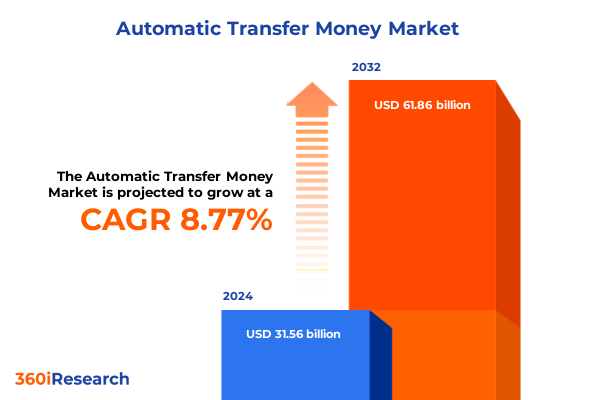

The Automatic Transfer Money Market size was estimated at USD 34.29 billion in 2025 and expected to reach USD 37.14 billion in 2026, at a CAGR of 8.79% to reach USD 61.86 billion by 2032.

Unlocking The Strategic Importance Of Automated Money Transfer Ecosystems In A Digitally Connected Global Economy For Enterprises Worldwide

In an era characterized by accelerated digital convergence, the mechanism of transferring money has evolved beyond simple account-to-account exchanges to encompass a complex ecosystem of real-time rails, cross-border corridors, and programmable payment infrastructures. This evolution reflects not only the relentless demand for faster, more reliable financial interactions but also the emergence of new regulatory frameworks, competitive fintech entrants, and shifting consumer expectations. As organizations navigate these multifaceted dynamics, understanding the strategic imperatives underlying automated transfer systems becomes pivotal to achieving operational resilience and market differentiation.

The automation of money transfers integrates advanced technologies such as APIs, secure data encryption, and machine learning-driven risk monitoring to create seamless, cost-effective pathways for funds movement. Enterprises and service providers alike are redefining customer experiences by embedding payments into broader digital journeys, from mobile commerce to supply chain finance. Consequently, automated transfers have become a cornerstone for financial inclusion, enabling underbanked regions to access real-time services while streamlining treasury management for large-scale corporates.

This report delves into the transformative currents shaping the automated transfer money landscape, offering a holistic view of the technological, regulatory, and competitive forces at play. It provides insights on how these forces coalesce to drive strategic decisions, foster innovation in service delivery, and ultimately, shape the trajectory of global financial ecosystems.

Examining The Key Transformative Shifts Redefining Money Transfer Infrastructures Through Innovation And Regulatory Evolution

The past decade has witnessed profound shifts that have redefined the contours of money transfer infrastructures, propelling the industry toward a more agile, transparent, and interconnected state. At the forefront of these changes is the rise of open banking frameworks, which have dismantled legacy barriers to data flow and empowered third-party providers to offer value-added services. By facilitating account aggregation and payment initiation through standardized APIs, open banking has catalyzed a wave of innovation in automated transfers.

Simultaneously, real-time payment rails have moved from pilot phases to mainstream adoption, enabling instant settlement across both domestic and cross-border channels. This transition has not only accelerated transaction cycles but has also heightened expectations for continuous availability and robust fraud prevention mechanisms. Providers that have integrated machine learning and behavioral analytics into their platforms can now detect anomalies in milliseconds, reinforcing a secure environment while minimizing operational disruptions.

Furthermore, the proliferation of digital wallets and embedded finance solutions has expanded the horizons of automated transfers. Fintech firms are increasingly partnering with traditional financial institutions to deliver white-label solutions, combining legacy expertise with nimble technological capabilities. The convergence of blockchain-based settlement networks and conventional banking rails is another emerging trend, driving experimentation with programmable money and smart contracts to automate escrow, trade finance, and remittance flows.

Meanwhile, regulatory evolution continues to shape the landscape, with jurisdictions around the world adopting stricter know-your-customer (KYC) and anti-money laundering (AML) standards. These developments demand that service providers balance compliance requirements with customer convenience, often leading to the adoption of digital identity solutions and risk-based authentication protocols. Ultimately, the industry’s ability to navigate these transformative shifts will determine which players can sustain competitive advantage in a rapidly evolving market.

Assessing How The 2025 United States Tariff Measures Are Shaping Costs Service Models And Strategic Decisions Across Automated Transfer Operators

The implementation of targeted tariffs by the United States in 2025 has introduced a complex layer of cost dynamics within the automated transfer ecosystem, particularly for services that rely on hardware, proprietary software components, or third-party technology licenses. These measures, aimed at balancing trade relationships and protecting domestic industries, have indirectly influenced the cost structures faced by payment processors, banks, and fintech solution providers.

As tariffs have elevated import expenses for essential components such as secure hardware modules, network infrastructure appliances, and specialized encryption devices, service providers are re-evaluating partnerships with international vendors and exploring alternative supply chains. In parallel, increased duties on cross-border transaction services have spurred strategic negotiations between providers and correspondent banking networks to mitigate pass-through costs borne by end users. This realignment has intensified competition among domestic providers seeking to differentiate through pricing strategies, service bundling, and localized infrastructure deployment.

Moreover, the cumulative impact of tariffs has had an indirect effect on the innovation pipeline, with some technology development initiatives experiencing budgetary constraints or delays due to higher procurement costs. Organizations are increasingly considering risk mitigation strategies such as shifting to cloud-native infrastructures, leveraging public cloud services, and adopting software-defined networking to decouple hardware dependencies. This trend underscores a broader strategic pivot toward scalable, tariff-resilient architectures that balance performance, security, and cost efficiency.

In response, industry stakeholders are advocating for policy dialogues and trade agreements that foster a more balanced regulatory environment, emphasizing the critical role of automated transfer systems in supporting commerce and financial inclusion. As these discussions evolve, the alignment between trade policy and digital infrastructure planning will remain central to shaping the future contours of money movement services.

Deriving Deep Market Insights Through MultiDimensional Segmentation Of Transaction Types Channels Products Users And Deployment Options

A multidimensional segmentation framework provides crucial insights into the nuanced behaviors and needs of stakeholders within the automated transfer market. By examining transaction type, the industry divides into cross-border and domestic flows, where cross-border transactions encompass both high-value strategic settlements and low-value remittance corridors, while domestic operations range from real-time instant settlements to scheduled transfers orchestrated for payroll and recurring obligations. Understanding these distinctions enables providers to tailor service levels, pricing models, and risk management protocols to each transaction profile.

Equally important is the segmentation based on end users, which differentiates between large enterprises with complex treasury management requirements and small and medium enterprises seeking cost-effective, user-friendly payment solutions. The contrasting scale and sophistication of these customer segments drive divergent expectations around customization, integration capabilities, and support services, prompting providers to design modular offerings that can flexibly address varying volumes and workflow complexities.

Channel segmentation further influences delivery strategies, with automated transfers occurring through traditional ATMs, mobile banking platforms, and online banking portals. Mobile channels incorporate both downloadable applications and SMS-based interfaces to serve connectivity-constrained environments, whereas online banking solutions leverage API integrations for seamless ecosystem interoperability alongside web portal access for self-service management. The interplay between channel preferences and user demographics shapes the digital journey, underscoring the need for adaptive user experiences and reliable network availability.

From a product perspective, the market encompasses bulk transfers, instant transfers, and scheduled transfers, each subdivided into specialized offerings. For instance, bulk transfers support payroll and vendor payments, instant transfers facilitate account-to-account and peer-to-peer disbursements, and scheduled transfers automate recurring payments and standing orders. This product taxonomy reflects the diverse operational imperatives across industries, from retail payroll cycles to real-time settlement demands in gig economy models.

Finally, deployment mode segmentation reveals a strategic choice between cloud and on-premises solutions. Cloud deployments offer elasticity and reduced capital expenditure, with options spanning hybrid, private, and public cloud architectures to address performance, security, and regulatory compliance. Conversely, on-premises implementations afford direct control over infrastructure and data residency but require significant upfront investment and ongoing maintenance. Recognizing the trade-offs inherent in each deployment path is critical for aligning technology strategies with organizational risk tolerances and growth objectives.

This comprehensive research report categorizes the Automatic Transfer Money market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Transaction Type

- Channel

- Product Type

- Deployment Mode

- End User

Uncovering Regional Dynamics And Growth Trajectories In The Americas EMEA And AsiaPacific Automated Transfer Markets Landscape

Regional dynamics in the automated transfer market reveal differentiated growth patterns, regulatory environments, and technology adoption curves across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, the confluence of mature payment infrastructures and burgeoning fintech ecosystems has accelerated the proliferation of real-time rails, with stakeholders collaborating to expand corridor reach and enhance interoperability. Regulatory initiatives such as instant payment mandates and open banking frameworks have further catalyzed innovation, particularly among community banks and non-bank payment facilitators.

Across Europe Middle East & Africa, the landscape is characterized by a patchwork of regulatory regimes and diverse market maturities. The Single Euro Payments Area serves as a model for cross-border harmonization, enabling streamlined credit transfers and direct debits, while in emerging markets, digital identity solutions and mobile money platforms continue to drive financial inclusion. North African and Middle Eastern economies are investing in centralized clearing systems to support higher transaction volumes, and this regional push toward standardization has prompted providers to develop scalable, multi-jurisdictional platforms.

In the Asia-Pacific region, rapid adoption of mobile wallets and super-apps in Southeast Asia, alongside government-led initiatives in China and India, has propelled the shift toward real-time, low-cost transfers. These markets emphasize localized innovation, such as QR-code payments and interoperable wallet networks, to address fragmented banking landscapes. Furthermore, Asia-Pacific’s strong focus on digital identity, supported by national e-KYC programs, is laying the groundwork for advanced risk management and onboarding frameworks that will influence automated transfer services globally.

The interplay of regulatory harmonization, digital inclusion initiatives, and cross-border collaboration underscores the importance of regionally nuanced strategies. Providers must calibrate their offerings to align with local policy objectives, technology preferences, and consumer behaviors to achieve scale and profitability across these diverse markets.

This comprehensive research report examines key regions that drive the evolution of the Automatic Transfer Money market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Technological Partnerships And Competitive Differentiators Among Leading Automated Payment Solution Providers

Leading entities in the automated transfer domain are forging strategic alliances and harnessing technological innovations to bolster their market positions. Established global payment networks continue to leverage their extensive clearing and settlement infrastructure, investing in next-generation APIs and enhanced security protocols to maintain relevance in an era of fintech disruption. These incumbents often pursue targeted acquisitions to integrate complementary capabilities, such as digital onboarding solutions or real-time fraud detection modules.

At the same time, fintech challengers are differentiating through speed, user experience, and cost efficiency. By capitalizing on cloud-native architectures and microservices, these agile players deliver modular transfer services that can be rapidly deployed to meet evolving client demands. Many have cultivated strategic partnerships with banking institutions to tap into existing customer bases while retaining the flexibility to innovate on product features and channel integrations.

Technology vendors specializing in payment processing and treasury management software are also redefining their roadmaps to incorporate AI-driven analytics and blockchain-enabled settlement options. These providers are collaborating with enterprise clients to co-develop bespoke solutions that address industry-specific requirements, such as automated reconciliation for supply chain workflows or programmable escrow arrangements in trade finance.

Furthermore, the competitive landscape includes emerging decentralized finance platforms exploring peer-to-peer and cross-chain transfers. While regulatory clarity remains a barrier for widespread adoption, these experiments signal a potential paradigm shift in how value moves across networks. Collectively, these strategic moves, technological investments, and partnerships highlight the dynamic interplay between legacy operators and innovative entrants reshaping the automated transfer market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Transfer Money market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Apple Inc.

- Azimo Limited

- Block, Inc.

- Chime Financial, Inc.

- Early Warning Services, LLC

- Google LLC

- MoneyGram International, Inc.

- Monzo Bank Limited

- N26 GmbH

- Payoneer Inc.

- PayPal Holdings, Inc.

- Paysend Inc.

- Remitly Global, Inc.

- Revolut Ltd.

- Skrill Holdings Ltd.

- Stripe, Inc.

- The Western Union Company

- TransferGo Ltd.

- Venmo LLC

- Wise Payments Limited

- WorldRemit Ltd.

- Xoom Corporation

Implementing Actionable Strategies For Industry Leaders To Innovate Optimize And Navigate Complexities In Automated Transfer Ecosystems

To navigate the complexities of the automated transfer ecosystem and sustain competitive advantage, industry leaders must adopt a proactive, multidimensional strategy. Investing in API-centric platforms that facilitate seamless integration with corporate ERPs, financial marketplaces, and digital commerce channels will be critical to capturing new revenue streams and improving customer retention. Enhancing developer ecosystems through comprehensive documentation and sandbox environments can further accelerate partner onboarding and collaborative innovation.

Strengthening cybersecurity and compliance frameworks is another imperative. By adopting advanced identity verification technologies and continuous transaction monitoring powered by machine learning, organizations can mitigate fraud risks and streamline KYC/AML processes. This approach not only reduces operational friction but also fosters customer trust, a key differentiator in a market where service reliability and data security are paramount.

Optimizing operational efficiency through cloud migration and infrastructure-as-code practices will enable organizations to scale transfer services dynamically while maintaining cost discipline. Leveraging public, private, or hybrid cloud deployments in line with data residency and performance requirements can unlock tariff-resilient architectures and enhance disaster recovery capabilities. Moreover, aligning IT governance with business objectives will ensure that new initiatives deliver measurable ROI and support long-term growth.

Finally, engaging in open policy dialogues and industry consortia can influence regulatory frameworks and promote interoperable standards. By collaborating with trade associations, standards bodies, and government agencies, providers can advocate for balanced regulations that facilitate innovation while safeguarding financial stability. This collective approach will be essential to shaping a conducive environment for the next generation of automated money transfer services.

Detailing Comprehensive Research Methodologies Data Sources Expert Engagements And Analytical Approaches Underpinning The Transfer Market Study

This study combines qualitative insights from executive interviews and industry roundtables with quantitative analysis of transaction data and technology adoption metrics. Primary research involved structured discussions with senior leaders of financial institutions, payment service providers, and fintech startups to capture firsthand perspectives on strategic priorities, operational challenges, and innovation roadmaps. These dialogues were supplemented by workshops convened with regulatory representatives to gauge policy trajectories and risk considerations.

Secondary research encompassed a thorough examination of publicly available documents, including central bank reports, regulatory guidelines, and technology whitepapers. This phase also leveraged academic publications on payment system design, cybersecurity frameworks, and blockchain applications to contextualize emerging technical paradigms. Additionally, proprietary databases were consulted to trace historical tariff measures, supplier partnerships, and technology licensing trends relevant to the automated transfer domain.

Data triangulation was achieved by cross-referencing interview insights with market activity indicators such as transaction volumes, technological deployment rates, and service-level performance benchmarks. Analytical frameworks employed include SWOT analyses of major providers, maturity assessments of payment rails, and geographic heat maps to illustrate regional adoption patterns. Rigorous validation methods were applied to ensure consistency and accuracy, including peer reviews and expert panel evaluations.

This integrated methodology ensures that the findings presented herein are grounded in diverse data sources and enriched by the practical experiences of industry practitioners. It provides a robust foundation for strategic decision-making and future research initiatives within the automated money transfer ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Transfer Money market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Transfer Money Market, by Transaction Type

- Automatic Transfer Money Market, by Channel

- Automatic Transfer Money Market, by Product Type

- Automatic Transfer Money Market, by Deployment Mode

- Automatic Transfer Money Market, by End User

- Automatic Transfer Money Market, by Region

- Automatic Transfer Money Market, by Group

- Automatic Transfer Money Market, by Country

- United States Automatic Transfer Money Market

- China Automatic Transfer Money Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings And ForwardLooking Perspectives To Guide Strategic Decisions In Automated Transfer Services Markets

Synthesizing the insights from technological trends, regulatory developments, and market segmentation reveals a landscape in flux, driven by the dual imperatives of speed and security. The convergence of open banking, real-time rails, and cloud-native deployments marks a departure from monolithic, on-premises architectures toward agile, API-driven ecosystems. This shift positions service providers to deliver differentiated experiences while maintaining the robustness required to safeguard against escalating fraud threats.

The impact of the 2025 United States tariffs underscores the need for resilient infrastructure strategies that decouple core capabilities from hardware dependencies. Organizations that successfully migrate to flexible cloud environments and adopt software-defined approaches will be best positioned to absorb regulatory cost pressures and pivot swiftly in response to policy changes. Moreover, the nuanced segmentation framework highlights the importance of tailoring offerings to distinct transaction types, customer profiles, distribution channels, product categories, and deployment preferences.

Regionally, divergent regulatory harmonization efforts and technology adoption rates necessitate targeted market entry and expansion strategies. Providers must balance global ambitions with localized expertise in areas ranging from mobile wallet integration in Asia-Pacific to real-time interbank settlement in the Americas and cross-jurisdictional compliance in EMEA. Competitive dynamics among legacy incumbents, agile fintech challengers, and emerging decentralized platforms will continue to drive partnerships, M&A activity, and ecosystem collaborations.

Looking forward, the automated transfer sector is poised for sustained innovation, as emerging technologies such as distributed ledger systems, artificial intelligence-driven analytics, and programmable payments gain traction. Industry participants that embrace a mindset of continuous improvement, regulatory engagement, and strategic collaboration will unlock new pathways to growth and differentiation. Ultimately, the insights presented in this report serve as a compass for navigating the complexities of a rapidly evolving money movement landscape.

Engage With Associate Director Sales And Marketing To Unlock The Full Potential Of The Automated Transfer Market Research Insights

For organizations seeking unparalleled clarity and actionable insights into the automated transfer market landscape, scheduling a tailored briefing with Ketan Rohom presents a strategic avenue to capture full value. As the Associate Director of Sales & Marketing, Ketan Rohom will orchestrate a comprehensive overview of the research findings, aligning specific challenges and opportunities with organizational goals. This collaborative dialogue ensures that each element of the report is contextualized to the unique operational and strategic requirements of your team, transforming data into decisive planning.

Engaging directly with the Associate Director creates a streamlined process for accessing customized deliverables, from executive summaries to in-depth analyses of segmentation, regional dynamics, and competitive positioning. It also provides an opportunity to discuss custom data sets or extended consulting engagements, accelerating time to insight and decision. By connecting with Ketan Rohom, stakeholders can secure flexible purchasing options, volume licensing arrangements, and the latest updates on emerging trends, ensuring that your organization remains at the forefront of innovation in automated money transfer services.

To seize this opportunity and gain exclusive access to the detailed market report, you are invited to reach out and book a personalized consultation. This conversation will equip you with the foundational intelligence needed to drive strategic initiatives, optimize operational workflows, and capture market share in an increasingly competitive environment.

- How big is the Automatic Transfer Money Market?

- What is the Automatic Transfer Money Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?