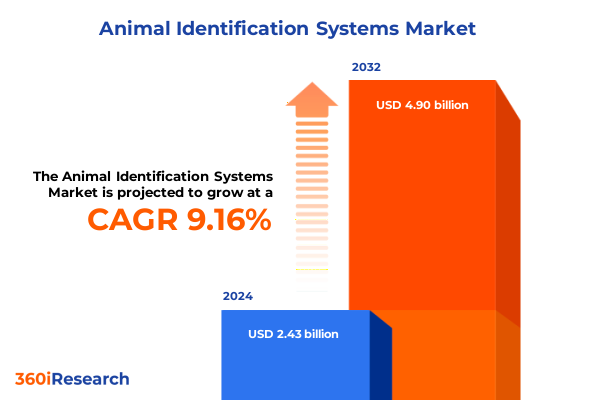

The Animal Identification Systems Market size was estimated at USD 2.66 billion in 2025 and expected to reach USD 2.91 billion in 2026, at a CAGR of 9.41% to reach USD 4.99 billion by 2032.

Exploring the Critical Importance of Modern Animal Identification Systems in Strengthening Traceability, Health Management, and Regulatory Compliance

Animal identification systems have become indispensable in modern agriculture for ensuring robust traceability, enhancing animal welfare, and supporting regulatory compliance. The USDA’s Animal and Plant Health Inspection Service finalized a rule in April 2024 mandating electronic identification tags for certain cattle and bison moving across state lines, signaling a decisive shift from visual to electronic tagging methods to safeguard public health and disease control efforts. In parallel, the European Union’s EC 1760/2000 regulation, which requires all bovines to carry electronic identifiers with a 92% compliance rate as of December 2024, illustrates the global momentum behind standardized, technology-driven tracking solutions.

Technological innovations have further elevated the role of animal identification systems. The integration of GPS-enabled ear tags rose by 7% in 2024, with 21% of global ear tags featuring real-time positioning capabilities, offering farmers enhanced visibility into livestock movements and behavior. These advancements in non-permanent identification solutions have improved disease detection, breeding management, and supply chain transparency without imposing invasive procedures on animals. Consequently, precision livestock farming has gained traction, enabling data-driven decision-making and operational efficiencies that respond to both economic constraints and evolving consumer expectations.

Beyond hardware, the convergence of digital ecosystems has redefined traceability. Retailers such as Carrefour have adopted blockchain platforms like IBM Food Trust to record product journeys from farm to shelf, empowering consumers with immutable access to origin data and supporting rapid response in recall events. Meanwhile, startups like Breedr leverage cloud-based analytics and blockchain to offer lifetime tracking of individual cattle, facilitating collaboration across supply chain participants and delivering measurable improvements in productivity and sustainability. Together, these developments set the stage for a new era of transparent, efficient, and accountable animal identification practices.

Navigating the Major Transformative Shifts Redefining Animal Identification Systems Through Technological Innovation and Regulatory Evolution

A profound transformation is underway in the animal identification landscape as emerging technologies enable more intelligent and connected solutions. Traditionally reliant on one-dimensional barcodes and manual recordkeeping, the industry is now embracing RFID systems that support both active and passive modalities, delivering real-time visibility of livestock location and status. The 2023 deployment of GPS-integrated ear tags saw a marked uptick, with usage rates growing as farmers recognized the value of precise geofencing and remote monitoring for herd management. Concurrently, two-dimensional barcodes are migrating from static labels to dynamic QR-coded ear tags, facilitating swift data retrieval and consumer engagement at retail points.

Biometric identification has also emerged as a complementary approach, with facial recognition and footprint scanning technologies gaining attention for non-invasive, animal-friendly tagging alternatives. Early pilots in Australia demonstrated that combining biometric sensors with RFID chips can reduce tag rejection rates and enhance the integrity of health monitoring systems. These hybrid solutions are rapidly evolving, offering the promise of seamless integration across multiple identification modalities to suit diverse species and environments.

In tandem with hardware innovation, software and analytical platforms are advancing to harness the wealth of data captured by identification devices. Predictive health monitoring applications, now adopted by 37% of North American livestock operations, leverage AI-driven algorithms to forecast disease outbreaks and optimize feeding schedules, reducing mortality and improving feed conversion efficiency. Meanwhile, blockchain-based traceability networks, exemplified by Beefchain’s USDA Process Verified Program certification in 2018, validate provenance and quality attributes, building consumer trust and creating new market premiums for verified products. Collectively, these advancements signal a decisive move toward comprehensive, end-to-end identification ecosystems that transcend simple tagging, ushering in an era of data-centric animal management.

Assessing the Cumulative Impact of United States Tariffs on Animal Identification Systems Amid 2025 Trade Policy Changes

The introduction of substantial tariffs under U.S. trade policy in 2025 has exerted multifaceted pressure on the animal identification systems supply chain. A baseline tariff of 10% on all imports, coupled with targeted rates reaching up to 54% on electronics from China and 25% on materials from Canada and Mexico, has raised the landed cost of RFID tags, readers, and essential electronic components by an estimated 15–20%. These levies apply directly to the microchips, sensors, plastics, and metals integral to both passive and active RFID systems, challenging manufacturers to absorb added expenses or transfer them downstream to end users.

Compounding this, the USTR’s January 1 2025 Section 301 tariff increases on semiconductor wafers, polysilicon, and select tungsten products have imposed a 50% duty on critical chip substrates and a 25% duty on metal components, further escalating costs for embedded electronics in ear tags and bolus devices. This has intensified supply chain disruptions, prompting some firms to delay production runs while seeking alternative sources or exploring domestic fabrication partnerships. The resulting bottlenecks have underscored the vulnerability of just-in-time manufacturing strategies in high-volume agtech hardware.

Despite these headwinds, regulatory mandates and traceability requirements remain non-negotiable, insulating baseline demand from tariff-related volatility. End users reliant on USDA APHIS compliance and EU traceability laws have maintained upgrade schedules, while larger manufacturers with diversified supplier networks have begun reshoring critical production stages to U.S. facilities. Nonetheless, smaller enterprises without capitalized domestic operations face heightened margin pressures. As a result, the industry is witnessing a strategic pivot toward modular system designs, enabling hybrid configurations that blend locally produced modules with imported components to balance performance demands against tariff constraints.

Uncovering Key Segmentation Insights Across Technologies, Products, End Users, Applications, and Distribution Channels in Animal Identification Systems

A nuanced understanding of animal identification systems emerges when examining how technology, product offerings, end-user needs, application areas, and distribution pathways intersect. Technologically, markets have diversified beyond simple one-dimensional barcodes into two-dimensional formats, membrane-embedded RFID tags, GPS-enabled wearable devices, and biometric modalities such as facial and iris recognition. This spectrum illustrates how hardware and software solutions adapt to the granularity of traceability and health monitoring requirements across operations of varying scale.

From a product perspective, identification devices range from ingestible bolus sensors providing internal temperature and pH data to externally applied ear tags, which are available in printed barcode versions or RFID variants. Among ear tags, offerings subdivide into conventional barcode ear tags and RFID-equipped models; the latter further stratified into active, passive, or semi-passive configurations to balance battery life against read range and data throughput. This product segmentation reflects the industry’s drive to match system capabilities to species-specific physiology and farm infrastructure.

End users span aquaculture pens, beef and dairy herds, expansive poultry operations, and intensive swine productions, each with unique operational footprints and traceability imperatives. Across these verticals, identification systems support critical application areas including health monitoring through sensors and software analytics, security by authenticating animal identities and ownership, and tracking to maintain custody chains from birth through processing. Finally, distribution channels encompass direct sales arrangements for large integrators, specialized distributors serving regional markets, and growing online platforms that offer rapid procurement and digital after-sales support. By weaving these dimensions together, stakeholders can tailor solutions that align with farm size, species mix, regulatory context, and investment capacity.

This comprehensive research report categorizes the Animal Identification Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- End User

- Application

- Distribution Channel

Evaluating Strategic Regional Dynamics Shaping the Global Animal Identification Systems Market Across the Americas, EMEA, and Asia-Pacific

Regional dynamics in animal identification systems reveal distinct growth drivers and regulatory landscapes across the Americas, Europe-Middle East & Africa, and Asia-Pacific. In the Americas, North America leads in adoption, driven by stringent USDA APHIS mandates and voluntary traceability initiatives in Canada. The U.S. livestock identification market’s reliance on electronic ear tags has propelled a focus on RFID-based systems, with domestic production efforts accelerated to offset tariff-related cost pressures citeturn4search0. This regional momentum is underpinned by large-scale ranching operations that demand interoperable solutions for interstate commerce and export compliance.

In Europe, the Middle East, and Africa, regulatory frameworks such as the EU’s EC 1760/2000 regulation and British Rural Payments Agency requirements have elevated electronic bovine identification as a legal mandate. As a result, markets in Western Europe exhibit near-saturation of RFID ear tag deployments, while emerging economies in the Middle East and North Africa are investing in traceability infrastructures to meet halal certification and food safety standards. These developments foster downstream opportunities for value-added services, including blockchain-enabled supply chain verification and multi-modal readers adapted to diverse on-farm conditions.

Asia-Pacific represents the fastest-growing region, propelled by proactive government programs in China, Australia, and New Zealand. The Chinese Academy of Agricultural Sciences’ full-chain DNA traceability system, integrating RFID tags with embedded filter paper DNA markers, exemplifies the country’s innovative approach to product authenticity and quality control. Meanwhile, national animal husbandry standards introduced by China’s NHC and SAMR in March 2025 set hygienic practice codes for livestock by-products, with implementation slated for 2026, emphasizing end-to-end traceability of edible offal. Across Australia and New Zealand, public-private partnerships and export-oriented disease control initiatives reinforce a high-value adoption curve for integrated identification and monitoring systems.

This comprehensive research report examines key regions that drive the evolution of the Animal Identification Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation, Partnerships, and Competitive Strategies in the Animal Identification Systems Sector

The animal identification systems sector is characterized by a blend of established multinationals and innovative challengers shaping the competitive landscape. Global leaders such as Avery Dennison Corporation, Microchip Technology Inc., and MSD Animal Health leverage expansive R&D capabilities and international distribution networks to introduce next-generation tags and readers. In parallel, companies such as HID Global Corporation and Neogen Corporation emphasize regulatory compliance and data security in their hardware-software platforms. This tier of key players balances organic development with strategic acquisitions to consolidate technological competencies and geographic reach.

A subset of specialized innovators, including Datamars SA, Nedap N.V., and Gallagher Group Limited, drive differentiation through end-to-end solutions that integrate hardware with cloud-based analytics. Datamars, for example, has enhanced its pet tracking offerings via the acquisition of Kippy S.r.l., while investing heavily in battery-free sensor tags capable of measuring biometric parameters under extreme environmental conditions. Nedap’s SmartTag ear device underscores the company’s strategy to deliver real-time health insights for dairy operations. Meanwhile, Merck Animal Health’s Allflex subsidiary exploits dual-frequency tags and handheld readers to serve government disease eradication programs and large commercial producers.

Emerging players such as Agrident GmbH, HerdDogg, and Avid Identification Systems Inc. focus on niche applications like low-stressor biometric identifiers and integrated herd management apps. Their agility in piloting AI-driven analytics and blockchain traceability pilots gives them competitive latitude to forge partnerships with technology integrators and system resellers. Collectively, this diverse company ecosystem fuels continuous innovation, offering end users a spectrum of choices that align with budget, species, and operational complexity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Identification Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AEG Identifikationssysteme GmbH

- Allflex Livestock Intelligence

- Avery Dennison Corp.

- Avid Identification Systems Inc.

- Biomark Inc.

- Datamars

- Gallagher Group Limited

- HID Global Corporation

- IDEXX Laboratories Inc.

- Microchip Technology Inc.

- Nedap N.V.

- Neogen Corporation

- Shearwell Data LTD

- Y-Tex Corporation

- Zoetis Inc.

Actionable Recommendations for Industry Leaders to Leverage Emerging Technologies, Optimize Supply Chains, and Influence Policy Frameworks in Animal Identification

Industry leaders must prioritize strategic measures to navigate evolving market dynamics and maintain competitive advantage. Investing in domestic manufacturing partnerships or joint ventures can mitigate the impact of import tariffs and secure supply chain resilience. Stakeholders should explore incentives such as U.S. government advanced manufacturing grants and cooperative agreements with electronics fabricators to localize production of microchips and components.

Diversification of supplier networks is equally critical. By engaging with tariff-exempt trade partners and aligning procurement with FTAs under USMCA or allied nation agreements, companies can reduce cost exposure and avoid single-source dependencies. Hybrid system architectures-combining domestically produced modules with imported high-precision sensors-can deliver performance benchmarks while managing total landed costs. Furthermore, developing modular, upgradeable product lines allows end users to scale identification capabilities in phases, reducing upfront investment hurdles.

To enhance value propositions, vendors should integrate advanced analytics, AI, and blockchain into their platforms, offering predictive health alerts and immutable traceability records that underpin brand trust. Collaborations with software providers and industry consortia, such as the National Cattlemen’s Beef Association, can stimulate policy advocacy and standardization efforts, streamlining regulatory adoption. Finally, cultivating direct engagement with end users-through educational initiatives and hands-on pilot programs-will facilitate technology adoption, demonstrating return on investment through improved animal welfare, reduced losses, and enhanced operational transparency.

Detailing the Comprehensive Research Methodology Employed to Analyze Animal Identification Systems Market Trends, Segmentation, and Regulatory Impacts

This analysis employed a rigorous mixed-methodology framework to capture both quantitative trends and qualitative insights spanning the animal identification systems landscape. Secondary research involved an exhaustive review of publicly available regulatory documents, trade notices, patent filings, and industry press releases to contextualize the impact of U.S. tariffs, Section 301 rulings, and national traceability standards. Primary data was gathered through structured interviews with senior executives at leading hardware manufacturers, software integrators, and end-user farm operators to validate market observations and uncover emerging use cases.

A detailed segmentation mapping exercise aligned five core dimensions-technology, product, end user, application, and distribution channel-with prevailing market dynamics. Revenue and adoption metrics were cross-referenced against industry benchmarks from USDA APHIS rulemaking and EU traceability mandates. Regional analysis leveraged data from government extension services and trade body publications, supplemented by site visits to pilot implementation facilities in North America, Europe, and Asia-Pacific.

To ensure analytical integrity, data triangulation techniques reconciled insights from industry surveys, public filings, and expert interviews. Findings were subjected to peer review by subject matter specialists in agricultural economics and livestock health. The final report synthesizes these inputs into thematic narratives and strategic frameworks, offering stakeholders actionable recommendations grounded in current policy, technology, and competitive realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Identification Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Identification Systems Market, by Product

- Animal Identification Systems Market, by Technology

- Animal Identification Systems Market, by End User

- Animal Identification Systems Market, by Application

- Animal Identification Systems Market, by Distribution Channel

- Animal Identification Systems Market, by Region

- Animal Identification Systems Market, by Group

- Animal Identification Systems Market, by Country

- United States Animal Identification Systems Market

- China Animal Identification Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing the Strategic Importance of Animal Identification Systems for Enhanced Traceability, Sustainability, and Market Growth

Animal identification systems stand at the nexus of technological advancement, regulatory rigor, and operational necessity, serving as foundational elements in modern livestock management. The convergence of RFID, GPS, biometric, and blockchain technologies has not only elevated traceability standards but also unlocked new potentials in health monitoring, disease prevention, and supply chain transparency. Meanwhile, tariff modifications and trade policies underscore the need for strategic supply chain realignment and domestic manufacturing initiatives to uphold cost-effectiveness and resilience.

Segmentation insights reveal a market landscape defined by tailored solutions that respond to species-specific requirements, varying investment profiles, and distribution frameworks. Regional analyses highlight distinct adoption trajectories-from regulated saturation in Europe and North America to rapid expansion in Asia-Pacific-while company profiles demonstrate a competitive ecosystem balancing scale, specialization, and innovation. These collective insights underscore the imperative for industry players to adopt modular, interoperable platforms that can evolve alongside regulatory changes and emerging use cases.

Ultimately, stakeholders equipped with a deep understanding of technology shifts, tariff landscapes, and segmented buyer needs will be best positioned to capture growth opportunities and drive operational efficiencies. The dynamic interplay between policy, innovation, and market demand calls for agile strategies that align R&D investments with end-user pain points and compliance imperatives, ensuring long-term value creation and sustained competitive advantage.

Engage with Ketan Rohom to Acquire an In-Depth Animal Identification Systems Market Research Report and Unlock Strategic Growth Opportunities

If you’re seeking to gain a competitive edge with unparalleled market intelligence on animal identification systems, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive report can inform your strategic decisions and drive growth. Engage with Ketan to request sample insights, customize data views, and secure your access to actionable intelligence covering technology trends, tariff impacts, segmentation analysis, regional dynamics, and key company profiles. Connect with Ketan Rohom today and take the first step towards capitalizing on emerging opportunities in the animal identification systems landscape.

- How big is the Animal Identification Systems Market?

- What is the Animal Identification Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?