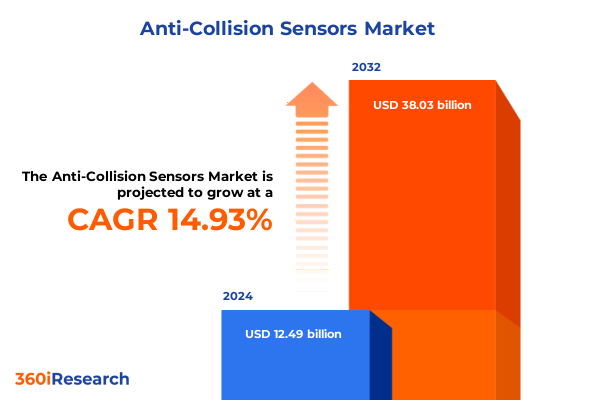

The Anti-Collision Sensors Market size was estimated at USD 14.29 billion in 2025 and expected to reach USD 16.36 billion in 2026, at a CAGR of 15.00% to reach USD 38.03 billion by 2032.

Pioneering Safety Through Innovation: Unveiling the Critical Role and Emerging Significance of Anti-Collision Sensors in Modern Industries and Autonomous Systems

Anti-collision sensors represent a cornerstone of modern safety technologies, enabling vehicles and automated systems to proactively detect obstacles and initiate preemptive measures. These devices employ an array of detection methods-including radar, LiDAR, ultrasonic, and infrared-to continuously monitor surroundings and trigger alerts or automatic responses when an imminent collision is detected. As global safety standards evolve, these systems have expanded beyond traditional automotive applications into robotics, industrial automation, aerospace, and healthcare environments, underscoring their critical role in safeguarding both people and assets.

In the automotive sector, automatic emergency braking (AEB) systems have emerged as a defining application of anti-collision sensors. The U.S. National Highway Traffic Safety Administration (NHTSA) finalized Federal Motor Vehicle Safety Standard FMVSS No. 127 in April 2024, mandating that all passenger cars and light trucks be equipped with AEB, including pedestrian detection, by September 2029. This regulation is expected to prevent at least 360 fatalities and 24,000 injuries annually by requiring vehicles to detect potential collisions with other vehicles up to 62 mph and apply brakes automatically up to 90 mph when needed.

Meanwhile, global regulators are steadily increasing performance requirements for these systems. Current voluntary agreements indicate that approximately 90% of new vehicles already incorporate AEB features, but effectiveness can vary significantly across lighting and speed conditions. As these mandates come into force, the integration of anti-collision sensors will transition from premium add-ons to standard safety equipment, driving broader adoption and catalyzing further innovation across sectors.

How Technological Advancements and Regulatory Dynamics Are Revolutionizing the Anti-Collision Sensor Landscape and Shaping the Future of Safety and Efficiency

The anti-collision sensor landscape is undergoing transformative shifts driven by rapid technological evolution and increasingly stringent regulatory frameworks. Sensor fusion, which combines data from radar, LiDAR, ultrasonic, and infrared modules, is now standard practice in advanced driver assistance systems (ADAS) and autonomous platforms. This approach enhances detection accuracy, reduces false positives, and extends operational envelopes to cover high-speed highway scenarios as well as complex urban environments. At the same time, software-defined safety architectures are rising in prominence, allowing manufacturers to deploy over-the-air updates that continuously refine detection algorithms and response behaviors.

Concurrently, emerging semiconductor technologies are enabling smaller, more energy-efficient sensors capable of delivering higher resolution and longer detection range. For example, solid-state LiDAR arrays are transitioning from bulky rotating units to compact, chip-scale modules, significantly lowering integration barriers for passenger vehicles and robotics. Radar systems are also benefiting from advancements in millimeter-wave designs, which improve object classification while maintaining performance in adverse weather and low-visibility conditions. Ultrasonic sensors continue to evolve as cost-effective solutions for low-speed detection in parking and maneuvering applications, but their limitations in range are driving increased adoption of hybrid architectures.

Regulatory forces are reinforcing these trends. As countries move to standardize AEB and adaptive cruise control, manufacturers are prioritizing scalable sensor platforms that can be tailored to regional performance mandates. Meanwhile, industry consortia and open-source initiatives are fostering interoperability and reducing time-to-market for next-generation safety solutions. The convergence of these factors is reshaping the competitive landscape, compelling legacy vendors and new entrants alike to accelerate R&D efforts and establish strategic partnerships.

Assessing the Cumulative Impact of 2025 United States Trade Policies and Tariffs on the Cost Structures and Supply Chains of Anti-Collision Sensor Manufacturers

The cumulative impact of U.S. tariff policies enacted in early 2025 is reshaping cost structures and supply chain configurations for anti-collision sensor manufacturers. Under the Trade Expansion Act’s Section 232, the Commerce Department initiated a probe into semiconductor imports, with potential duties up to 25% aimed at bolstering domestic chip production. In parallel, the government implemented a universal 10% tariff on virtually all imports effective April 2025, creating layered cost pressures on sensor component procurement and finished module imports.

Further complicating the environment, the administration imposed 25% tariffs on steel and aluminum imports as of March 12, 2025, to protect U.S. producers, while excluding no major trading partner. The new levy also encompasses derivative products unless they demonstrate domestic melt and pour or smelt and cast origins, requiring detailed customs declarations and increasing logistical overhead. These combined measures have elevated the landed cost of sensor housings, mounting brackets, and associated mechanical components-many of which rely on lightweight aluminum alloys and specialized steel alloys for durability and corrosion resistance.

Equally significant are the near-universal 25% duties on goods imported from Canada and Mexico, enforced from March 4, 2025, under newly imposed trade tensions. This policy has disrupted long-standing North American supply chains, compelling manufacturers to reroute component imports, requalify suppliers, or absorb increased duties to maintain price consistency. With multiple tariff layers interacting, anti-collision module producers face compressed margins, leading some to explore nearshoring strategies or to negotiate long-term supplier agreements with fixed pricing structures to mitigate volatility.

Deep Dive into Critical Market Segmentation Revealing Unique Demand Patterns and Technology Preferences Across Vehicle Types, Sensor Technologies, and Key End-Use Applications

Segmenting the anti-collision sensor market by vehicle type highlights distinct performance and durability needs between commercial and passenger applications. Commercial vehicles, including heavy-duty trucks and buses, demand sensors with extended range, robust environmental tolerance, and redundancy to support stringent safety protocols. In contrast, passenger vehicles prioritize compact form factors, cost efficiency, and seamless integration with infotainment and driver-assistance systems, driving engineers to refine sensor modularity and packaging.

Examining sensor types reveals that infrared modules are increasingly adopted for indoor and close-range detection use cases in industrial and healthcare settings, while radar stands out for its all-weather operational consistency in automotive and aerospace scenarios. Ultrasonic sensors remain prevalent in low-speed maneuvers such as parking assistance due to their affordability, but limitations in detection range have prompted a gradual shift toward LiDAR for medium-to-long-range detection. LiDAR’s high-resolution point-cloud mapping capabilities are particularly valued in autonomous platforms and robotics, where precise spatial awareness underpins navigation and obstacle avoidance.

Differentiating by application uncovers that aerospace and defense programs require the highest levels of system validation and redundancy, facilitating the adoption of multi-modal sensor suites. Automotive applications focus on compliance with evolving safety regulations and user experience enhancements through intuitive driver feedback. In healthcare environments, anti-collision sensors enhance patient safety in automated transport systems and assistive robotics. Industrial automation leverages these sensors for machine safeguarding and collision prevention in complex manufacturing lines. Finally, robotics innovators integrate these technologies to deliver autonomous mobile robots capable of dynamic obstacle negotiation in unstructured environments.

This comprehensive research report categorizes the Anti-Collision Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Sensor Type

- Application

Exploring Regional Dynamics Driving Adoption, Innovation, and Competitive Forces in the Global Anti-Collision Sensors Market Across the Americas, EMEA, and Asia-Pacific

Regional insights into the global anti-collision sensor market underscore diverse adoption drivers, regulatory pressures, and competitive dynamics. In the Americas, stringent safety regulations and high consumer expectations for advanced driver assistance features have spurred rapid deployment of radar-based and LiDAR-enabled systems across both passenger and commercial vehicle segments. Meanwhile, the ongoing trade war with Canada and Mexico, marked by 25% cross-border tariffs as of March 2025, has prompted U.S. manufacturers to reassess supply chain footprints and localize key production processes to avoid duty escalations.

In Europe, Middle East & Africa (EMEA), robust regulatory frameworks and coordinated safety mandates-such as the Euro NCAP’s evolving AEB testing protocols-drive uniform adoption of high-performance anti-collision sensors. European OEMs are collaborating with specialized sensor vendors to co-develop integrated systems that meet pan-regional type approval requirements, while Middle Eastern defense programs prioritize multi-modal sensor fusion for border security and unmanned aerial vehicle applications. At the same time, Africa’s nascent automotive and industrial automation markets present greenfield opportunities for cost-optimized sensor platforms.

Asia-Pacific stands out as both a major production hub and a rapidly growing consumer market. China’s push for semiconductor self-reliance under its “Made in China 2025” initiative has intensified domestic sensor component manufacturing, reducing dependency on Western imports despite potential quality control challenges. In Japan and South Korea, established electronics supply chains and robotics leadership accelerate the commercialization of compact, high-precision modules. India’s infrastructure modernization efforts and emphasis on smart manufacturing further bolster demand for anti-collision systems in industrial and transport sectors.

This comprehensive research report examines key regions that drive the evolution of the Anti-Collision Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Companies Pioneering Breakthroughs Through Strategic Collaborations, Mergers, and Product Innovations in the Anti-Collision Sensor Industry

Leading players in the anti-collision sensor market are executing multifaceted strategies to maintain technological leadership and secure market share. Traditional automotive suppliers such as Bosch and Continental continue to diversify their portfolios by integrating infrared, radar, and ultrasonic modules into centralized electronic control units, enabling unified sensor fusion platforms and seamless OEM integration. At the same time, semiconductor stalwarts like Texas Instruments are expanding in-house capability to supply radar-on-chip solutions, driving down component costs and streamlining procurement for module assemblers.

New entrants and specialized innovators are also reshaping the competitive landscape. Companies like Luminar Technologies and Quanergy are pioneering solid-state LiDAR solutions optimized for both automotive and industrial robotics applications, achieving centimeter-level resolution at reduced price points. Meanwhile, Velodyne Lidar has introduced compact, MEMS-based architectures that address space constraints in passenger vehicles. Additionally, major OEMs such as General Motors and Ford are internalizing sensor development efforts, partnering with start-ups for software integration while leveraging their scale advantages to negotiate favorable long-term component agreements.

Across the board, collaboration between hardware vendors, software developers, and system integrators is intensifying. Joint development agreements and strategic alliances-often supported by venture capital investments and acquisition activities-are enabling rapid iteration of sensor algorithms, real-time data processing frameworks, and edge-compute architectures. This ecosystem-driven approach is accelerating time-to-market for new safety features and bolstering the ability of established and emerging vendors to respond to evolving regulatory and performance requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Collision Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Analog Devices, Inc.

- Aptiv PLC

- Autoliv Inc.

- Continental AG

- Delphi Technologies Plc

- Denso Corporation

- GEM Electronica Co., Ltd.

- Hella KGaA Hueck & Co.

- Hitachi Automotive Systems, Ltd.

- Honeywell International Inc.

- Infineon Technologies AG

- LG Innotek Co., Ltd.

- Mobileye N.V.

- NXP Semiconductors N.V.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Sensata Technologies Holding PLC

- Siemens AG

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- TE Connectivity Ltd.

- Valeo SA

- ZF Friedrichshafen AG

Actionable Recommendations for Industry Leaders to Optimize Supply Chains, Accelerate Innovation, and Strengthen Competitive Positioning in the Anti-Collision Sensors Sector

Industry leaders should prioritize supply chain diversification to mitigate tariff-driven cost pressures and geopolitical uncertainty. By cultivating relationships with multiple tier-1 and tier-2 suppliers across different regions, companies can secure critical components at competitive prices and avoid single-source dependencies. Additionally, nearshore manufacturing hubs can be leveraged to reduce lead times and transportation costs while ensuring compliance with local content requirements.

Investing in proprietary semiconductor and software capabilities will be vital for sustaining performance differentiation. Organizations are encouraged to establish internal R&D centers focused on advanced sensor fusion algorithms, edge-compute platforms, and AI-enabled anomaly detection. Leveraging partnerships with semiconductor foundries and academic institutions can further accelerate innovation while controlling IP and reducing licensing fees. At the same time, modular hardware architectures should be emphasized to facilitate rapid customization and ease of integration across diverse vehicle types and industrial applications.

Engagement with regulatory bodies and participation in industry consortia will help shape performance standards that align with practical deployment timelines. Proactive collaboration on test protocols, interoperability frameworks, and safety validation methodologies ensures that new technology introductions meet or exceed regional requirements. Finally, cultivating a culture of continuous learning and cross-functional collaboration-bridging hardware, software, and system integration teams-will enable organizations to rapidly adapt to evolving market demands and maintain a competitive edge.

Detailed Research Methodology and Analytical Framework Employed to Uncover Insights Into Technological Trends, Market Drivers, and Competitive Landscapes

This research leverages a comprehensive, multi-tiered methodology combining both primary and secondary sources to ensure robust, fact-based insights. Secondary research encompassed an extensive review of industry publications, regulatory filings from the NHTSA and USTR, company annual reports, and technology whitepapers to map the competitive landscape and regulatory environment. Insights from government databases and customs documentation were also analyzed to quantify the impact of newly imposed tariff measures.

Primary research included in-depth interviews with over two dozen senior executives from leading sensor manufacturers, automotive OEMs, system integrators, and supply chain specialists. These discussions provided granular perspectives on strategic priorities, technology roadmaps, and cost management approaches. Additionally, an expert panel comprising academics, policy analysts, and field engineers conducted structured workshops to validate assumptions, stress-test findings, and identify emerging risks and opportunities.

Data triangulation and cross-referencing techniques were employed throughout to reconcile disparate information sources and reinforce confidence in the conclusions drawn. Quantitative inputs were supplemented by qualitative annotations that highlight contextual nuances, while scenario analysis frameworks were applied to project potential pathway outcomes under varying regulatory and market conditions. This blended approach ensures action-oriented recommendations grounded in real-world applicability and forward-looking accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Collision Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Collision Sensors Market, by Vehicle Type

- Anti-Collision Sensors Market, by Sensor Type

- Anti-Collision Sensors Market, by Application

- Anti-Collision Sensors Market, by Region

- Anti-Collision Sensors Market, by Group

- Anti-Collision Sensors Market, by Country

- United States Anti-Collision Sensors Market

- China Anti-Collision Sensors Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Concluding Perspectives on Market Dynamics, Emerging Challenges, and Strategic Imperatives Shaping the Future Trajectory of Anti-Collision Sensors Across Industries

The anti-collision sensor market stands at a pivotal juncture where technological innovation, regulatory momentum, and global trade dynamics converge to redefine industry trajectories. Rising mandates for advanced driver assistance and autonomous safety functions are accelerating adoption across automotive and non-automotive sectors, compelling stakeholders to prioritize rapid iteration of sensor platforms and software ecosystems. Meanwhile, evolving tariff landscapes are reshaping cost structures and supply chain footprints, necessitating strategic agility and diversified sourcing approaches.

Companies that successfully integrate multi-modal sensor fusion, cultivate semiconductor self-sufficiency, and forge collaborative partnerships will be best positioned to capture growth and navigate emerging challenges. As performance benchmarks tighten and integration complexity increases, a holistic approach that aligns hardware innovation with software enhancements and validation protocols will separate market leaders from laggards. Regulatory collaboration, ecosystem participation, and proactive cost mitigation strategies will serve as critical differentiators in sustaining competitive advantage.

Looking ahead, the market’s future trajectory will be influenced by advancements in AI-driven perception systems, the maturation of solid-state sensor architectures, and the harmonization of global safety standards. Firms that embrace an innovation-oriented mindset, bolstered by robust research methodologies and actionable intelligence, will not only adapt to disruption but also shape the next frontier of collision prevention technologies.

Connect with Ketan Rohom to Unlock Comprehensive Market Intelligence and Drive Strategic Decisions With the Latest Anti-Collision Sensor Industry Research Report

Ready to gain a competitive edge in the rapidly evolving anti-collision sensors market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore comprehensive insights customized to your strategic needs. With tailored guidance, detailed competitive analysis, and actionable trend forecasts, you’ll have everything required to make informed decisions and accelerate growth initiatives. Don’t miss the opportunity to leverage this in-depth research to drive operational excellence, optimize your technology roadmap, and secure a leadership position. Contact Ketan Rohom today to purchase the definitive anti-collision sensor market research report and transformer your organization’s approach to safety and automation.

- How big is the Anti-Collision Sensors Market?

- What is the Anti-Collision Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?