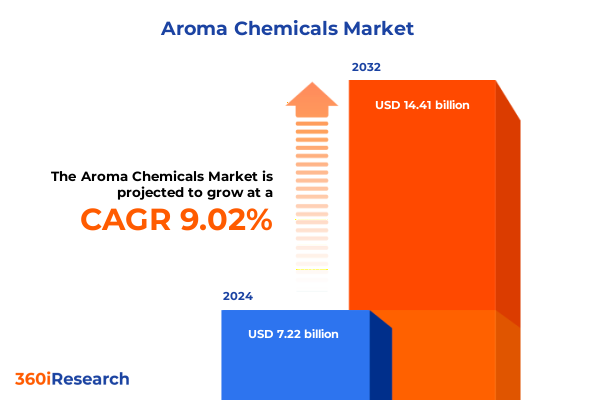

The Aroma Chemicals Market size was estimated at USD 7.72 billion in 2025 and expected to reach USD 8.27 billion in 2026, at a CAGR of 9.31% to reach USD 14.41 billion by 2032.

Unveiling the Fragrant Nexus Where Consumer Desires, Regulatory Dynamics, and Technological Innovations Shape the Aroma Chemicals Industry

In an era defined by converging consumer expectations, regulatory scrutiny, and rapid technological progress, the aroma chemicals industry stands at the crossroads of unprecedented opportunity and complexity. What began as traditional botanical extractions has evolved into a sophisticated ecosystem where flavor, fragrance, and specialty ingredients are engineered through cutting-edge synthetic biology, green chemistry, and data-driven innovation. As global markets intensify their focus on health, wellness, and sustainability, aroma chemical suppliers must adapt to dynamic supply chain constraints, shifting consumer preferences, and an evolving regulatory environment.

Moreover, the interdependence between flavor applications in food and beverages and fragrance applications in personal care and household products underscores the multifaceted nature of aroma chemistry. Companies are not only tasked with delivering compelling olfactory experiences but also with ensuring ingredient traceability, ethical sourcing, and compliance with stringent safety standards. Consequently, success in this competitive landscape hinges on the ability to balance creative formulation with operational resilience and strategic foresight.

As we embark on this executive summary, readers will gain an integrated view of the forces reshaping the aroma chemicals sector, from transformative technological breakthroughs to the regulatory and trade dynamics influencing cost structures and market access. By examining key segmentation, regional dynamics, and competitive strategies, this report lays the groundwork for data-backed decisions and future-proof planning.

Exploring How Sustainability Imperatives Biotechnological Breakthroughs and Evolving Consumer Tastes Are Redefining Aroma Chemical Innovation

Over the past several years, sustainability imperatives have risen to the forefront of strategic planning across the aroma chemicals value chain, compelling companies to reconfigure sourcing and production processes. Innovative green chemistry solutions, such as biodegradable floral molecules that outperform traditional alternatives by a significant margin while adhering to renewable feedstock principles, have gained traction among leading suppliers. These developments reflect a broader industry commitment to reducing carbon footprints and enhancing lifecycle profiles without compromising olfactory performance.

Alongside eco-driven innovation, biotechnological breakthroughs are revolutionizing the way aroma molecules are produced. The integration of fermentation-based processes and enzymatic catalysis has enabled the scalable manufacturing of complex nature-identical ingredients, offering a sustainable substitute for conventional petrochemical or plant-derived sources. This shift not only addresses raw material scarcity and price volatility but also aligns with consumer demand for cleaner labels and bio-based claims.

Finally, digital transformation is catalyzing new paradigms in fragrance development and consumer engagement. From interactive digital platforms that translate olfactory experiences into immersive storytelling to AI-powered product lifecycle management tools that forecast geopolitical risks and optimize supply chains, the industry is embracing data analytics as a core competency. These technologies foster agility, enabling brands to anticipate trends and rapidly reformulate products in response to market disruptions.

Examining the Multifaceted Impact of New United States Tariff Policies on Supply Chains Cost Structures and Reformulation Approaches in 2025

In April 2025, the United States Trade Representative enacted enhanced tariff measures on selected chemical imports, introducing duties as high as 50 percent on certain fragrance and flavor intermediates sourced from key trading partners. The imposition of these tariffs has triggered a complex cascade of operational adjustments, compelling companies to reassess supplier portfolios and to consider near-shoring or regional diversification as a means of mitigating cost escalations. These dynamics have also accelerated strategic stockpiling behavior as manufacturers seek to buffer their production pipelines against anticipated duty increases.

Consequently, ingredient costs for common essences such as geranium, eucalyptus, and peppermint oils have surged, prompting multiple approaches to cost management. Larger corporations with diversified global infrastructures have begun to absorb partial duty increases to preserve pricing stability, while others are investing in alternative sources or synthetic analogs to offset rising import fees. The ensuing reformulation initiatives, fueled by advanced molecular mapping technologies, strive to maintain olfactory integrity while circumventing tariff-exposed supply lines.

Moreover, small and independent perfumers face acute financial pressure as margins tighten and purchasing power diminishes. Several emerging brands have reported a discernible slowdown in order volumes due to uncertainty around tariff permanency, with many opting to postpone significant inventory replenishments until policy clarity emerges. Industry experts caution that prolonged tariff enforcement could perpetuate supply chain volatility and erode market diversity, ultimately stifling innovation and constraining the competitive landscape.

Illuminating Critical Market Segmentation Insights Spanning Usage Patterns Sources Applications Product Forms and Distribution Mechanisms

An intricate tapestry of segmentation underpins the aroma chemicals market, beginning with usage categories that distinguish between flavor and fragrance. Flavor applications extend across beverage enhancements, dairy formulations, fruit concentrates, and savory umami systems, while fragrance applications encompass citrus aromas, delicate floral bouquets, exotic oriental accords, and robust woody signatures.

A second dimension considers the source of raw materials, differentiating natural extractions such as animal, microbial, or plant derivatives from nature-identical constructs produced via biotech processes or chemical synthesis, and from fully synthetic compounds synthesized by petrochemical or advanced biotech methods.

Application-based segmentation further delineates the market into cosmetics and personal care products, including bath and body, hair and oral care, and skin care systems; food and beverage sectors such as bakery, beverage, confectionery, and dairy; household products including air fresheners, cleaning agents, and detergents; and pharmaceutical delivery formats such as inhalers and topical formulations.

The form of the product offers another lens, separating liquids-whether concentrated or diluted-from pastes classified by viscosity profiles and from powders characterized as dry or granulated.

Finally, sales channels range from direct corporate or original equipment manufacturer arrangements to broad distribution networks managed by global or regional distributors and increasingly important digital platforms encompassing company websites and third-party e-commerce marketplaces.

This comprehensive research report categorizes the Aroma Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Product Form

- Application

- Sales Channel

- Usage

Unlocking Regional Dynamics Through a Comprehensive Lens Across the Americas Europe Middle East Africa and Asia Pacific Markets

Across the Americas, North and South American markets are characterized by mature regulatory frameworks, advanced manufacturing infrastructures, and a heightened emphasis on clean-label and natural-origin claims. Market participants in this region leverage integrated supply chains and proximity to agricultural feedstocks to optimize cost efficiency while adhering to stringent safety standards and certification regimes.

In Europe, the Middle East, and Africa, a diverse regulatory landscape and a broad spectrum of consumer preferences drive regional variation in product development and sourcing strategies. The EMEA region’s rigorous environmental regulations and growing demand for sustainable and ethically sourced ingredients spur the adoption of biotechnological solutions and transparent traceability initiatives.

The Asia-Pacific region exhibits the fastest growth trajectories, fueled by rapid urbanization, rising disposable incomes, and expanding personal care and processed food industries. Local governments actively promote innovation through research grants and public-private partnerships, fostering ecosystems where biotechnology and digitalization converge to create novel aroma solutions tailored to regional sensory profiles.

This comprehensive research report examines key regions that drive the evolution of the Aroma Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Initiatives and Competitive Positioning of Leading Global Aroma Chemical Manufacturers Driving Innovation and Market Leadership

Global leadership in the aroma chemicals market is concentrated among a handful of key players whose strategic initiatives epitomize a blend of innovation, scale, and market reach. Switzerland’s Givaudan has doubled down on digitalization, unveiling interactive olfactive storytelling platforms that bridge consumer engagement with data analytics, reinforcing its position at the nexus of technology and fragrance creativity. This approach underscores the company’s commitment to evolving consumer experiences through immersive digital tools.

U.S.-based International Flavors & Fragrances (IFF) emphasizes biotechnology and sustainable sourcing, leveraging enzyme-based processes and microbial fermentation to produce nature-identical aroma chemicals. By forming strategic alliances and integrating research capabilities, IFF seeks to expand its portfolio of bio-based ingredients and to meet robust demand for clean-label solutions.

Germany’s Symrise prioritizes transparency and sustainability throughout its supply chain, deploying blockchain technologies to trace ingredient origins and to provide customers with verifiable information on environmental impact. These initiatives dovetail with the company’s investments in renewable feedstocks and green chemistry methodologies.

Firmenich, another Swiss leader, focuses on collaboration and co-creation with customers, harnessing neuroscientific research and consumer insights to inform product development. By integrating proprietary olfactive intelligence algorithms and expanding its fragrance and flavor research centers, Firmenich aims to deliver tailored sensory solutions that resonate with evolving consumer preferences. Four major manufacturers face ongoing antitrust scrutiny concerning pricing practices, highlighting the industry's complex competitive dynamics and the importance of governance in maintaining market integrity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aroma Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bell Flowers & Fragrances

- DOHLER GmbH

- Eternis Fine Chemicals

- Firmenich International SA

- Givaudan S.A

- Henkel AG & Co. KGAA

- International Flavors & Fragrances Inc.

- Jayshree Aromatics Pvt.

- Jiaxing Wintrust Flavours Co., Ltd.

- KAO CHEMICALS EUROPE, S.L.

- KDAC CHEM Pvt. Ltd.

- LANXESS Aktiengesellschaft

- Mane SA

- Oriental Aromatics Limited

- PFW Aroma Chemicals

- Privi Speciality Chemicals Limited

- Robertet SA

- S H Kelkar and Company Limited

- Sensient Technologies Corporation

- Sigma-Aldrich by Merk Group

- SOM Extracts Ltd.

- Symrise AG

- T. Hasegawa Co., Ltd.

- Takasago International Corporation.

- Valtris Specialty Chemicals Limited

- YingYang (China) Aroma Chemical Group

Empowering Industry Leaders with Strategic Roadmaps to Navigate Complexity Drive Sustainable Growth and Foster Agility in Aroma Chemical Markets

To navigate volatility and capitalize on emerging opportunities, industry leaders must prioritize strategic diversification of raw material sourcing. By establishing multi-regional supply networks and fostering supplier partnerships across varied geographies, companies can mitigate tariff risks and maintain uninterrupted production flows. This approach enhances agility in responding to policy shifts and resource constraints.

Investment in advanced biotechnology platforms represents another critical imperative. Firms that allocate resources to enzyme engineering, microbial fermentation, and cell-based synthesis can secure proprietary nature-identical ingredients, reduce dependency on finite natural resources, and optimize cost structures. Collaborative ventures with academic institutions and biotech startups accelerate innovation cycles and fortify competitive positioning.

Furthermore, integrating digital solutions into product development and consumer outreach enables real-time responsiveness to market trends and regulatory changes. Digital olfactive platforms, AI-driven formulation tools, and blockchain-enabled traceability systems not only elevate consumer engagement but also streamline compliance and quality assurance processes.

Finally, sustainability must be embedded in corporate strategy beyond marketing rhetoric. Leaders should adopt science-based targets for emissions reduction, embrace circular economy principles, and transparently communicate progress to stakeholders. By aligning business objectives with environmental and social governance goals, companies strengthen brand equity and foster long-term resilience.

Detailing Rigorous Research Methodologies Incorporating Primary Interviews Secondary Data Triangulation and Analytical Frameworks for Robust Insights

This research combines rigorous primary and secondary methodologies to ensure the validity and depth of our insights. Primary research encompasses structured interviews with C-suite executives, R&D heads, and supply chain managers within leading aroma chemical companies, complemented by expert consultations with regulatory authorities and industry associations. These dialogues provide firsthand perspectives on market challenges, innovation pipelines, and strategic priorities.

Secondary research involves comprehensive analysis of company publications, technical white papers, patent databases, and peer-reviewed journals in chemistry and biotechnology. International trade data, customs records, and tariff schedules are examined to trace shifts in global supply chains and cost structures, while regulatory frameworks from major markets inform our assessment of compliance landscapes.

Data triangulation is achieved through cross-referencing quantitative findings with qualitative narratives, ensuring robust validation and uncovering nuanced interdependencies among industry drivers. Analytical frameworks, including SWOT, PESTLE, and Porter’s Five Forces, guide the synthesis of trends and competitive positioning, while scenario modeling captures potential policy and technological trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aroma Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aroma Chemicals Market, by Source

- Aroma Chemicals Market, by Product Form

- Aroma Chemicals Market, by Application

- Aroma Chemicals Market, by Sales Channel

- Aroma Chemicals Market, by Usage

- Aroma Chemicals Market, by Region

- Aroma Chemicals Market, by Group

- Aroma Chemicals Market, by Country

- United States Aroma Chemicals Market

- China Aroma Chemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Core Findings to Illuminate Future-Proof Strategies Resilience Drivers and Innovation Pathways in the Aroma Chemicals Landscape

The aroma chemicals landscape is being reshaped by an intricate interplay of sustainability mandates, technological breakthroughs, and geopolitical dynamics. Companies that harness the power of green chemistry and biotech will be uniquely positioned to respond to both environmental imperatives and consumer demand for transparent, eco-friendly products. Digital platforms, from AI-driven formulation suites to interactive olfactive experiences, will further differentiate market leaders and deepen customer engagement.

Simultaneously, trade policies and tariff measures introduced in 2025 have underscored the need for resilient supply chains and agile sourcing strategies. Organizations that diversify procurement, invest in alternative feedstocks, and leverage molecular mapping technologies will mitigate cost headwinds and preserve product integrity. Strategic collaboration with regulators and industry bodies can also influence policy outcomes and reduce operational uncertainties.

Looking forward, the integration of sustainability, innovation, and digitalization will serve as the triad of competitive advantage. Market participants that proactively invest in biotechnology research, embed circular economy principles, and champion transparent governance will not only navigate current challenges but will also set the stage for long-term growth. The insights presented herein offer a blueprint for future-proof strategies that align with evolving consumer, regulatory, and technological landscapes.

Seize the Opportunity to Gain In-Depth Aroma Chemicals Market Insights and Connect Directly with Ketan Rohom to Acquire the Definitive Research Report

If you’re poised to elevate your strategic positioning and capitalize on transformative developments within the aroma chemicals market, don’t miss the opportunity to secure the full research report. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to comprehensive insights, detailed analyses, and proven strategies tailored for decision-makers like you. Empower your organization with the definitive guide to navigating complexity, driving innovation, and achieving sustainable growth in a competitive landscape. Contact Ketan today to take the next step toward informed action and long-term success.

- How big is the Aroma Chemicals Market?

- What is the Aroma Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?