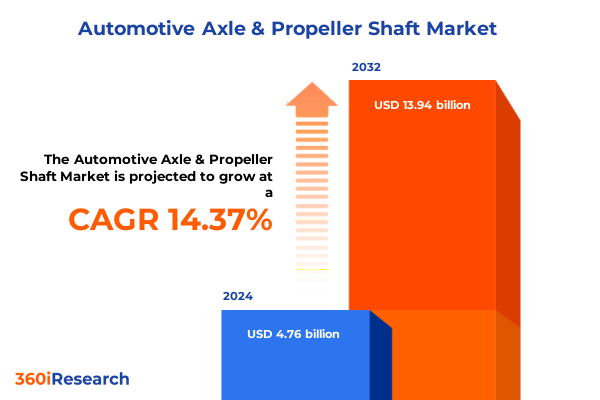

The Automotive Axle & Propeller Shaft Market size was estimated at USD 5.39 billion in 2025 and expected to reach USD 6.11 billion in 2026, at a CAGR of 14.53% to reach USD 13.94 billion by 2032.

Exploring the Critical Role of Axles and Propeller Shafts in Modern Automotive Systems Amid Evolving Technological and Regulatory Dynamics

As vehicles evolve toward greater efficiency, safety, and electrification, the automotive axle and propeller shaft segment has emerged as a cornerstone of drivetrain performance. These critical components transmit torque from powertrains to the wheels, underpinning ride comfort, handling precision, and overall vehicle reliability. Over recent years, advances in materials science, manufacturing techniques, and design optimization have elevated the role of axles and shafts beyond mere mechanical linkages, transforming them into high-performance enablers for next-generation platforms.

Against a backdrop of intensifying regulatory standards on emissions and fuel economy, lightweighting has become an imperative. Manufacturers are increasingly integrating advanced alloys and composite materials to reduce unsprung mass without sacrificing structural integrity. Concurrently, digital manufacturing practices such as additive production and predictive analytics are enhancing component consistency and throughput. These developments are driving a wave of innovation that demands a clear understanding of how axles and propeller shafts intersect with the broader trends shaping the global automotive supply chain.

In response to these market imperatives, this executive summary explores how technological inflection points and evolving trade dynamics converge to influence production strategies, cost structures, and competitive positioning. It lays the foundation for a deeper examination of transformative shifts, tariff pressures, segmentation nuances, regional contours, and best practices for sustaining leadership in an increasingly dynamic environment.

Examining the Transformative Technological Innovations and Market Dynamics Reshaping the Automotive Axle and Propeller Shaft Landscape Globally

The automotive axle and propeller shaft landscape is undergoing rapid transformation as electrified powertrains, lightweight materials, and digitalization converge to redefine performance benchmarks. Electric vehicles (EVs), with their instantaneous torque delivery and unique chassis dynamics, have necessitated bespoke shaft designs capable of accommodating higher torque densities and more stringent NVH (noise, vibration, and harshness) criteria. As a result, suppliers have intensified R&D investments to develop specialized alloys and multi-material constructs that reconcile strength with reduced mass.

Simultaneously, manufacturing innovation is reshaping production workflows. Forging and machining processes have integrated real-time monitoring and closed-loop control systems, elevating yield rates and dimensional accuracy. Additive manufacturing techniques, while still in nascent stages for high-volume production, are gaining traction for prototyping and complex forgings, enabling rapid iteration and cost-effective customization. Welding and joining technologies have likewise evolved, with friction stir welding and laser-based systems delivering superior metallurgical bonds and minimized thermal distortion.

Beyond technological advances, strategic partnerships and convergence between component specialists and OEMs have become essential for scaling new platforms efficiently. Joint development agreements accelerate knowledge transfer and mitigate integration risks, while alliances with material suppliers foster co-innovation in high-performance alloys. Looking ahead, the interplay of sustainability mandates, digital twins, and automation will continue to propel the industry toward leaner, more agile supply chains equipped to respond to shifting consumer preferences and regulatory imperatives.

Assessing the Cumulative Impact of the 2025 United States Steel and Aluminum Tariff Adjustments on Axle and Propeller Shaft Production and Supply Chains

In early 2025, the United States reinstated comprehensive steel and aluminum tariffs, signaling a renewed emphasis on protecting domestic metal producers. On February 10, proclamations expanded Section 232 duties by raising aluminum tariffs from 10% to 25%, eliminating all exemptions and closing the product-specific exclusion process. This shift imposed broader levies on downstream steel and aluminum components, including automotive driveline parts, and took effect on March 12, 2025 when exemption arrangements officially terminated.

Despite a May 2025 ruling that curtailed IEEPA-based global tariffs, Section 232 levies remained intact. Then, on June 3, 2025, steel and aluminum duties were further escalated from 25% to 50% for most trading partners, reinforcing the cost burden on imported raw materials and subcomponents. Automakers and suppliers reporting second-quarter results have already begun absorbing sizable tariff hits. For instance, GM disclosed a $1.1 billion tariff impact in the quarter, while Stellantis noted $350 million in additional costs for the first half of 2025.

The repercussions extend beyond OEM balance sheets. Suppliers of axles and propeller shafts have experienced material cost volatility and supply chain bottlenecks as procurement teams scramble to secure sufficient domestic steel and aluminum. Inflationary pressures are mounting, yet consumer prices have remained relatively stable as manufacturers prioritize profit margins over immediate pass-through. However, analysts anticipate that sustained tariff rates will eventually lead to price adjustments, potentially dampening demand in sensitive vehicle segments.

Moreover, the bilateral framework with Japan introduced a 15% tariff on Japanese vehicles, further complicating competitive dynamics. U.S. producers face asymmetrical barriers as Japanese automakers gain preferential treatment under the new arrangement while U.S. parts and vehicles remain subject to higher levies. This unequal footing is prompting suppliers to explore near-shoring strategies, diversify sourcing, and strengthen domestic production capacity to mitigate the cumulative impact of tariff regimes on drivetrain component supply chains.

Unveiling Key Segmentation Insights Across Manufacturing Processes Materials Vehicle Types and End Use to Illuminate Market Opportunities

A granular understanding of market segmentation reveals where strategic focus can unlock value. When evaluating manufacturing processes, conventional casting workflows-both sand and die casting-continue to serve high-volume production, while machining operations deliver tight tolerances essential for performance-oriented shafts. Forging remains a cornerstone for high-strength applications, with closed-die techniques enabling complex geometries and open-die processes offering flexibility for large diameters. Welding practices, meanwhile, facilitate multi-component assemblies and emerging hybrid material combinations.

Material selection further differentiates supplier offerings. Steel retains dominance due to cost-effectiveness and proven durability, particularly for commercial vehicle axles subject to rugged duty cycles. Nevertheless, aluminum alloys have gained traction in passenger cars and light trucks driven by lightweighting mandates, while composites are carving out specialized niches where corrosion resistance and weight savings justify premium pricing. Each material class requires unique process controls and post-treatment protocols to ensure fatigue resistance and dimensional integrity.

Vehicle type adds another layer of complexity. Heavy commercial vehicles, spanning buses and heavy-haul trucks, demand robust driveline systems engineered for longevity under high torque. Light commercial vehicles, including pickups and vans, prioritize a balance between payload capacity and ride quality. Off-road platforms, from agricultural tractors to construction machines, expose axles and shafts to abrasive environments, making protective coatings and hardened surfaces critical. In contrast, passenger cars-comprising hatchbacks, sedans, and SUVs-drive continuous innovation in noise-vibration-harshness, efficiency, and integration with advanced driver assistance systems.

Finally, end-use segmentation reflects divergent customer expectations. OEMs require scalable production, stringent quality management, and collaborative development to align component specifications with evolving vehicle architectures. Aftermarket channels, by contrast, emphasize rapid availability, cross-compatibility, and cost sensitivity. Recognizing these nuanced requirements allows suppliers to tailor value propositions that resonate across the manufacturing lifecycle and aftermarket service networks.

This comprehensive research report categorizes the Automotive Axle & Propeller Shaft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Manufacturing Process

- Material

- Vehicle Type

- End Use

Deriving Regional Perspectives from the Americas Europe Middle East Africa and Asia-Pacific to Guide Strategic Choices for Axle and Propeller Shaft Suppliers

Regional landscapes exert profound influence on production strategies and market access within the axle and propeller shaft domain. In the Americas, the United States, Canada, and Mexico benefit from a deeply integrated North American supply chain under USMCA provisions, which promote regional content and reduce border friction. Domestic steel and aluminum production, while subject to tariff volatility, still offers a reliable foundation for driveline manufacturing. Meanwhile, key automotive hubs in the United States continue to attract investment in electrification and advanced manufacturing, driving demand for lighter, higher-precision components.

In Europe, Middle East, and Africa, stringent emissions regulations and aggressive electrification targets are prompting rapid restructuring of driveline portfolios. Suppliers face the dual challenge of meeting CO₂ thresholds and managing material costs amid energy price fluctuations. Concurrently, the Middle East is emerging as a dedicated hub for specialty vehicle production, backed by sovereign wealth funds and strategic partnerships. Africa’s automotive sector, while more nascent, shows potential for growth in commercial vehicles tailored to infrastructure development projects, creating opportunities for robust and cost-effective shaft assemblies.

The Asia-Pacific region remains the largest automotive market, with China, India, Japan, South Korea, and Southeast Asia driving both volume and innovation. China’s commitment to NEV (new energy vehicle) adoption has spurred significant investments in high-torque electric drive axles, while India’s growing light commercial vehicle sector demands efficient and scalable shaft solutions. Trade agreements such as RCEP facilitate cross-border sourcing, though local content requirements and variable tariff structures necessitate careful navigation. As offshore manufacturing centers evolve, suppliers must balance cost-optimization with responsiveness to local customer requirements and evolving regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Automotive Axle & Propeller Shaft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Participants Strategies Investments and Competitive Dynamics in the Automotive Axle and Propeller Shaft Ecosystem

Industry leaders have adopted a variety of strategies to strengthen their market positions. Major public companies with global footprints leverage vertically integrated supply chains, securing raw material streams and reducing exposure to commodity price swings. Concurrently, mid-tier specialists differentiate through nimble capabilities in niche segments, such as high-performance shafts for off-road vehicles or lightweight casings for electric drive modules. Cross-industry collaborations with alloy providers and additive manufacturing partners are also on the rise, enabling accelerated technology transfer and rapid product validation.

Investment patterns underscore a wave of consolidation and portfolio diversification. Leading driveline suppliers are acquiring or joint venturing with companies that bring complementary technologies, such as friction-stir welding expertise or composite material know-how. These alliances facilitate entry into adjacent markets, including electric axle assemblies with integrated motors and power electronics. At the same time, established suppliers are renovating legacy plants with digital tools-ranging from AI-driven process analytics to robotics-enhanced finishing-to bolster throughput and quality consistency.

Performance metrics reveal that agile operations and customer-centric innovation correlate strongly with margin resilience. Suppliers that have embedded Sustainable Development Goals into their roadmaps-focusing on energy efficiency, waste reduction, and circularity-are gaining preferential consideration from OEMs committed to green procurement. Meanwhile, aftermarket specialists are introducing value-added services such as condition-monitoring programs and remanufacturing solutions to extend revenue streams and strengthen customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Axle & Propeller Shaft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Axle & Manufacturing Holdings, Inc.

- Automotive Axles Limited

- Dana Incorporated

- Gestamp Automoción

- GKN Automotive Limited

- GNA Axles Limited

- Hitachi Astemo, Ltd.

- Hyundai WIA Corporation

- IFA Rotorion Holding GmbH

- JTEKT Corporation

- Magna International Inc.

- Meritor, Inc.

- NSK Ltd.

- NTN Corporation

- RSB Group

- Schaeffler AG

- Showa Corporation

- SKF AB

- Talbros Engineering Limited

- ZF Friedrichshafen AG

Formulating Actionable Strategies to Overcome Regulatory Pressures Technological Evolution and Supply Chain Disruptions in Drive Component Sectors

To thrive amid regulatory headwinds and market shifts, suppliers must proactively retool their strategic playbooks. First, diversifying raw material sourcing across domestic, regional, and low-risk international partners mitigates the impact of tariff volatility and supply disruptions. By integrating real-time procurement analytics, firms can anticipate price variations and streamline inventory buffers. Second, expanding additive and hybrid manufacturing capabilities accelerates time-to-market for customized shaft designs, reduces tooling costs, and facilitates trial runs for emerging vehicle segments.

Simultaneously, strengthening collaboration with OEM innovation teams can unlock co-development opportunities for electrified drivetrains. Early engagement in concept definition and simulation exercises helps align material selections and design parameters with overarching vehicle architectures. Moreover, investing in digital twins and predictive maintenance platforms not only enhances product reliability but also supports aftermarket services and recurring revenue models. These digitally enabled offerings can differentiate suppliers in a crowded field.

Finally, embedding sustainability into core operations confers both compliance advantages and reputational benefits. Suppliers should pursue energy-efficient process upgrades, circular materials initiatives, and transparent ESG reporting frameworks. By demonstrating measurable reductions in carbon footprint and waste intensity, firms can secure partnerships with OEMs adopting aggressive decarbonization targets. Collectively, these actionable strategies position drive component suppliers to weather disruptions and capitalize on the next wave of automotive innovation.

Detailing the Rigorous Multi Stage Research Methodology Employed to Capture Comprehensive Insights for Automotive Axle and Propeller Shaft Analysis

This analysis draws on a comprehensive multi-stage approach designed to ensure depth, accuracy, and relevance. Primary research involved structured interviews with executives and technical leaders across global OEMs, Tier 1 driveline suppliers, material producers, and aftermarket distributors. These conversations provided firsthand insights into cost structures, design priorities, and procurement strategies. In addition, surveys targeting industry associations and trade bodies captured broader sentiment on regulatory impacts and technology adoption rates.

Secondary research integrated a wide array of publicly available resources, including company annual reports, White House proclamations, regulatory filings, and automotive trade publications. Where applicable, government documents such as Section 232 and IEEPA proclamations were cross-referenced to verify tariff timelines and scope. Market intelligence databases provided granular data on production footprints and capacity utilization, while patent analyses highlighted emerging innovations in fastening methods, materials, and manufacturing processes.

Data triangulation was achieved by reconciling insights from primary interviews with documented supply chain performance metrics and trade flow statistics. Quality assurance protocols included peer reviews by subject-matter experts and validation workshops with industry stakeholders to ensure that conclusions accurately reflect current trends and future possibilities within the axle and propeller shaft segment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Axle & Propeller Shaft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Axle & Propeller Shaft Market, by Manufacturing Process

- Automotive Axle & Propeller Shaft Market, by Material

- Automotive Axle & Propeller Shaft Market, by Vehicle Type

- Automotive Axle & Propeller Shaft Market, by End Use

- Automotive Axle & Propeller Shaft Market, by Region

- Automotive Axle & Propeller Shaft Market, by Group

- Automotive Axle & Propeller Shaft Market, by Country

- United States Automotive Axle & Propeller Shaft Market

- China Automotive Axle & Propeller Shaft Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Reflections on Strategic Imperatives and Evolving Market Dynamics Shaping the Future of Axle and Propeller Shaft Solutions

The confluence of technological innovation, regulatory recalibration, and shifting trade policies has placed the automotive axle and propeller shaft landscape at a strategic inflection point. Companies that anticipate material and process transformations, while fortifying supply chain resilience against tariff disruptions, will secure a significant competitive advantage. Embracing data-driven operational excellence and collaborative development models can accelerate the deployment of high-performance components tailored for both conventional and electrified platforms.

Looking ahead, the capacity to adapt swiftly to variable raw material costs and evolving vehicle architectures will define market leaders. As regulatory regimes continue to evolve globally, agile suppliers that integrate sustainability, digitalization, and regional optimization into their core strategies will create enduring value. Ultimately, a holistic, forward-leaning approach to component design and manufacturing will empower businesses to meet the demands of a rapidly changing automotive ecosystem.

Empowering Decision Makers to Accelerate Market Leadership Through Exclusive Access to In Depth Automotive Axle and Propeller Shaft Research Reports

For decision makers ready to sharpen their competitive edge, engaging directly with Ketan Rohom delivers unmatched access to the comprehensive in-depth analysis on axle and propeller shaft markets. His expertise in tailoring research reports ensures that you receive actionable intelligence aligned with your strategic priorities. Reach out today to secure the detailed insights and forward-looking perspectives you need to drive innovation within your organization and stay ahead of evolving market dynamics.

- How big is the Automotive Axle & Propeller Shaft Market?

- What is the Automotive Axle & Propeller Shaft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?