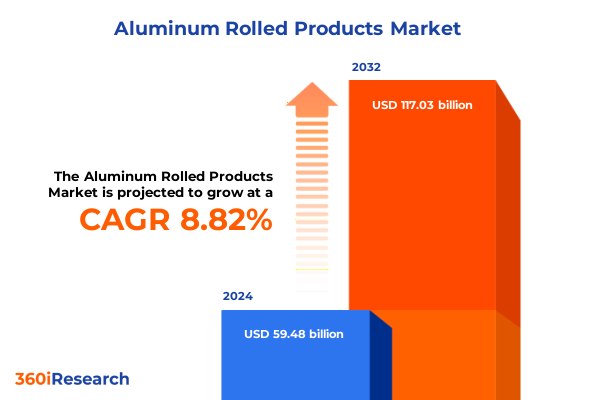

The Aluminum Rolled Products Market size was estimated at USD 64.03 billion in 2025 and expected to reach USD 68.92 billion in 2026, at a CAGR of 8.99% to reach USD 117.03 billion by 2032.

Pioneering a New Era in Aluminum Rolled Products Contextualizing Market Dynamics Adoption Drivers and Future Trajectories Influencing Stakeholders

The landscape of aluminum rolled products is undergoing a pivotal transformation as industry practitioners navigate a convergence of technological advancements, sustainability imperatives, and shifting end-use demands. Historically perceived as a mature sector, the market is now witnessing an infusion of innovation that ranges from digital process control enhancements to novel alloy compositions designed to meet evolving performance requirements. These developments are not only redefining value propositions but also expanding the scope of application across critical industries such as automotive manufacturing and high-performance aerospace components.

In addition, the accelerating pace of decarbonization initiatives is driving manufacturers to adopt greener production techniques, tight material efficiency standards, and end-to-end lifecycle management. As a result, downstream stakeholders are reassessing supply chain resilience, prioritizing suppliers with robust traceability frameworks and energy-efficient operations. This mutually reinforcing dynamic between technological integration and environmental accountability sets the stage for new entrants and incumbents to differentiate through operational excellence and strategic partnerships.

Unveiling Transformative Shifts in the Aluminum Rolled Products Arena Driven by Technological Innovation Sustainability Imperatives and Evolving Supply Chain Dynamics

The aluminum rolled products market has seen transformative shifts that stem from a combination of global decarbonization agendas, rapid digitalization, and the rise of lightweighting demands in transportation sectors. Advanced hot and cold rolling techniques now incorporate real-time monitoring, predictive maintenance, and adaptive automation, reducing defect rates and enhancing yield outcomes. Meanwhile, demand for ultra-thin gauge sheets in electronics and packaging has prompted investments in high-precision rolling mills capable of delivering consistent tolerances at scale.

Moreover, sustainability has emerged as a core strategic theme. Manufacturers are increasingly integrating recycled content, optimizing energy recovery systems, and pursuing closed-loop processes to meet stringent environmental regulations. Such commitments not only mitigate carbon footprints but also unlock cost efficiencies through resource conservation. Consequently, technology partnerships between equipment suppliers, software developers, and primary producers are accelerating, creating a collaborative ecosystem that redefines industry benchmarks for quality and performance.

Examining the Cumulative Impact of 2025 United States Tariffs on Aluminum Rolled Products and Its Far Reaching Consequences for Domestic and Global Industries

In 2025, the United States adjusted its tariff framework on imported aluminum rolled products, amplifying the impact of existing Section 232 measures introduced earlier. The revised duties, implemented to bolster domestic production and address perceived national security concerns, have effectively raised import costs for key product categories, including coil, plate, and sheet. Consequently, domestic mills have experienced an uptick in order volumes; however, this dynamic has also challenged downstream fabricators reliant on competitively priced inputs.

Transitioning from policy to market behavior, international suppliers have responded with strategic rerouting of trade flows, leveraging free trade agreements and tariff-exempt jurisdictions to maintain market share. Simultaneously, domestic producers have pursued capacity expansions and cooperative ventures to meet incremental demand. Although these developments reinforce local value chains, increased input prices have led to margin compression for sectors with limited pricing power, especially in cost-sensitive applications such as standard packaging and mass-market construction materials.

Deriving Key Segmentation Insights by Analyzing Product Forms Rolling Processes Thickness Ranges Alloy Specifications and Diverse End Use Industry Demands

A nuanced understanding of the market emerges when examining the interplay of product form, rolling process, thickness range, alloy classification, and end-use industry. When exploring product form modalities such as coil, plate, and sheet, each segment exhibits distinct supply chain nuances, from continuous cast capabilities for coil to precision trimming requirements for plate. Parallelly, manufacturing pathways bifurcate into cold rolling and hot rolling processes, each delivering specified mechanical properties and surface finishes that cater to divergent consumer needs.

Furthermore, thickness range considerations-spanning thick gauge applications in structural engineering to ultra-thin foils for flexible electronics-dictate specialized rolling mill configurations and quality assurance protocols. Alloy selection, from 1000 Series purity grades to 6000 Series formability alloys, underpins performance criteria across corrosion resistance, weldability, and strength thresholds. Finally, end-use sectors such as aerospace, automotive, construction, electrical, and packaging each apply unique technical specifications, leading manufacturers to tailor product portfolios and support services accordingly.

This comprehensive research report categorizes the Aluminum Rolled Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Rolling Process

- Thickness Range

- Alloy

- End-Use Industry

Illuminating Key Regional Insights into the Aluminum Rolled Products Market across the Americas Europe Middle East and Africa and Asia Pacific Ecosystems

Geographic dynamics play a pivotal role in shaping demand, supply chain integrity, and investment patterns across key macroregions. Within the Americas, supply chain proximity advantages have spurred onshore expansions and vertically integrated operations, particularly in the United States and Canada, where automotive lightweighting and infrastructure renewal programs drive consumption of high-strength alloys.

In the Europe, Middle East & Africa corridor, stringent environmental legislation and the European Green Deal framework have precipitated investments in recycled-content facilities and process electrification. At the same time, emerging economies in the Middle East are channeling sovereign wealth into downstream aluminum value chains to diversify hydrocarbon-reliant revenues. Conversely, the Africa landscape presents a burgeoning opportunity set, characterized by nascent primary production paired with growing construction demand.

Meanwhile, Asia-Pacific continues to dominate global output, led by megaprojects in China, Japan’s technological leadership in cold rolling innovations, and Southeast Asia’s capacity additions catering to regional infrastructure growth. Each subregion manifests a distinct blend of competitive drivers, regulatory environments, and consumer expectations, compelling stakeholders to adopt bespoke market strategies.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Rolled Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking Competitive Landscapes and Key Company Strategies Shaping the Aluminum Rolled Products Market with Focused Profiles and Strategic Initiatives

Key industry participants have adopted differentiated strategies to consolidate their market positions and address emerging challenges. Tier-one producers are channeling investments into digital transformation, from AI-enabled process optimization to blockchain-driven supply chain transparency initiatives. At the same time, integrated manufacturing groups are forging strategic alliances with equipment suppliers and technology firms to co-develop next-generation rolling technologies and surface treatment solutions.

In parallel, mid-market specialists have focused on niche differentiation, offering customized alloy blends and value-added services such as on-site slitting, advanced metallurgical testing, and design consultation. Several global conglomerates have also pursued acquisitions of regional players to secure upstream access to raw materials and downstream proximity to key end-use segments. Across the board, a shared emphasis on sustainability, operational resilience, and innovative product development underpins the competitive landscape, driving continuous evolution of go-to-market approaches.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Rolled Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akao Aluminium Co,. Ltd

- Aluminium Bahrain B.S.C.

- Arconic Corporation

- Chalco Aluminum Group

- Hindalco Industries Limited

- Kaiser Aluminum Corporation

- Novelis Inc.

- Rio Tinto Group

- Sumitomo Corporation

- UACJ Corporation

- Vedanta Limited

- Viohalco S.A.

Formulating Actionable Recommendations for Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Opportunities in Aluminum Rolled Products

Industry leaders seeking to solidify their market positions must prioritize a multi-faceted approach that balances technological mastery with customer-centric solutions. To begin with, accelerating the adoption of digital twins and predictive analytics can enhance production agility, reduce downtime, and optimize material yields. Simultaneously, establishing collaborative research partnerships with academic institutions and technology providers will drive the innovation pipeline for advanced alloys and processing methods.

Moreover, companies should reevaluate supply chain architectures, integrating nearshoring tactics and multi-sourcing frameworks to mitigate geopolitical and tariff-related risks. Engaging proactively with regulatory bodies to shape policy discourse around trade measures and environmental standards will also foster a more predictable operating environment. Finally, embedding circular economy principles-such as closed-loop recycling and remelting capabilities-into core processes can yield both sustainability benefits and cost efficiencies, ultimately delivering competitive differentiation.

Detailing Rigorous Research Methodology Employed to Ensure Data Accuracy Reliability and Comprehensive Coverage of the Aluminum Rolled Products Market Analysis

This report’s foundation rests upon a rigorous research methodology that combines primary interviews, secondary data triangulation, and advanced analytics. Primary research encompassed in-depth discussions with C-level executives, plant managers, procurement specialists, and R&D directors across the aluminum rolled products ecosystem to capture firsthand perspectives on market drivers and barriers.

Secondary sources included industry association publications, government trade data, technical white papers, and corporate sustainability disclosures. Qualitative insights were synthesized with quantitative trend analysis using statistical validation techniques to ensure robustness. Furthermore, cross-verification protocols were employed to reconcile discrepancies between public filings and proprietary datasets, reinforcing the reliability of the findings.

Analytical frameworks such as Porter’s Five Forces and SWOT analysis were applied at each stage to distill strategic imperatives, while scenario planning modules assessed the impact of regulatory shifts, technology breakthroughs, and macroeconomic fluctuations. The comprehensive methodological rigor ensures that stakeholders can confidently leverage this research to inform strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Rolled Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Rolled Products Market, by Product Form

- Aluminum Rolled Products Market, by Rolling Process

- Aluminum Rolled Products Market, by Thickness Range

- Aluminum Rolled Products Market, by Alloy

- Aluminum Rolled Products Market, by End-Use Industry

- Aluminum Rolled Products Market, by Region

- Aluminum Rolled Products Market, by Group

- Aluminum Rolled Products Market, by Country

- United States Aluminum Rolled Products Market

- China Aluminum Rolled Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Critical Findings and Strategic Takeaways Converging from the Aluminum Rolled Products Market Analysis to Inform Decision Making Trajectories

The cumulative findings of this executive summary highlight several overarching themes. First, technological innovation-particularly digitalization and advanced rolling techniques-constitutes a primary catalyst for market evolution. Second, sustainability mandates and tariff policies exert a dual influence, creating both opportunities for domestic capacity growth and challenges related to input cost volatility.

Third, segmentation insights reveal that tailored product offerings across form factors, processes, and alloy grades are essential to meet diverse application requirements. Regional dynamics further underscore the importance of localized strategies, with each macroregion presenting unique regulatory, economic, and competitive conditions. Finally, competitive analysis confirms that leading companies will continue to differentiate through partnerships, targeted investments, and deep customer engagement.

Together, these insights coalesce into a coherent strategic narrative: to thrive in the aluminum rolled products sector, organizations must balance innovation with operational resilience, engage proactively with policy environments, and deliver customer-focused solutions that address both performance and sustainability objectives.

Prompting Engagement with Our Associate Director for Tailored Insights and Exclusive Access to the Comprehensive Aluminum Rolled Products Market Research Report

Engaging with Ketan Rohom, Associate Director, Sales & Marketing, offers an opportunity to secure a tailored version of the comprehensive research report that aligns precisely with your strategic objectives. By collaborating directly, organizations can request focused data sets, bespoke competitive benchmarking, and exclusive scenario planning tools. This personalized engagement ensures that decision-makers access the most relevant insights on evolving market dynamics, regulatory influences, and emerging technologies in aluminum rolled products. Reach out today to explore flexible pricing options, multi-user licenses, and value-added advisory sessions designed to accelerate your time-to-insight and inform high-impact strategies.

- How big is the Aluminum Rolled Products Market?

- What is the Aluminum Rolled Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?