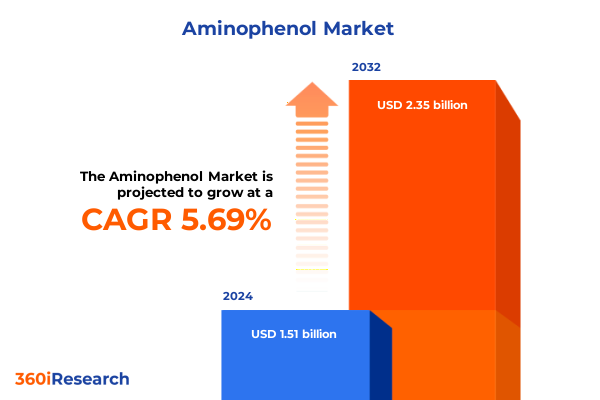

The Aminophenol Market size was estimated at USD 1.59 billion in 2025 and expected to reach USD 1.69 billion in 2026, at a CAGR of 5.69% to reach USD 2.35 billion by 2032.

Exploring Aminophenol: Foundational Overview of Chemical Characteristics, Production Pathways, and Diverse End-Use Applications Fueling Market Demand

Aminophenol stands at the crossroads of chemistry and commerce, serving as a critical intermediate that bridges core industrial processes with cutting-edge applications. This compound’s unique molecular structure, featuring both amino and hydroxyl functional groups on a benzene ring, underpins its versatility in numerous sectors. From its role as a key precursor in analgesic and antihistamine pharmaceuticals to its function in the production of vibrant reactive dyes, aminophenol’s chemical properties enable a spectrum of reactions vital to diverse manufacturing pathways. In parallel, stringent regulatory frameworks governing purity, handling, and waste management reinforce the compound’s prominence, shaping how producers and end users align operations to global environmental and safety standards.

Over the past decade, advancements in production technologies-including catalytic reduction of nitrophenols and refined separation techniques-have enhanced yield and consistency, reducing impurities and enabling scalable manufacturing. While traditional batch processes remain prevalent for specialty grades, continuous flow reactors are emerging as a transformative approach for high-volume standard grades, offering tighter process control and reduced energy consumption. These innovations not only address evolving regulatory demands but also facilitate the compound’s adaptation into new applications, such as novel rubber chemical formulations that improve tire performance and durability. As industries pursue higher efficiency and sustainability, aminophenol’s foundational attributes continue to catalyze innovation across value chains.

Unraveling Transformative Industry Shifts That Are Redefining Aminophenol Supply Chains, Technological Innovations, and Regulatory Compliance Across Markets

Recent years have witnessed a paradigm shift in how aminophenol flows through global supply networks, driven by seismic changes in trade policies, sustainability mandates, and digitalization trends. Sourcing dynamics have evolved as producers increasingly diversify beyond traditional chemical hubs, exploring emerging manufacturing centers in Southeast Asia and the Middle East to mitigate geopolitical risks. Naturally, the search for cost-effective feedstocks and secure logistics corridors has prompted strategic alliances and localized production facilities, reshaping established trade routes and introducing new centers of gravity in the global pipeline of intermediates.

Simultaneously, digitalization has crept into every stage of the aminophenol lifecycle. Process analytics platforms now harness real-time sensor data to optimize reaction parameters and ensure consistent quality, while enterprise resource planning systems integrate procurement, production, and distribution functions to enhance visibility across the value chain. These technological interventions dovetail with heightened regulatory scrutiny, prompting operators to adopt advanced monitoring tools that ensure compliance with evolving environmental, health, and safety standards. In turn, this convergence of digital innovation and policy evolution is not only enhancing operational resilience but also delineating a clear competitive divide between agile, tech-savvy producers and those bound to legacy processes.

Assessing How 2025 United States Tariff Adjustments Have Compounded Cost Pressures, Supply Disruptions, and Strategic Sourcing for Aminophenol Manufacturers

The tariff recalibrations implemented by the United States in 2025 have introduced a fresh layer of complexity to aminophenol economics, amplifying cost pressures at every stage of the value chain. With import duties adjusted upwards for key chemical intermediates sourced from specific trade partners, downstream manufacturers have encountered higher landed costs, leading to strategic re-evaluations of sourcing strategies. Many firms have moved to renegotiate long-term supply contracts to lock in favorable terms, while others have accelerated domestic production investments to circumvent external levies.

These measures have not only influenced procurement decisions but also reverberated through pricing structures for end users, particularly in sectors with high exposure to raw material fluctuations. Regulatory compliance costs have concurrently risen, as domestic producers adapt facilities to process alternative feedstock streams and comply with tightened environmental standards. Nonetheless, the tariff environment has also catalyzed innovation, spurring collaborative ventures aimed at developing cost-effective synthetic routes that reduce reliance on imported aminophenol. As companies strive to balance margin preservation with market competitiveness, the cumulative impact of these trade measures is driving a fundamental reorientation of strategic priorities.

Decoding Critical Segmentation Factors Revealing Unique Market Dynamics Across End Use, Product Variants, Form Configurations, Purity Levels, and Sales Channels

In dissecting the aminophenol landscape, it becomes evident that end-use segmentation reveals distinct demand drivers and growth prospects. Within agrochemical applications, aminophenol derivatives contribute to pesticide formulations that enhance crop resilience, even as global regulatory trends push for reduced environmental impact. The dye intermediates sphere, encompassing azo dyes, pigments, and reactive dyes, demands consistent product quality to deliver colorfast performance in textiles, requiring close coordination between suppliers and fabric mills. Pharmaceutical channels, from analgesics to antihistamines and antipyretics, hinge on ultra-high purity grades, compelling producers to maintain rigorous analytical grade specifications.

Examining product type further distinguishes the market by isomeric form, where o-aminophenol often serves in high-performance coating formulations, m-aminophenol finds niche applications in specialized polymer chains, and p-aminophenol remains a staple for large-scale pharmaceutical synthesis. Meanwhile, the choice between powder and solution forms shapes logistical considerations: bag, bulk, and drum-packed powders cater to discrete batch operations, whereas concentrated and diluted solutions streamline continuous processes. Purity levels-ranging from technical to industrial through to analytical grades-dictate facility investments and quality assurance protocols, with each tier commanding unique process controls. Finally, sales channels split between direct sales relationships that enable bespoke support and distributor networks that offer global versus regional reach, underscoring the importance of channel alignment to customer service expectations.

This comprehensive research report categorizes the Aminophenol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use

- Product Type

- Form

- Purity

- Sales Channel

Illuminating Regional Market Nuances That Drive Aminophenol Demand Patterns and Strategic Growth Opportunities in the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in defining aminophenol market contours, with the Americas shaped by strong pharmaceutical end markets and robust agrochemical demand. North American manufacturers, leveraging advanced production technologies and supportive regulatory frameworks, have sustained competitive positions despite cost headwinds, while Latin American players have increasingly invested in local capacity to supply regional textile and rubber industries. In contrast, Europe, the Middle East, and Africa present a tapestry of regulatory stringencies and evolving sustainability mandates, driving manufacturers to adopt green chemistry processes. Western European markets, with their emphasis on stringent environmental controls, serve as test beds for next-generation catalytic methods, whereas emerging EMEA economies focus on cost-effective production expansion.

Asia-Pacific remains the largest hub for aminophenol production, benefitting from integrated chemical clusters and diversified feedstock sources. China’s established infrastructure continues to dominate supply, though Indian and Southeast Asian capacities are rapidly scaling to capitalize on shifting trade flows and competitive labor costs. Moreover, governments across APAC are incentivizing domestic value addition, fostering a rise in high-purity production facilities aimed at meeting pharmaceutical-grade requirements. These regional variances underscore the necessity for nuanced market entry and expansion strategies that reflect local regulatory environments, resource availability, and end-use consumption patterns.

This comprehensive research report examines key regions that drive the evolution of the Aminophenol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Influential Industry Players and Their Strategic Initiatives, Partnerships, and Innovations Driving Competitive Differentiation in the Aminophenol Sector

Aminophenol’s competitive arena is anchored by a mix of integrated chemical conglomerates, specialized mid-tier producers, and niche innovators. Leading conglomerates leverage global footprints to optimize raw material procurement and capitalize on scale efficiencies across multiple derivative pathways. Meanwhile, specialized producers differentiate through high-purity offerings, investing heavily in analytical instrumentation and quality management systems to serve pharmaceutical clients. Emerging innovators focus on sustainable process development, applying enzymatic catalysis and renewable feedstock integration to reduce carbon intensity and meet increasingly rigorous ESG benchmarks.

Collaborative partnerships have become a hallmark of strategic advancement, with alliance models linking research institutions, technology licensors, and production platforms to accelerate product development. Such alliances often center on high-value applications, including advanced rubber chemicals that enhance performance characteristics like thermal resistance and longevity. Venture-backed startups are also entering the fray, introducing digital process optimization tools and novel reactor designs that promise to disrupt traditional manufacturing paradigms. Together, these varied players contribute to a dynamic ecosystem where technological prowess, scale, and sustainability commitments define the competitive hierarchy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aminophenol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acros Organics

- Baoran Chemical Co., Ltd.

- Cambridge Isotope Laboratories, Inc.

- CDH Fine Chemical Co., Ltd.

- DKSH Holdings Ltd.

- Granules India Limited

- IOL Chemicals and Pharmaceuticals Ltd.

- Jayvir Dye Chem Pvt. Ltd.

- JSK Chemicals Pvt. Ltd.

- MedKoo Biosciences, Inc.

- Merck KGaA

- Muby Chemicals

- Ningbo Inno Pharmchem Co., Ltd.

- Panoli Intermediates Pvt. Ltd.

- Rochem International Inc.

- Spectrum Chemical Manufacturing Corp.

- Thermo Fisher Scientific Inc.

- Xiamen Equation Chemical Co., Ltd.

Strategic Roadmap Outlining High-Impact Recommendations for Industry Leaders to Navigate Regulatory, Supply Chain, and Technological Challenges Effectively

Industry leaders must adopt a multifaceted strategy to navigate the intersecting challenges of regulatory complexity, supply chain volatility, and evolving end-use requirements. First, prioritizing investment in advanced process technologies-such as continuous flow reactors and real-time analytics-will enhance operational agility and reduce dependency on external suppliers. Aligning these investments with environmental, social, and governance objectives can simultaneously lower compliance risk and strengthen stakeholder trust.

Equally critical is forging resilient partnerships across the value chain. Developing collaborative frameworks with key end users in pharmaceuticals, dyes, and agrochemicals can foster co-development opportunities and secure long-term supply agreements. Meanwhile, engaging with tier-one logistics providers to diversify transportation routes and storage facilities will mitigate disruption risk. Leaders should also cultivate an innovation pipeline focused on green chemistry and alternative feedstocks to preemptively address tightening regulatory standards. Together, these initiatives will build a robust foundation for sustainable growth and durable competitive advantage.

Detailing Rigorous Research Methodology Employed to Ensure Comprehensive Data Collection, Multi-Source Validation, and Analytical Integrity in Market Insights

This analysis integrates primary and secondary research methodologies to ensure a comprehensive understanding of the aminophenol market. Primary research encompassed in-depth interviews with senior executives across chemical manufacturing, distribution, and end-use segments, supplemented by operational site visits to benchmark production technologies and quality assurance practices. Secondary research sources included industry white papers, government trade filings, and peer-reviewed journals focused on emerging process chemistries.

Quantitative data collection leveraged proprietary industry surveys and customs databases to validate trade flow disruptions and cost impact projections. Qualitative insights were triangulated through expert roundtables and cross-referenced against regulatory filings to ensure alignment with the latest policy developments. Rigorous data validation protocols-encompassing consistency checks, outlier analysis, and methodological audits-underpin the robustness of the findings. This dual-pronged research approach delivers a holistic perspective, balancing macroeconomic trends with granular operational intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aminophenol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aminophenol Market, by End Use

- Aminophenol Market, by Product Type

- Aminophenol Market, by Form

- Aminophenol Market, by Purity

- Aminophenol Market, by Sales Channel

- Aminophenol Market, by Region

- Aminophenol Market, by Group

- Aminophenol Market, by Country

- United States Aminophenol Market

- China Aminophenol Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections Emphasizing the Synergy of Market Trends, Regulatory Impacts, and Strategic Opportunities Shaping the Future of Aminophenol

Overall, the aminophenol landscape is undergoing a meaningful transition, shaped by technological innovation, shifting trade policies, and region-specific dynamics. Manufacturers are adapting to escalating regulatory demands and tariff-driven cost pressures by investing in advanced production technologies and diversifying supply chains. Meanwhile, segmentation analysis underscores the importance of tailoring offerings across end-use applications, product types, and purity grades to meet precise customer specifications.

The convergence of sustainability imperatives and digital transformation is creating opportunities for agile players to leapfrog traditional competitors. By prioritizing collaborative partnerships and green process development, industry participants can secure resilience and unlock new value streams. As global trade patterns continue to evolve, the ability to anticipate regulatory shifts and respond swiftly to end-market needs will separate industry leaders from the rest of the pack, charting a clear path forward in a rapidly changing market environment.

Engage with Ketan Rohom to Unlock the Comprehensive Aminophenol Market Research Report and Propel Data-Driven Strategic Decision Making

I invite you to collaborate directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your strategic advantage through early access to the comprehensive Aminophenol market research report. Engaging with Ketan will offer you tailored insights that align with your organization’s unique objectives, providing a detailed roadmap to address supply chain complexities, regulatory challenges, and evolving end-use requirements. By partnering now, you can empower your decision-making with robust data, actionable intelligence, and exclusive analysis that will inform your growth strategies and optimize resource allocation. Reach out to elevate your market positioning and transform potential challenges into competitive opportunities with a report designed for forward-looking leaders who demand precision and clarity in a rapidly changing environment.

- How big is the Aminophenol Market?

- What is the Aminophenol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?