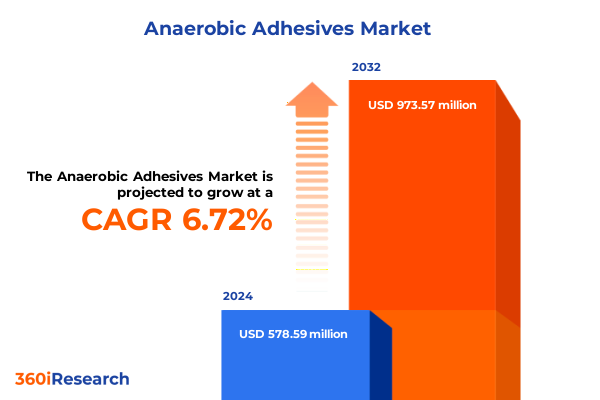

The Anaerobic Adhesives Market size was estimated at USD 617.20 million in 2025 and expected to reach USD 655.94 million in 2026, at a CAGR of 6.72% to reach USD 973.57 million by 2032.

Setting the Stage for Anaerobic Adhesives as a Critical Enabler of Reliability and Efficiency Across High-Performance Manufacturing Sectors

Anaerobic adhesives have emerged as essential bonding agents that cure upon exclusion of air, offering unmatched reliability in securing metal assemblies and threaded components. Their unique chemistry ensures that when liquids are confined between metal surfaces, polymerization initiates to form polymer chains that resist vibration, leakage, and mechanical stresses. As industries demand ever-greater performance from simpler fastening processes, these adhesives have transitioned from niche applications to core solutions for automotive, industrial equipment, and electronics markets.

In recent years, the maturation of anaerobic formulations has expanded their utility beyond traditional threadlocking and retaining applications. Innovations in structural adhesives now leverage tailored molecular backbones that balance rigidity with toughness, while advanced metal bonding compounds accommodate dissimilar joint substrates. These developments underscore the adhesive’s role not just as a replacement for mechanical fasteners but as an enabler of lighter, more integrated designs.

Looking ahead, the pace of automation and the push for leaner production lines are set to drive broader adoption. Anaerobic chemistries align with smart manufacturing protocols by simplifying assembly sequences and reducing torque-angle variances. At the same time, increasing focus on durability and lifecycle management is highlighting the importance of adhesives that can maintain integrity under extreme temperatures, chemicals, and cyclic loading. Consequently, decision-makers are reevaluating assembly strategies to incorporate anaerobic solutions as standard practice rather than specialized use cases.

Unraveling the Forces Reshaping the Anaerobic Adhesives Arena From Digital Innovation to Sustainable Chemistry Innovations That Drive Industry Transformation

The landscape of anaerobic adhesives is undergoing transformative shifts driven by digital integration, sustainability imperatives, and collaborative innovation models. Digital tools such as virtual formulation platforms and AI-assisted property prediction are accelerating product development cycles, enabling chemists to simulate bond performance under real-world stress profiles before conducting physical tests. This fusion of data science with polymer chemistry not only reduces R&D timelines but also fosters greater confidence in early-stage concept validation.

Concurrently, sustainability mandates are reshaping raw material sourcing and end-life considerations. Biobased monomers and recyclable polymer backbones are gaining traction as manufacturers seek to reduce carbon footprints and comply with evolving regulatory frameworks. Partnerships between adhesive producers and resin suppliers have intensified, reflecting a broader shift toward shared responsibility for environmental impact across the value chain.

Moreover, supply chain resilience has become a strategic priority in light of logistical bottlenecks and raw material scarcity. Companies are investing in dual-sourcing agreements for critical feedstocks and exploring decentralized production hubs to mitigate disruptions. These structural adjustments are complemented by a culture of open innovation, where industry alliances and academic consortia collaborate on next-generation anaerobic systems that promise faster curing speeds and enhanced chemical resistance. Together, these forces are redefining what end-users expect from anaerobic adhesives and setting new benchmarks for performance and sustainability.

Examining the Disruptive Impact of Recent United States Tariff Measures on Anaerobic Adhesive Supply Chains and Cost Structures Throughout 2025

In early 2025, the United States implemented new tariff measures targeting certain chemical intermediates and resin precursors used in anaerobic adhesive formulations, marking a significant turning point for domestic and global suppliers. These duties have driven up the cost of key imported monomers, prompting formulators to reassess procurement strategies and collaborate more closely with North American manufacturers of base chemicals. The immediate impact has been a measured increase in raw material expenditure, forcing adhesive producers to optimize production efficiencies and seek alternative feedstock partnerships.

Beyond near-term cost pressures, the tariff environment has accelerated regionalization of adhesive supply chains. With higher import barriers on specific chemistries sourced from traditional overseas hubs, major producers are evaluating the viability of domestic polymerization capacity and exploring joint ventures to localize key stages of manufacturing. This shift is complemented by rising investments in process intensification, where reactive extrusion and continuous flow reactors enhance yield while reducing energy consumption.

At the customer interface, end users have responded to these cost dynamics by extending contract terms, consolidating orders, and engaging in collaborative cost-reduction initiatives with suppliers. In parallel, distributors are recalibrating inventory strategies to buffer against tariff volatility, leveraging their network breadth to secure priority access to scarce materials. Collectively, these adaptations illustrate the profound ripple effects of tariff policy on the economics and architecture of the anaerobic adhesives ecosystem throughout 2025.

Revealing Critical Segmentation Patterns Across Product Types Applications and End Use Industries Driving Targeted Growth in the Anaerobic Adhesives Market

A nuanced review of product type segmentation reveals a broad spectrum of anaerobic adhesive offerings that cater to diverse application demands. Gasket makers have benefited from formulations designed to withstand high pressure and temperature cycles, while instant adhesives continue to deliver rapid bond formation for light-duty assemblies. Metal bonding adhesives are evolving toward enhanced shear resistance, and retaining compounds are being optimized for shrink tube fitting and cylindrical component stabilization. Structural adhesives now underpin load-bearing joints with stiff yet resilient linkages, and threadlockers-available in high-strength, medium-strength, and low-strength grades-ensure tailored torque retention without risk of overlocking.

Application-based segmentation further underscores the adhesive’s versatility across sectors. In aerospace, materials must meet stringent flammability and outgassing criteria, leading to ultra-low viscosity chemistries that flow into micro-gaps. The automotive segment encompasses body assembly, chassis and suspension, electrical systems, and engine components, each driving specific performance priorities such as corrosion resistance, vibration damping, and thermal stability. Electronics applications demand high electrical insulation and minimal ionic contamination, while healthcare installations require biocompatible formulations that can endure sterilization cycles. Industrial uses span heavy machinery, pump seals, and gear manufacturing where chemical resilience and mechanical integrity are paramount.

The end use industry perspective highlights distinct procurement patterns between aftermarket service providers, automotive original equipment manufacturers, construction firms, electronics manufacturers, and machinery producers. Aftermarket technicians increasingly favor all-in-one threadlockers for rapid on-site repairs, whereas OEM assembly lines integrate bulk liquid systems into automated dispensing platforms. Construction specialists utilize paste and film forms for flange sealing, and electronics manufacturers adopt liquid formulations compatible with pick-and-place robotics. Meanwhile, machinery fabricators harness tape-based adhesives for dowel bonding and gasket replacement.

Form considerations shape handling and curing characteristics. Film formats facilitate pre-coating of mating surfaces, liquid compositions enable fine-tuned dispensing precision, paste grades offer thixotropic control in vertical joints, and adhesive tapes deliver clean application with minimal equipment. Sales channel dynamics influence customer engagement and availability; direct sales teams provide technical support for formulary customization, distribution networks extend regional reach and buffer inventory risks, and e-commerce platforms are gaining ground among smaller end users seeking rapid order fulfillment and off-the-shelf product guidance.

This comprehensive research report categorizes the Anaerobic Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- Sales Channel

- End Use Industry

Unpacking the Diverse Regional Dynamics Shaping Demand and Innovation in the Americas Europe Middle East Africa and Asia Pacific for Adhesive Technologies

Regional dynamics in the Americas have been shaped by a robust manufacturing base and strategic proximity to chemical feedstock suppliers. North American producers benefit from access to domestic petrochemical complexes along the Gulf Coast, while end users leverage integrated supply chains to streamline just-in-time delivery. Within Latin America, growth has been supported by rising industrialization in automotive and construction, though local manufacturers often contend with infrastructure constraints and import dependencies for advanced chemistries.

Across Europe, the Middle East, and Africa, regulatory harmonization and sustainability mandates are key drivers of adhesive innovation. European Union directives on volatile organic compound emissions have propelled formulators toward low-odor, low-VOC anaerobic systems. In the Middle East, rapid expansion of aerospace and oil and gas fabrication is accelerating demand for high-performance retaining and threadlocking solutions that withstand extreme thermal cycling. African markets, while still emerging, present long-term potential underpinned by infrastructure investments and local assembly projects in automotive and machinery manufacturing.

The Asia-Pacific region remains the most dynamic growth arena, propelled by major automotive hubs in China, Japan, and South Korea, as well as burgeoning electronics manufacturing in Southeast Asia. Regional players are investing heavily in localized production to meet stringent lead time requirements and reduce logistics costs. This localizing trend is accompanied by rising competition from domestic adhesive producers that are capitalizing on governmental incentives for high-value manufacturing. As a result, global companies are forming joint ventures and licensing agreements to secure market share and ensure compliance with regional standards, thereby reinforcing a dual strategy of global brand strength and local responsiveness.

This comprehensive research report examines key regions that drive the evolution of the Anaerobic Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Competitive Landscape Through Key Strategic Moves Collaboration Patterns and Innovation Portfolios of Leading Adhesive Manufacturers Worldwide

The competitive landscape of anaerobic adhesives is anchored by a group of established chemical conglomerates and specialized formulators pursuing strategic growth through acquisitions, joint ventures, and targeted R&D investments. Leading manufacturers have been expanding their adhesive portfolios with high-value specialty products and forging partnerships with automotive OEMs and industrial equipment suppliers to co-develop bespoke solutions. Key players are also enhancing downstream capabilities by integrating adhesives into system-level offerings that combine adhesives with primers, sealants, and ancillary dispensing technologies.

Collaboration patterns reveal a trend toward cross-sector alliances where technology providers, raw material suppliers, and end users jointly address emerging application challenges, such as bonding hybrid materials in electric vehicles and sealing hermetic enclosures for IoT devices. This ecosystem approach accelerates technology transfer and allows adhesive producers to scale innovations more rapidly.

In parallel, innovation portfolios showcase advancements in green chemistries and enhanced curing control. Companies are patenting novel initiator systems that offer faster activation under lower temperatures and reduced induction times. Others are focusing on multifunctional resin backbones that combine anaerobic curing with secondary mechanisms like UV-triggered crosslinking for complex assembly workflows. These strategic moves collectively underscore the importance of a balanced approach between leveraging core competencies and pioneering next-generation adhesive modalities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anaerobic Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adhesive Systems Inc.

- Aremco Products Inc.

- Chemence Limited

- Cyberbond LLC

- Dymax Corporation

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hernon Manufacturing Inc.

- Infinity Bond LLC

- ITW Performance Polymers

- Kisling AG

- LORD Corporation

- Loxeal Engineering Adhesives

- Master Bond Inc.

- Parson Adhesives Inc.

- Permabond LLC

- Permatex Inc.

- Royal Adhesives & Sealants LLC

- Sika AG

- ThreeBond Holdings Co., Ltd.

- Uniseal Inc.

- Weicon GmbH & Co. KG

Strategic Imperatives for Industry Leaders to Navigate Volatile Markets Optimize Value Chains and Capitalize on Emerging Opportunities in Anaerobic Adhesives

Industry leaders should prioritize diversification of feedstock sources by securing supply agreements with multiple resin producers and evaluating bio-based monomer alternatives to circumvent volatility in petrochemical markets. Simultaneously, investing in digital simulation tools for formulation design will shorten development cycles and enhance product differentiation through tailored adhesive properties. By integrating predictive analytics and laboratory automation, organizations can rapidly iterate on chemistries that meet precise performance thresholds for emerging applications in electric mobility and smart infrastructure.

Another imperative is to strengthen customer engagement by offering integrated system solutions that bundle adhesives with dispensing equipment, technical training, and performance monitoring services. This value-added approach fosters deeper partnerships, drives recurring revenue streams, and builds resilience against commoditization. Leaders should also explore strategic alliances with end users to co-innovate, sharing testing facilities and pilot lines to de-risk new product launch cycles.

Finally, embedding sustainability across the product life cycle-from green raw materials and energy-efficient processing to post-consumer recycling initiatives-will be critical for meeting evolving regulatory and corporate responsibility standards. Transparent reporting on carbon footprint reductions, coupled with certifications such as ISO 14001 and REACH compliance, will enhance brand reputation and access to environmentally sensitive markets. These combined strategies form a cohesive roadmap for navigating volatility, unlocking new opportunities, and securing competitive advantage.

Outlining a Robust Multi-Tiered Research Methodology Integrating Qualitative Expert Interviews and Quantitative Data Validation for Industry Insight

The research methodology underpinning this analysis integrates both qualitative and quantitative approaches to ensure robust, actionable insights. Primary data was gathered through in-depth interviews with industry executives, R&D heads, and procurement specialists from adhesive manufacturers, automotive OEMs, electronics firms, and construction contractors. These conversations provided firsthand perspectives on emerging application requirements, supply chain challenges, and strategic roadmaps.

Secondary research encompassed a comprehensive review of technical publications, patent filings, regulatory frameworks, and company disclosures to map innovation trajectories and competitive positioning. Emphasis was placed on identifying advancements in polymer chemistry, sustainable material adoption, and manufacturing process enhancements. Proprietary data aggregation tools were employed to collate pricing trends, tariff developments, and regional production capacities.

Quantitative validation involved cross-referencing shipment volumes and production outputs from trade associations with procurement records shared by key distributors. Scenario modeling was used to assess the potential impact of tariff adjustments and raw material price fluctuations on cost structures. Data integrity was assured through triangulation, using multiple independent sources to confirm critical findings. This multi-tiered methodology ensures that the insights presented are both comprehensive and reliable, providing a solid foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anaerobic Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anaerobic Adhesives Market, by Product Type

- Anaerobic Adhesives Market, by Form

- Anaerobic Adhesives Market, by Application

- Anaerobic Adhesives Market, by Sales Channel

- Anaerobic Adhesives Market, by End Use Industry

- Anaerobic Adhesives Market, by Region

- Anaerobic Adhesives Market, by Group

- Anaerobic Adhesives Market, by Country

- United States Anaerobic Adhesives Market

- China Anaerobic Adhesives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings to Illuminate the Strategic Value Proposition and Long Term Implications for Stakeholders in Anaerobic Adhesives

This analysis synthesizes core findings to underscore the strategic value proposition of anaerobic adhesives across diverse industrial contexts. The compelling interplay between advanced chemistries and digital formulation tools has created a platform for rapid innovation, enabling adhesives to meet increasingly stringent performance criteria. Concurrently, supply chain realignment driven by tariff policy and regional production strategies highlights the necessity for agile procurement practices and collaborative partnerships.

Stakeholders should recognize that segmentation insights reveal critical pathways to targeted growth: from specialized threadlockers and structural adhesives to application-tailored offerings in automotive, aerospace, and electronics. Regional nuances further emphasize the importance of localized production and regulatory compliance, particularly in markets with stringent environmental and safety standards. Competitive analysis of leading adhesive producers demonstrates the imperative to balance core portfolio strength with continuous R&D investment in next-generation formulations.

The long-term implications extend beyond immediate cost and performance considerations. As sustainability becomes central to corporate agendas, anaerobic adhesive manufacturers that deliver green solutions while maintaining technical excellence will command a premium. Similarly, companies that harness digital platforms to accelerate product development and integrate service-based offerings will differentiate themselves in an increasingly commoditized marketplace. These insights collectively offer a strategic roadmap for decision-makers seeking to capitalize on the full potential of anaerobic adhesives.

Driving Action and Engagement With a Personalized Call To Evaluate the Definitive Anaerobic Adhesives Market Research Report

To access the most comprehensive analysis of evolving trends and strategic imperatives in the anaerobic adhesives sector, please reach out directly to Ketan Rohom, the Associate Director, Sales & Marketing. By securing this definitive report, stakeholders will gain a deep understanding of supply chain resilience, technological breakthroughs, and regional dynamics that are shaping competitiveness today. Engage with Ketan to explore tailored insights, customizable consulting options, and volume licensing packages that align with your organizational objectives. Elevate decision-making through immediate access to granular data, expert interpretation, and forward-looking recommendations that drive growth and innovation. Contact Ketan Rohom now to transform market intelligence into actionable strategy and secure your advantage in the rapidly advancing world of anaerobic adhesives

- How big is the Anaerobic Adhesives Market?

- What is the Anaerobic Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?