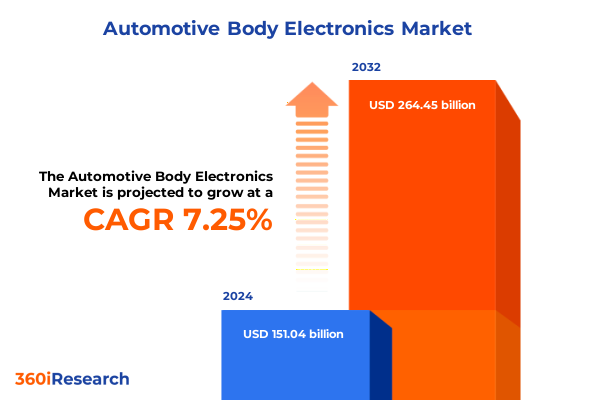

The Automotive Body Electronics Market size was estimated at USD 159.80 billion in 2025 and expected to reach USD 169.09 billion in 2026, at a CAGR of 7.46% to reach USD 264.45 billion by 2032.

Setting the Stage for a New Era in Automotive Body Electronics Delivering Connectivity, Electrification, and Advanced Software-Driven Vehicle Architectures

Automotive body electronics encompass a diverse array of electronic control modules and systems responsible for essential vehicle functions such as lighting control, door and window actuation, mirror adjustment, climate management, and airbag deployment. These systems are integral to modern vehicle architectures, providing scalability and flexibility that support both traditional combustion-engine vehicles and the emerging fleet of electrified, software-defined models. Infineon’s description of body control modules highlights how these components have evolved to integrate motor control, power distribution, and smart access features into a cohesive, decentrally managed ecosystem. Moreover, Wikipedia notes that body control modules communicate over CAN bus networks to actuate relays for load drivers, demonstrating the complexity and critical safety functions they manage in vehicles.

Over the past decade, the shift from discrete, function-specific ECUs to consolidated zonal and domain controllers has accelerated, driven by the demand for reduced wiring weight, enhanced diagnostics, and over-the-air update capabilities. According to McKinsey, this consolidation is expected to replace multiple point ECUs with fewer, more capable domain controllers, particularly in ADAS and infotainment domains, within the next two to three years. Concurrently, advances in AI-driven cabin intelligence, predictive maintenance, and connectivity are pushing vehicle electronics to new levels of integration and software dependence, as highlighted by market research analysts discussing AI, HUDs, and 5G adoption in body electronics.

As vehicles become increasingly connected and electrified, body electronics now serve as gateways for smart features, safety enhancements, and seamless user experiences. Exhibits from CES 2025 showcased by major OEMs and suppliers underscored how panoramic digital displays, personalized cabin environments, and satellite-based connectivity solutions are redefining the driver–vehicle interface. These developments reflect the crucial role of body electronics in enabling next-generation vehicle platforms that demand higher performance, robust cybersecurity, and enhanced passenger convenience.

Navigating Transformative Shifts as Electrification, Connected Services, and Consolidated ECU Architectures Redefine Automotive Body Electronics

The progressive electrification of powertrains has significantly altered body electronics requirements, as electric vehicles necessitate sophisticated power management solutions, battery thermal controls, and regenerative braking indicators. S&P Global Mobility projects that U.S. vehicles will carry greater semiconductor content per unit, driven by the need for advanced power modules and sensor networks that ensure energy efficiency and meet stringent safety mandates. Similarly, the trend towards AI-enabled predictive maintenance and adaptive comfort systems is reshaping module functionality, enabling real-time diagnostics and personalized climate and seating adjustments based on passenger preferences.

Concomitantly, the industry is witnessing a fundamental shift from distributed ECUs towards consolidated domain controllers and zonal architectures. McKinsey’s research predicts that vehicle functions will transition to integrated domain controllers within three years, replacing the traditional “add-a-box” approach with consolidated computing platforms for ADAS, infotainment, and body functions alike. This transformation reduces wiring complexity, lowers weight, and provides unified software frameworks that facilitate continuous feature upgrades and cybersecurity management.

Connectivity advancements, including 5G and edge computing, are further transforming body electronics by enabling low-latency V2X communications, real-time telematics, and over-the-air software updates. McKinsey estimates that value enabled by edge and 5G in connected-car use cases will rise from 5 percent in 2020 to nearly 30 percent by 2030, unlocking new services and user experiences. In parallel, regulatory momentum towards Software-Defined Vehicles (SDVs) underscores the imperative for robust cybersecurity frameworks, as highlighted by TechRadar, which emphasizes the integration of ISO/SAE 21434 and UNECE WP.29 standards to secure continuous software updates and protect against large-scale remote attacks.

Moreover, the confluence of sustainable materials, lightweight electronics, and flexible printed sensors is redefining interior and exterior component design. Manufacturers are exploring in-mold electronics, transparent heaters, and curved OLED displays to meet aesthetic and efficiency goals, signaling a new frontier in eco-friendly automotive innovations. These transformative shifts demand strategic agility from OEMs and suppliers to capitalize on emerging technologies and evolving regulatory landscapes.

Assessing the Cumulative Impact of 2025 United States Tariffs on Automotive Body Electronics Supply Chains, Costs, and Strategic Sourcing Decisions

In 2025, the U.S. government’s expanded tariff regime under Section 232 and Section 301 has imposed significant duties on imported auto parts, steel, aluminum, semiconductors, and battery components. According to a supply chain analysis by SDI, tariffs of 25–35 percent on steel and aluminum, combined with 15–40 percent rates on semiconductor microcontrollers, have driven overall vehicle production costs up by an estimated 7–12 percent per unit. These measures aim to protect domestic industries but have also amplified raw material costs and introduced new sourcing complexities across the automotive supply chain.

The financial impact is already evident in second-quarter results, with General Motors reporting a $1.1 billion tariff hit and projecting up to $5 billion in annual tariff-related expenses. GM’s mitigation strategy includes a $4 billion investment to repatriate production and shift sourcing to U.S. facilities, covering approximately 30 percent of the expected cost burden. Stellantis has similarly disclosed $350 million in tariff-related costs for the first half of the year, highlighting that while consumer price increases remain limited, OEM profit margins are under sustained pressure. Meanwhile, a new U.S.-Japan trade deal promises reduced auto import duties, though broader tariff policy uncertainty persists ahead of potential EU negotiations.

To address these challenges, industry leaders are diversifying their supply chains through nearshoring, dual-sourcing strategies, and selective localization of key components. S&P Global Mobility anticipates that automakers will accelerate partnerships with domestic semiconductor fabs and secure long-term supplier agreements to manage volatility. At the same time, smaller Tier-2 and Tier-3 suppliers face heightened risk, with many SMBs unable to absorb the increased duties, leading to consolidation and greater emphasis on resilient manufacturing footprints.

Unveiling Key Segmentation Insights Across Product Types, Vehicle Categories, Applications, and Sales Channels in Automotive Body Electronics

The automotive body electronics landscape is meticulously segmented by product type, encompassing Airbag Control Units differentiated into driver and passenger modules; Body Control Modules further categorized into multi-function and single-function units; Door Modules partitioned between front and rear designs; Instrument Clusters spanning analog, digital, and head-up display variants; Lighting Systems divided into daytime running lights, headlamps, and tail lamps; Mirror Systems comprising auto-dimming, manual, and power mirrors; Telematics Control Units available as embedded or tethered solutions; and Wiper Systems offered in conventional and intermittent formats. This segmentation enables stakeholders to tailor R&D priorities and supply strategies to specific functional domains.

When viewed by vehicle type, the market distinguishes Heavy Commercial Vehicles, which demand ruggedized electronics for durability; Light Commercial Vehicles, prioritizing cost-effective yet reliable modules; and Passenger Cars, where consumer preferences drive rapid feature adoption in comfort, connectivity, and aesthetics. These categorizations guide OEMs and suppliers in aligning product roadmaps with fleet requirements and regulatory expectations.

Application-based segmentation further refines market analysis, covering Comfort & Convenience systems - including central locking, climate control, power seats, and power windows - that enhance occupant experience; Connectivity & Telematics solutions such as infotainment systems, navigation platforms, and telematics control units that underpin data-driven services; Entertainment offerings from rear-seat entertainment systems to premium audio speakers; Lighting applications integrating daytime running lights, headlamps, and tail lamps to satisfy visibility regulations; and Safety & Security modules encompassing airbags, alarm systems, crash sensors, and door lock actuators that meet increasingly stringent safety standards.

Finally, sales channel segmentation differentiates Aftermarket distribution, capturing vehicle upgrades and retrofits, from Original Equipment Manufacturer channels that embed electronic modules into new vehicle production. Understanding these distinct channels is essential for designing targeted go-to-market strategies and forecasting inventory requirements.

This comprehensive research report categorizes the Automotive Body Electronics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Sales Channel

- Application

Highlighting Key Regional Dynamics Influencing Automotive Body Electronics Growth Across Americas, EMEA, and Asia-Pacific Markets

In the Americas, the United States leads the charge with robust EV incentives, federal safety regulations like FMVSS updates, and substantial investments to repatriate production facilities. Corporate trials in zonal architectures and AI-driven comfort features are gaining traction, while OEMs ramp up partnerships with domestic semiconductor fabs to mitigate tariff-driven supply volatility. Meanwhile, Canada and Mexico benefit from integrated North American trade agreements, though they too are adjusting supply chains in response to U.S. steel and aluminum duties.

Europe, Middle East & Africa (EMEA) is undergoing a pivotal transition fueled by stringent Euro 7 emissions standards and the EU’s mandate to end sales of new combustion-engine vehicles by 2035. European automakers face competitive pressure from affordable Chinese-branded EVs, prompting localization of battery production and advanced display innovations. The prominence of the Emotional Cockpit with ePaper displays and panoramic head-up systems demonstrates how regional consumer expectations are shaping interior electronics design.

Asia-Pacific continues to dominate global demand for automotive electronics, driven by China’s rapid EV adoption, government subsidies, and deep supply chain integration. As the region’s manufacturing powerhouse, China leads in volume, while Japan pioneers human–machine interfaces and India emphasizes cost-sensitive aftermarket enhancements. According to GlobeNewswire, Asia-Pacific is projected to outpace all other regions with over 10 percent CAGR through 2030, underscoring its role as both a production hub and innovation incubator for advanced body electronics.

This comprehensive research report examines key regions that drive the evolution of the Automotive Body Electronics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Movements and Innovations Among Major Tier-1 Suppliers and OEMs in Automotive Body Electronics

Bosch has consolidated its software and electronics expertise into a dedicated Automotive Electronics division, employing over 17,000 associates across 40 locations worldwide. This unified division coordinates control-unit production for all vehicle domains, driving synergies in zonal computing, real-time Ethernet networks, and smart power distribution innovations. With a focused investment of over $2 billion in North America, Bosch is scaling U.S. manufacturing and software capabilities to meet regional demand.

Continental is pushing the boundaries of user-centric design through its Emotional Cockpit concept, featuring an E Ink Prism display for fully customizable dashboards that resonate with Gen Z’s desire for personalization. The company’s Scenic View HUD further enhances safety by delivering high-contrast visual information across the entire windshield, heralding a new era of immersive, pillar-to-pillar display integration in vehicles.

Denso continues to lead in thermal and comfort control modules with its latest electronic multi-zone climate control systems, delivering precise temperature regulation via advanced servomotors and intelligent filtration. At NAFA I&E 2025, Denso showcased its MobiQ™ keyless access solutions and V2X roadside units, emphasizing the convergence of security, connectivity, and data-driven fleet management capabilities.

Aptiv is spotlighting its open, scalable sensor-to-cloud platform at CES 2025, demonstrating advanced ADAS features, machine-learning-based predictive technologies, and next-generation in-cabin experiences. Its software-defined vehicles showcase the integration of high- and low-voltage electrification solutions alongside over-the-air update frameworks, reinforcing Aptiv’s role in enabling seamless software ecosystems for future mobility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Body Electronics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Continental Aktiengesellschaft

- Denso Corporation

- Hella GmbH & Co. KGaA

- Hitachi, Ltd.

- Infineon Technologies AG

- Lear Corporation

- Magna International Inc.

- Mouser Electronics, Inc.

- NXP Semiconductors N.V.

- Panasonic Holdings Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Valeo SA

- Visteon Corporation

- ZF Friedrichshafen AG

Delivering Actionable Recommendations for Industry Leaders to Navigate Supply Chain Disruptions, Accelerate Innovation, and Strengthen Competitive Position

Industry leaders should prioritize the rapid adoption of zonal and domain-control architectures to streamline wiring complexity and enable scalable over-the-air feature deployment. By investing in consolidated ECUs and real-time Ethernet communications, companies can reduce vehicle weight and accelerate software-defined feature rollouts, as underscored by McKinsey’s insights on domain consolidation and Infineon’s emphasis on flexible module integration.

To mitigate persistent supply chain risks and tariff pressures, organizations must diversify sourcing strategies by nearshoring critical component production and establishing dual-sourcing agreements with both domestic and allied international suppliers. BlueBay Automation’s analysis highlights the importance of balancing cost volatility with supply resilience, while recent U.S.-Japan trade adjustments demonstrate the value of strategic trade partnerships.

Embedding robust cybersecurity protocols into software-defined platforms is essential to protect connected vehicles from escalating threats. Adherence to ISO/SAE 21434 and UNECE WP.29 standards, combined with zero-trust frameworks and blockchain-based data integrity measures, will safeguard continuous over-the-air updates and V2X communications, as illustrated by TechRadar’s analysis of SDV security imperatives.

Collaboration with semiconductor fabs, cloud providers, and startup ecosystems can catalyze innovation in AI-driven cabin intelligence, predictive maintenance, and next-generation sensor technologies. Leveraging edge computing and 5G integration, in partnership with leading semiconductor and cloud platforms, will unlock new data-driven services and revenue streams while positioning companies at the forefront of intelligent mobility.

Detailing Our Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation for Unbiased Insights

This study employs a robust mixed-methods research approach, commencing with secondary research that includes in-depth analysis of industry publications, company filings, regulatory databases, and peer-reviewed literature to establish an authoritative knowledge base. Key sources span technical standards bodies, trade associations, and market intelligence repositories, ensuring comprehensive coverage of automotive body electronics trends and technologies.

Primary research comprised structured interviews and surveys with senior executives, engineers, and procurement specialists at OEMs, Tier-1 suppliers, and semiconductor manufacturers. These engagements provided first-hand insights into strategic priorities, technology adoption timelines, and supply chain resilience strategies. Data triangulation was applied to reconcile quantitative findings with qualitative perspectives, enhancing the validity and reliability of the conclusions.

Analytical frameworks-including segmentation analysis, SWOT assessment, and PESTEL evaluation-were used to contextualize market dynamics across product types, applications, and regions. Forecast scenarios were stress-tested against policy shifts, trade developments, and technological disruptions to identify potential inflection points. Rigorous peer reviews and data validation exercises underpin the study’s impartiality and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Body Electronics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Body Electronics Market, by Product Type

- Automotive Body Electronics Market, by Vehicle Type

- Automotive Body Electronics Market, by Sales Channel

- Automotive Body Electronics Market, by Application

- Automotive Body Electronics Market, by Region

- Automotive Body Electronics Market, by Group

- Automotive Body Electronics Market, by Country

- United States Automotive Body Electronics Market

- China Automotive Body Electronics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Perspectives on the Automotive Body Electronics Landscape Highlighting Imperatives for Strategic Agility and Innovation

The automotive body electronics sector stands at the nexus of electrification, connectivity, and software transformation, with profound implications for vehicle performance, safety, and user experience. Strategic agility and technology convergence are essential for stakeholders seeking to capitalize on emerging opportunities while managing supply chain complexities and regulatory shifts.

As OEMs and suppliers navigate the evolving landscape, those who effectively integrate domain controllers, secure software‐defined architectures, and diversify sourcing networks will secure a competitive edge. Concurrently, proactive engagement with cybersecurity standards and collaborative innovation partnerships will shape the future of passenger comfort, safety, and intelligent mobility.

This executive summary underscores the critical imperatives facing industry leaders: embrace architectural consolidation, fortify supply chain resilience, safeguard digital ecosystems, and foster open ecosystems for continuous product evolution. In doing so, organizations will be well-positioned to lead the next wave of advancements in automotive body electronics.

Take Action Now and Engage with Ketan Rohom to Unlock Exclusive Insights from the Automotive Body Electronics Market Research Report

To explore the comprehensive findings, in-depth analysis, and actionable insights contained in the full report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan ensures you receive tailored guidance on how these insights can inform your strategic priorities, investment decisions, and product roadmaps. Secure access today and equip your organization with the intelligence needed to lead in the evolving automotive body electronics landscape.

- How big is the Automotive Body Electronics Market?

- What is the Automotive Body Electronics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?