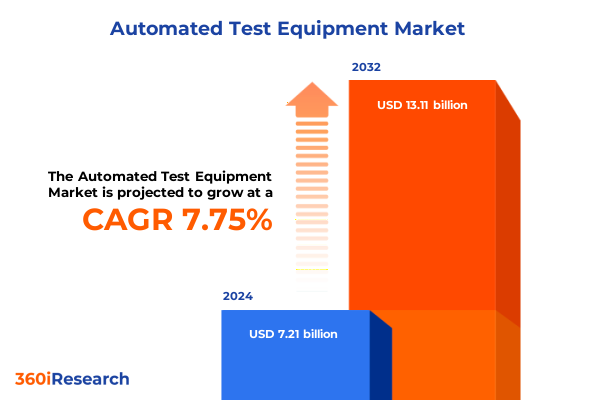

The Automated Test Equipment Market size was estimated at USD 7.69 billion in 2025 and expected to reach USD 8.21 billion in 2026, at a CAGR of 7.91% to reach USD 13.11 billion by 2032.

Groundbreaking Overview of the Automated Test Equipment Market Landscape Highlighting Emerging Technologies and Strategic Imperatives

The Automated Test Equipment market is at the forefront of quality assurance and process optimization, enabling industries to validate complex electronic assemblies with unparalleled precision. As devices become more compact, embedded intelligence grows, and system complexity escalates, manufacturers across sectors rely on sophisticated testing platforms to verify performance, reliability, and compliance. This report provides a nuanced exploration of how automated test systems underpin innovation cycles, reduce time-to-market, and mitigate risk in mission-critical applications.

Central to this discussion are the converging forces of semiconductor miniaturization, the proliferation of connected devices, and the evolving demands of digital infrastructure. By examining the multifaceted drivers-from surge in electric vehicle production and 5G network roll-out to advanced aerospace systems and consumer electronics-the introduction frames the strategic imperatives that shape procurement, development, and deployment of automated test solutions. Stakeholders will gain clarity on technology synergies, operational challenges, and the evolving paradigm of testing methodologies.

Pivotal Technological and Market Disruptions Reshaping Automated Test Equipment Dynamics Across Industries and Applications

The automated test arena is experiencing catalytic transformations driven by seminal technological breakthroughs and shifting application profiles. Artificial intelligence and machine learning have begun to permeate diagnostic routines, enabling predictive maintenance, adaptive test sequences, and anomaly detection with minimal human intervention. Concurrently, digital twin architectures facilitate virtual validation before physical deployment, reducing iteration cycles and enhancing yield in semiconductor final test environments.

Market dynamics are equally influenced by the rise of electric vehicles, which demand high-throughput battery validation and powertrain component testing, and by next-generation telecom infrastructures requiring stringent signal integrity assessments. Additionally, the transition to heterogeneous integration in advanced packaging compels equipment providers to innovate hybrid test platforms that accommodate wafer-level, package-level, and module-level verifications within consolidated systems. These shifts collectively underscore a landscape in flux, compelling OEMs and test solution vendors to reevaluate strategic roadmaps.

Comprehensive Evaluation of the Cumulative Effects of Recent United States Tariffs on Automated Test Equipment Supply Chains and Cost Structures

Since early 2025, the implementation of broad-based U.S. tariffs has exerted a pronounced influence on supply chain configurations, component sourcing, and cost structures related to automated test solutions. Levies imposed under Section 301 extended to imported fixtures, probes, and semiconductor substrates have elevated input costs, prompting test equipment manufacturers to seek alternative vendors or to absorb incremental expenses through regional manufacturing. This tariff regime has also catalyzed shifts in procurement strategies, with many stakeholders accelerating qualification of domestic suppliers to mitigate exposure to variable duties.

Moreover, the ripple effects include extended lead times for critical test components, as new supplier relationships undergo rigorous validation processes. In response, several leading providers have diversified production footprints across North America, Europe, and Asia-Pacific to balance duty burdens against logistical complexities. While some cost pressures persist, these adaptive measures reveal a resilient ecosystem that prioritizes agility and supply chain transparency in the face of evolving trade policy environments.

In-Depth Dissection of Market Segmentation Revealing Critical User Industry, Test Technology, Product Type, and Sales Channel Nuances

An incisive understanding of market segmentation illuminates where demand culminates and innovation accelerates. When viewed through the prism of end user industry, the landscape spans Aerospace & Defense-differentiated across Military and Space applications-Automotive encompassing Conventional Vehicles and Electric Vehicles, Electronics covering Consumer Electronics and Industrial Electronics, Semiconductor segmented into Final Test and Wafer Test, and Telecom. Each of these verticals imposes distinct performance thresholds, reliability mandates, and throughput expectations, driving equipment customization and service models.

Similarly, test technology segmentation reveals functional test options split between Automated Test and Semi Automated Test, in-circuit test approaches divided into Fixture Based and Flying Probe, and system test environments combining Burn In and Environmental suites. Product typology spans Benchtop, Portable-further differentiated into Cart Mounted and Handheld-and Rack Mounted form factors. Finally, sales channels bifurcate into Direct engagement and Distribution networks, with the latter encompassing Online Distribution and Secondary Distributor pathways. This multi-dimensional segmentation framework underscores the necessity for flexible, scalable solutions tailored to end users’ operational footprints.

This comprehensive research report categorizes the Automated Test Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Test Technology

- Sales Channel

- End User Industry

Strategic Regional Analysis Uncovering Distinct Growth Drivers and Adoption Patterns in the Americas, EMEA, and Asia-Pacific Automated Test Equipment Sectors

Regional dynamics in the Americas continue to reflect robust investment in semiconductor fabs, electric vehicle manufacturing facilities, and aerospace production hubs, driving demand for high-precision test platforms. Collaboration between research institutions and industry stakeholders has intensified, fostering innovation in automated validation techniques. Manufacturers prioritize onshoring capacity to reduce exposure to global trade uncertainties, while advanced analytics deliver real-time quality insights across distributed testing centers.

In Europe, Middle East & Africa, regulatory frameworks governing defense procurement, safety certifications, and environmental compliance shape testing requirements. Major telecom operators in the region are upgrading networks to support 5G and edge computing, necessitating rigorous performance verification of radio frequency modules. Investments in industrial automation and smart manufacturing further contribute to a diverse demand profile, prompting equipment providers to offer modular, reconfigurable test systems.

The Asia-Pacific region remains a powerhouse for electronics assembly, driven by consumer device OEMs and leading semiconductor fabrication capacities. Countries such as China, South Korea, and Taiwan concentrate on wafer test throughput and yield enhancement, while Japan’s automotive sector demands integrated solutions for powertrain and battery testing. Regional clusters emphasize cost-effective scaling, fostering partnerships that streamline logistics and enable rapid deployment of automated test platforms.

This comprehensive research report examines key regions that drive the evolution of the Automated Test Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analytical Profile of Pioneering and Emerging Players Steering Innovation, Strategic Partnerships, and Competitive Differentiation in the Automated Test Equipment Market

Key players in the automated test equipment domain are forging strategic alliances, investing in research and development, and acquiring niche specialists to broaden their technology portfolios. Legacy firms with deep expertise in semiconductor test have expanded into adjacent markets such as power electronics and aerospace, leveraging scalable platform architectures. Concurrently, agile entrants focus on software-driven diagnostics and cloud-native analytics to deliver remote monitoring and enhanced service offerings.

Collaborative partnerships between equipment manufacturers and component suppliers have accelerated the integration of advanced sensors, robotic handlers, and traceability modules. Emphasis on open software ecosystems promotes interoperability across diverse hardware environments, facilitating multi-vendor deployments within large-scale production lines. In addition, several vendors are augmenting their offerings with subscription-based maintenance, calibration services, and training programs to cultivate long-term customer engagement and reliable test throughput.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Test Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Controls, Inc.

- Advantest Corporation

- ALL-TEST Pro, LLC

- Astronics Corporation

- Averna Technologies Inc.

- CAES Mission Systems LLC

- Chroma ATE Inc.

- Cohu, Inc.

- Innovar Systems Limited

- InterTech Development Co.

- Kokusai, Inc.

- Marvin Test Solutions, Inc.

- MEL Systems and Services Ltd.

- Micro-Epsilon

- National Instruments Corporation

- OMRON Corporation

- Rennova Solutions

- Roos Instruments, Inc.

- STAr Technologies

- TBG Solutions

- Teradyne, Inc.

- Testamatic Systems

- TRICOR Systems, Inc.

- Viewpoint Systems, Inc

- Wabtec Corporation

Strategic Imperatives for Industry Leaders to Accelerate Technological Integration, Supply Chain Resilience, and Competitive Advantage in Automated Testing

Industry leaders should prioritize investment in artificial intelligence and machine learning capabilities embedded within test platforms to enable predictive failure analysis, dynamic test planning, and self-optimizing calibration routines. Concurrently, diversifying supplier networks-particularly for critical components such as probes, fixtures, and semiconductor substrates-will bolster resilience against tariff volatility and logistical disruptions. Embracing modular architectures that support scalable throughput and rapid reconfiguration can further align capital expenditure with evolving production demands.

To capitalize on the shift toward connected testing environments, organizations must adopt secure digital twin frameworks and cloud-based analytics for holistic performance monitoring. Developing strategic alliances with software providers and academic institutions will facilitate knowledge transfer and spur development of next-generation diagnostic algorithms. Lastly, upskilling the engineering workforce with cross-disciplinary expertise in data science, robotics, and advanced instrumentation will underpin successful implementation of cutting-edge automated test strategies.

Methodological Framework Detailing Data Collection, Expert Validation, and Analytical Approaches Underpinning the Automated Test Equipment Study Insights

This study employs a rigorous methodological framework, beginning with comprehensive secondary research sourced from patent filings, regulatory databases, and industry whitepapers. These insights inform a series of structured interviews with C-level executives, test engineering managers, and domain experts across end user industries. The primary qualitative inputs are complemented by in-depth vendor briefings and on-site facility visits, ensuring firsthand validation of equipment capabilities and deployment scenarios.

Quantitative data is synthesized through a triangulation process, reconciling external findings with proprietary survey results and expert panel feedback. Analytical models are designed to identify emerging patterns, competitive benchmarks, and potential inflection points across technology segments. Throughout the research, quality control measures-such as peer review and cross-functional audit-ensure accuracy, relevance, and objectivity of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Test Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Test Equipment Market, by Product Type

- Automated Test Equipment Market, by Test Technology

- Automated Test Equipment Market, by Sales Channel

- Automated Test Equipment Market, by End User Industry

- Automated Test Equipment Market, by Region

- Automated Test Equipment Market, by Group

- Automated Test Equipment Market, by Country

- United States Automated Test Equipment Market

- China Automated Test Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Compelling Synthesis of Key Findings Emphasizing Strategic Imperatives and Industry Evolution in Automated Test Equipment Landscape

The insights distilled in this report highlight a market characterized by rapid technological convergence, shifting trade dynamics, and evolving application demands. Automated test solutions are increasingly indispensable across diverse sectors-from semiconductors and electric vehicles to aerospace and telecommunications-where rigorous quality assurance underpins both innovation and regulatory compliance. Organizations that calibrate their strategies to integrate advanced analytics, diversified supply chains, and modular test architectures will secure a competitive edge.

As the landscape continues to evolve, stakeholders must remain vigilant to disruptive forces such as emergent materials, geopolitical developments, and sustainability mandates. By aligning investment priorities with data-driven recommendations and fostering collaborative ecosystems, industry participants can navigate complexities, optimize operational efficiency, and accelerate product time-to-market.

Engaging Invitation to Connect with Associate Director Sales & Marketing to Secure Comprehensive Automated Test Equipment Market Research Report Purchase

To explore the depth and granularity of this extensive report, decision-makers and technical leaders are invited to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored demonstrations, ensuring that each insight aligns precisely with your organization’s strategic objectives and technical requirements.

Engaging with Ketan will grant you access to comprehensive datasets, proprietary analytical frameworks, and expert commentary that transcend generic market overviews. His collaborative approach guarantees that confidentiality and bespoke service are paramount, empowering you to make informed, high-impact decisions. Contact him today to secure your copy of the Automated Test Equipment market research report and transform data into strategic advantage.

- How big is the Automated Test Equipment Market?

- What is the Automated Test Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?