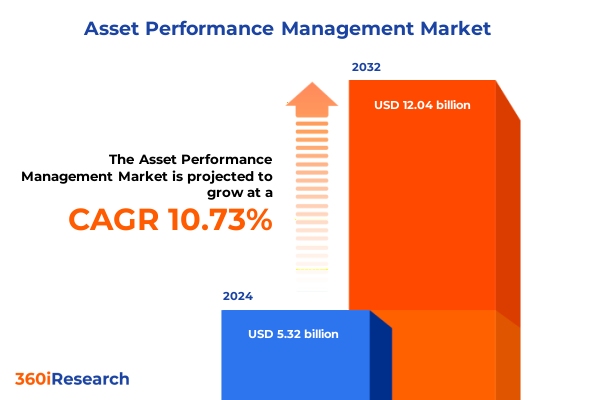

The Asset Performance Management Market size was estimated at USD 5.85 billion in 2025 and expected to reach USD 6.45 billion in 2026, at a CAGR of 10.84% to reach USD 12.04 billion by 2032.

Charting the Evolution of Asset Performance Management in the Digital Era with AI, IoT, and Predictive Maintenance Solutions Across Industries

Asset Performance Management (APM) has evolved into a foundational discipline for enterprises aiming to transform maintenance, reliability, and operational efficiency through data-driven strategies. By integrating real-time data collection via Internet of Things sensors and advanced analytics, APM enables organizations to move beyond reactive maintenance toward predictive and prescriptive methodologies. This technological progression has been accelerated by continued investments in digital twins, edge computing, and machine learning, allowing asset-intensive industries to anticipate failures, optimize maintenance schedules, and extend asset lifecycles with unprecedented accuracy and agility

However, achieving these benefits requires overcoming significant challenges related to fragmented data environments, siloed systems, and insufficient analytical maturity. Many organizations struggle to integrate sensor-generated data into centralized platforms or to apply the right algorithms for anomaly detection and failure prediction. The rise of scalable cloud-based APM solutions offers a path forward, enabling seamless data integration and collaborative workflows across maintenance, operations, and IT teams. As regulatory demands and sustainability goals become more stringent, APM is also emerging as a critical enabler of compliance reporting and environmental performance management

Unveiling the Technological Inflection Point in APM: Digital Twins, Edge Computing, Cloud-Native Platforms, and Integrated Cybersecurity Are Redefining Asset Management

The APM landscape is undergoing transformative shifts powered by the convergence of emerging technologies and evolving business imperatives. Digital twin technology, which creates virtual replicas of physical assets, now supports real-time scenario simulations that enhance maintenance planning and risk mitigation. Concurrently, augmented reality and wearable devices are enabling maintenance technicians to access immersive, context-driven instructions while performing complex tasks, reducing human error and accelerating repair cycles. These advancements are underpinned by edge computing architectures that process sensor data locally, minimizing network latency and ensuring continuous operational visibility even in connectivity-constrained environments

Simultaneously, the shift towards cloud-native APM platforms is reshaping deployment models and total cost of ownership. Cloud-based solutions offer elasticity, rapid feature updates, and integration with enterprise resource planning and maintenance management systems, enabling organizations to scale their APM initiatives without extensive IT investments. This trend is complemented by the growing incorporation of cybersecurity measures directly into APM architectures, safeguarding sensitive asset data and ensuring system integrity in the face of increasingly sophisticated threats. As a result, industry leaders are redefining asset management as a unified, strategic capability that blends operational technology, information technology, and organizational processes to drive business value

Analyzing the Cumulative Impact of Expanding U.S. Tariffs on Asset-Intensive Industries and Predictive Maintenance Supply Chains Throughout 2025

In 2025, the cumulative impact of escalating U.S. tariffs has introduced new cost pressures and supply chain complexities for asset-intensive industries. According to the Federal Reserve’s Beige Book, businesses across sectors are already experiencing higher input costs for critical raw materials, notably steel and aluminum, which are essential for heavy machinery and infrastructure components. Many firms have either absorbed these increased expenses or raised prices modestly, but widespread anticipation of additional tariff hikes suggests that these costs will increasingly erode margins and elevate the risk of unplanned maintenance backlogs as spare components become less affordable

Specific industries have taken proactive measures to mitigate tariff-related disruptions. Manufacturing companies, in particular, have diversified their supply chains and accelerated procurement cycles, with over half of those surveyed implementing strategic sourcing adjustments. Similarly, the semiconductor sector, which underpins modern predictive maintenance platforms, confronts the prospect of blanket 25 percent tariffs that could slow innovation adoption and inflate the cost of critical IoT devices used for asset health monitoring. Automotive manufacturers also face substantial headwinds, as estimated tariff-driven cost increases on imported components could translate into price hikes up to 15 percent on finished vehicles, potentially depressing demand and complicating maintenance planning for fleet operators

Dissecting Core APM Segmentation: Components, Components’ Subservices, Deployment Archetypes, Asset Classes, Enterprise Scale, and Industry-Specific Customizations

Asset Performance Management adoption spans multiple solution and service components, modules, asset types, deployment models, organization sizes, and industry verticals. At the component level, organizations choose between managed and professional services to implement end-to-end APM solutions, which encompass integrity, reliability, strategy management, condition monitoring, and predictive maintenance. These solutions are organized into modules focusing on asset health, reliability, and strategy, providing targeted capabilities that align with specific maintenance philosophies.

When considering asset type, APM platforms must accommodate fixed, infrastructure, mobile, and production assets, each with unique operational characteristics and data requirements. Deployment options range from cloud-native implementations offering rapid scalability to on-premises installations that meet stringent data residency and security mandates. The decision between global enterprises and small to medium-sized businesses further influences solution architecture and support models. Finally, vertical-specific adaptation is vital: sectors such as chemicals, energy and utilities, food and beverages, government and defense, healthcare and pharmaceuticals, manufacturing, oil and gas, and telecommunications demand tailored functionality-downstream energy operators prioritize regulatory compliance, while telecom providers focus on network asset availability and data center resiliency

This comprehensive research report categorizes the Asset Performance Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Module

- Asset Type

- Deployment Type

- Organization Size

- Vertical

Mapping Regional APM Priorities and Adoption Patterns Driven by Manufacturing Growth, Regulatory Mandates, and Smart Industry Initiatives

Regional dynamics play a decisive role in shaping APM adoption and strategic priorities. In the Americas, robust manufacturing, energy, and infrastructure sectors drive demand for predictive maintenance and digital twin implementations. Companies in North and South America leverage cloud-based APM solutions to enhance visibility across expansive asset networks and to meet evolving environmental and safety regulations, while Latin American markets prioritize cost-effective managed services to bolster operational reliability and prove value in asset lifecycles.

In Europe, Middle East, and Africa, stringent regulatory frameworks around health, safety, and environmental compliance have catalyzed APM investments focused on asset integrity and risk management. EMEA organizations often favor on-premises or hybrid architectures to address data sovereignty and security concerns, integrating APM with existing enterprise resource planning and maintenance management systems. Meanwhile, in the Asia-Pacific region, rapid industrialization and the proliferation of smart manufacturing initiatives are fueling demand for AI-driven predictive analytics and IoT-enabled condition monitoring, with many APAC firms partnering with global solution providers to accelerate digital transformation and achieve high asset availability targets

This comprehensive research report examines key regions that drive the evolution of the Asset Performance Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Advancements of Leading APM Vendors Including SAP’s Embedded IoT and GE Digital’s Modular Predix Enhancements

Leading technology vendors and software providers are constantly refining their APM offerings to meet escalating customer expectations for performance, usability, and industry focus. SAP’s Embedded IoT innovation, built on the Cumulocity platform, exemplifies this trend by providing real-time asset health monitoring and AI-driven insights as a foundational capability within its enterprise suite. This embedded approach streamlines data ingestion and accelerates time to value for asset-intensive organizations by reducing integration complexity and enabling continuous improvements in asset reliability monitoring

GE Digital’s Predix APM updates illustrate how modular enhancements, such as advanced predictive diagnostics, visualization dashboards, and industry-specific compliance features, can rapidly extend platform functionality. The Predix APM 4.4 release introduced prognostic capabilities that forecast failure thresholds, enabling maintenance teams to prioritize interventions precisely when needed. Additionally, the integration of business intelligence tools and OPC connectivity frameworks demonstrates a strategic effort to unify asset data visualization and operational workflows, particularly for oil and gas, power generation, and utilities customers in North America and Europe

This comprehensive research report delivers an in-depth overview of the principal market players in the Asset Performance Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB SKF

- ABB Ltd.

- Accenture PLC

- Bentley Systems, Incorporated

- Dassault Systèmes SE

- DNV Group AS

- EAMbrace by Gaurik Solutions, Inc.

- Emerson Electric Co.

- Fortive Corporation

- GE Vernova Inc.

- Gray Matter Systems

- Hexagon AB

- Hitachi, Ltd.

- Honeywell International Inc.

- IFS AB

- Infor

- Innovapptive Inc.

- International Business Machines Corporation

- IPS Intelligent Process Solutions GmbH

- Kongsberg Digital

- ManWinWin Software

- Mitsubishi Electric Corporation

- Nexus Global Business Solutions, Inc.

- Oracle Corporation

- Pragma Group

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Tata Consultancy Services

- Yokogawa Electric Corporation

Implementing Outcome-Driven APM Programs with Agile Pilots, Cross-Functional Teams, and Governance for Sustained Predictive Maintenance Success

Industry leaders seeking to maximize APM impact should adopt a phased, outcome-driven implementation strategy. Begin with pilot deployments focused on high-impact assets, validate predictive maintenance use cases through key performance indicators such as reduced unplanned downtime and maintenance cost avoidance, and then scale across asset fleets. This approach ensures quick wins that build organizational momentum and secure executive sponsorship for broader APM programs. Investing in cross-functional teams that blend operations, maintenance, data science, and IT expertise is critical to align technical capabilities with business objectives and to foster a culture of continuous improvement

To sustain long-term value, organizations must establish robust governance frameworks that oversee data quality, model performance, and change management. Define clear roles and responsibilities for asset data stewardship, incorporate feedback loops for algorithm refinement, and monitor cybersecurity posture for connected devices. Furthermore, integrate APM insights into enterprise planning processes-such as capital expenditure prioritization and reliability engineering roadmaps-to ensure that predictive maintenance becomes an integral driver of strategic decision-making rather than a standalone initiative

Integrating Tariff Exposure Models, Executive Surveys, and Expert Interviews with Industry Consulting Insights to Underpin a Rigorous APM Research Framework

The research methodology underpinning this analysis integrates quantitative data from tariff exposure models and CFO surveys with qualitative insights from case studies and expert interviews. Tariff impacts were assessed using average effective tariff rate (AETR) analyses and corroborated by findings from the Richmond Fed’s economic brief, which detail sectoral responses to the 2025 tariff measures. Complementary qualitative data were gathered through discussions with executives in manufacturing, utilities, and telecommunications to validate real-world challenges and strategic reactions

Technology trend evaluations leveraged secondary research from leading consulting firms, including Deloitte and McKinsey, to identify transformative shifts such as predictive maintenance frameworks, digital twin adoption, and AI-driven work management tools. Vendor capabilities were profiled through product releases and industry press, ensuring that solution enhancements are contextualized within enterprise adoption patterns. All findings were triangulated with publicly available reports and industry benchmarks to ensure reliability and relevance for decision-makers in asset-intensive organizations

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Asset Performance Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Asset Performance Management Market, by Component

- Asset Performance Management Market, by Module

- Asset Performance Management Market, by Asset Type

- Asset Performance Management Market, by Deployment Type

- Asset Performance Management Market, by Organization Size

- Asset Performance Management Market, by Vertical

- Asset Performance Management Market, by Region

- Asset Performance Management Market, by Group

- Asset Performance Management Market, by Country

- United States Asset Performance Management Market

- China Asset Performance Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Positioning Asset Performance Management as a Strategic Differentiator by Addressing Data Integration, Trade Uncertainty, and Governance for Scalable Predictive Maintenance Success

As the asset performance management landscape continues to mature, the confluence of digital twins, machine learning, and IoT promises to elevate maintenance from a cost center to a strategic enabler of operational excellence. Organizations that proactively address data integration challenges, embrace cloud-native architectures, and fortify cybersecurity will be best positioned to harness predictive and prescriptive maintenance at scale. Simultaneously, the evolving trade policy environment underscores the importance of supply chain resilience and strategic sourcing to protect maintenance capabilities against cost volatility and component shortages

By leveraging the segmentation insights, regional dynamics, and vendor roadmaps detailed in this report, decision-makers can craft tailored APM strategies that align with organizational goals, regulatory requirements, and industry best practices. The actionable recommendations provided serve as a roadmap for piloting high-value use cases, scaling governance structures, and embedding asset health into enterprise planning processes, ensuring that APM becomes an integral competitive differentiator rather than a standalone technology initiative

Unlock Comprehensive Asset Performance Management Insights and Propel Operational Excellence by Partnering with Ketan Rohom to Purchase Our In-Depth Market Research Report

Elevate your organization’s asset performance strategy by securing access to our comprehensive market research report. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored insights, engage in a personalized consultation, and obtain the data-driven analysis necessary to drive operational excellence and competitive advantage.

- How big is the Asset Performance Management Market?

- What is the Asset Performance Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?