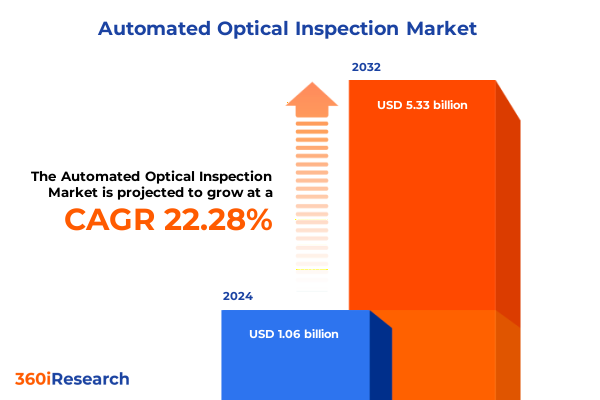

The Automated Optical Inspection Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.59 billion in 2026, at a CAGR of 22.30% to reach USD 5.33 billion by 2032.

Exploring the Evolution of Automated Optical Inspection as It Shapes Quality Assurance and Production Efficiency Across Multiple High-Tech Industries

The rapid evolution of automated optical inspection technology has become a cornerstone for quality assurance across multiple high-tech sectors. As manufacturing complexity intensifies alongside miniaturization and higher component densities, manual inspection methods struggle to deliver the precision and throughput that modern production demands. In this context, automated optical inspection systems have emerged as a vital enabler of defect detection, process optimization, and yield enhancement. Leading organizations have integrated advanced algorithms, high-resolution imaging, and real-time analytics to transform inspection from a reactive checkpoint into a proactive driver of continuous improvement.

Moreover, the convergence of machine learning and computer vision capabilities has redefined the role of automated optical inspection in smart factories. By leveraging adaptive inspection routines and self-learning defect libraries, these systems can dynamically adjust to new component geometries and production variants, reducing downtime and setup complexity. Consequently, manufacturers can achieve higher first-pass yields, minimize costly rework cycles, and accelerate time to market. As this technology continues to mature, its strategic importance will only intensify, positioning automated optical inspection as a foundational pillar for the next wave of manufacturing innovation.

Illuminating Key Technological Innovations and Operational Shifts Driving the Next Generation of Automated Optical Inspection in Complex Manufacturing Environments

Over the past several years, transformative shifts in automated optical inspection have been driven by breakthroughs in imaging resolution, data processing speeds, and software intelligence. Innovations in 3D inspection now allow for volumetric analysis of solder joints and component heights, addressing defects that were previously undetectable by conventional 2D systems. This three-dimensional perspective not only improves defect classification accuracy but also yields richer data for process engineers to fine-tune solder paste volumes and component placement parameters. Consequently, manufacturers are experiencing fewer field returns and improved cost efficiency.

In parallel, the integration of edge computing and distributed architectures has reshaped deployment models. Modular AOI platforms can be embedded directly on production lines, enabling near-zero latency feedback loops that instantly trigger corrective actions. Such localization of intelligence reduces reliance on centralized servers, mitigates network congestion, and enhances system resilience. Furthermore, the adoption of open-source frameworks and industry-standard communication protocols has accelerated interoperability, making it simpler to integrate inspection data into broader manufacturing execution systems. As smart factory initiatives advance, these technological and operational shifts are redefining quality control paradigms and setting new benchmarks for production agility.

Assessing How Recent United States Trade Measures and Tariffs Introduced in 2025 Are Reshaping Supply Chains Component Sourcing and Cost Structures for Automated Optical Inspection Solutions

In 2025, the United States implemented targeted tariff measures aimed at reshoring critical electronics manufacturing capabilities, leading to significant repercussions for automated optical inspection supply chains. Increased levies on imported imaging sensors, precision optics, and related semiconductor components have elevated landed costs and intensified procurement challenges. Equipment providers and end users alike are now assessing the total cost of ownership more rigorously, factoring in tariff-induced expenses alongside traditional maintenance and upgrade budgets.

These trade actions have catalyzed a diversification of sourcing strategies, with several inspection system manufacturers forging partnerships with domestic suppliers and exploring onshore production of key optical modules. As a result, lead times for custom optical assemblies have gradually shortened, and concerns over geopolitical disruptions have been somewhat alleviated. Nevertheless, the initial price pressure has driven innovation in component standardization and design for supply chain flexibility, ensuring that automated optical inspection solutions remain accessible without compromising performance. Looking ahead, the cumulative impact of these trade dynamics will continue to reverberate through procurement, pricing, and strategic planning activities across the industry.

Unveiling Deep-Dive Insights into End User Industry Demands Technology Variants and System Configurations That Drive Distinct Adoption Patterns in Automated Optical Inspection

A nuanced understanding of market segmentation reveals distinct patterns in technology adoption and performance expectations. End user industries such as aerospace & defense emphasize stringent inspection of avionics, navigation systems, and radar systems, prioritizing traceability and reliability across mission-critical assemblies; automotive manufacturers require deep analytics for advanced driver assistance systems, body electronics, infotainment suites, and powertrain components where safety and functional integrity are non-negotiable; consumer electronics producers focus on high-resolution inspection of PCs & laptops, smartphones, tablets, and wearables to maintain rapid innovation cycles and sleek form factors; healthcare equipment suppliers deploy automated optical inspection within diagnostic equipment, medical imaging devices, and patient monitoring systems, where regulatory compliance and zero-defect standards are paramount; and telecommunications firms inspect base stations, modems, and routers & switches to uphold network performance and minimize downtime in interconnected infrastructures.

When segmenting by technology, two-dimensional inspection remains indispensable for high-speed inline checks, whereas three-dimensional systems are increasingly critical for comprehensive volumetric analysis in high-mix production. Surface mount technology mounting types account for the majority of board populations, although through-hole applications persist in legacy and specialized assemblies. Moving from pre-reflow to post-reflow inspection stages, manufacturers leverage inline implementations for real-time feedback, while modular and standalone solutions enable in-depth analysis and customization. Collectively, these segmentation dimensions inform optimal solution selection and deployment strategies tailored to specific production requirements.

This comprehensive research report categorizes the Automated Optical Inspection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Mounting Type

- Inspection Stage

- System Type

- End User Industry

Analyzing How Americas Europe Middle East Africa and Asia Pacific Regional Dynamics Influence Automated Optical Inspection Adoption Innovation and Support Ecosystems

Regional dynamics play a pivotal role in shaping the adoption and innovation of automated optical inspection systems. In the Americas, a strong focus on advanced automotive manufacturing, semiconductor assembly, and aerospace supply chains has fostered collaborations between system integrators and original equipment manufacturers. This market emphasizes industrial automation, lean manufacturing practices, and localized after-sales support to sustain high production volumes and rapid changeovers.

Across Europe, the Middle East & Africa, a diverse regulatory ecosystem and varied manufacturing maturity levels create both challenges and opportunities. European countries lead in precision optics research and sustainability initiatives, while emerging economies within the region pursue capacity building through technology transfer and workforce development. In the Middle East, investments in defense and telecommunications infrastructure have prompted the integration of AOI into new production facilities. Africa’s expanding electronics assembly hubs are beginning to adopt automated inspection to meet global quality benchmarks.

In the Asia-Pacific region, a pervasive electronics manufacturing network drives continuous advancement in inspection technologies. High-volume producers in East Asia demand turnkey inline solutions capable of supporting massive throughput, while Southeast Asia’s contract manufacturers increasingly incorporate modular and standalone systems to accommodate mixed workloads. Furthermore, governmental incentives for smart manufacturing in key economies have accelerated the deployment of AI-powered optical inspection platforms, reinforcing the region’s reputation as a global innovation leader.

This comprehensive research report examines key regions that drive the evolution of the Automated Optical Inspection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Understanding the Strategic Positioning Technological Differentiation and Service Excellence of Leading Automated Optical Inspection Vendors Driving Market Leadership

Leading solution providers have strategically positioned themselves to capitalize on growing demand for automated optical inspection. One prominent manufacturer has built its reputation on cutting-edge three-dimensional inspection modules and advanced machine learning algorithms, offering scalable platforms that cater to complex, high-mix production environments. Another established vendor differentiates through modular architectures, enabling seamless integration into existing lines and facilitating flexible deployment across diverse inspection stages.

A third key player focuses on service excellence and global support networks, ensuring rapid response times for maintenance and calibration through localized service centers. Meanwhile, a company renowned for its precision optics has leveraged proprietary lens technologies to enhance image quality and defect detection sensitivity, collaborating with semiconductor suppliers to optimize sensor performance. Additionally, a specialized provider offers configurable standalone systems tailored to the healthcare and telecommunications sectors, combining ease of use with stringent compliance features. Collectively, these industry leaders drive competition and foster continuous innovation, setting high benchmarks for performance, reliability, and customer-centricity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Optical Inspection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Camtek Ltd.

- CyberOptics Corporation

- Hanwha Systems Co., Ltd.

- Koh Young Technology Inc.

- Mirtec Co., Ltd.

- Nordson Corporation

- Omron Corporation

- Orbotech

- Saki Corporation

- Test Research, Inc.

- ViTrox Corporation Berhad

Strategic Imperatives and Operational Recommendations for Industry Leaders Aiming to Amplify Quality Control and Competitive Advantage with Advanced Optical Inspection

To thrive in a rapidly evolving automated optical inspection landscape, industry leaders must adopt a proactive strategic posture. Investing in hybrid inspection solutions that combine two-dimensional speed with three-dimensional depth can enhance defect detection coverage while optimizing throughput. Furthermore, aligning with domestic component suppliers and building flexible sourcing agreements will mitigate risks associated with trade measures and supply chain disruptions.

Organizations should also prioritize the integration of real-time analytics into manufacturing execution systems, enabling closed-loop feedback and continuous process optimization. Collaborating with software partners to develop custom defect classification libraries can reduce false calls and improve system adaptability for new product introductions. Equally important is the cultivation of cross-functional teams encompassing process engineers, data scientists, and quality managers to drive effective deployment and iterative refinement of inspection routines.

Finally, dedicating resources to operator training and change management will ensure that personnel can fully leverage advanced inspection capabilities. By embracing these imperatives, manufacturers will not only enhance product quality and yield but also position themselves to respond swiftly to emerging market demands and technological advancements.

Explaining the Comprehensive Research Approach Combining Expert Interviews Data Triangulation and Independent Review to Ensure Robust Automated Optical Inspection Insights

This research effort combines a rigorous blend of primary and secondary methodologies to deliver comprehensive insights into the automated optical inspection market. Initially, a series of in-depth interviews were conducted with subject matter experts, including manufacturing engineers, quality assurance managers, and technology innovators, to capture practical perspectives on deployment challenges and emerging trends. These qualitative inputs were systematically encoded and validated against industry case studies.

Complementing the primary research, a thorough review of trade publications, patent filings, and regulatory announcements provided contextual data on technological breakthroughs and policy developments. Market participants’ white papers and thought leadership reports were analyzed to trace competitive strategies and innovation roadmaps. All findings underwent triangulation to reconcile potential discrepancies and ensure accuracy. Additionally, a panel of independent consultants and academic researchers reviewed the synthesized insights, reinforcing the relevance and applicability of conclusions. This methodological framework guarantees a balanced, data-driven perspective that reflects both strategic imperatives and operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Optical Inspection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Optical Inspection Market, by Technology

- Automated Optical Inspection Market, by Mounting Type

- Automated Optical Inspection Market, by Inspection Stage

- Automated Optical Inspection Market, by System Type

- Automated Optical Inspection Market, by End User Industry

- Automated Optical Inspection Market, by Region

- Automated Optical Inspection Market, by Group

- Automated Optical Inspection Market, by Country

- United States Automated Optical Inspection Market

- China Automated Optical Inspection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Critical Insights Illuminating How Technological Advancements Policy Developments and Regional Variations Will Shape the Future of Automated Optical Inspection Landscape

In conclusion, the automated optical inspection landscape is undergoing a profound transformation propelled by technological innovation, shifting trade dynamics, and regional market evolutions. The integration of advanced 3D imaging and machine learning has elevated quality control from a reactive checkpoint to a proactive enabler of manufacturing excellence. Meanwhile, trade measures implemented in 2025 have underscored the importance of supply chain resilience and strategic sourcing.

Segmentation analysis illustrates that end user industries, inspection stages, and system architectures each demand tailored approaches, reinforcing the need for flexible, interoperable solutions. Regional insights reveal that while mature markets focus on incremental optimization and localized support, emerging hubs pursue rapid capacity expansion and digitalization initiatives. Leading vendors continue to drive differentiation through specialized technologies and service networks, setting aspirational benchmarks for performance and customer engagement.

As manufacturers confront rising complexity and competitiveness, adopting a holistic inspection strategy that blends technological agility with operational discipline will be paramount. These critical insights lay the groundwork for informed decision-making and strategic investment in automated optical inspection capabilities.

Take Immediate Action to Equip Your Organization with Comprehensive Automated Optical Inspection Insights and Unlock Growth Opportunities Today

For executives ready to secure a leading edge in automated optical inspection, initiating next steps is essential. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to obtain the in-depth report and unlock tailored insights that can guide strategic decisions and optimize inspection capabilities.

- How big is the Automated Optical Inspection Market?

- What is the Automated Optical Inspection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?