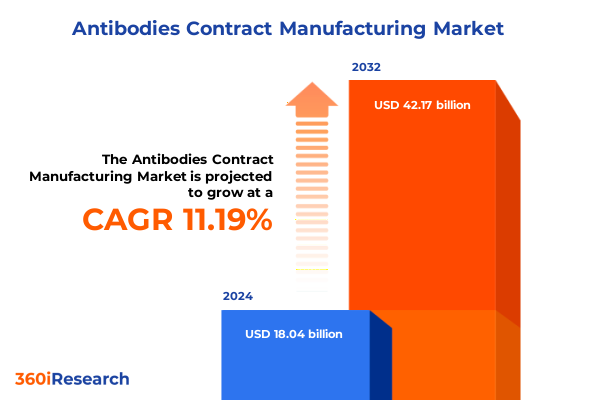

The Antibodies Contract Manufacturing Market size was estimated at USD 20.05 billion in 2025 and expected to reach USD 22.07 billion in 2026, at a CAGR of 11.20% to reach USD 42.17 billion by 2032.

Understanding the foundational dynamics behind antibody contract manufacturing that shape biopharmaceutical innovation and supply chain resilience

Antibody contract manufacturing represents a cornerstone of modern biopharmaceutical innovation, enabling developers to access specialized capabilities without the capital intensity of in-house production. This collaborative model has emerged as a critical enabler for companies seeking to accelerate timelines, maintain flexible capacity and ensure quality in complex biologics manufacturing. As the pipeline of therapeutic antibodies expands worldwide, the reliance on contract development and manufacturing organizations (CDMOs) has intensified, positioning these partnerships at the nexus of innovation and supply chain resilience.

In recent years, stakeholders have confronted an intricate regulatory and competitive landscape, where rapid technology adoption must align with compliance objectives and cost controls. Shifts in global demand have placed added pressure on CDMOs to enhance throughput, minimize contamination risks and tailor processes to diverse molecular formats. Against this backdrop, companies that integrate advanced capabilities-ranging from cell line engineering to high-performance purification platforms-are redefining the value proposition of outsourced manufacturing.

Looking ahead, the strategic interplay between developers and specialized service providers will determine the speed and success of antibody drug commercialization. With multiple modalities converging around monoclonal and bispecific constructs, contract manufacturers are compelled to deliver end-to-end solutions that streamline scale-up, ensure reproducibility and optimize yield. Consequently, decision-makers must evaluate partnerships through the lens of technology readiness, capacity flexibility and regulatory agility.

This executive summary provides a comprehensive overview of the evolving dynamics in antibody contract manufacturing, highlighting transformative trends, segmentation nuances and regional imperatives. By synthesizing critical insights, this document equips industry leaders with a roadmap for leveraging contract manufacturing as a strategic advantage in a rapidly shifting biopharma ecosystem.

Analyzing the major technological, regulatory, and strategic transformations revolutionizing antibody contract manufacturing practices and positioning

Antibody contract manufacturing has undergone dramatic transformations as emerging technologies, regulatory reforms and strategic collaborations converge. Continuous processing has advanced from conceptual pilots to commercial-scale implementation, enabling manufacturers to reduce footprint and enhance product consistency. Simultaneously, single-use bioreactor systems have matured, offering flexible capacity expansion and minimizing turnaround times. Digital twins and real-time analytics now inform process control decisions, further optimizing batch performance and reducing risk.

Regulatory frameworks have evolved to support these innovations, with agencies publishing guidance that clarifies comparability expectations for process changes and novel platforms. This guidance has encouraged CDMOs to adopt modular facility designs and invest in platform technologies that adhere to standardized validation pathways. Such regulatory clarity fosters greater confidence in outsourcing, as developers can mitigate compliance uncertainty and accelerate submission timelines.

Strategically, partnerships between developers and CDMOs have shifted toward co-development models, where early-stage process design integrates seamlessly with scale-up activities. This approach reduces technology transfer friction and aligns objectives across the value chain. Alliances with academic centers and specialized equipment vendors further accelerate innovation, enriching the repertoire of purification and formulation solutions available to manufacturers.

As these transformative shifts gain momentum, stakeholders must navigate an intricate web of technological options, regulatory milestones and partnership frameworks. By understanding the interplay between continuous manufacturing, digital integration and co-development strategies, decision-makers can position their organizations to capture the full benefits of a rapidly advancing contract manufacturing landscape.

Evaluating the effects of United States tariff adjustments in 2025 on global antibody contract manufacturing supply chain resilience and operational strategies

The introduction of new tariff measures by the United States in 2025 has prompted a recalibration of supply chain strategies within the antibody contract manufacturing sector. These levies, targeting specific reagents, raw materials and certain finished components imported from key Asian markets, have increased landed costs and introduced complexity to procurement planning. In response, manufacturers are exploring alternative sourcing agreements, dual-vendor frameworks and regional distribution hubs to secure uninterrupted material flows.

Companies have begun to pass incremental cost burdens through tiered pricing structures or absorption mechanisms, balancing margin protection against developer expectations for stable contract terms. This shift has underscored the importance of proactive cost-modeling exercises and risk scenario planning. By quantifying tariff impacts at each stage of the value chain-from bioreactor media procurement to chromatography resin supply-organizations can develop targeted mitigation strategies that preserve operational efficiency.

Moreover, the evolving tariff environment has reinforced the value of nearshoring capabilities. CDMOs with production sites in North America have experienced enhanced demand from clients seeking to reduce exposure to cross-border trade uncertainties. Concurrently, investments in domestic logistics and customs expertise have become differentiators, enabling faster turnaround times and reduced documentation errors.

Ultimately, the cumulative impact of the 2025 tariff adjustments has catalyzed a shift toward more resilient supply chain architectures. Manufacturers that integrate flexible sourcing policies, invest in regional capacity and incorporate dynamic cost analytics are better positioned to maintain continuity of supply and meet accelerating demand for antibody therapeutics.

Uncovering downstream and upstream segmentation insights that reveal process optimization and therapeutic development in antibody contract manufacturing

The segmentation of antibody contract manufacturing processes illuminates critical junctures where efficiency gains and quality controls converge. On the downstream side, chromatography purification serves as the workhorse for achieving high-purity antibody products. Variants such as hydrophobic interaction chromatography, ion exchange chromatography and protein A chromatography each address distinctive aspects of impurity removal and product binding, enabling manufacturers to refine selectivity and minimize yield loss. Complementing these purification methods, filtration and centrifugation platforms provide essential clarification and impurity reduction, while ultrafiltration and diafiltration concentrate final formulations and exchange buffers to meet stringent product specifications.

Upstream processing underpins therapeutic yield and consistency, starting with robust cell line development protocols that optimize expression constructs and enhance stability. Media and feed preparation strategies further drive productivity, employing fed-batch or perfusion approaches tailored to complex antibody modalities. Bioreactor operation unifies these elements, orchestrating temperature, pH and dissolved oxygen parameters within single-use or stainless-steel systems. By integrating advanced sensors and automated control loops, manufacturers can achieve reproducible cell culture profiles and accelerate scale-up timelines.

Interdependencies between upstream and downstream processes highlight the importance of holistic process design. Early collaboration between process development and purification teams ensures that feed composition, impurity profiles and volume constraints are managed proactively. This integrated view of segmentation supports continuous improvement, as adjustments in media formulation can reduce downstream load and lower overall processing costs.

As developers prioritize speed-to-clinic and cost containment, CDMOs that offer seamless handoffs across these downstream and upstream segments will command a strategic advantage. By aligning purification choices with bioreactor performance and cell line characteristics, stakeholders can unlock process synergies that drive both operational excellence and therapeutic efficacy.

This comprehensive research report categorizes the Antibodies Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Antibody Type

- Expression System

- Process Stage

- Scale Of Operation

- Antibody Format

- Outsourcing Model

- Contract Type

- Therapeutic Area

- End Use

- Customer Type

Delving into Americas, Europe Middle East & Africa, and Asia-Pacific factors driving strategic direction and resilience in antibody contract manufacturing

Regional dynamics continue to shape the strategic calculus for antibody contract manufacturing, with each geography offering distinct advantages and imperatives. In the Americas, a dense concentration of biotechnology hubs has fostered robust CDMO networks, underpinned by established regulatory frameworks and a mature supply chain infrastructure. Access to cutting-edge research institutions and proximity to major developer headquarters have fueled collaborative process innovations, while domestic manufacturing nodes mitigate trade-related uncertainties.

Across Europe, the Middle East and Africa, harmonization efforts under EMA and regional consortia have streamlined approval pathways for biologics, encouraging capacity investments in countries such as Germany, Switzerland and the United Arab Emirates. This regulatory coherence, combined with strong biotech clusters in Western Europe, has enabled manufacturers to achieve consistent quality standards and improved market access. Concurrently, emerging markets in Eastern Europe and Africa are attracting facility expansions aimed at serving local therapeutic demands and biosimilar production goals.

In the Asia-Pacific region, rapid growth in China, India and Southeast Asia reflects significant financial commitments to domestic biomanufacturing ecosystems. Government incentives and public-private partnerships have accelerated the establishment of world-class facilities, supported by local talent development programs. These emerging hubs not only address regional demand but also contribute to global capacity augmentation, leveraging economies of scale and cost-competitive operations.

Understanding these regional strengths and constraints is vital for developers seeking to optimize their manufacturing footprints. By aligning project requirements with regional capabilities-from high-complexity biologics in North America to cost-efficient bulk production in Asia-Pacific-organizations can enhance resilience, reduce lead times and capitalize on local innovation corridors.

This comprehensive research report examines key regions that drive the evolution of the Antibodies Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining contract manufacturing organizations alongside emerging innovators driving operational excellence and competitive advantage in antibody production

The competitive landscape of antibody contract manufacturing is defined by a mix of established global CDMOs and agile regional specialists. Leading organizations have scaled capacity through multi-site networks and have invested heavily in platform technologies that streamline process transfer and ensure consistent manufacturability. These incumbents often provide end-to-end services spanning cell line development to fill-finish, leveraging long-standing regulatory relationships and deep technical expertise to support late-stage and commercial productions.

At the same time, emerging innovators are carving niche positions by offering specialized offerings such as high-throughput screening, microscale process development and rapid scale-down models. These capabilities allow smaller developers to de-risk early-stage programs and make informed decisions before committing to larger scale operations. By integrating digital modeling and automated sampling workflows, these new entrants have accelerated lead optimization timelines and enhanced process understanding.

Partnership strategies have also evolved, with co-development agreements and joint venture models becoming increasingly common. Such collaborations enable shared risk, aligned incentives and faster go-to-market schedules. For developers, a diversified supplier portfolio that balances global reach with localized expertise has emerged as a best practice, ensuring both capacity assurance and specialized support.

In this competitive environment, the ability to combine proven platform processes with adaptive innovation will determine which organizations capture the next wave of antibody manufacturing projects. Providers that can seamlessly scale single-use operations, integrate digital control systems and offer transparent cost structures will continue to set the benchmark for operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antibodies Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Abzena Holdings Ltd.

- AGC Biologics

- Aldevron LLC

- Avid Bioservices Inc.

- Batavia Biosciences B.V.

- Boehringer Ingelheim International GmbH

- Catalent Inc.

- Eurofins Scientific SE

- Fujifilm Holdings Corporation

- Goodwin Biotechnology Inc.

- KBI Biopharma Inc.

- Lonza Group AG

- Merck KGaA

- MilliporeSigma

- Novasep Holding SAS

- Piramal Pharma Solutions

- Rentschler Biopharma SE

- Samsung Biologics Co. Ltd.

- Selexis SA

- Syngene International Limited

- Thermo Fisher Scientific Inc.

- WuXi Biologics Inc.

Strategic guidance for decision-makers to optimize antibody contract manufacturing operations, enhance resilience, and navigate evolving market challenges

To secure a leadership position in antibody contract manufacturing, companies should adopt a proactive technology roadmap that prioritizes the integration of continuous processing and real-time analytics. Investing in modular, single-use infrastructure will enable rapid capacity adjustments and reduce capital cycle times. Concurrently, building digital twins and predictive modeling frameworks can drive yield improvements and process robustness, minimizing the risk of batch failures and compliance deviations.

Diversifying supply chains remains essential in the context of evolving trade policies and regional disruptions. Establishing dual-sourcing strategies for critical raw materials and partnering with suppliers across multiple geographies will ensure continuity in the face of tariff shifts or logistical bottlenecks. Close collaboration with regulatory experts can further streamline approvals for process changes and site expansions, reducing lead times and preventing avoidable delays.

Strengthening strategic alliances through co-development agreements with biotech innovators can accelerate candidate progression and align incentives across the value chain. Such partnerships should incorporate clear milestone definitions, shared investment structures and transparency in knowledge transfer protocols. This collaborative approach not only spreads risk but also leverages diverse expertise to optimize process designs.

Finally, prioritizing workforce development and sustainability initiatives will sustain long-term competitive advantage. Training programs for specialized bioprocess engineers, combined with green chemistry and waste reduction efforts, will enhance both operational efficiency and corporate responsibility profiles. By adopting these targeted recommendations, industry leaders can position themselves to navigate complexity, drive innovation and capitalize on the expanding opportunities in antibody contract manufacturing.

Detailing the research framework, data collection techniques, and analytical approaches supporting an in-depth examination of antibody contract manufacturing

This analysis draws upon a multi-layered research framework designed to capture the full spectrum of antibody contract manufacturing dynamics. Initially, industry-specific secondary sources were reviewed to map historical trends, technology milestones and regulatory developments. Trade journals, white papers and agency guidelines served as foundational inputs to establish a chronological understanding of process innovations and policy shifts.

Complementing desk research, structured interviews were conducted with senior bioprocess engineers, regulatory affairs specialists and CDMO executives. These discussions illuminated practical challenges in scale-up, quality assurance and cross-border logistics, providing granular insights into decision-making drivers. Interview findings were then corroborated through anonymized developer surveys, quantifying priorities related to capacity flexibility, technology adoption and cost structures.

Data triangulation techniques were applied to reconcile qualitative feedback with market activity indicators, such as capital expenditure announcements and facility expansions. Analytical approaches included thematic coding of interview transcripts and cross-regional comparative assessments to highlight divergent regulatory environments. The segmentation framework was informed by a detailed process flow analysis, identifying key upstream and downstream junctures where value accrues.

This rigorous methodology ensures that the findings reflect both strategic imperatives and operational realities. By combining diverse data sources, expert validation and structured analysis, the research delivers a comprehensive perspective on the evolving landscape of antibody contract manufacturing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antibodies Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antibodies Contract Manufacturing Market, by Service Type

- Antibodies Contract Manufacturing Market, by Antibody Type

- Antibodies Contract Manufacturing Market, by Expression System

- Antibodies Contract Manufacturing Market, by Process Stage

- Antibodies Contract Manufacturing Market, by Scale Of Operation

- Antibodies Contract Manufacturing Market, by Antibody Format

- Antibodies Contract Manufacturing Market, by Outsourcing Model

- Antibodies Contract Manufacturing Market, by Contract Type

- Antibodies Contract Manufacturing Market, by Therapeutic Area

- Antibodies Contract Manufacturing Market, by End Use

- Antibodies Contract Manufacturing Market, by Customer Type

- Antibodies Contract Manufacturing Market, by Region

- Antibodies Contract Manufacturing Market, by Group

- Antibodies Contract Manufacturing Market, by Country

- United States Antibodies Contract Manufacturing Market

- China Antibodies Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 23]

- List of Tables [Total: 4293 ]

Summarizing the key insights and future outlook that underscore the pivotal role of antibody contract manufacturing in advancing biopharmaceutical innovation

The landscape of antibody contract manufacturing continues to evolve under the influence of technological breakthroughs, shifting trade policies and regional strategic imperatives. The rise of continuous processing, advanced purification platforms and digital analytics has redefined expectations around speed, quality and cost efficiency. Meanwhile, the 2025 tariff adjustments have highlighted the critical importance of supply chain agility and regional diversification strategies.

Segmentation analysis underscores the interdependence of upstream cell culture operations, media optimization and downstream purification processes, revealing opportunities for integrated process design that enhances yield and reduces variability. Regional insights demonstrate that the Americas, EMEA and Asia-Pacific each play complementary roles in capacity provision, regulatory harmonization and cost-effective production. Collectively, these factors shape a dynamic environment where CDMOs and developers must continuously adapt to maintain competitive edge.

Key players are responding with strategic partnerships, modular facility investments and specialized process development offerings. Emerging innovators are challenging traditional paradigms by delivering rapid scale-down models and high-throughput screening capabilities. In tandem, co-development agreements and nearshoring initiatives are driving new levels of collaboration across the value chain.

Looking forward, organizations that embrace a holistic view of technology integration, supply chain resilience and regulatory engagement will be best positioned to capitalize on the expanding pipeline of antibody therapeutics. The insights presented here chart a course for navigating complexity and seizing growth opportunities in the next era of contract manufacturing.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock antibody contract manufacturing research and drive informed strategic action

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock antibody contract manufacturing research and drive informed strategic action

- How big is the Antibodies Contract Manufacturing Market?

- What is the Antibodies Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?