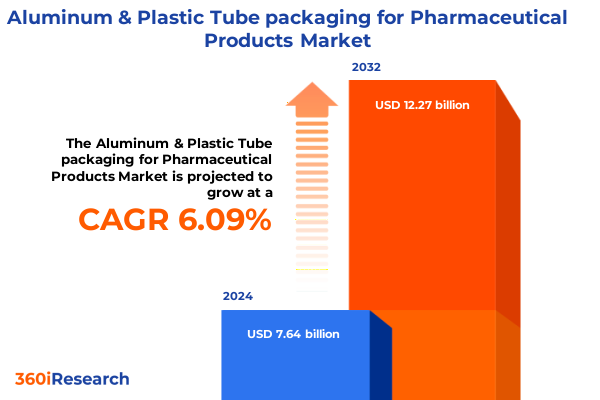

The Aluminum & Plastic Tube packaging for Pharmaceutical Products Market size was estimated at USD 8.02 billion in 2025 and expected to reach USD 8.42 billion in 2026, at a CAGR of 6.26% to reach USD 12.27 billion by 2032.

Exploring the Transformative Role of Aluminum and Plastic Tube Packaging in Enhancing Pharmaceutical Product Integrity and Patient Engagement

The contemporary pharmaceutical landscape demands packaging solutions that do more than simply contain medications. Aluminum and plastic tubes have emerged as critical enablers for safeguarding product efficacy, ensuring patient compliance, and reinforcing brand trust. By offering robust barrier properties against light, moisture, and oxygen, these tube formats protect sensitive formulations from degradation, extending shelf life and preserving therapeutic performance. As patient-centricity becomes a hallmark of pharmaceutical marketing, tubes facilitate intuitive dosing and enhance the user experience through ergonomic designs and tactile finishes.

Moreover, regulatory authorities worldwide are tightening requirements around product safety and labeling. Tubes lend themselves to precision printing and decoration, which supports clear instruction sets and brand differentiation on crowded pharmacy shelves. At the same time, rising consumer expectations for eco-friendly packaging are driving material innovation and lightweighting trends. Manufacturers and brand owners are increasingly evaluating trade-offs between aluminum’s recyclability and plastic’s formability, seeking optimal combinations of cost efficiency, sustainability, and manufacturability. Consequently, tubes now represent a strategic intersection of functional performance, environmental stewardship, and brand storytelling within the pharmaceutical packaging domain.

Uncovering the Key Technological, Environmental, and Consumer-Driven Transformations Shaping the Aluminum and Plastic Tube Packaging Landscape

Over the past several years, the pharmaceutical tube packaging sector has undergone seismic shifts fueled by technological advances, environmental imperatives, and evolving consumer behaviors. Sustainable material reformulations are now at the forefront, with blends of recycled aluminum and bio-based polymers gaining traction as brands strive to meet circular economy goals. In parallel, digital printing and micro-dispensing technologies now allow for rapid customization of tube designs, enabling on-demand production runs and personalized patient communications.

At the same time, the integration of smart labeling and serialization features is enhancing supply chain transparency and tamper evidence. Manufacturers are embedding QR codes and NFC tags directly into tube closures, offering patients real-time access to dosing reminders and authentication tools. Furthermore, as direct-to-consumer channels proliferate, tube packaging has adapted to support streamlined fulfillment models, with sturdier closures and shippers designed to withstand last-mile handling pressures. Consequently, the industry is witnessing a convergence of digital, sustainable, and consumer-driven forces reshaping how pharmaceutical tubes are designed, produced, and distributed.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Aluminum and Plastic Pharmaceutical Tube Packaging Supply Chains

In response to evolving trade policies, the United States implemented new tariffs on aluminum and plastic packaging imports in early 2025, reflecting broader strategic efforts to revitalize domestic manufacturing. These measures have had a compounding effect on the pharmaceutical tube market, elevating raw material costs and prompting many converters to reassess their supply arrangements. Companies reliant on imported aluminum foil laminate are now seeking alternative sources, forging strategic partnerships with domestic mills and investing in higher-capacity extrusion lines to mitigate future exposures.

Consequently, supply chain footprints have contracted as organizations localize production closer to end markets. This nearshoring trend, while reducing transit lead times, also demands capital investments in equipment and quality certifications. Furthermore, the cumulative impact of tariffs has accelerated material substitution initiatives, with several global brands piloting advanced polymer alternatives to light-gauge aluminum. Ultimately, these shifts underscore the tension between cost containment and performance requirements, forcing industry stakeholders to adopt more agile procurement strategies and to integrate scenario planning into their operational roadmaps.

Illuminating Critical Market Segmentation Dynamics Across Drug Types, Material Composition, Volume Ranges, Closure Mechanisms, and Filling Forms

Diving into the detailed segmentation of pharmaceutical tube packaging reveals nuanced preferences and performance criteria across drug categories, materials, volumes, closures, and formulations. When analyzed by drug type, over-the-counter remedies and prescription medications present distinct packaging imperatives, with OTC products favoring consumer-friendly features and prescription lines emphasizing stringent barrier properties. Material composition further differentiates market needs: aluminum tubes excel in light-sensitive and preservative-free formulations, while plastic tubes offer cost-effective versatility for less reactive compounds.

Volume ranges introduce additional complexities; small 20-milliliter tubes frequently accommodate concentrated topical gels and ointments for targeted applications, whereas mid-sized 21-to-50-milliliter formats often serve multi-dose creams and antiseptics. Above 50 milliliters, and particularly in the 51-to-100-milliliter bracket, end-users expect robust dispensing mechanisms, aligning closely with screw-cap and snap-cap designs. Volumes exceeding 100 milliliters are typically reserved for high-frequency therapeutic regimens, demanding both durability and ease of use. Closure types significantly influence user experience, with flip-top mechanisms enabling one-handed operation, screw caps providing airtight seals, and snap caps balancing convenience with security. Equally, the intended filling form-whether cream, gel, ointment, or paste-dictates tube wall thickness, nozzle geometry, and compatibility testing protocols, shaping the final product’s functional reliability and brand appeal.

This comprehensive research report categorizes the Aluminum & Plastic Tube packaging for Pharmaceutical Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Tube Structure

- Capacity Range

- Product Formulation Type

- Drug Type

- Manufacturing Process

- End User Type

- Therapeutic Application

Analyzing Regional Market Variations and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia Pacific Pharmaceutical Tube Packaging Sectors

Regional market dynamics for pharmaceutical tube packaging vary significantly, reflecting the economic maturity, regulatory environment, and consumer expectations within each territory. In the Americas, mature markets in North America drive steady demand for premium aluminum tubes incorporating advanced barrier solutions. At the same time, Latin American markets show rising interest in cost-efficient plastic tubes as domestic generic drug production expands. Sustainability regulations in Canada and the United States continue to incentivize lightweighting and recyclable material adoption, reinforcing manufacturers’ investment in closed-loop recycling programs.

Across Europe, the Middle East and Africa, regulatory harmonization under European Union directives has catalyzed innovation in reusable and mono-material tube structures to simplify end-of-life processing. Emerging markets in the Gulf region are simultaneously driving demand for high-quality pharmaceutical packaging, with a particular focus on patient safety features and serial tracking. In Asia Pacific, rapid urbanization and healthcare access initiatives are fostering growth in both branded and generic pharmaceuticals, fueling demand for locally produced tubes. Here, cost competitiveness remains a primary driver, yet leading converters are differentiating through digital print capabilities and rapid fulfillment models designed to meet local regulatory requirements and retailer specifications.

This comprehensive research report examines key regions that drive the evolution of the Aluminum & Plastic Tube packaging for Pharmaceutical Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators and Strategic Partnerships Driving Innovation in Aluminum and Plastic Tube Packaging for Pharmaceuticals

The competitive landscape of pharmaceutical tube packaging is defined by a handful of global leaders and innovative regional players. Amcor leverages its integrated aluminum foil and polymer extrusion assets to offer a broad portfolio of high-barrier tubes and multilayer laminates. Constantia Flexibles has carved a niche in lightweight, mono-material structures, enabling easier recycling without compromising on barrier performance. Berry Global, buoyed by strategic acquisitions, has expanded its footprint in Asia Pacific, offering custom digital decoration services and enhanced closure systems.

Key players are also forging partnerships to accelerate technology adoption. Albea’s collaboration with polymer innovators has yielded bio-based tube formulations that reduce carbon footprints while maintaining processability. Essel Propack continues to lead in volume capacity, particularly in emerging markets, and has invested heavily in automation to streamline production of high-speed lines. Schott Pharma’s expertise in specialty glass and aluminum hybrid tubes underlines the growing interest in premium packaging for biologics. AptarGroup focuses on advanced closure technologies, integrating child-resistant features and tamper-evident seals to meet stringent global safety standards. Together, these companies are shaping a competitive ecosystem characterized by technological collaboration, geographic expansion, and a shared commitment to sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum & Plastic Tube packaging for Pharmaceutical Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adelphi Healthcare Packaging Limited

- Albea S.A.

- ALLTUB Group B.V.

- Almin Extrusion Private Limited

- Amcor plc

- Antilla Inc.

- Aphena Pharma Solutions, Inc.

- AptarGroup, Inc.

- Berry Global Group, Inc.

- BRK Packwell Private Limited

- CCL Industries Inc.

- EPL Limited

- Essentra plc

- Gerresheimer AG

- Hoffmann Neopac AG

- Junsam Packaging Material Co., Ltd.

- Montebello Packaging Inc.

- Multitubes Group B.V.

- Plastirey S.A. de C.V.

- Sanner GmbH

- Silgan Holdings Inc.

- Tekni-Plex, Inc.

- TUBEX Holding GmbH

- Victor Packaging, Inc.

Formulating Strategic and Operational Recommendations to Enhance Supply Chain Resilience, Sustainability, and Competitive Positioning in Tube Packaging

To navigate the complexities of today’s pharmaceutical tube packaging environment, industry leaders must adopt a multi-pronged strategy. First, diversifying raw material sourcing by establishing secondary supplier relationships can mitigate tariff-related disruptions and ensure continuity of supply. Concurrently, investing in alternative material research-such as recycled aluminum alloys and biodegradable polymers-will bolster sustainability credentials and future-proof product lines against evolving regulatory mandates.

Operational excellence can be enhanced by deploying digital workflow platforms that provide real-time visibility into production metrics, quality parameters, and inventory levels. These systems enable proactive maintenance scheduling and rapid response to deviation events. Strengthening collaboration across the supply chain, from foil suppliers to contract manufacturers, fosters shared risk management and cost-optimization initiatives. Moreover, incorporating circular economy principles-through tube take-back programs and end-of-life recycling partnerships-can significantly reduce landfill contributions and align stakeholders behind a common environmental vision. Lastly, a disciplined focus on closure selection and customization will distinguish products on pharmacy shelves and in e-commerce channels, enhancing patient safety and brand loyalty.

Detailing Comprehensive Research Methodology and Analytical Framework Employed in the Study of Pharmaceutical Tube Packaging Market Trends and Drivers

This study was constructed through a robust, multi-tiered research methodology designed to deliver reliable, actionable insights. Initially, secondary data was gathered from industry publications, regulatory filings, and materials science journals to establish baseline market context and identify key performance indicators. Subsequently, primary research was conducted via structured interviews with senior executives, packaging technologists, procurement leaders, and regulatory experts, enabling firsthand perspectives on emerging trends and strategic imperatives.

Data triangulation ensured the validity of findings, with quantitative metrics cross-verified against historical shipment records, import-export statistics, and company financial disclosures. A granular segmentation approach dissected the market across drug types, materials, volume ranges, closures, and filling forms, while regional analyses incorporated economic indicators, healthcare infrastructure metrics, and environmental regulations. Analytical frameworks such as SWOT assessments and Porter’s Five Forces evaluated competitive dynamics, and scenario planning workshops with client stakeholders informed risk-adjusted strategic recommendations. Rigorous data cleansing and quality assurance protocols were applied at each stage, ensuring transparency and reproducibility of insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum & Plastic Tube packaging for Pharmaceutical Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Material Type

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Tube Structure

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Capacity Range

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Product Formulation Type

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Drug Type

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Manufacturing Process

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by End User Type

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Therapeutic Application

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Region

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Group

- Aluminum & Plastic Tube packaging for Pharmaceutical Products Market, by Country

- United States Aluminum & Plastic Tube packaging for Pharmaceutical Products Market

- China Aluminum & Plastic Tube packaging for Pharmaceutical Products Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Strategic Implications of Aluminum and Plastic Tube Packaging Trends for Stakeholders and Industry Decision Makers

The comprehensive examination of aluminum and plastic tube packaging reveals a sector at the crossroads of innovation, regulation, and sustainability. Technological advancements in materials and digital printing are enabling more personalized and eco-conscious designs, while trade policy shifts mandate resilient sourcing strategies. Deep segmentation analysis underscores the importance of aligning tube formats with specific drug categories, volume requirements, closure preferences, and formulation characteristics to optimize both functionality and user experience.

Regional insights highlight the divergent growth patterns across mature and emerging markets, each driven by unique regulatory landscapes and cost structures. The competitive intelligence on leading suppliers demonstrates that collaboration, capacity expansion, and material innovation are key differentiators in a crowded market. Stakeholders equipped with these findings can make informed decisions about portfolio optimization, supplier partnerships, and sustainability initiatives. Ultimately, this synthesis provides industry decision-makers with a clear roadmap for leveraging tube packaging as a competitive advantage, ensuring product integrity, patient satisfaction, and long-term growth.

Take Action Today by Partnering with Ketan Rohom to Purchase the Comprehensive Aluminum and Plastic Tube Packaging Market Research Report

Partnering with Ketan Rohom provides a streamlined path to unlocking a wealth of specialized intelligence tailored specifically to aluminum and plastic pharmaceutical tube packaging. With his deep understanding of market drivers and regulatory demands, he can guide you through a customized engagement that aligns with your strategic priorities and operational challenges. By securing this market research report, you gain access to actionable insights, detailed segmentation analysis, and regional breakdowns that will inform your product development and go-to-market strategies. Reach out today to schedule a consultation and explore tailored data modules, executive briefings, and value-added services designed to accelerate your decision-making and competitive positioning. Invest in this comprehensive resource now to stay ahead in the evolving packaging landscape and drive sustainable growth.

- How big is the Aluminum & Plastic Tube packaging for Pharmaceutical Products Market?

- What is the Aluminum & Plastic Tube packaging for Pharmaceutical Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?