviews were executed to uphold the highest standards of methodological transparency and analytical accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Filters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Filters Market, by Product Type

- Automotive Filters Market, by Media Type

- Automotive Filters Market, by Structure Type

- Automotive Filters Market, by Vehicle Type

- Automotive Filters Market, by Application

- Automotive Filters Market, by Region

- Automotive Filters Market, by Group

- Automotive Filters Market, by Country

- United States Automotive Filters Market

- China Automotive Filters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Drawing Conclusive Perspectives on Automotive Filters Market Dynamics and Synthesizing Critical Findings to Guide Future Strategic Endeavors

In summary, the automotive filters sector stands at the intersection of technological innovation, regulatory evolution, and supply chain transformation. Advanced media technologies and digital monitoring solutions are redefining performance expectations, while 2025 tariff realignments have prompted renewed emphasis on regional sourcing and production agility. A nuanced understanding of segmentation by product typology, media composition, structural design, vehicle application, and channel orientation is critical for identifying areas of strategic focus.

Looking ahead, success will hinge on the ability to harness cross-industry collaborations, integrate sustainable materials, and deploy forward-looking service models. By synthesizing market, regional, and competitive insights, decision-makers can chart a proactive course that balances cost efficiency with product excellence, positioning their organizations to thrive amid ongoing market shifts.

Engage with Ketan Rohom for Tailored Insights and Exclusive Access to the Full Automotive Filters Market Research Report to Empower Your Strategic Decisions

To explore this comprehensive analysis in greater depth and obtain bespoke insights tailored to your organization’s specific needs, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By connecting with Ketan, you can request a personalized walkthrough of critical findings, gain clarity on emerging trends and regional nuances, and align the report’s perspectives with your strategic priorities.

Securing the full automotive filters market report will empower your leadership team with timely, actionable intelligence that drives informed decisions across product development, supply chain management, and commercial operations. Reach out to Ketan Rohom today to secure exclusive access, discuss custom research add-ons, and accelerate your path to competitive advantage.

- How big is the Automotive Filters Market?

- What is the Automotive Filters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?