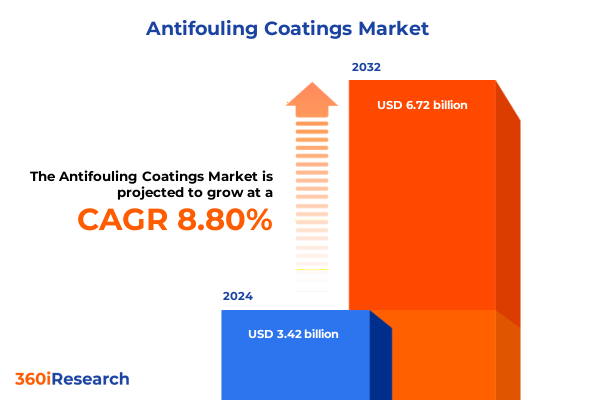

The Antifouling Coatings Market size was estimated at USD 3.70 billion in 2025 and expected to reach USD 4.00 billion in 2026, at a CAGR of 8.89% to reach USD 6.72 billion by 2032.

Setting the Stage for Antifouling Coatings: Introduction to Market Dynamics and Strategic Imperatives for Industry Stakeholders

The global marine industry continues to demand more efficient solutions to combat biofouling, driving the evolution of antifouling coatings from traditional biocidal paints to advanced polymeric technologies. Historically, marine operators have faced significant operational challenges linked to hull fouling, including increased drag, higher fuel consumption, and elevated carbon emissions. With rising environmental scrutiny and pressure to meet stringent regulatory standards, industry participants are seeking coatings that not only deliver robust protection but also align with sustainability goals.

Introduction to this market’s dynamics reveals a landscape where innovation intersects with environmental responsibility. Technological breakthroughs-ranging from silicone-based foul-release systems to novel anti-adhesive polymers-are gaining traction. Alongside these advancements, regulatory bodies have intensified oversight of chemical leachates, prompting manufacturers to explore solutions that minimize ecological impact. As vessel owners and operators navigate a complex interplay of performance demands and compliance requirements, the adoption curve for next-generation coatings accelerates.

This report sets the stage by examining macroeconomic factors, environmental imperatives, and technological developments that collectively shape the antifouling coatings industry. Through this lens, stakeholders can anticipate emerging trends, evaluate strategic options, and position themselves to capitalize on opportunities arising from the transition to more effective and eco-friendly fouling control technologies.

Analyzing Transformative Shifts Reshaping the Antifouling Coatings Landscape Through Technological, Regulatory, and Environmental Drivers

Over the past several years, the antifouling coatings landscape has undergone a transformative shift driven by converging technological, regulatory, and environmental forces. Innovations in polymer science have introduced siloxane and fluoropolymer formulations capable of repelling aquatic organisms without relying on high biocide concentrations. These foul-release technologies have set new performance benchmarks, particularly for high-speed vessels where reduced friction directly translates into operational savings.

Simultaneously, regulatory developments-such as the International Maritime Organization’s biofouling guidelines and regional bans on certain organotin compounds-have compelled manufacturers to rethink chemical formulations. This alignment of policy with environmental stewardship has accelerated the adoption of non-toxic and low-leach solutions. Research into biocompatible coatings and micro-structured surfaces underscores the industry’s commitment to balancing efficacy with ecological protection.

Environmental drivers continue to reshape market priorities. Heightened scrutiny of greenhouse gas emissions and the pursuit of carbon neutrality are amplifying the value proposition of coatings that enhance fuel efficiency. Looking ahead, digital monitoring and data-driven maintenance protocols are emerging as complementary innovations, enabling predictive performance management and optimized recoating schedules. Together, these shifts mark a pivotal evolution for an industry that must reconcile high-performance requirements with sustainability goals.

Evaluating the Aggregate Effects of 2025 United States Tariff Measures on Antifouling Coatings Supply Chains and Competitive Positioning

The implementation of new United States tariffs in 2025 has introduced a layer of complexity for stakeholders sourcing raw materials and finished products in the antifouling coatings supply chain. Tariff adjustments targeting copper compounds and specialty polymers have increased landed costs, prompting manufacturers to reevaluate procurement strategies. In response, many suppliers are shifting toward strategic stockpiling and negotiating longer-term contracts to mitigate price volatility and secure uninterrupted production.

These measures have also triggered a reconfiguration of regional trade flows. Suppliers in Asia are redirecting exports toward markets with more favorable trade terms, while domestic producers in the Americas are accelerating capacity expansions to capture share. At the same time, end users are examining the total cost of ownership with greater scrutiny, balancing up-front material expenses against lifecycle benefits delivered by high-performance coatings.

Despite the initial cost pressures, this realignment offers an opportunity for innovation in formulation optimization and supply chain resilience. Manufacturers are exploring alternative resin chemistries and local sourcing of key inputs to buffer against further tariff fluctuations. As the industry adapts, companies that proactively integrate cost management with product differentiation will be best positioned to maintain competitive advantage amid evolving trade dynamics.

Uncovering Critical Segmentation Insights Across Resin Formulations and Diverse Applications Driving Market Differentiation

Examining the market through the prism of resin type reveals two distinct trajectories: one rooted in longstanding copper-based technologies and another propelled by next-generation silicone-based formulations. Copper-based coatings continue to offer proven efficacy against a broad spectrum of marine organisms, benefiting from decades of performance validation. In contrast, silicone-based alternatives are gaining momentum for their foul-release capabilities and lower environmental footprint, especially in applications where rapid removal of biofouling yields measurable operational gains.

When applied across the diverse range of maritime assets-from aquaculture nets to fishing boats-the relative demands on coating performance become clear. In aquaculture, resistance to barnacle and mussel attachment is critical to maintaining water flow and stock health. Fishing boats require coatings that withstand variable speeds and frequent docking cycles without compromising catch quality. Mooring lines demand shear-resistant properties to minimize abrasion and biofilm accumulation. Meanwhile, coatings for shipping vessels emphasize long-term durability during extended deployments and adherence to global regulatory regimes. Yachts, often subject to stringent aesthetic and performance standards, increasingly leverage high-end silicone systems to streamline maintenance intervals and uphold sleek hull finishes.

This segmentation underscores the importance of aligning resin selection with application-specific performance metrics. By integrating insights on resin type and application context, stakeholders can tailor product portfolios to meet discerning end-user needs, striking a balance between proven chemistries and emerging foul-release technologies.

This comprehensive research report categorizes the Antifouling Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Resin Type

- Application

- End‑Use Industry

Highlighting Key Regional Trends in Americas, Europe Middle East Africa, and Asia Pacific and Their Influence on Strategic Priorities

Regional dynamics in the antifouling coatings sector reflect a complex interplay of regulatory regimes, maritime growth patterns, and environmental priorities. In the Americas, regulatory frameworks emphasize clean water initiatives and greenhouse gas reduction commitments, prompting vessel operators to adopt coatings that extend drydock cycles and improve fuel efficiency. Domestic producers are capitalizing on nearshore manufacturing to support retrofitting programs and fleet renewals, strengthening regional supply chains in response to evolving trade policies.

Europe, Middle East & Africa presents a mosaic of stringent environmental mandates, led by the European Union’s rigorous product registration requirements and Middle Eastern investments in port infrastructure. Shipowners in this region are exploring biocide-free solutions to comply with ballast water management and biofouling control regulations. Simultaneously, Africa’s expanding offshore activities are spurring demand for robust, corrosion-resistant coatings capable of withstanding challenging marine conditions and limited maintenance windows.

In Asia-Pacific, the combination of rapid fleet expansion, growing aquaculture sectors, and robust shipbuilding activities is driving significant demand for both high-performance and cost-effective coatings. Regional manufacturers are intensifying research into silicone-modified resins and eco-friendly additives to satisfy local regulations while supporting fast-growing maritime markets. These regional trends highlight the necessity for strategic alignment between product innovation and localized requirements, ensuring that coating solutions deliver both compliance and competitive differentiation.

This comprehensive research report examines key regions that drive the evolution of the Antifouling Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Top Industry Players’ Strategic Moves Shaping Innovation, Partnerships, and Competitive Dynamics Within the Antifouling Coatings Sphere

Leading companies in the antifouling coatings arena are differentiating themselves through a blend of technological innovation, strategic partnerships, and sustainability commitments. Industry veterans are investing heavily in research and development to refine silicone-based foul-release systems, driving enhancements in adhesion properties and service life. Collaborative initiatives between coating manufacturers and marine equipment OEMs are facilitating co-development of integrated solutions, such as hull monitoring sensors paired with smart coatings that can signal recoat requirements in real time.

Meanwhile, strategic alliances with chemical suppliers are enabling streamlined access to novel raw materials, including functionalized polymers and bio-inspired additives. Through targeted acquisitions and joint ventures, key players are expanding their geographic footprint to serve emerging markets and diversify risk across regional trade landscapes. Partnerships with academic institutions have also bolstered innovation pipelines, fostering breakthroughs in nano-engineered surface textures that deter fouling organisms without releasing harmful compounds.

Sustainability has become a competitive differentiator, as companies pursue third-party certifications and eco-label endorsements to validate the environmental performance of their products. By aligning corporate social responsibility goals with product development roadmaps, these organizations are establishing credibility with environmentally conscious shipowners, regulatory authorities, and end users aiming to achieve carbon reduction targets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antifouling Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AE Paints & Coatings Pvt. Ltd.

- Akzo Nobel N.V.

- Altex Coatings Inc.

- Axalta Coating Systems Ltd.

- BASF SE

- Boero YachtCoatings S.p.A.

- Chugoku Marine Paints, Ltd.

- CMP Coatings Inc.

- DuPont de Nemours, Inc.

- Hempel A/S

- Jotun Group

- Kansai Paint Co., Ltd.

- KCC Corporation

- Nippon Paint Marine Coatings Co., Ltd.

- Nofirno B.V.

- Oceanmax Corporation

- Pettit Marine Paint Co., Inc.

- PPG Industries, Inc.

- RPM International Inc.

- Sea Hawk Paints, Inc.

- Sika AG

- The Sherwin‑Williams Company

- Witham Group Ltd.

- Zhejiang Yutong New Materials Co., Ltd.

Delivering Actionable Recommendations to Maximize Operational Efficiency, Environmental Compliance, and Market Access for Industry Decision Makers

To navigate the evolving antifouling coatings landscape and secure a sustainable competitive advantage, industry leaders must prioritize a multifaceted action plan. Investment in advanced formulation research remains paramount, particularly in the refinement of silicone-based foul-release systems that deliver both environmental compliance and operational savings. Establishing collaborative partnerships with raw material providers and marine OEMs will accelerate co-innovation efforts and reduce time to market for cutting-edge product offerings.

Operational resilience can be further enhanced by diversifying supply chains to mitigate tariff impacts and raw material shortages. By engaging with multiple sourcing partners across regions, coating manufacturers can ensure continuity of supply while optimizing cost structures. Concurrently, integrating digital monitoring technologies into service offerings enables predictive maintenance, extending recoating intervals and strengthening customer loyalty through value-added services.

Regulatory foresight is equally critical; proactive engagement with policy makers and participation in standards development will position companies to anticipate future compliance requirements. Finally, a clear sustainability narrative-bolstered by validated eco-label certifications and transparent life-cycle assessments-will resonate with environmentally focused stakeholders, unlocking new market segments and reinforcing corporate social responsibility objectives.

Detailing the Research Methodology Underpinning This Report Including Data Sources, Analytical Frameworks, and Validation Protocols

This report draws upon a blended research approach designed to deliver robust and reliable insights. Primary data collection included structured interviews and in-depth discussions with coating formulators, marine operators, and regulatory experts to capture firsthand perspectives on performance requirements and compliance challenges. These insights were complemented by a comprehensive review of secondary sources, including technical journals, patent databases, and industry conference proceedings, to map the evolution of key technologies and market drivers.

Analytical frameworks employed within the study encompassed SWOT analysis, value-chain mapping, and scenario planning to evaluate competitive dynamics and potential future states. Data triangulation was applied rigorously, cross-referencing quantitative inputs-from cost components to coating performance metrics-with qualitative findings from expert interviews. Validation protocols included peer reviews by independent industry consultants, ensuring that conclusions accurately reflect real-world conditions and emerging trends.

Throughout the research process, adherence to ethical standards and data integrity protocols was maintained. Confidential information from participating organizations was anonymized, and all findings were subjected to internal quality control checks. This systematic methodology underpins the credibility of the report’s strategic insights, offering stakeholders a reliable basis for informed decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antifouling Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antifouling Coatings Market, by Type

- Antifouling Coatings Market, by Resin Type

- Antifouling Coatings Market, by Application

- Antifouling Coatings Market, by End‑Use Industry

- Antifouling Coatings Market, by Region

- Antifouling Coatings Market, by Group

- Antifouling Coatings Market, by Country

- United States Antifouling Coatings Market

- China Antifouling Coatings Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Drawing Conclusions on the Current State of Antifouling Coatings and Their Strategic Implications for Industry Growth Trajectories

The antifouling coatings market stands at a critical juncture, where technological innovation intersects with escalating environmental expectations and shifting trade landscapes. The maturation of silicone-based foul-release technologies, coupled with regulatory constraints on traditional biocides, underscores a broader transition toward sustainable marine solutions. At the same time, emerging tariff regimes have accentuated the importance of supply chain agility and cost optimization.

Segment analysis highlights the dual relevance of copper-based and silicone-based systems, each serving unique application demands from aquaculture net maintenance to luxury yacht upkeep. Regional variations emphasize the need for tailored strategies, with Americas focusing on carbon reduction, Europe Middle East & Africa driving compliance through stringent mandates, and Asia-Pacific addressing fleet expansion and aquaculture growth.

In this evolving landscape, industry leaders that align innovation with operational resilience will thrive. The adoption of advanced polymers, the integration of digital monitoring, and the cultivation of sustainable value propositions are no longer optional-they are prerequisites for competitive differentiation. By embracing proactive engagement with regulatory developments and forging strategic partnerships, organizations can navigate complexities and capitalize on opportunities across the global antifouling coatings market.

Engage with Ketan Rohom to Secure a Comprehensive Antifouling Coatings Market Research Report Tailored to Your Strategic Objectives

To explore how this report can be customized to your specific objectives and to secure immediate access to comprehensive insights into the antifouling coatings market, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, he will guide you through a tailored engagement process that aligns this research with your strategic priorities. Ketan’s deep understanding of market dynamics ensures that your organization receives actionable intelligence designed to accelerate decision making and competitive advantage. Contact Ketan to discuss your requirements, obtain detailed sample pages, and arrange a briefing to demonstrate how this report can drive value for your business.

- How big is the Antifouling Coatings Market?

- What is the Antifouling Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?