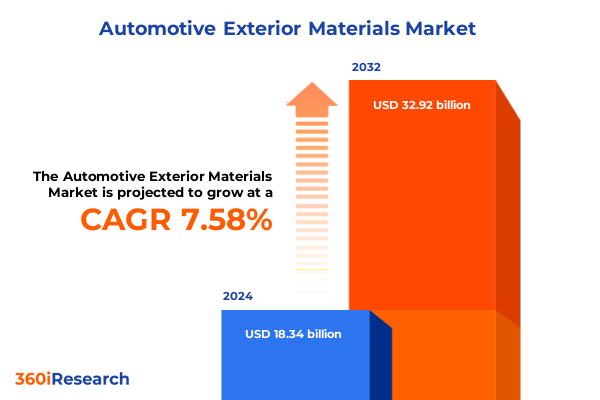

The Automotive Exterior Materials Market size was estimated at USD 19.42 billion in 2025 and expected to reach USD 20.57 billion in 2026, at a CAGR of 7.82% to reach USD 32.92 billion by 2032.

Unveiling the Evolving Horizon of Automotive Exterior Materials Strategic Imperatives and Opportunities Shaping Industry Transformation

The automotive industry is witnessing an unprecedented wave of material innovation, driven by shifting consumer expectations, tightening regulatory requirements, and the relentless pursuit of efficiency. Manufacturing footprints are evolving as original equipment manufacturers and tier-one suppliers explore alternative exterior substrates to meet stringent safety and environmental standards. Simultaneously, end users demand vehicles that blend aesthetic appeal with lightweight performance and durability. Such complex, multifaceted pressures are reshaping long-standing practices and opening a new chapter in exterior materials strategy.

In this context, glass, metals, plastics & composites, and rubber are no longer simply passive enablers of form and function. Rather, they serve as dynamic assets for balancing cost, weight, and performance in a competitive marketplace. Laminated glass and tempered glass technologies are advancing to deliver higher impact resistance and UV protection, while aluminum, magnesium, and steel alloys are being engineered for optimal strength-to-weight ratios. Fiber reinforced composites such as carbon fiber reinforced polymer and glass fiber reinforced polymer are gaining prominence, alongside thermoplastics and thermosets that leverage novel resin chemistries for enhanced rigidity and finish quality. Rubber variants including EPDM, natural rubber, and silicone rubber provide critical sealing, vibration dampening, and weather resistance capabilities.

The convergence of these material streams marks a strategic inflection point for decision-makers. As environmental mandates intensify and electrification drives new vehicle architectures, this report sheds light on critical dynamics. The following sections illuminate transformative shifts, policy impacts, segmentation intelligence, regional nuances, competitive landscapes, and pragmatic recommendations, equipping stakeholders with a holistic compass to navigate this rapidly changing terrain.

How Electrification, Sustainability Mandates, and Digital Innovation Are Redefining the Automotive Exterior Materials Ecosystem

Over the past decade, the automotive exterior materials domain has undergone transformative shifts that extend beyond incremental technology improvements. One of the most significant drivers has been the accelerating electrification of vehicles. Electric vehicle platforms demand lightweight materials to offset heavy battery packs, prompting a surge in adoption of advanced composites and high-strength aluminum alloys. Coupled with this trend is the growing consumer appetite for premium aesthetics, which has catalyzed the development of novel coatings and surface treatments that rival traditional paint in durability and finish quality.

Meanwhile, macroeconomic volatility and supply chain disruptions have underscored the importance of material sourcing resilience. OEMs are diversifying supply bases and strategically regionalizing procurement to mitigate risk from geopolitical tensions and natural disasters. This pivot has strengthened collaborations between tier-one suppliers and raw material producers, fostering integrated innovation ecosystems. At the same time, sustainability imperatives are reshaping material lifecycles, with closed-loop recycling programs for metals and thermoplastics gaining traction to reduce environmental footprints.

Technological convergence is another hallmark of this era. Digital engineering tools, such as generative design and virtual prototyping, enable rapid iteration of exterior panels, bumpers, and moldings to meet evolving crash, pedestrian safety, and aerodynamic criteria. Coating technologies have likewise advanced, with UV-curable and waterborne formulations reducing volatile organic compound emissions and curing times. Together, these shifts herald a new paradigm in material development-one defined by agility, performance, and ecological stewardship-and set the stage for subsequent policy and commercial impacts detailed in the following analysis.

Assessing the Cumulative Impacts of US Tariff Structures on Automotive Exteriors and Strategic Material Flows in 2025

The United States government’s tariff regime for 2025 continues to exert material effects on automotive exterior substrates, spanning both raw inputs and finished components. Section 232 tariffs on steel and aluminum, imposed in 2018, remain at 25 percent and 10 percent respectively, elevating domestic metal costs and incentivizing alternative material adoption. These duties have driven manufacturers to intensify research into lightweight composites and thermoplastic substitutes to hedge against elevated metal prices.

Complementing these measures are Section 301 tariffs targeting select Chinese imports, which include certain polymer compounds and assembled exterior parts. The additional 25 percent duties on acrylonitrile butadiene styrene, polycarbonate blends, and fiber reinforced modules have reshaped sourcing strategies, prompting OEMs and suppliers to shift orders to South Korea, Taiwan, and emerging Southeast Asian hubs. As a result, regional supply chains are lengthening, and cost structures are adjusting to internalize higher duty burdens.

In response, several manufacturers have relocated coating and molding operations stateside to capture duty exemptions on finished goods and benefit from domestic incentive programs. State tax credits for advanced manufacturing and federal grants for green technology deployment further mitigate the tariff headwinds. However, these policy levers introduce additional complexity around capital allocations and long-term production planning. The net effect is a more diversified material mix on vehicle exteriors, where composites, advanced thermosets, and domestically produced steel and aluminum components co-exist to optimize total landed costs and regulatory compliance.

Deciphering the Complex Multi-Dimensional Segmentation Framework Underpinning the Automotive Exterior Materials Industry

A nuanced understanding of the automotive exterior materials market emerges when evaluating it through multiple segmentation lenses. Based on material type, the landscape encompasses glass, metals, plastics & composites, and rubber, each subdivided into specialized grades. Glass evolves through laminated and tempered formats to optimize safety and acoustics, while metals span aluminum, magnesium, and steel alloys tailored for specific strength and weight targets. Plastics & composites encompass fiber reinforced composites, thermoplastics, and thermosets, with fiber reinforcements such as carbon and glass variants delivering high stiffness, thermoplastics like ABS, polyamide, and polypropylene offering design flexibility, and thermosets such as epoxy, phenolic, and polyurethane ensuring robust thermal and chemical resistance. Rubber is likewise differentiated across EPDM, natural rubber, and silicone rubber for sealing and vibration management.

Turning to exterior components, the market covers body panels, bumpers, grilles, mirrors, and moldings. Each component category is further refined into subsegments-doors, fenders, hood, and roof within body panels; front and rear sections in bumpers; plus side and window moldings-illustrating the granularity of design and material choices. Coating technologies add another layer of stratification, ranging from powder coatings in epoxy and polyester formulations to solvent-borne acrylic, nitrocellulose, and polyurethane systems, as well as UV-curable acrylate and epoxy options, and waterborne acrylic and polyurethane emulsions targeting low-VOC standards. Lastly, vehicle typology divides the market into heavy and light commercial vehicles and passenger cars, with the latter further segmented into hatchback, sedan, and SUV configurations.

This multifaceted segmentation framework reveals distinct value pools and performance priorities. Lightweight composites and premium UV-curable coatings dominate high-end passenger car segments, particularly SUVs, whereas steel, rubber, and solvent-borne coatings retain prominence in commercial vehicle applications. Glass architectures, notably laminated variants, are essential across all vehicle types for safety compliance and acoustic comfort. Such segmentation insights guide material selection, optimize manufacturing processes, and align product roadmaps with end-market demands.

This comprehensive research report categorizes the Automotive Exterior Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Exterior Component

- Coating Technology

- Vehicle Type

Unraveling Regional Material Dynamics across the Americas Europe Middle East Africa and Asia-Pacific Automotive Markets

Regional dynamics play a pivotal role in shaping material strategies and end-market adoption rates. In the Americas, legacy automakers and renowned suppliers leverage established steel and aluminum mills, while pioneering composites capacity is emerging in the U.S. Southeast and Mexico. The robust domestic demand for light trucks and SUVs drives continuous optimization of rubber and metal sealing solutions, alongside increasing interest in recycled thermoplastics for eco-friendly badging and trim.

Shifting focus to Europe, the Middle East & Africa region, stringent emissions and safety regulations have propelled a transition toward high-strength alloys and eco-conscious coatings. European OEMs are at the forefront of implementing waterborne and UV-curable coatings to meet low-VOC mandates, and composites R&D clusters in Germany, France, and the U.K. are exploring bio-based resin chemistries. Meanwhile, manufacturers in the Middle East are investing in local aluminum smelting capacity to reduce import dependencies, and African markets display nascent demand for cost-effective steel and tempered glass solutions as vehicle penetrations expand.

In Asia-Pacific, rapid vehicle electrification and consumer premiumization fuel demand for lightweight substrates and advanced surface finishes. Japan and South Korea excel in high-precision glass and aluminum components, while China’s maturing composites sector focuses on scaling carbon fiber and advanced thermoset production. Southeast Asian economies serve as competitive hubs for thermoplastics extrusion and rubber compounding, capitalizing on lower labor costs and favorable trade agreements. The interplay of regulatory drivers, supply chain maturation, and local manufacturing incentives creates a diverse regional tapestry, highlighting where strategic investments and partnerships can yield the greatest competitive advantage.

This comprehensive research report examines key regions that drive the evolution of the Automotive Exterior Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape of Integrated Material Suppliers Technology Innovators and Alloy Producers

The competitive landscape of automotive exterior materials is dominated by a blend of diversified conglomerates and specialized technology providers. Global steel and aluminum producers continue to underpin the market with scale advantages and backward integration, enabling them to offer alloy grades tailored for next-generation vehicle platforms. Composite innovators are forging strategic partnerships with OEMs to co-develop fiber reinforcements and resin systems, often embedding joint-venture facilities within automotive clusters for real-time collaboration.

Coating technology leaders maintain strong positions through continuous formulation enhancements that improve cure times, durability, and sustainability profiles. These suppliers are investing in digital color customization platforms and automated spray systems that reduce waste and cycle times. Rubber compounding specialists, meanwhile, differentiate through proprietary additive packages that deliver superior weather resistance and noise dampening, often securing long-term supply agreements with major OEMs.

Tier-one automotive suppliers are increasingly integrating multiple material capabilities-combining advanced plastics injection, composite layup, and coating application under one roof to simplify procurement and accelerate time-to-market. This vertical integration trend puts pressure on single-source material vendors to broaden their portfolios or forge alliances. As electrification and autonomous driving enhance the value proposition of lightweight and multifunctional exteriors, incumbent players with flexible, modular manufacturing platforms stand to capture disproportionate growth. The interplay of scale, technological edge, and strategic alliances defines the competitive dynamics and sets the stage for future consolidation and innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Exterior Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Arkema S.A.

- BASF SE

- Covestro AG

- Dow Inc.

- DuPont de Nemours, Inc.

- DURA Automotive Systems, LLC

- Evonik Industries AG

- Flex‑N‑Gate Corporation

- Gestamp Automoción S.A.

- Grupo Antolín S.A.

- INOAC Corporation

- KIRCHHOFF Automotive GmbH

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- Magna International Inc.

- Mitsubishi Chemical Corporation

- Plastic Omnium Co.

- SABIC (Saudi Basic Industries Corporation)

- Solvay S.A.

- Teijin Limited

- Toray Industries, Inc.

- Toyoda Gosei Co., Ltd.

- Toyota Boshoku Corporation

- Trinseo S.A.

Strategic Imperatives for Manufacturers to Drive Resilient Innovation and Sustain Competitive Advantage

Industry leaders seeking to capitalize on emerging opportunities should prioritize investment in agile R&D and modular manufacturing. By establishing collaborative innovation hubs that unite materials scientists, design engineers, and digital specialists, organizations can accelerate the development of next-gen composites and coatings while de-risking scale-up challenges. Leveraging advanced simulation tools and pilot-scale production lines will shorten development cycles and provide real-world validation under diverse climate and stress scenarios.

Supply chain resilience must be strengthened through multi-source strategies for critical inputs, particularly specialty polymers and high-grade aluminum alloys. Cultivating partnerships with regional producers in North America, Europe, and Asia-Pacific will buffer against tariff volatility and logistics disruptions. Additionally, embedding sustainability metrics across material lifecycles-from recycled content targets to end-of-life recyclability-aligns product innovation with evolving regulatory and consumer expectations, enhancing brand equity.

Finally, embracing digitalization across procurement and production, including AI-driven demand forecasting and factory analytics, will optimize inventory levels and identify process bottlenecks. A phased roadmap that integrates digital twins, IoT-enabled equipment, and data-driven quality controls can yield significant cost and time savings. By combining technological leadership with operational excellence and strategic collaborations, industry players can secure competitive advantage as the exterior materials market continues its rapid evolution.

Detailing a Rigorous Hybrid Research Methodology Incorporating Primary Interviews Secondary Data and Quantitative Modeling

This research employs a multi-method approach to ensure comprehensive coverage and robust insights. Primary interviews with senior executives and technical leads at OEMs, tier-one suppliers, and raw material producers formed the backbone of qualitative analysis, providing firsthand perspectives on technology adoption, cost pressures, and regulatory impacts. Secondary research encompassed trade journals, patent filings, government trade data, and sustainability reports to map historic trends and emerging patterns, with particular emphasis on tariff legislation and regional manufacturing incentives.

Quantitative data were gathered through subscription-based industry databases and proprietary surveys targeting procurement and R&D teams across the Americas, Europe, Middle East & Africa, and Asia-Pacific. These datasets were normalized to account for currency fluctuations, inflation, and volume differentials, enabling cross-regional comparisons at a granular component and material level. Market models integrated these inputs with scenario-based analyses to explore the effects of policy shifts, electrification penetration rates, and sustainability targets.

The triangulation of primary insights, secondary sources, and quantitative modeling yields a holistic view of the automotive exterior materials sector. Rigorous data validation protocols, including cross-verification with multiple vendor sources and sensitivity testing, underpin the credibility of our findings. This methodological foundation ensures that stakeholders can rely on the report’s conclusions to inform strategic planning, investment decisions, and technology roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Exterior Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Exterior Materials Market, by Material Type

- Automotive Exterior Materials Market, by Exterior Component

- Automotive Exterior Materials Market, by Coating Technology

- Automotive Exterior Materials Market, by Vehicle Type

- Automotive Exterior Materials Market, by Region

- Automotive Exterior Materials Market, by Group

- Automotive Exterior Materials Market, by Country

- United States Automotive Exterior Materials Market

- China Automotive Exterior Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

Synthesizing Critical Findings to Illuminate the Interplay of Materials Innovation Regulation and Market Dynamics in Automotive Exteriors

Throughout this analysis, it is evident that the automotive exterior materials industry stands at the confluence of technological innovation, regulatory evolution, and shifting market expectations. Advanced composites and high-strength alloys are no longer niche options but core enablers of lightweight vehicle architectures, while sustainable coatings and recycled polymers are transforming supplier roadmaps. Regional variations in tariff regimes and regulatory environments have diversified material flows and spurred localized manufacturing solutions.

Key segmentation insights highlight the critical importance of tailoring material and component strategies to specific vehicle types and regional demands. For passenger cars, particularly SUVs, premium composites and UV-curable coatings deliver the desired combination of aesthetics and performance, whereas commercial vehicles continue to rely on proven metal-rubber assemblies and solvent-borne finishes for durability and cost efficiency. Competitive dynamics favor suppliers with integrated capabilities and flexible production footprints, capable of co-innovation and rapid scale-up.

As the industry advances, success will hinge on balancing short-term cost optimization with long-term investments in R&D, sustainability, and digital transformation. Stakeholders that adopt a proactive, data-driven approach to material selection, supply chain resilience, and technology partnerships will be best positioned to navigate tariff uncertainties and capitalize on the next wave of electrification and autonomy.

Elevate Your Strategic Footprint with Exclusive Access to Comprehensive Automotive Exterior Materials Insights Through Direct Engagement with Our Specialist

We appreciate your interest in this comprehensive examination of the automotive exterior materials landscape. To gain unparalleled access to the in-depth analysis, data appendices, and strategic tools contained within the full market research report, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through tailored licensing options, supplemental insights, and bespoke consulting services designed to empower your organization’s decision-making and drive competitive advantage in this fast-evolving industry. Reach out today to secure your copy and start leveraging actionable intelligence that positions your team at the forefront of innovation and growth in the automotive exterior materials market.

- How big is the Automotive Exterior Materials Market?

- What is the Automotive Exterior Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?