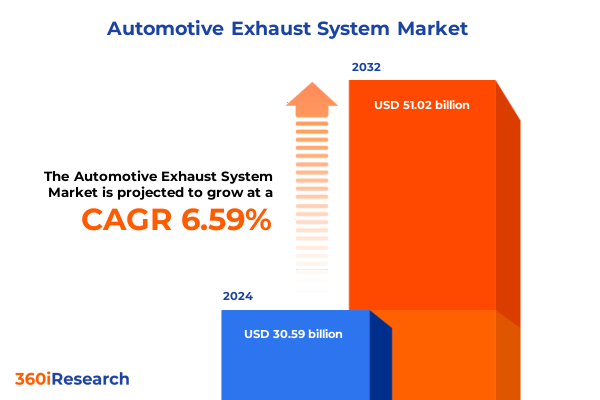

The Automotive Exhaust System Market size was estimated at USD 32.58 billion in 2025 and expected to reach USD 34.69 billion in 2026, at a CAGR of 6.61% to reach USD 51.02 billion by 2032.

Comprehensive Prelude to Emerging Dynamics and Strategic Imperatives Shaping the Future Trajectory of the Automotive Exhaust System Market

The automotive exhaust system market is undergoing a pivotal convergence of regulatory intensity, technological innovation, and evolving powertrain preferences. Stricter emissions standards, epitomized by the Euro 7 regulation taking effect in mid-2025, are redefining exhaust after-treatment requirements to achieve ultra-low NOx and particulate emissions across all light-duty vehicles. These mandates extend beyond tailpipe emissions to include particle matter from brake wear and tire abrasion, challenging manufacturers and suppliers to integrate advanced sensors, on-board diagnostics, and new substrate materials to maintain compliance throughout extended vehicle lifecycles.

How Global Electrification Trends and Emissions Regulations Are Catalyzing Rapid Evolution Across Exhaust After-Treatment and Powertrain Integration

Several transformative forces are reshaping the automotive exhaust landscape at an unprecedented pace. The surge in battery electric vehicle adoption, projected by the International Energy Agency to reach twenty-five percent of global car sales in 2025, directly displaces traditional exhaust component demand even as falling battery costs drive broader EV affordability. Concurrently, hybrid powertrains-including plug-in and mild hybrids-are rising to prominence as OEMs balance regulatory compliance with consumer expectations for range and performance. Their intermittent use of internal combustion engines sustains demand for sophisticated catalytic converters and NOx after-treatment systems.

Assessing the Layered Impact of Recent U.S. Tariff Measures on the Cost Structures and Supply Chain Strategies of Automotive Exhaust Component Manufacturers

The cumulative impact of United States tariffs enacted in early 2025 has introduced significant cost pressures for automotive exhaust system manufacturers and OEMs reliant on imported components. Section 232 and Section 301 levies, imposing up to twenty-five percent on vehicles and auto parts and maintaining China-focused duties ranging from seven-and-a-half to twenty-five percent, have directly affected catalytic converter substrates, exhaust manifolds, and muffler imports. Although relief measures in late April 2025 provided partial duty offsets for domestically assembled vehicles through credit mechanisms of up to 3.75 percent of MSRP, the unintended consequence has been a scramble to localize production of complex components that previously leveraged lower-cost global supply chains. As a result, many Tier-1 suppliers are accelerating investments in U.S. fabrication facilities, prioritizing reshoring initiatives to mitigate tariff exposure and reinforce supply chain resilience.

In-Depth Perspectives on Essential Market Segmentation Parameters to Guide Strategic Product Development and Channel Optimization

Integrating six critical segmentation dimensions reveals nuanced opportunities and constraints across the exhaust system value chain. Vehicle type segmentation distinguishes heavy and light commercial vehicles from a diverse passenger vehicle fleet encompassing coupes, hatchbacks, sedans, and utility vehicles, each demanding tailored exhaust flow and acoustic profiles. Fuel type differentiation spans battery electric, hybrid, gasoline, and fuel cell electric designs alongside heavy and light duty diesel platforms, driving distinct after-treatment architectures for NOx and particulate control. Component segmentation covers catalytic converters-featuring ceramic or metallic substrates-along with exhaust manifolds, flex pipes, mufflers, resonators, and tail pipes, each requiring precise material science to balance durability, weight, and thermal tolerance. Material choices range from aluminized and stainless steels to high-strength titanium alloys, influencing product life and cost. Sales channels bifurcate between OEM and aftermarket, the latter serving both replacement and performance upgrade demands. Finally, system type segmentation contrasts single and dual exhaust configurations, reflecting divergent performance, packaging, and styling considerations. Understanding how these dimensions intersect is crucial for product portfolio optimization and go-to-market alignment in a highly fragmented environment.

This comprehensive research report categorizes the Automotive Exhaust System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Vehicle Type

- Fuel Type

- Material

- Sales Channel

Exploring Distinct Regional Regulatory Regimes and Market Dynamics Shaping Exhaust System Adoption in Key Global Territories

Regional dynamics exert a profound influence on exhaust system trends and investment priorities. In the Americas, rigorous fuel economy standards under the U.S. Corporate Average Fuel Economy program and renewed light vehicle tariffs are prompting manufacturers to enhance exhaust after-treatment efficiency for gasoline and diesel engines, while also accelerating electrification pathways. Mexico’s role as a manufacturing hub continues to expand, with local content incentives reshaping assembly footprints. Across Europe, Middle East, and Africa, the introduction of Euro 7 and the forthcoming ban on new internal combustion passenger cars after 2035 compel a shift toward hybrid integration and advanced emission control modules, supported by multilayered incentive schemes and research grants. Meanwhile, Asia-Pacific remains the epicenter of electric mobility disruption, with China exceeding fifty percent NEV sales share and leading the deployment of fuel cell and alternative fuel vehicles. Domestic OEMs in Japan and South Korea are simultaneously advancing selective catalytic reduction technologies and lightweight exhaust assemblies to meet stringent local emission targets and sustain export competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Automotive Exhaust System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Initiatives and Collaborative Ventures by Leading OEMs and Suppliers Redefining the Competitive Landscape of the Exhaust System Industry

Leading players in the automotive exhaust ecosystem are forging multi-pronged strategies to capture emerging growth streams and navigate headwinds. Tier-1 suppliers such as Tenneco, Faurecia, and Eberspächer are investing heavily in next-generation catalytic substrates, diesel particulate filter coatings, and integrated active noise cancellation solutions for passenger cars and light trucks. OEMs including General Motors and Stellantis are deepening vertically integrated capabilities by expanding in-house exhaust component production to mitigate tariff impacts and ensure quality control. Specialists in high-performance segments, notably Akrapovič and Borla, are leveraging titanium and stainless steel alloys to deliver weight-optimized systems for premium vehicles, simultaneously fostering aftermarket demand. Complementary technology firms are embracing digitalization platforms for real-time emission monitoring and predictive maintenance, creating new service-driven revenue models. Strategic collaborations between battery and exhaust technology providers are also emerging, underscoring the transitional coexistence of electric and hybrid powertrains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Exhaust System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Akrapovič d.d.

- AP Emissions Technologies, Inc.

- Benteler International AG

- Borla Performance Industries, Inc.

- Bosal International NV

- Continental Aktiengesellschaft

- Dana Incorporated

- Dinex A/S

- Eberspächer Group GmbH

- ElringKlinger AG

- Faurecia SA

- Friedrich Motorsport GmbH

- Harbin Airui Automotive Exhaust System Co., Ltd.

- HJS Emission Technology GmbH & Co. KG

- Johnson Matthey Plc

- Katcon Global S.A. de C.V.

- Magna International Inc.

- MagnaFlow Performance Exhaust

- Mando Corporation

- Marelli Europe S.p.A.

- Robert Bosch GmbH

- Shouguang Xinchengyuan Automotive Exhaust System Co., Ltd.

- Tenneco Inc.

Targeted Strategies and Collaborative Opportunities for Industry Stakeholders to Strengthen Resilience and Drive Long-Term Profitability

Industry leaders must proactively adapt to converging pressures by implementing targeted actions. First, accelerating regional production footprints through greenfield facilities and joint ventures will offset existing tariff burdens and reduce lead times for critical after-treatment modules. Simultaneously, prioritizing research into next-generation ceramic and metallic substrate innovations can deliver higher conversion efficiencies while reducing reliance on scarce raw materials. To address electrification’s displacement effect, firms should diversify into thermal management and hydrogen combustion exhaust components, leveraging core metallurgical expertise to capture adjacent markets. Enhancing digital integration across the supply chain-employing IoT-enabled sensors and blockchain-backed traceability-will bolster compliance reporting, reduce warranty costs, and strengthen customer engagement. Finally, cultivating cross-sector partnerships with energy providers and infrastructure developers can unlock new service offerings surrounding emission testing, retrofit solutions, and end-of-life recycling programs. Together, these initiatives will position companies to thrive amid a rapidly evolving regulatory and technological environment.

Robust Multi-Source Research Approach Incorporating Qualitative Stakeholder Interviews and Quantitative Policy and Technology Analysis

Our research methodology synthesizes primary and secondary data sources to ensure comprehensive coverage and analytical rigor. Primary research encompasses in-depth interviews with executive leaders from OEMs, Tier-1 suppliers, and regulatory authorities, supplemented by surveys of aftermarket distributors and end-users to capture usage patterns and preference shifts. Secondary data integrates official regulatory publications, trade association white papers, and publicly available financial statements to validate market developments and quantify technology adoption rates. Advanced analytic tools, including scenario planning and sensitivity analysis, were applied to assess tariff impact scenarios and material cost fluctuations. Geographic segmentation leveraged regional policy databases and production statistics to map manufacturing capacities and incentive frameworks. Component-level insights were derived from technical journals, patent filings, and collaboration agreements, ensuring accurate representation of emerging after-treatment and material innovations. This multi-method approach guarantees that findings reflect current industry realities and anticipate future inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Exhaust System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Exhaust System Market, by System Type

- Automotive Exhaust System Market, by Component

- Automotive Exhaust System Market, by Vehicle Type

- Automotive Exhaust System Market, by Fuel Type

- Automotive Exhaust System Market, by Material

- Automotive Exhaust System Market, by Sales Channel

- Automotive Exhaust System Market, by Region

- Automotive Exhaust System Market, by Group

- Automotive Exhaust System Market, by Country

- United States Automotive Exhaust System Market

- China Automotive Exhaust System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Regulatory Drivers, Technological Advances, and Market Realities Defining the Future Outlook for Automotive Exhaust Ecosystems

The automotive exhaust system industry stands at a critical inflection point defined by the dual imperatives of emissions compliance and powertrain transition. While stringent regulations such as Euro 7 and U.S. tariff regimes introduce immediate challenges, they simultaneously catalyze innovation in after-treatment technologies, material science, and production localization. The rapid ascent of electrification undeniably reallocates demand, yet parallel growth in hybrid, hydrogen combustion, and synthetic fuel applications sustains a viable market for exhaust solutions. Regions worldwide exhibit distinct trajectories, from Americas’ tariff-driven reshoring to Asia-Pacific’s EV proliferation, reinforcing the necessity for adaptive, geographically tailored strategies. By aligning segmentation insights, harnessing collaborative ventures, and embracing digital transformation, industry participants can secure competitive advantage and drive sustainable growth as the sector evolves.

Engage with Our Associate Director to Unlock Complete Market Insights and Elevate Your Automotive Exhaust Strategy to Outpace Competition

Don’t let emerging regulatory demands and market shifts leave your organization behind; connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure the full report and translate insights into decisive competitive advantage. Ketan’s deep expertise in automotive powertrain research ensures tailored guidance on navigating tariffs, emissions regulations, and electrification impacts. Reach out to schedule a personalized briefing and gain exclusive access to comprehensive analysis, actionable data, and strategic recommendations that will empower your leadership teams to optimize product development, supply chain resilience, and market positioning. Unlock the next phase of growth and innovation-contact Ketan Rohom today and drive your exhaust system strategy toward unparalleled success.

- How big is the Automotive Exhaust System Market?

- What is the Automotive Exhaust System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?