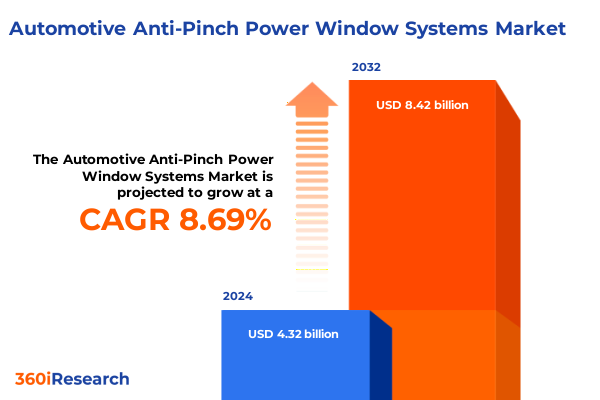

The Automotive Anti-Pinch Power Window Systems Market size was estimated at USD 4.69 billion in 2025 and expected to reach USD 5.08 billion in 2026, at a CAGR of 8.72% to reach USD 8.42 billion by 2032.

Revolutionizing vehicle safety through advanced anti-pinch power window technology that safeguards passengers and addresses emerging regulatory demands

In an era where passenger safety is paramount, anti-pinch power window systems have emerged as a critical technology designed to prevent injuries by automatically reversing window movement upon detecting an obstruction. Initially introduced to comply with stringent automotive safety standards, these systems have rapidly evolved from a regulatory requirement into a key differentiator among vehicle manufacturers. As consumers grow increasingly aware of safety features and governments worldwide tighten safety mandates, the significance of robust anti-pinch functionality cannot be overstated.

Consequently, stakeholders across the automotive value chain-from component suppliers to original equipment manufacturers-are intensifying their focus on sensor accuracy, response speed, and system reliability. Recent advances in sensor technology, coupled with improvements in motor control and software algorithms, have enhanced the performance of anti-pinch systems, reducing false activations and ensuring swift reversal actions. As a result, both new vehicle designs and retrofit markets are experiencing rising demand for solutions that blend safety with seamless user experience, setting the stage for a new chapter in automotive window safety.

Rapid evolution in automotive window mechanisms driven by integration of smart sensors connectivity electrification and enhanced user experience requirements

The landscape of automotive anti-pinch power window systems is undergoing transformative shifts driven by rapid advances in electrification, connectivity, and intelligent sensing. Electric vehicle platforms, in particular, have accelerated the adoption of power-operated windows with integrated safety features, leveraging onboard high-voltage architectures to power more sophisticated sensors and control units. Furthermore, the convergence of vehicle-to-cloud connectivity has enabled over-the-air software updates, allowing manufacturers to fine-tune pinch-detection algorithms in response to real-world performance data and evolving safety requirements.

Moreover, the integration of machine learning and predictive analytics is redefining how anti-pinch systems detect and classify obstructions. Emerging infrared and optical sensor arrays can now differentiate between a child’s finger, a grooved object, or environmental debris, significantly reducing false positives and improving system trustworthiness. As a result, consumer acceptance is strengthening, prompting tier-one suppliers to forge strategic partnerships with semiconductor and software firms to co-develop next-generation sensing modules. In parallel, regulatory bodies in key markets are signaling intentions to raise pinch-force and detection speed thresholds, compelling industry players to re-engineer their systems accordingly.

Analyzing the cumulative repercussions of recent United States tariffs on automotive window safety components and their cascading effects on supply chains

The imposition of updated United States tariffs in 2025 on imported automotive electronic components has substantially altered the cost structure for anti-pinch power window systems. Tariffs targeting advanced sensor modules and precision motor assemblies have prompted manufacturers to reassess their global sourcing strategies. In response, several tier-one suppliers have initiated dual-sourcing arrangements, pairing domestic production of key mechanical components with localized assembly of sensitive electronics to mitigate tariff exposure and transportation bottlenecks.

This reconfiguration of supply chains, while safeguarding margins, has introduced new challenges in quality control and logistics coordination. Domestic suppliers are under pressure to scale up capacity rapidly while adhering to stringent performance standards. At the same time, increased lead times for certain semiconductor chips have necessitated forecast-driven inventory management and the exploration of alternative sensor providers. Through collaborative demand planning and closer integration with freight partners, stakeholders have begun to stabilize delivery schedules and preserve system reliability, demonstrating the industry’s resilience in the face of evolving trade policies.

Critical segmentation insights unveiling distinct market dynamics across vehicle categories distribution channels motor types window locations and sensor technologies

The market for anti-pinch power window systems exhibits nuanced dynamics when examined through the lens of vehicle type, sales channel, motor type, window position, and sensor technology. In commercial vehicles, where durability and reliability are non-negotiable, manufacturers typically favor DC motors paired with force sensor technology to ensure robust performance under continuous operation conditions. Conversely, passenger cars increasingly leverage BLDC motors and optical sensors to deliver precise, energy-efficient operations and seamless user interactions.

Sales channels further influence system specifications and pricing models. Original equipment manufacturers integrate these systems into new vehicles with customized control logic and proprietary interface configurations, while the aftermarket segment prioritizes modularity and plug-and-play compatibility to facilitate retrofitting across diverse makes and models. When considering window position, front-positioned assemblies receive heightened scrutiny for rapid response times, prompting suppliers to deploy advanced infrared sensors capable of millisecond-scale detection. Rear window applications, by contrast, often balance cost and performance with stepper motors and basic force sensors, especially in price-sensitive tiers.

This comprehensive research report categorizes the Automotive Anti-Pinch Power Window Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Window Position

- Sensor Technology

- Vehicle Type

- Sales Channel

Regional market perspectives highlighting unique adoption patterns regulatory frameworks and growth drivers across Americas EMEA and Asia-Pacific territories

Regional variances in the adoption of anti-pinch power window systems are shaped by differing regulatory frameworks, consumer expectations, and industrial capabilities. In the Americas, stringent safety regulations and high consumer awareness have driven early market adoption, with OEMs prioritizing full integration of infrared and optical sensing modules. Meanwhile, South American markets, while still emerging, are witnessing growth driven by aftermarket upgrades and fleet operator demands for enhanced safety.

Europe, the Middle East, and Africa present a highly heterogeneous landscape. European Union mandates on occupant safety and harmonized homologation processes have fostered uniform adoption of advanced anti-pinch features. In the Middle East, where luxury vehicle penetration remains high, premium sensor packages and BLDC motor configurations are common. African markets are in a nascent stage, with aftermarket sales leading initial uptake as regulatory oversight and OEM integration continue to mature. In the Asia-Pacific region, a dual scenario unfolds: mature markets such as Japan and South Korea demand cutting-edge systems with integrated connectivity, while Southeast Asian economies emphasize cost-effective solutions, often balancing stepper motor assemblies with reliable force sensors to meet local price sensitivities.

This comprehensive research report examines key regions that drive the evolution of the Automotive Anti-Pinch Power Window Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key industry players advancing anti-pinch power window innovation through strategic partnerships technology licensing and expansive global production networks

Leading players are steering the evolution of anti-pinch power window systems through a combination of strategic partnerships, intellectual property development, and global production expansion. Major automotive suppliers have forged alliances with semiconductor manufacturers to co-innovate sensor chips that meet the dual requirements of speed and sensitivity. Concurrently, joint ventures between control module specialists and software firms are enabling the integration of advanced diagnostics, predictive maintenance capabilities, and real-time performance monitoring through connected vehicle platforms.

Production footprints are also evolving, with established suppliers expanding manufacturing capacities in key trade zones to offset tariff pressures and reduce shipping distances. Investments in automated assembly lines and robotics have enhanced precision and throughput, while rigorous in-house validation labs accelerate time-to-market for new sensor configurations. These initiatives are complemented by targeted mergers and acquisitions aimed at acquiring niche expertise in optical sensing, machine learning algorithms, and miniaturized motor designs, further consolidating the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Anti-Pinch Power Window Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Continental AG

- DENSO Corporation

- Johnan Manufacturing Inc.

- JTEKT Corporation

- KOSTAL Group

- Leopold Kostal GmbH & Co. KG

- Magna International Inc.

- Nidec Corporation

- NSK Ltd.

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Actionable recommendations for automotive OEMs suppliers and technology innovators to capitalize on safety trends and fortify market positioning

To capitalize on burgeoning safety trends, industry leaders should prioritize collaborative innovation with sensor technology firms to develop multi-modal detection systems that combine force, infrared, and optical sensing capabilities. By investing in advanced control algorithms and machine learning models, manufacturers can enhance obstruction classification accuracy and reduce warranty costs associated with false activations. Simultaneously, establishing dual-sourcing frameworks for critical components will safeguard against supply disruptions and tariff volatility.

Moreover, engaging proactively with regulatory bodies to shape evolving safety standards can yield competitive advantages, enabling early adoption of enhanced pinch-force thresholds and detection speed requirements. Companies should also explore aftermarket service partnerships, offering retrofit kits that leverage existing window motor architectures and minimize installation complexity. Through these strategic initiatives-spanning R&D collaboration, supply chain resilience, and regulatory advocacy-organizations can strengthen their market positioning and deliver superior value to both OEM customers and end-users.

Methodological framework combining primary stakeholder interviews secondary data triangulation and rigorous validation procedures to ensure robust insights

The findings presented herein are derived from a comprehensive research methodology that blends primary data collection with rigorous secondary analysis. Stakeholder interviews were conducted with senior executives at vehicle manufacturers, tier-one suppliers, and aftermarket distributors to capture firsthand perspectives on technological requirements, procurement strategies, and end-user preferences. These qualitative insights were complemented by a systematic review of industry literature, patent filings, regulatory releases, and technical white papers to validate emerging trends and competitive developments.

Quantitative data were triangulated through cross-referencing multiple secondary sources, including trade association reports, customs records, and component shipment statistics. The resulting dataset underwent a multi-stage validation process, incorporating expert panel reviews and consistency checks to ensure both accuracy and relevance. This methodological rigor ensures that the analysis reflects the latest industry dynamics and offers reliable guidance for decision-makers seeking to navigate the evolving anti-pinch power window systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Anti-Pinch Power Window Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Anti-Pinch Power Window Systems Market, by Motor Type

- Automotive Anti-Pinch Power Window Systems Market, by Window Position

- Automotive Anti-Pinch Power Window Systems Market, by Sensor Technology

- Automotive Anti-Pinch Power Window Systems Market, by Vehicle Type

- Automotive Anti-Pinch Power Window Systems Market, by Sales Channel

- Automotive Anti-Pinch Power Window Systems Market, by Region

- Automotive Anti-Pinch Power Window Systems Market, by Group

- Automotive Anti-Pinch Power Window Systems Market, by Country

- United States Automotive Anti-Pinch Power Window Systems Market

- China Automotive Anti-Pinch Power Window Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusive reflections emphasizing the pivotal role of anti-pinch window systems in enhancing passenger protection and steering future automotive safety agendas

As automotive safety imperatives continue to intensify, anti-pinch power window systems stand at the forefront of occupant protection technologies. Their evolution from basic mechanical safeguards to sophisticated sensor-driven solutions underscores a broader industry shift toward holistic safety integration. By harnessing advances in sensor technology, control algorithms, and connectivity, stakeholders can deliver systems that not only meet regulatory requirements but also exceed consumer expectations for seamless and reliable operation.

Looking forward, the convergence of electrification, autonomous driving technologies, and smart cabin ecosystems will further expand the functional scope of anti-pinch systems. These window assemblies will become integral nodes within the connected vehicle architecture, feeding data into broader safety and comfort systems. Ultimately, organizations that embrace collaborative innovation, resilient supply chains, and proactive regulatory engagement will be best positioned to shape the next generation of automotive window safety and drive enduring competitive differentiation.

Drive strategic decision-making and secure exclusive market intelligence on anti-pinch power window systems by engaging with Ketan Rohom today

To seize unparalleled strategic advantages in the rapidly evolving anti-pinch power window systems market, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure an exclusive in-depth report. This comprehensive study offers nuanced insights into emerging sensor technologies, supply chain dynamics, and regional adoption patterns, empowering decision-makers with the actionable intelligence needed to outperform competitors. Through a personalized consultation, Ketan Rohom will guide you in tailoring the findings to your organization’s unique priorities, ensuring your roadmap aligns with evolving safety regulations and consumer expectations.

Don’t miss this opportunity to elevate your competitive edge. Reach out today to arrange a briefing, gain early access to proprietary data, and explore collaborative research opportunities that will position your company at the vanguard of automotive safety innovation.

- How big is the Automotive Anti-Pinch Power Window Systems Market?

- What is the Automotive Anti-Pinch Power Window Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?