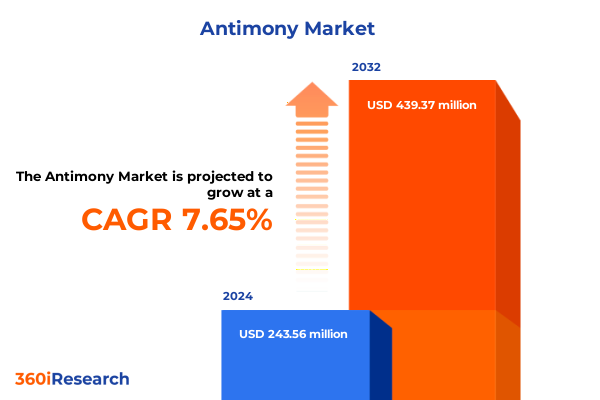

The Antimony Market size was estimated at USD 262.24 million in 2025 and expected to reach USD 280.87 million in 2026, at a CAGR of 7.65% to reach USD 439.37 million by 2032.

Unveiling the Intrinsic Value of Antimony Through Supply Chain Dynamics and Critical Growth Drivers in an Intensifying Resource Market

Antimony has emerged as a critical mineral in modern industrial applications, underpinning advancements from flame retardants to semiconductors. As global supply chains experience heightened scrutiny, understanding the nuances of antimony sourcing and utilization has become indispensable for strategic planners. This introduction lays the groundwork for a deeper exploration of the factors shaping antimony demand, from raw material availability to downstream processing requirements.

Initially, antimony’s role in flame retardants solidified its position as a non-negotiable component in safety standards for electronics, textiles, and automotive components. Meanwhile, the element’s semiconducting properties opened new avenues for photovoltaic devices and high-efficiency diodes. Against this backdrop, stakeholders have intensified efforts to diversify supply networks, seeking to mitigate geopolitical risks associated with concentrated mining regions. Consequently, alternative sourcing initiatives and recycling programs have gained momentum, setting the stage for a more resilient value chain.

As we embark on this summary, readers will gain a holistic view of antimony’s market pillars and emerging opportunities. The subsequent sections delve into transformative market shifts, tariff impacts, and strategic segmentation, equipping decision makers with actionable insights to harness antimony’s full potential in an evolving resource landscape.

Exploring the Transformative Ripples in Antimony Demand Fueled by Technological Breakthroughs and Geopolitical Realignments Across Global Supply Chains

Over the past decade, the antimony market has witnessed transformative ripples as technological breakthroughs and geopolitical realignments reshape global supply chains. Initially driven by escalating demand for flame retardants in consumer electronics, the market pivoted toward battery and semiconductors following renewed emphasis on energy storage and digital infrastructure. This convergence of end-use sectors has compelled manufacturers to invest in high-purity antimony applications and to explore novel alloy formulations.

Concurrently, regulatory mandates aimed at reducing flammability risks propelled advancements in antimony-based catalysts, enhancing performance while aligning with environmental safety standards. In parallel, circular economy initiatives spurred development of efficient recycling channels, reducing dependence on primary ore extraction. These sustainability imperatives have led to collaborative research between material scientists and chemical producers, fostering innovations in recovery technologies.

Moreover, shifting trade alliances and tariff negotiations introduced new supply corridors, incentivizing exploration in previously underdeveloped mining regions. As companies adjust to these strategic shifts, they increasingly prioritize flexibility, establishing multi-source frameworks to hedge against disruptions. In essence, the antimony landscape continues to evolve under the dual forces of technological innovation and geopolitical flux, presenting both challenges and avenues for substantial growth.

Analyzing the Far Reaching Cumulative Effects of Newly Imposed United States Tariffs on Antimony Trade Channels and Domestic Industry Equilibrium in 2025

The implementation of new United States tariffs on antimony and its derivatives in early 2025 marked a significant inflection point for domestic and international stakeholders. These duties, designed to bolster domestic refining capabilities, have introduced additional costs at multiple points along the value chain, from importers through to end-use manufacturers. As a result, companies sourcing antimony for flame retardants, battery alloys, and chemical intermediates have observed an immediate impact on procurement strategies.

Faced with higher landed costs, importers have accelerated efforts to secure partnerships with regional producers in the Americas and Asia-Pacific. Simultaneously, domestic smelters have ramped up capacity expansions to capture increased demand, supported by government incentives aimed at revitalizing local mining infrastructure. This dynamic has created a more competitive environment, enabling refiners with advanced purification technologies to gain market share by offering superior quality and shorter lead times.

Furthermore, downstream users of metallic antimony and antimony trioxide have reevaluated their inventory management, shifting toward just-in-time models to reduce tariff-related holding costs. In turn, these practices have influenced production scheduling and logistical frameworks, prompting a reevaluation of long-term supplier contracts. Ultimately, the tariff adjustments of 2025 have redefined trade flows and competitive positioning within the antimony ecosystem, underscoring the importance of agile procurement and strategic sourcing initiatives.

Decoding Strategic Segmentation Insights by Product Form Purity and Application to Illuminate Niche Opportunities and Unique Market Dynamics in Antimony

A nuanced appreciation of antimony’s segmentation uncovers critical paths for value creation and competitive advantage. When examining product types spanning antimony alloy, antimony trioxide, and metallic antimony, it becomes apparent that alloys-particularly copper-based, lead-based, and tin-based blends-dominate applications requiring enhanced mechanical and thermal properties. In contrast, antimony trioxide’s role as a flame retardant continues to benefit from stringent safety regulations, while metallic antimony remains essential for specialized electronic components.

Insights into form variations reveal distinct logistical and processing considerations. Whether supplied as flake, granule, or powder, each form factor influences reaction kinetics in chemical intermediates and surface area efficiency in catalyst systems. Notably, granules, pellets, and powder formulations cater to automated dosing in high-throughput manufacturing settings, underscoring the importance of tailoring form factors to end-use technology.

Purity levels further delineate market opportunities, where high purity grades command a premium in semiconductor and photovoltaic applications, while industrial grade material serves bulk flame retardant and battery sectors. Overlaying these dimensions with application insights-from all-metal alloys and diverse battery chemistries to fiberglass, specialty glass, catalysts, pharmaceuticals, pigments, fiber-based and composite flame retardants, as well as diode, photovoltaic, and transistor semiconductors-reveals a complex interplay of technical requirements. This segmentation matrix guides strategic investments by highlighting where incremental improvements in purity, form, or alloy composition translate directly into performance gains and market differentiation.

This comprehensive research report categorizes the Antimony market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Purity

- Form

- Application

- Application

Mapping Region Specific Trends and Growth Levers in the Americas Europe Middle East Africa and Asia Pacific to Chart Comprehensive Antimony Market Narratives

Regional analysis of the antimony market underscores distinct market drivers and growth potentials across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, strong incentives for domestic mining and refining have emerged, supported by policy frameworks that prioritize critical mineral security. This alignment has galvanized investment in local smelters and extraction projects, fostering a more resilient supply base for downstream manufacturers.

Transitioning to Europe Middle East & Africa, environmental regulations and circular economy goals have driven adoption of antimony in specialized fire-resistant materials and lead-acid battery recycling. Collaborative initiatives in this region focus on reducing landfill waste and improving catalyst recovery, reflecting a commitment to sustainability. Moreover, trade corridors linking African mining hubs to European chemical producers have strengthened, enhancing traceability and ethical sourcing standards.

In the Asia-Pacific, burgeoning demand for lithium-ion batteries and semiconductor devices has placed significant pressure on antimony supply chains. As a result, leading industrial players have prioritized strategic stockpiling and regional partnerships to secure high-purity feedstock. Additionally, research alliances between manufacturers and academic institutions are advancing novel alloy formulations to boost energy density and thermal stability. Collectively, these regional narratives paint a comprehensive picture of how local policies, end-use demand, and collaborative frameworks shape the global antimony market trajectory.

This comprehensive research report examines key regions that drive the evolution of the Antimony market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Corporate Strategies and Competitive Movements Driving Innovation Collaboration and Expansion Among Premier Antimony Supply Chain Stakeholders

Key corporate players in the antimony value chain have pursued varied strategies to fortify market positioning and drive innovation. Leading mining enterprises have expanded upstream operations, securing long-term ore supply agreements and deploying advanced exploration technologies to identify new deposits. These moves are complemented by substantial investments in refining capacity, where emerging entrants leverage proprietary purification processes to achieve ultra-high purity outputs suited for semiconductor applications.

Simultaneously, chemical manufacturers specializing in antimony trioxide and industrial catalysts have formed strategic alliances with technology providers, co-developing next-generation flame retardant systems that meet evolving safety and environmental standards. These collaborations have catalyzed rapid product rollouts, highlighting the synergy between R&D depth and manufacturing scale. In parallel, battery component suppliers have integrated antimony-based alloys into lead-acid and nickel-metal hydride platforms, while exploring formulations for lithium-ion applications to enhance cycle life and thermal conductance.

Throughout the ecosystem, companies have also engaged in targeted mergers and acquisitions to bolster their product portfolios and regional footprints. These consolidation efforts facilitate knowledge transfer across geographies and create more comprehensive service offerings for end-use sectors. Collectively, these corporate strategies underscore the competitive imperative to blend exploration, innovation, and partnership in capturing the full spectrum of antimony market opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimony market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amspec Chemical Corporation

- Bas Metal Madencilik San. ve Tic. A.S.

- Belmont Metals Inc.

- Campine NV

- Cominco Resources Ltd.

- Geopromining Ltd.

- Huachang Antimony Industry Co., Ltd.

- Korea Zinc Co., Ltd.

- Lambert Metals International

- Mandalay Resources Ltd.

- Mandarin Mining Corporation

- Reynolds Metals Company

- Sica Antimony

- United States Antimony Corporation

- Yiyang Huachang Antimony Co., Ltd.

- Yunnan Muli Antimony Industry Co., Ltd.

Delivering Action Oriented Recommendations for Industry Leaders to Strengthen Resilience Enhance Sustainability and Capitalize on Emerging Antimony Sector Opportunities

Industry leaders seeking to capitalize on antimony’s multifaceted growth prospects should prioritize strategic agility and stakeholder collaboration. First, diversifying raw material sourcing across multiple geographies can mitigate concentration risks, while establishing long-term offtake agreements with emerging producers ensures stable supply and cost predictability. In addition, investing in advanced purification technologies and proprietary alloy development will unlock higher-value applications in semiconductors and energy storage.

Concurrently, forging partnerships with academic and research institutions accelerates innovation cycles for next-generation catalysts, fire-resistant materials, and battery alloys. These alliances not only cultivate specialized expertise but also position companies at the forefront of regulatory developments and performance standards. Moreover, optimizing circular economy initiatives-such as closed-loop recycling and catalyst recovery programs-reduces reliance on primary ores and reinforces sustainability credentials among end-customers.

Finally, implementing flexible logistics and inventory management systems, including just-in-time and vendor managed inventory models, can offset tariff-induced cost fluctuations and enhance responsiveness to market shifts. By integrating these actions within a cohesive strategic framework, organizations can strengthen resilience, reduce environmental impact, and secure a competitive edge in the evolving antimony landscape.

Outlining Rigorous Research Methodology Employed to Ensure Robust Data Collection Validation and Analysis for Comprehensive Antimony Market Intelligence

A rigorous research methodology underpins the insights presented in this analysis, combining extensive primary engagement with comprehensive secondary data collection. Initially, industry veterans and key opinion leaders participated in structured interviews, offering qualitative perspectives on supply chain dynamics, technology advancements, and regulatory trends. These informed discussions provided foundational context for subsequent data triangulation.

Parallel to primary research, secondary sources including trade publications, government statistical releases, and academic journals were systematically reviewed. This desk research phase encompassed global trade flow analysis, import-export records, and environmental policy dossiers to validate emerging patterns and quantify shifts in demand drivers. Cross-referencing these datasets with proprietary transaction logs and logistics records enriched the granularity of the findings.

Furthermore, a multi-layered segmentation framework ensured that product type, form factor, purity grade, and application categories were meticulously defined. Geographic insights were derived through regional market mapping, integrating policy analyses and stakeholder surveys. Finally, all insights underwent robust validation through a peer review panel of subject matter experts, guaranteeing analytical integrity and actionability for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimony market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimony Market, by Product Type

- Antimony Market, by Form

- Antimony Market, by Purity

- Antimony Market, by Form

- Antimony Market, by Application

- Antimony Market, by Application

- Antimony Market, by Region

- Antimony Market, by Group

- Antimony Market, by Country

- United States Antimony Market

- China Antimony Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings to Present a Cohesive Narrative on Antimony Market Drivers Challenges and Strategic Imperatives for Industrial Decision Makers

In synthesizing the core findings, a cohesive narrative emerges: antimony operates at the nexus of critical industrial applications and geopolitical sensitivities, where supply diversification, technological innovation, and sustainability imperatives converge. The introduction highlighted antimony’s essential roles, setting the stage for understanding transformative shifts influenced by energy transition and digitalization.

A closer examination of tariff impacts revealed the necessity for agile procurement strategies and enhanced domestic refining capabilities to navigate 2025’s new trade regulations. Segment-level analysis underscored how tailored alloy compositions, form factors, and purity gradations map directly to performance requirements across batteries, flame retardants, and semiconductors. Regional deep dives further illuminated how policy incentives, recycling mandates, and R&D collaborations uniquely shape market dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific.

Corporate insights demonstrated a spectrum of competitive approaches-from upstream exploration and capacity expansions to strategic alliances and M&A-that collectively drive market evolution. By adopting the recommended actions around diversification, innovation, circularity, and logistics optimization, industry leaders can harness antimony’s full potential. This comprehensive picture equips decision makers with the strategic clarity needed to thrive in an increasingly complex and opportunity-rich antimony ecosystem.

Encouraging Executive Engagement with Ketan Rohom to Secure In Depth Antimony Market Intelligence and Empower Strategic Investment Decisions Today

In today’s rapidly shifting mineral landscape, securing definitive insights into antimony market dynamics is critical for sustaining competitive advantage. To explore tailored research findings, in-depth analysis of segmentation nuances, and region-specific trends, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, executives gain exclusive access to proprietary data sets, customized strategic roadmaps, and early advisories on emerging supply chain developments. This collaboration empowers decision makers to navigate tariff complexities, optimize sourcing strategies, and uncover high-purity production breakthroughs. Engage with Ketan to initiate a personalized consultation that will align your organization’s objectives with granular market intelligence. Elevate your strategic planning today by scheduling a one-on-one briefing and securing a comprehensive market research report designed to drive resilient growth and informed investment in the antimony sector

- How big is the Antimony Market?

- What is the Antimony Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?