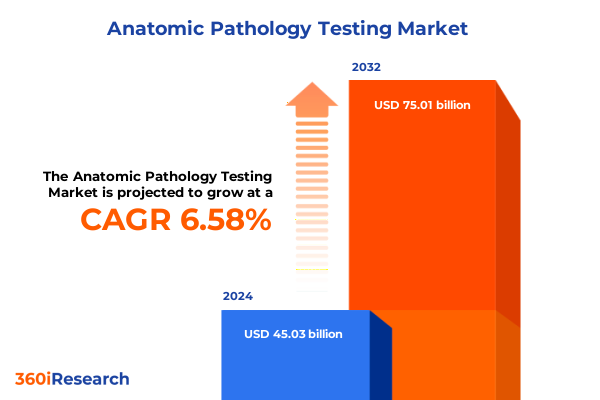

The Anatomic Pathology Testing Market size was estimated at USD 47.92 billion in 2025 and expected to reach USD 51.00 billion in 2026, at a CAGR of 6.60% to reach USD 75.01 billion by 2032.

Comprehensive Overview Highlighting the Critical Role and Evolving Dynamics of Anatomic Pathology Testing in Modern Healthcare Systems

The field of anatomic pathology testing sits at the nexus of patient diagnosis and therapeutic decision-making, playing an indispensable role in modern healthcare delivery. As clinical demands evolve, laboratories are tasked with integrating robust diagnostic protocols that combine time-honored staining techniques with emerging technological innovations. This report offers a comprehensive overview of the critical pathways and methodologies that underpin disease detection, encompassing digital pathology platforms, advanced staining procedures, and molecular diagnostics.

Through detailed exploration of industry drivers and operational imperatives, this analysis establishes a foundational understanding of the current landscape. It highlights the interplay between traditional histological methods and transformative digital tools that collectively enhance diagnostic confidence. By setting the stage with a thorough introduction to core concepts and market dynamics, readers will be prepared to engage with deeper insights on shifts in technology, policy influences, segmentation granularity, and regional variations guiding strategic planning.

Detailed Exploration of Transformative Technological and Operational Shifts Redefining the Anatomic Pathology Testing Arena for Enhanced Diagnostic Precision

In recent years, anatomic pathology testing has undergone a profound metamorphosis brought about by the convergence of digital transformation and precision medicine. Laboratories across academic centers, reference facilities, and hospital networks are increasingly adopting whole-slide imaging and image analysis software to streamline workflow, reduce diagnostic turnaround times, and improve inter-observer consistency. At the same time, the integration of artificial intelligence algorithms into digital pathology has accelerated image-based detection of anomalies, enabling pathologists to focus on complex case review and value-added interpretive tasks.

Alongside these technological advances, operational practices are evolving to meet heightened regulatory standards and quality benchmarks. The shift from manual staining protocols toward automated immunohistochemistry platforms underscores the demand for reproducibility and high-throughput capabilities. Concurrently, the emergence of next-generation sequencing and fluorescence in situ hybridization reinforces the transition toward molecular interrogation of tissue specimens. Collectively, these shifts have redefined diagnostic precision and established new best practices, laying the groundwork for the next generation of integrated anatomic pathology services.

In-Depth Assessment of the Cumulative Impact of 2025 United States Tariffs on Supply Chains Pricing and Accessibility in Anatomic Pathology Testing

The introduction of renewed tariff policies in the United States during 2025 has exerted a cumulative influence on the anatomic pathology supply chain, particularly affecting the cost and availability of critical reagents, monoclonal antibodies, and imaging hardware. Increased duties on imported components have translated into elevated procurement expenses for laboratories, prompting many organizations to reevaluate sourcing strategies and negotiate longer-term supplier agreements. In response, some vendors have sought to mitigate price pressures by localizing manufacturing or revising distribution channels.

Moreover, the tariff environment has fostered a renewed emphasis on cost containment and inventory optimization within pathology departments. Stakeholders are embracing just-in-time inventory models and leveraging group purchasing organizations to secure volume discounts. While these tactical adjustments serve to buffer short-term financial impacts, industry leaders recognize the importance of diversifying supplier portfolios and investing in adaptable procurement frameworks. Ultimately, the cumulative effect of these tariffs underscores the need for resilient supply chains and strategic planning to ensure sustained access to advanced diagnostic tools.

Comprehensive Insights into Market Segmentation Illuminating Varied Test Types Sample Types Applications and End-User Dynamics Shaping the Industry

An in-depth understanding of market segmentation reveals how diverse test types, sample varieties, applications, and end-user preferences collectively shape the anatomic pathology domain. Within test types, digital pathology platforms comprised of slide scanners and specialized image analysis software are gaining traction alongside conventional staining approaches such as hematoxylin and eosin, immunohistochemistry with its monoclonal and polyclonal antibody formats, molecular pathology techniques including polymerase chain reaction, next-generation sequencing and fluorescence in situ hybridization, as well as specialized staining methodologies like periodic acid-Schiff, silver stain, and trichrome protocols. This rich tapestry of methodologies enables laboratories to customize diagnostic pathways according to case complexity and specimen characteristics.

When considering sample types, the distinct handling requirements for cytology samples, frozen sections, and tissue biopsies demand tailored processing workflows that maintain specimen integrity and support downstream analytical accuracy. Likewise, application-based segmentation underscores how genetic disorder screening focuses on chromosomal and single-gene abnormalities, infectious disease testing targets bacterial and viral pathogens, and oncology assessments of breast, lung, and prostate cancers rely on a combination of histological and molecular insights. Finally, the dynamics of end users-ranging from high-throughput diagnostic laboratories and hospital-based pathology departments to specialized research institutes-illustrate how organizational scale and operational priorities influence technology adoption and service models.

This comprehensive research report categorizes the Anatomic Pathology Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Sample Type

- Application

- End User

Strategic Perspective on Regional Dynamics Uncovering Growth Opportunities and Challenges Across Americas Europe Middle East Africa and Asia Pacific

Regional nuances across the globe have significant implications for the deployment of anatomic pathology testing solutions, with distinct drivers emerging in Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, strong investment in digital infrastructure and a robust regulatory framework have fueled adoption of automated staining systems and AI-supported image analysis. Laboratories in North and Latin America benefit from established reimbursement pathways, yet face pressures to optimize cost efficiencies amid shifting healthcare budgets.

Conversely, Europe Middle East & Africa presents a mosaic of markets where regulatory harmonization challenges coexist with opportunities to upgrade legacy pathology workflows. In Western Europe, stringent quality standards propel modernization efforts, whereas emerging economies in Eastern Europe and parts of the Middle East adopt hybrid models to balance affordability with performance. Asia-Pacific stands out for its rapid infrastructure expansion and growing emphasis on precision medicine, as regional governments and private entities invest heavily in next-generation sequencing capabilities. The interplay of local regulations, reimbursement schemes, and infrastructure readiness across these regions informs strategic localization of product portfolios and service offerings.

This comprehensive research report examines key regions that drive the evolution of the Anatomic Pathology Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analytical Examination of Key Industry Players Their Strategic Initiatives Partnerships and Innovations Driving Progress in Anatomic Pathology Testing

The competitive landscape in anatomic pathology testing is characterized by established players and innovative newcomers striving to advance diagnostic accuracy and operational efficiency. Key organizations have prioritized portfolio expansion through strategic acquisitions, partnerships, and the in-licensing of cutting-edge technologies. The integration of digital slide scanning and AI-powered image analytics has emerged as a central theme, prompting collaboration between pathology solution providers and software developers to deliver end-to-end digital pathology suites.

Simultaneously, instrument manufacturers are enhancing automated immunostaining platforms to support a broader range of monoclonal and polyclonal antibody assays, catering to evolving clinical protocols. In the molecular domain, alliances with sequencing and PCR specialists enable multiparametric tissue analysis that aligns with personalized medicine initiatives. These corporate strategies, underpinned by robust R&D investments, highlight the commitment of leading companies to address end-user demands for faster turnaround times, reproducible results, and seamless integration within laboratory information systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anatomic Pathology Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abcam plc

- Agilent Technologies Inc.

- Becton, Dickinson and Company

- BioGenex Laboratories Inc.

- Bio SB Inc.

- Danaher Corporation

- Eurofins Scientific SE

- F. Hoffmann‑La Roche AG

- Hamamatsu Photonics K.K.

- Hologic Inc.

- Indica Labs LLC

- Laboratory Corporation of America Holdings

- Leica Biosystems

- Merck KGaA

- NeoGenomics Laboratories Inc.

- PerkinElmer Inc.

- Philips Healthcare

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Sakura Finetek USA Inc.

- Sonic Healthcare Limited

- Synlab Holding GmbH

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Practical Actionable Recommendations Empowering Industry Leaders to Leverage Emerging Technologies Optimize Operations and Enhance Diagnostic Outcomes

Industry leaders must embrace a proactive approach to harness emerging technologies, optimize operational workflows, and mitigate market headwinds. First, laboratories should prioritize the transition to digital pathology platforms that integrate slide scanning with advanced image analysis tools, thereby improving diagnostic consistency and enabling remote consultation capabilities. Next, stakeholders are advised to develop flexible procurement frameworks that address tariff-related cost fluctuations and safeguard continuous access to essential reagents and components.

To further enhance diagnostic outcomes, organizations should invest in cross-disciplinary training programs that equip pathologists and laboratory technicians with skills in AI-assisted interpretation and molecular assay design. Aligning technology adoption with robust quality management systems will ensure compliance with evolving regulatory standards and support accreditation goals. Finally, decision-makers should explore collaborative partnerships with academic centers and software innovators to pilot next-generation sequencing and multiplex imaging approaches that unlock deeper insights into tissue biology and patient stratification.

Transparent Overview of Research Methodology Including Robust Data Collection Analytical Approaches and Validation Processes Ensuring Report Credibility

The insights presented in this report are grounded in a rigorous, multi-method research design encompassing primary interviews, secondary data review, and quantitative validation techniques. Primary research involved in-depth discussions with pathologists, laboratory managers, procurement specialists, and regulatory experts, yielding qualitative perspectives on technology adoption drivers, supply chain dynamics, and regional nuances. Secondary sources were systematically analyzed from peer-reviewed journals, industry white papers, regulatory guidance documents, and non-proprietary corporate disclosures to ensure comprehensive coverage of market developments.

Quantitative data were triangulated and cross-validated to reinforce the credibility of thematic findings, employing sensitivity checks to account for potential variability in regulatory timelines and tariff impacts. Throughout the process, strict adherence to ethical research standards and confidentiality protocols was maintained. By combining robust data collection methodologies with expert interpretive analysis, this study delivers reliable insights that inform strategic decision-making in anatomic pathology testing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anatomic Pathology Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anatomic Pathology Testing Market, by Test Type

- Anatomic Pathology Testing Market, by Sample Type

- Anatomic Pathology Testing Market, by Application

- Anatomic Pathology Testing Market, by End User

- Anatomic Pathology Testing Market, by Region

- Anatomic Pathology Testing Market, by Group

- Anatomic Pathology Testing Market, by Country

- United States Anatomic Pathology Testing Market

- China Anatomic Pathology Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Conclusive Perspective Emphasizing the Strategic Imperatives and Future Significance of Anatomic Pathology Testing Within Evolving Healthcare Paradigms

The strategic imperatives identified throughout this report underscore the transformative potential of anatomic pathology testing within evolving healthcare ecosystems. As laboratories navigate the intersection of digital innovation, regulatory flux, and supply chain complexities, a clear roadmap emerges for enhancing diagnostic precision and operational resilience. Embracing integrated workflows that converge histological staining, immunohistochemistry, and molecular techniques will be critical to addressing the nuanced demands of oncology, genetic disorder screening, and infectious disease diagnostics.

Looking ahead, organizations that proactively adapt to tariff-induced cost shifts, cultivate agile procurement strategies, and invest in AI-enabled platforms will differentiate themselves in an increasingly competitive landscape. By leveraging the segmentation insights and regional dynamics detailed herein, stakeholders can refine market approaches and align resource allocation with areas of highest strategic impact. Ultimately, the convergence of technological innovation and best-practice methodologies promises to elevate patient outcomes and reinforce the pivotal role of anatomic pathology in precision medicine.

Engaging Call To Action Inviting Stakeholders To Connect With Associate Director For Personalized Insights And Report Acquisition

As an industry leader committed to advancing diagnostic excellence, your engagement is pivotal in harnessing the full potential of anatomic pathology testing. We invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and strategic guidance designed to address your organization’s unique challenges. Through a collaborative partnership, you will gain access to a comprehensive market research report that delivers in-depth analysis across test type innovations, regulatory impacts, segmentation nuances, and regional dynamics.

Don’t miss the opportunity to leverage expert-driven recommendations that empower you to optimize workflows, integrate cutting-edge technologies, and navigate evolving tariff landscapes. Reach out today to secure your copy of this indispensable resource and position your organization at the forefront of diagnostic progress.

- How big is the Anatomic Pathology Testing Market?

- What is the Anatomic Pathology Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?