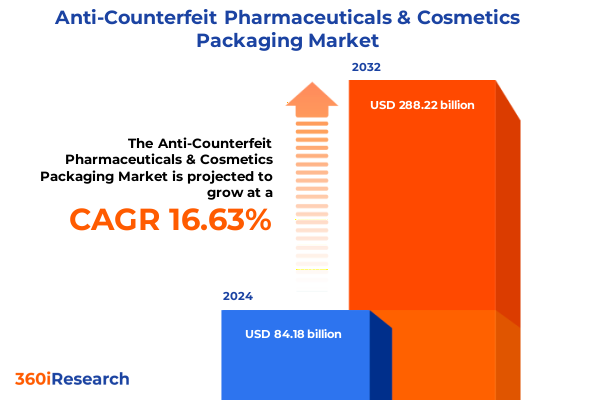

The Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market size was estimated at USD 98.08 billion in 2025 and expected to reach USD 113.52 billion in 2026, at a CAGR of 16.64% to reach USD 288.22 billion by 2032.

A rapidly evolving global threat compels industry to fortify pharmaceutical and cosmetics packaging against sophisticated counterfeiting schemes

Counterfeit pharmaceuticals and cosmetics pose a critical threat to global health and brand reputation, with illicit products permeating legitimate supply chains and endangering consumers. According to the World Health Organization, approximately 10.5 percent of medical products in low- and middle-income countries are either substandard or falsified, illustrating the scope of this risk on patient safety and market stability. High-profile incidents have underscored the human cost; criminal networks exploiting popular medications such as Ozempic have distributed counterfeit batches across at least ten countries, prompting urgent interventions from health authorities and illuminating the complex challenges of batch verification and packaging integrity.

Breakthrough innovations and regulatory mandates collide to redefine authentication, traceability, and sustainability in high-security packaging

The last few years have seen transformative shifts reshaping every dimension of security packaging, driven by advancements in digital authentication and regulatory rigor. Leading technology providers are integrating artificial intelligence-driven anomaly detection with blockchain-based traceability to deliver immutable product verification and real-time supply chain monitoring. The convergence of these solutions allows manufacturers and regulators to share secure, tamper-proof data, reducing the window of opportunity for counterfeiters to infiltrate distribution channels.

Expansive tariff measures in 2025 are reshaping supply chains and cost structures across pharmaceutical and cosmetics packaging markets

The tariff landscape in 2025 has introduced significant cost pressures and compelled packaging stakeholders to reassess sourcing strategies. The Office of the United States Trade Representative extended exclusions for certain Chinese imports under Section 301 through August 31, 2025, but maintained substantial duties on key materials, underscoring the continued importance of strategic tariff management. Concurrently, the reinstatement of a 25 percent tariff on steel and aluminum imports, combined with the removal of previous exemptions, has elevated costs for metal-based packaging components, from aerosol cans to closures.

Advanced segmentation reveals nuanced technology, material, packaging type, and end-use dynamics driving security packaging innovation

A detailed segmentation analysis reveals the diverse technology layers essential for modern security packaging. Covert authentication features and forensic markers provide a hidden first line of defense, while holographic elements-such as diffractive holograms, embossed holograms, and kinegrams-offer visible anti-tamper confirmation. Complementing these are overt authentication features and advanced RFID and NFC integrations, encompassing active RFID, passive RFID, and NFC, which enable both supply chain transparency and consumer engagement. Security inks-including IR, thermochromic, and UV inks-add further complexity, while serialized barcodes and QR codes, in both 1D and 2D formats, underpin track-and-trace systems. Finally, tamper-evident seals such as induction seals, shrink bands, and tamper-evident films close the loop on comprehensive security solutions.

This comprehensive research report categorizes the Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Packaging Type

- End Use

Differing regulatory frameworks, market maturity, and technology adoption define regional anti-counterfeit packaging trends in Americas, EMEA, and Asia-Pacific landscapes

Regional divergences in regulation, market maturity, and technology adoption shape the deployment of anti-counterfeit packaging solutions. In the Americas, the Drug Supply Chain Security Act (DSCSA) has accelerated the adoption of serialization and RFID tracking to safeguard prescription products, while the United States-Mexico-Canada Agreement (USMCA) facilitates tariff-free sourcing of materials, driving innovation in track-and-trace integration. North America remains a leader in smart packaging due to stringent regulations and well-developed supply chain infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading companies are transforming security packaging through strategic investments, partnerships, and innovative technology deployments

Leading tier-1 packaging and technology providers leverage scale and expertise to set industry benchmarks. Companies such as 3M, Avery Dennison, and SICPA combine extensive R&D investments with broad regulatory relationships to deliver RFID-enabled security labels, holographic seals, and forensic inks globally. Tier-2 innovators, including Authentix, AlpVision, and TraceLink, focus on specialized digital watermarking, cloud-based verification platforms, and serialization services, offering versatile, cost-effective solutions. Emerging players such as Applied DNA Sciences, Holostik, SML Group, and Zebra Technologies bring niche capabilities-ranging from DNA taggants and IoT-enabled holograms to conductive inks-further diversifying the competitive ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AlpVision SA

- Antares Vision Group S.p.A.

- Applied DNA Sciences, Inc.

- Authentix Inc.

- Avery Dennison Corporation

- De La Rue plc

- Entrust Corporation

- Holostik India Limited

- Impinj, Inc.

- Markem-Imaje

- NXP Semiconductors N.V.

- OpSec Security Group plc

- OPTEL Group

- SICPA Holding SA

- Sproxil, Inc.

- Systech

- TraceLink, Inc.

- TruTag Technologies, Inc.

- Zebra Technologies Corporation

Strategic imperatives for industry leaders to harness emerging technologies, fortify supply chains, and uphold regulatory compliance in anti-counterfeit packaging

Industry leaders should prioritize multi-layered security architectures that blend overt, covert, and forensic authentication elements with real-time track-and-trace platforms. By partnering with specialized technology providers and integrating mass serialization, holographic features, and AI analytics, companies can achieve end-to-end visibility and rapid counterfeit detection. Ongoing collaboration with regulators will ensure alignment with evolving mandates and reduce compliance risks.

Rigorous research methodology combining primary interviews, secondary source triangulation, and data validation ensures comprehensive market insights

This research employs a rigorous methodology combining primary interviews with executives from packaging manufacturers, pharmaceutical and cosmetics brand owners, technology providers, and regulatory officials. Complementing these insights, the analysis draws upon a comprehensive review of secondary sources, including trade publications, government tariff notices, academic journals, and press releases. Collected data underwent cross-validation through triangulation techniques, ensuring consistency and reliability. Qualitative findings were contextualized through expert panel discussions, while quantitative metrics were tested via scenario analysis and sensitivity modeling to capture market complexity and emerging trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market, by Technology

- Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market, by Material

- Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market, by Packaging Type

- Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market, by End Use

- Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market, by Region

- Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market, by Group

- Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market, by Country

- United States Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market

- China Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Conclusion summarizing critical role of advanced packaging solutions in safeguarding consumer safety and brand integrity

The convergence of sophisticated counterfeiting techniques with complex global supply chains has elevated the stakes for pharmaceutical and cosmetics brand protection. Advanced authentication technologies, robust track-and-trace systems, and sustainable packaging innovations now form the cornerstone of effective defense strategies. Stakeholders who proactively invest in multi-layered security architectures, engage collaboratively with regulators, and adapt to dynamic tariff landscapes will be best positioned to safeguard consumer safety and uphold brand integrity in this high-risk market environment.

Secure your advantage with an exclusive anti-counterfeit packaging research report by engaging with our Associate Director, Sales & Marketing today

To gain a competitive edge and unlock comprehensive analysis of anti-counterfeit packaging dynamics across pharmaceutical and cosmetics sectors, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the report’s rich insights, from advanced authentication technologies to region-specific strategies and actionable recommendations. Engaging with him ensures you receive tailored information aligned with your organization’s priorities, empowering you to implement solutions that protect your brand and customers. Secure your copy today to stay ahead in a market where innovation and security converge.

- How big is the Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market?

- What is the Anti-Counterfeit Pharmaceuticals & Cosmetics Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?