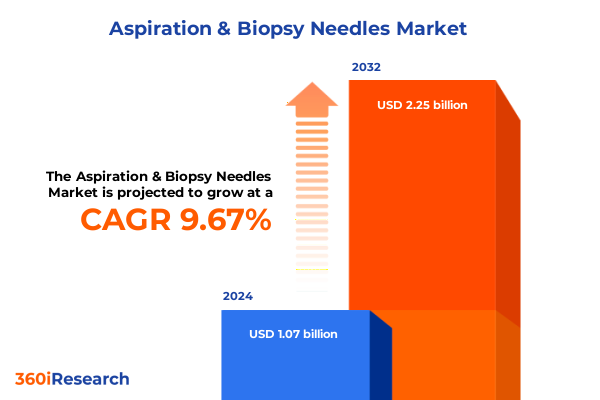

The Aspiration & Biopsy Needles Market size was estimated at USD 1.17 billion in 2025 and expected to reach USD 1.29 billion in 2026, at a CAGR of 9.73% to reach USD 2.25 billion by 2032.

Understanding the Critical Role of Aspiration and Biopsy Needles in Modern Healthcare and the Dynamics Driving Their Market Evolution

The use of aspiration and biopsy needles has become a cornerstone of modern diagnostic healthcare, underpinning critical procedures that range from tissue sampling to precise therapeutic interventions. These devices enable clinicians to retrieve cellular and tissue specimens with minimal invasiveness, thus accelerating diagnostic turnaround times and improving patient comfort. In cardiology, aspiration needles facilitate the removal of intracoronary thrombi, while in oncology, a variety of biopsy needles support accurate tumor characterization and personalized treatment planning. As minimally invasive techniques continue to supplant open surgeries, the significance of high-performance needle technologies in delivering better clinical outcomes cannot be overstated.

Moreover, the role of these needles extends beyond mere instrumentation; it encompasses the broader interplay between device design, material selection, and procedural guidance systems. Stakeholders across hospitals, diagnostic laboratories, and specialized clinics increasingly demand solutions that integrate advanced imaging compatibility, ergonomic handling, and consistent yield of high-quality samples. These evolving expectations drive manufacturers to innovate in gauge optimization, material composition, and distribution pathways. This report offers a thorough exploration of the forces shaping the aspiration and biopsy needle arena, illuminating the pathways for stakeholders to navigate complexity and capitalize on emerging opportunities

Revolutionary Technological Advancements and Evolving Clinical Practices Shaping the Next Generation of Aspiration and Biopsy Needle Solutions

In recent years, aspiration and biopsy needles have undergone transformative technological evolution, fundamentally altering procedural efficiency and diagnostic precision. Advancements in imaging-guided systems, notably real-time ultrasound and computed tomography integration, have elevated needle targeting accuracy, reducing complications and repeat procedures. Concurrently, the introduction of smart needle prototypes featuring embedded pressure sensors and feedback mechanisms illustrates a shift towards enabling clinicians to monitor tissue resistance and location in situ. These innovations represent more than incremental improvements; they signal a pivotal movement toward converging device intelligence with minimally invasive practice.

At the same time, material science breakthroughs have catalyzed the adoption of novel alloys and coatings that enhance needle flexibility and biocompatibility. Nickel titanium composites, for example, offer superior shape memory properties that accommodate complex anatomical pathways without compromising lumen integrity. Stainless steel variants, conversely, remain prevalent for procedures requiring exceptionally sharp tips to traverse dense tissue matrices. This nuanced material differentiation reflects a broader trend of customizing device attributes to diverse clinical scenarios.

Finally, evolving clinical guidelines emphasizing rapid diagnosis and outpatient procedures have led to increased demand for fine-needle aspiration and vacuum-assisted biopsy techniques. Health systems prioritize shorter patient stays and lower complication rates, which in turn has elevated expectations for needle performance. Taken together, these shifts underscore a decisive movement towards highly specialized, technology-driven needle solutions that can seamlessly integrate into an expanding array of procedural contexts

Assessing the Compound Effects of 2025 United States Import Tariffs on Aspiration and Biopsy Needle Supply Chains and Industry Adaptation

The imposition of import tariffs by the United States in early 2025 has exerted a multifaceted influence on the aspiration and biopsy needle ecosystem. Raw materials such as stainless steel and nickel titanium, critical to needle manufacture, encountered increased cost pressures as duties were levied on key imports. Consequently, manufacturers faced immediate increases in production expenses, prompting strategic sourcing shifts toward domestic suppliers and alternative low-tariff jurisdictions. In response, some leading producers have begun to negotiate supply contracts with U.S.-based alloy manufacturers to mitigate exposure to fluctuating duty rates.

Beyond procurement, the tariffs have revealed vulnerabilities in existing supply chain structures. Distributors and direct sales channels have experienced extended lead times as inventory buffers were recalibrated to anticipate further policy adjustments. This recalibration has, in turn, influenced pricing strategies downstream, with healthcare providers encountering modest cost escalations that may affect budget allocations for diagnostic devices. To adapt, a number of companies have accelerated investments in manufacturing footprint expansion within North America, thereby reducing tariff-related friction while enhancing responsiveness to shifts in clinical demand.

Moreover, the tariff environment has incentivized collaboration between device makers and logistic stakeholders to optimize cross-border transit routes. Enhanced forecasting models now incorporate tariff impact simulations, enabling stakeholders to preemptively allocate resources and maintain supply continuity. These cumulative adjustments illustrate how a singular policy shift can catalyze comprehensive reengineering of production, distribution, and procurement strategies across the aspiration and biopsy needle industry

Deep Dive into Product, Application, End User, Distribution Channel, Material, and Gauge Segmentation Unveiling Critical Trends in the Needle Market

Analyzing product segmentation provides insight into how aspiration needles and biopsy needles diverge in clinical role and growth trajectory. Aspiration needles, prized for their efficacy in fluid and cellular sampling, continue to show robust demand in interventional cardiology applications. Biopsy needles, by contrast, serve a broader oncology landscape, where core needle biopsies supply histological architecture and fine-needle aspirations provide cytological assessments, while vacuum-assisted biopsy devices facilitate larger tissue retrievals for comprehensive analysis.

The application spectrum further underscores this differentiation. In cardiology, the prominence of aspiration needles reflects their rapid thrombus extraction capacity, essential in acute coronary interventions. Oncology adoption spans core needle biopsy, fine needle aspiration, and vacuum-assisted biopsy, each technique offering distinct trade-offs among sample integrity, procedural complexity, and patient comfort. Consequently, clinical decision-makers select device types based on tumor accessibility, desired sample volume, and institutional procedural protocols.

Turning to end users, hospitals lead utilization due to their advanced interventional suites and higher procedural volumes, followed by diagnostic laboratories that value consistent sample quality for pathology workflows, and clinics that prioritize device portability and ease of use. This hierarchy reveals that device makers must tailor marketing and training initiatives to each channel’s unique requirements.

Distribution channels also shape market dynamics. Direct sales foster close customer relationships and facilitate real-time technical support, whereas distributors expand geographic reach through established networks, and online sales platforms are emerging as convenient avenues for lower-volume purchases and aftermarket supplies. Material choice, segmented into nickel titanium and stainless steel, informs device flexibility and sharpness, aligning with procedural needs. Finally, gauge selection-spanning 20 to 25G, greater than 25G, and less than 20G-dictates sample volume and patient comfort levels. By integrating these segmentation lenses, stakeholders can pinpoint areas for targeted innovation and bespoke product offerings

This comprehensive research report categorizes the Aspiration & Biopsy Needles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Gauge

- Application

- End User

- Distribution Channel

Analyzing Regional Divergences and Growth Drivers across the Americas, Europe Middle East Africa, and Asia-Pacific in Aspiration and Biopsy Equipment Use

Regional analysis reveals distinct growth trajectories shaped by infrastructure maturity, regulatory environments, and healthcare priorities. In the Americas, advanced reimbursement frameworks and widespread access to interventional suites underpin strong uptake of both aspiration and biopsy needles. The United States, in particular, benefits from a high volume of outpatient procedures combined with robust private sector investment in minimally invasive device procurement.

In Europe, Middle East, and Africa, regulatory heterogeneity and procurement mechanisms vary widely. European Union member states adhere to rigorous CE marking standards that demand extensive clinical validation, while Middle Eastern markets often rely on government tenders that prioritize cost efficiency. In Africa, infrastructure constraints slow adoption, but targeted initiatives spearheaded by regional healthcare coalitions have started to improve access to diagnostic technologies.

Asia-Pacific presents a blend of rapid growth and diverse market conditions. Developed economies such as Japan and Australia showcase high penetration rates driven by strong hospital networks and comprehensive insurance systems. Meanwhile, emerging markets like India and Southeast Asia offer substantial growth potential fueled by expanding healthcare infrastructure, increasing disease awareness, and government programs aimed at early cancer detection. Across the region, price sensitivity dictates that manufacturers adapt product portfolios to balance cost-effectiveness with clinical performance, thereby capitalizing on burgeoning demand for minimally invasive diagnostics

This comprehensive research report examines key regions that drive the evolution of the Aspiration & Biopsy Needles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players in Aspiration and Biopsy Needles Highlighting Competitive Strategies, Innovation Focus, and Market Positioning

Leading companies in the aspiration and biopsy needle domain have adopted diverse strategies to maintain competitive advantage. Some have prioritized product portfolio diversification, introducing integrated system solutions that combine needle sets with compatible imaging accessories. Others have focused on enhancing core technologies, investing in material sciences to develop ultra-thin gauges that maximize sample yield while minimizing patient discomfort.

Collaborative partnerships and licensing agreements have also emerged as key drivers of innovation. Strategic alliances between device manufacturers and imaging technology firms facilitate the development of proprietary guidance systems, enabling seamless integration that enhances procedural accuracy. Additionally, selective mergers and acquisitions have allowed established players to absorb niche innovators, thereby accelerating time-to-market for specialized needle variants.

Complementing technological progress, companies are leveraging data analytics and digital marketing to refine customer engagement. By analyzing purchase patterns across hospitals, diagnostic labs, and clinics, they tailor training programs and after-sales support to nurture long-term client relationships. This customer-centric approach not only elevates service quality but also generates valuable usage data that informs iterative product improvements, positioning these industry leaders as forward-looking and responsive to evolving clinical needs

This comprehensive research report delivers an in-depth overview of the principal market players in the Aspiration & Biopsy Needles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Argon Medical Devices, Inc.

- Becton, Dickinson and Company

- Biomedical Srl

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Conmed Corporation

- Cook Group Incorporated

- Doctor Japan Co., Ltd.

- Geotek Medical

- Hakko Co., Ltd.

- Inrad, Inc.

- Iscon Surgicals Ltd.

- Medtronic, Plc

- Merit Medical Systems, Inc.

- Mermaid Medical Group

- Nemvelo Healthcare

- Olympus Corporation

- Ranfac Corp.

- Remington Medical Inc.

- Somatex Medical Technologies GmbH

- Stryker Corporation

- Suretech Medical Inc.

- Volkmann MedizinTechnik GmbH

- Zamar Care

Strategic Imperatives for Industry Leaders to Navigate Tariff Pressures, Foster Innovation, and Enhance Distribution Networks in Needle Technologies

To effectively navigate the evolving landscape, industry leaders should adopt a multi-pronged strategy that addresses both immediate tariff challenges and long-term innovation imperatives. First, diversifying supply bases across multiple jurisdictions will reduce reliance on any single tariff-affected country, thus ensuring continuity in raw material provisioning. Implementing dynamic sourcing agreements with tier-one alloy producers can further mitigate cost volatility and maintain margin stability.

Second, investing in R&D for next-generation needle technologies will differentiate product offerings and meet escalating clinical demands. Prioritizing sensor-enhanced needles and integrating advanced coatings can improve sampling accuracy and reduce procedure times. Concurrently, establishing joint development initiatives with imaging solution providers will reinforce the compatibility of needle systems within integrated procedural workflows.

Finally, optimizing distribution networks through targeted channel strategies is crucial. Strengthening direct sales infrastructure in key hospital clusters should be balanced with empowering distributor partnerships in cost-sensitive regions. Expanding online sales channels with value-added services, such as virtual product demonstrations and rapid reordering capabilities, will cater to evolving procurement preferences and drive incremental revenue streams

Comprehensive Mixed-Methods Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Validation for Robust Market Intelligence

This analysis is grounded in a rigorous mixed-methods research framework that encompasses both primary and secondary data collection techniques. Primary insights were derived from structured interviews with interventional cardiologists, oncologists, procurement managers, and medical device engineers, ensuring first-hand perspectives on procedural requirements, device performance, and purchasing considerations.

Secondary data sources included peer-reviewed journals, regulatory filings, clinical trial registries, and company disclosures. These sources provided verification of technological claims, material specifications, and market activity patterns. Data triangulation was achieved by cross-referencing interview feedback with statistical trends observed in healthcare utilization reports and customs import records, thereby enhancing the robustness of findings.

Quality assurance was maintained through iterative validation workshops with industry experts, during which preliminary conclusions were stress-tested against real-world operational contexts. This methodological rigor ensures that the report’s insights are both actionable and reflective of current industry realities, offering stakeholders a reliable foundation for strategic decision-making

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aspiration & Biopsy Needles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aspiration & Biopsy Needles Market, by Product Type

- Aspiration & Biopsy Needles Market, by Material

- Aspiration & Biopsy Needles Market, by Gauge

- Aspiration & Biopsy Needles Market, by Application

- Aspiration & Biopsy Needles Market, by End User

- Aspiration & Biopsy Needles Market, by Distribution Channel

- Aspiration & Biopsy Needles Market, by Region

- Aspiration & Biopsy Needles Market, by Group

- Aspiration & Biopsy Needles Market, by Country

- United States Aspiration & Biopsy Needles Market

- China Aspiration & Biopsy Needles Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Critical Insights on Market Dynamics, Competitive Landscapes, and Strategic Opportunities within the Aspiration and Biopsy Needle Domain

Bringing together the complexities of technology innovation, tariff dynamics, and diverse segmentation reveals a market in flux yet ripe with opportunity. Technological advancements in materials and imaging integration are elevating the performance threshold for aspiration and biopsy needles, while regulatory and policy shifts compel stakeholders to adapt supply chain strategies with agility.

By examining regional disparities and competitive maneuvers, it becomes clear that companies poised to invest in R&D, diversify sourcing, and enhance customer engagement will lead the next phase of growth. The insights consolidated in this report underscore the importance of strategic foresight, collaborative innovation, and adaptive marketing approaches in securing a sustainable edge within the aspiration and biopsy needle sector

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence and Secure Your Competitive Edge in Aspiration and Biopsy Needle Innovations

To secure a strategic advantage and obtain the full spectrum of insights on the evolving aspiration and biopsy needle landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in interpreting nuanced regional dynamics, tariff implications, and segmentation trends ensures you will receive tailored guidance to optimize your procurement and innovation strategies.

By partnering with Ketan, you gain direct access to an in-depth market research report that delves into the latest technological breakthroughs, competitor positioning, and regulatory shifts pressing on the industry. His consultative approach facilitates workshops and presentations designed to align the report’s findings with your organization’s strategic objectives. Engage with Ketan Rohom today to transform data-driven intelligence into actionable business growth and maintain leadership in aspiration and biopsy needle innovations

- How big is the Aspiration & Biopsy Needles Market?

- What is the Aspiration & Biopsy Needles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?