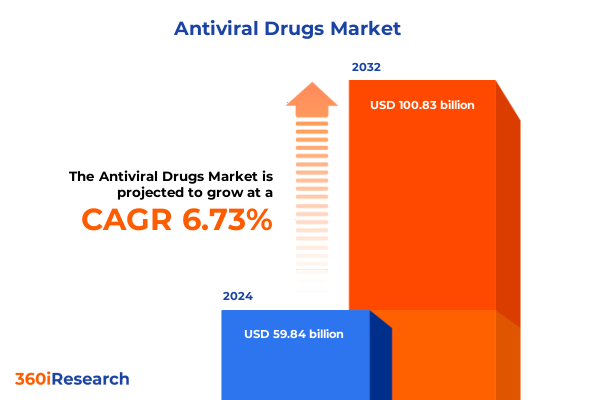

The Antiviral Drugs Market size was estimated at USD 62.81 billion in 2025 and expected to reach USD 65.92 billion in 2026, at a CAGR of 6.99% to reach USD 100.83 billion by 2032.

Exploring the Evolution and Critical Importance of Antiviral Therapeutics in Shaping Global Health Security and Patient Outcomes

Antiviral therapeutics occupy a pivotal position in global healthcare, offering targeted interventions that inhibit viral replication and mitigate disease progression. From the first nucleoside analogues developed in the 1960s to today’s advanced molecular platforms, the evolution of antiviral agents reflects a continuous commitment to countering emerging and re-emerging viral threats. Recent scientific breakthroughs have expanded the scope of drug candidates, encompassing host-directed therapies and self-amplifying nucleotide constructs designed to overcome viral resistance and enhance clinical efficacy. These developments underscore the urgency of staying informed about the shifting landscape of antiviral research and deployment in order to safeguard public health and maintain therapeutic relevance.

Pioneering Science and Innovative Therapies Are Redefining the Antiviral Drug Landscape with Breakthroughs in mRNA and Host-Targeted Approaches

The antiviral domain is undergoing transformative shifts driven by converging scientific disciplines and novel technological platforms. Messenger RNA vaccines, once confined to pandemic response, have demonstrated utility beyond SARS-CoV-2, with regulatory bodies expanding authorizations to target respiratory syncytial virus in younger adult cohorts based on robust immune response data. Meanwhile, self-amplifying mRNA candidates for influenza A H5N1 have received fast track designation, signaling regulatory recognition of the need for agile countermeasures against pandemic-potential strains. Host-targeted broad-spectrum compounds have also emerged, harnessing optogenetically identified stress response pathways to confer multi-virus inhibition in preclinical models. These parallel advances herald a paradigm shift away from pathogen-specific drugs toward modular, adaptable platforms capable of responding to both known and novel viral challenges.

Evaluating the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Antiviral Drug Supply Chains, Costs, and Access to Treatment

The implementation of U.S. tariffs in 2025 has had cumulative effects on antiviral supply chains, influencing both cost structures and access to essential therapies. Applied duties of 25% on active pharmaceutical ingredients from China and 20% from India have disproportionately impacted generic antiviral manufacturers, who operate on narrow margins and depend on imported bulk APIs. Additionally, global tariffs on medical packaging and pharmaceutical machinery have disrupted downstream production timelines for temperature-sensitive injectables, complicating distribution for complex biologic agents. The resulting inflationary pressures have prompted industry stakeholders to intensify “China+1” sourcing strategies, yet diversifying supply chains entails regulatory revalidation that can extend timelines by several years. Amid escalating geopolitical tensions, the imperative to develop resilient, locally anchored supply networks has become a defining priority for antiviral producers seeking to mitigate future trade-related risks.

Uncovering Comprehensive Market Segmentation Insights Illuminating Key Drivers Across Indications, Drug Classes, Routes, Distribution, and End Users

Detailed analysis across indication, drug class, administration route, distribution channel, and end-user group reveals nuanced opportunities and challenges within the antiviral sector. In terms of clinical application, chronic and acute indications-from hepatitis B and C to herpes simplex, HIV, influenza, and respiratory syncytial virus-drive varied therapeutic requirements, efficacy thresholds, and regulatory pathways. Drug classes span fusion inhibitors, integrase inhibitors, non-nucleoside reverse transcriptase inhibitors, nucleoside analogues, and protease inhibitors, each with distinct mechanisms of action that inform pipeline prioritization and competitive positioning. The choice of inhalation, injectable, oral, or topical delivery modalities further modulates pharmacokinetics and patient adherence, shaping formulation strategies. Distribution channels-including clinics, hospital pharmacies, online pharmacies, and retail pharmacies-serve as critical interfaces for drug dispensing, while the ultimate adoption by clinics, home care providers, hospitals, and long-term care facilities underscores the importance of tailored patient access models and reimbursement frameworks.

This comprehensive research report categorizes the Antiviral Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Drug Class

- Route Of Administration

- End User

- Distribution Channel

Decoding Regional Dynamics to Reveal How Americas, Europe Middle East & Africa, and Asia-Pacific Are Shaping Antiviral Therapy Adoption

Regional dynamics in the antiviral market are distinctly characterized by market maturation, regulatory landscapes, and healthcare infrastructure variations. In the Americas, evolving tariff policies have spurred major pharmaceutical players to invest in domestic manufacturing capacity and explore licensing partnerships to secure API supply continuity. Concurrently, the U.S. Food and Drug Administration’s endorsement of novel therapies like mRNA RSV vaccines and fast track influenza candidates has accelerated adoption of advanced modalities. Europe, the Middle East & Africa feature a diverse regulatory mosaic where centralized approval pathways coexist with country-specific reimbursement criteria, driving innovation in patient access programs and public-private collaborations. Meanwhile, the Asia-Pacific region is witnessing rapid growth in biotech innovation, with multinational companies engaging Chinese biotech firms for early-stage licensing deals and local manufacturers expanding capacity in response to favorable government incentives. Across these regions, contrasting priorities in price control, R&D incentives, and supply chain security converge to shape distinct growth trajectories for antiviral therapeutics.

This comprehensive research report examines key regions that drive the evolution of the Antiviral Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Leadership by Industry Titans Driving Antiviral Innovation Through Pipeline Advancement and Collaborative Ventures

Leading pharmaceutical and biotech companies are leveraging strategic partnerships, diversified pipelines, and advanced research platforms to maintain competitive advantage in antiviral development. Gilead Sciences continues to optimize its broad-spectrum antiviral portfolio by advancing novel nucleoside analogues and fusion inhibitors through late-stage clinical evaluation. Merck & Co. has accelerated expansion of its oral antiviral franchises, integrating artificial intelligence-driven target discovery to identify next-generation non-nucleoside reverse transcriptase inhibitors with improved resistance profiles. Arcturus Therapeutics’ self-amplifying mRNA candidate for H5N1 influenza received Fast Track Designation, demonstrating the company’s ability to translate platform innovations into priority regulatory pathways. Innovative firms such as Integrated Biosciences and NanoViricides are pioneering host-directed nanomedicine and broad-spectrum compounds in preclinical models, while Cocrystal Pharma’s phase 2a influenza A antiviral underscores the potential of focused small molecule platforms. These diverse strategies reflect an industry-wide commitment to address both immediate public health needs and long-term resilience against future viral threats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antiviral Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- AstraZeneca plc

- Aurobindo Pharma Limited

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol‑Myers Squibb Company

- Cipla Limited

- Dr. Reddy’s Laboratories Ltd.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Hetero Labs Limited

- Johnson & Johnson

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Roche Holding AG

- Sandoz International GmbH

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Formulating Targeted Strategies for Industry Leaders to Capitalize on Emerging Trends in Antiviral Development, Supply, and Market Access

To capitalize on the evolving antiviral landscape, industry leaders must adopt multifaceted strategies that balance innovation, supply chain resilience, and market access optimization. Prioritizing investment in platform technologies-such as mRNA and host-targeted compounds-will enable rapid pivoting against emerging pathogens. Simultaneously, establishing redundant, geographically diversified manufacturing networks can mitigate tariff-related disruptions and reduce dependency on single-source regions. Strategic alliances with biotech innovators accelerate pipeline enrichment, while collaboration with regulatory authorities to streamline approval frameworks for broad-spectrum agents enhances time-to-market. Furthermore, embracing digital health solutions and decentralized distribution channels expands patient outreach in hard-to-reach settings, supporting adherence and outcomes. By integrating these approaches, stakeholders can both fortify their competitive positioning and ensure sustained progress in addressing global viral disease burdens.

Detailing the Rigorous Research Methodology Implemented to Ensure Robust, Validated Insights Into the Antiviral Drug Domain

The insights presented are derived from a rigorous research methodology combining primary and secondary data sources. In-depth interviews with pharmaceutical executives, healthcare providers, and policy experts provided nuanced perspectives on market barriers and innovation drivers. Secondary research encompassed peer-reviewed scientific literature, regulatory agency announcements, and industry news releases, ensuring factual accuracy and contemporary relevance. Data triangulation validated thematic trends and supply chain analyses, while quantitative assessments of patent filings and clinical trial registries informed competitive benchmarking. Geographic and segment-level granularity was achieved through analysis of regional regulatory policies, distribution channel reports, and demographic healthcare consumption patterns. This comprehensive approach ensures that the strategic recommendations and market insights reflect the most current developments in antiviral drug research, manufacturing, and commercialization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antiviral Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antiviral Drugs Market, by Indication

- Antiviral Drugs Market, by Drug Class

- Antiviral Drugs Market, by Route Of Administration

- Antiviral Drugs Market, by End User

- Antiviral Drugs Market, by Distribution Channel

- Antiviral Drugs Market, by Region

- Antiviral Drugs Market, by Group

- Antiviral Drugs Market, by Country

- United States Antiviral Drugs Market

- China Antiviral Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Reflections on Antiviral Drug Market Evolution and Imperatives for Stakeholders in a Rapidly Transforming Healthcare Environment

The antiviral drug sector stands at a critical juncture, informed by unprecedented scientific breakthroughs, shifting geopolitical landscapes, and evolving healthcare delivery models. Innovations in mRNA-based vaccines and host-directed small molecules expand the toolset for combating both endemic viruses and pandemic threats. Concurrently, trade policies and supply chain realignments underscore the need for resilient manufacturing and sourcing strategies. Market segmentation insights highlight the importance of tailored approaches to diverse clinical indications, delivery modalities, and end-user settings, while regional analyses reveal how local policies and partnerships shape therapeutic adoption. Against this complex backdrop, industry stakeholders must remain agile-investing in platform technologies, diversifying collaborations, and advocating for streamlined regulatory pathways-to ensure that antiviral therapies continue to evolve and meet the pressing needs of global public health.

Engage with Associate Director Ketan Rohom to Secure the Definitive Antiviral Drug Market Research Report and Drive Informed Decision Making

To explore the full depth of the antiviral drug landscape and equip your organization with comprehensive, data-driven insights that drive strategic decisions, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in pharmaceutical market dynamics and consultative approach will guide you in selecting the research package tailored to your needs. Reach out today to secure your copy of the market research report and ensure your team is armed with the latest intelligence on antiviral therapeutics.

- How big is the Antiviral Drugs Market?

- What is the Antiviral Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?