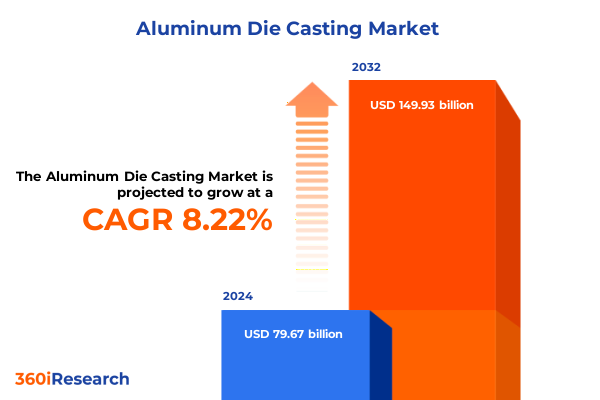

The Aluminum Die Casting Market size was estimated at USD 85.92 billion in 2025 and expected to reach USD 92.67 billion in 2026, at a CAGR of 8.27% to reach USD 149.93 billion by 2032.

Discover how aluminum die casting underpins modern industrial innovation through precision, efficiency, and lightweight design

Aluminum die casting has emerged as a cornerstone of modern manufacturing, driven by its ability to deliver high-strength, precision components at scale. Over the past decade, increasing demand for lightweight structures-particularly in automotive and aerospace sectors-has elevated this process to the forefront of materials engineering innovation. Simultaneously, advances in molten metal handling and mold design have dramatically enhanced process efficiency, reducing cycle times and supporting just-in-time production models.

This introduction sets the stage by highlighting how aluminum die casting serves as a critical enabler of technological progress. As industries pursue ever-greater performance specifications, the capacity to produce complex geometries with exceptional dimensional accuracy positions aluminum die casting as a preferred solution. This summary will navigate through the transformative dynamics shaping the landscape, the cumulative impact of tariff measures, and the strategic areas guiding future investment. By grounding our analysis in current trends, stakeholders can align operations and innovation priorities to harness the full potential of this vital manufacturing process.

Explore the dynamic evolution of aluminum die casting shaped by electric vehicle demand, miniaturization, and sustainability goals

In recent years, the aluminum die casting landscape has undergone transformative shifts as manufacturers adapt to evolving end-use requirements. The proliferation of electric vehicles, for instance, has accelerated demand for lightweight yet robust structural components, prompting suppliers to refine cold chamber processes that optimize fill rates and reduce porosity. Meanwhile, the consumer electronics sector has embraced miniaturization, emphasizing hot chamber die casting techniques for small, intricate parts that maintain high conductivity and thermal management.

Concurrently, environmental imperatives have pushed industry leaders to implement low-emission melting technologies and closed-loop recycling systems. This shift not only aligns with global sustainability goals but also secures cost advantages through energy savings and efficient scrap reuse. By integrating data-driven process monitoring and automation, plants are achieving unprecedented levels of consistency and throughput, underscoring the industry’s pivot toward smart manufacturing. These combined forces illustrate how aluminum die casting is adapting to meet diverse and demanding applications.

Understand how evolving U.S. tariff measures in 2025 are restructuring supply chains, costs, and partnerships in die casting

United States tariff policies in 2025 have exerted a cumulative effect on the aluminum die casting sector, altering supply chain structures and influencing cost bases. The continuation of Section 232 measures, alongside additional levies on select imported alloys, has compelled domestic cast houses to reconsider sourcing strategies. As import duties remain elevated, several users of aluminum castings have shifted toward local suppliers, recognizing the reliability and shorter lead times offered by domestic production.

This reconfiguration, however, has introduced complexity for tiers integrated within global manufacturing networks. Companies that previously relied on imported A380 alloy billets now face tighter material availability and must invest in in-house melting capabilities or secure contractual assurances from upstream smelters. While these adjustments have driven deeper collaboration across supply chains, they have also increased pressure on smaller foundries to maintain competitive pricing. The net result is a market that demands greater strategic alignment from participants to navigate tariff-induced challenges and leverage emerging opportunities.

Gain a nuanced understanding of market opportunities through die casting type, application focus, alloy selection, part size, and clamping force

Delving into segmentation provides critical insights that illuminate growth vectors and investment priorities. When examining die casting by type, cold chamber systems underscore the need for high-pressure injection capabilities suited for large structural components, while hot chamber methodologies excel in rapid, small-part production. Application analysis reveals that automotive customers continue driving investment, particularly as passenger cars and commercial vehicles demand lighter chassis and powertrain integration, whereas consumer electronics manufacturers seek compact, heat-dissipating housings.

Alloy selection further refines market understanding: A380 prevails for its flow characteristics in high-volume runs, whereas A356 is favored where fatigue resistance and post-machining performance are paramount. Part size considerations influence equipment choice, with under 5 kg castings suited to nimble, automated cells, while above 20 kg components necessitate substantial clamping forces and robust handling systems. Finally, machine clamping force segmentation indicates that under 1000 ton presses cater to smaller batch production, 1000–2000 ton units address mid-range demands, and above 2000 ton installations facilitate the largest structural casts. These layered perspectives enable stakeholders to target capabilities and capacity aligned with specific product portfolios.

This comprehensive research report categorizes the Aluminum Die Casting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Die Casting Type

- Production Process

- Alloy Type

- Process Type

- End-Use Industry

- End-Use Industry

Examine how regional manufacturing clusters and regulatory environments drive die casting across the Americas, EMEA, and Asia-Pacific

Regional dynamics in aluminum die casting reflect the interplay between industrial demand patterns and policy frameworks. In the Americas, automotive manufacturers in North America continue to source large engine blocks and structural brackets from local cast houses to comply with content regulations and minimize logistics complexity. South American markets exhibit growing potential as light vehicles and electrical infrastructure projects invest in die-cast components, benefitting from proximity to raw material sources.

Europe, the Middle East & Africa present a varied landscape: Western European foundries leverage advanced process controls to serve premium automotive brands and high-end consumer sectors, while Middle Eastern initiatives channel resources into industrial machinery and construction applications. In Africa, nascent automotive assembly operations and expanding mining equipment requirements bolster demand for durable die-cast parts. Asia-Pacific remains the largest hub, driven by expansive electronics manufacturing in East Asia and the rapid electrification of transportation in Southeast Asia. Across these regions, regulatory priorities around emissions, recycling content, and trade policies continue to shape manufacturing footprints and investment flows.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Die Casting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover how industry leaders leverage digital simulation, process monitoring, and strategic partnerships to strengthen market leadership

Leading firms in the aluminum die casting arena demonstrate strategic agility through technology adoption and global footprint optimization. Several producers have invested heavily in die-cast process simulation software and in-mold sensors that detect fill patterns in real time, reducing scrap rates and accelerating time to market. Collaboration with equipment suppliers has yielded presses capable of exerting precise clamping force at scale, catering to emerging demands for high-integrity structural castings.

At the same time, companies are forging partnerships with downstream integrators in automotive, electronics, and industrial segments to co-develop parts that streamline assembly and reduce part counts. Joint ventures with alloy smelters have also become more prevalent, ensuring consistency in chemical composition and enhancing material traceability. This trend underscores the importance of end-to-end quality assurance programs, which support customer certifications and regulatory compliance across diverse geographies. Collectively, these initiatives illustrate how top performers leverage innovation and collaboration to reinforce their competitive positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Die Casting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcast Technologies, Ltd.

- Aluminum Corporation of China Limited

- Aluminum Die Casting Company, Inc.

- Apex Aluminum Die Casting Co. Inc

- Beyonics Pte Ltd.

- Bocar Group

- Buvo Castings BV

- Chongqing Chal Precision Aluminium Co., Ltd.

- Consolidated Metco, Inc.

- Endurance Technologies Limited

- Form Technologies Company

- GF Casting Solutions AG

- Gulan Die Casting Ltd

- Kemlows Diecasting Products Ltd

- Koch Enterprises Inc.

- Madison-Kipp Corporation

- Magna International Inc.

- Martinrea Honsel Germany GmbH

- Minda Corporation Ltd.

- Nemak SAB De CV.

- Newcast Die Casting Private Limited

- Rheinmetall AG

- Rockman Industries

- Ryobi Limited

- Sika Technology Limited

Implement data-driven process automation, diversified alloy sourcing, and sustainable practices to secure future growth

To thrive in a rapidly evolving landscape, aluminum die casting executives must pursue a range of targeted actions. First, investing in advanced process controls and data analytics platforms will unlock gains in yield and throughput, while also facilitating predictive maintenance and energy optimization. Parallel to this, diversifying alloy sourcing by forming strategic alliances with global smelters can mitigate tariff exposure and ensure material consistency for critical applications.

Leaders should also explore opportunities in sustainable die casting, including the implementation of low-emission furnaces and closed-loop recycling of scrap. By adopting these practices, organizations can meet tightening environmental regulations and appeal to customers prioritizing green credentials. Finally, integrating additive manufacturing for mold prototyping and tooling can accelerate new product development cycles, enabling faster response to evolving customer specifications. Through these concerted efforts, decision-makers can position their operations to capture both short-term efficiencies and long-term growth prospects.

Learn how in-depth executive interviews, technical literature, and rigorous data triangulation underpin these market insights

This analysis is grounded in a robust research methodology that combines qualitative and quantitative approaches. The primary phase involved in-depth interviews with industry executives, process engineers, and procurement specialists, providing firsthand insights into operational challenges and strategic priorities. Complementing this, secondary research encompassed a thorough review of technical papers, trade publications, and government trade data to verify trends in production and policy impacts.

Data triangulation techniques were applied to reconcile disparate sources, ensuring consistency and reliability in our conclusions. Market mapping exercises identified key players across each segment, while process performance benchmarks were established through comparative analyses of die-cast part quality metrics and operational parameters. Finally, our experts synthesized these findings into actionable insights, leveraging their domain expertise to highlight areas of opportunity and risk. This multi-layered approach delivers a comprehensive and balanced view of the aluminum die casting ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Die Casting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Die Casting Market, by Die Casting Type

- Aluminum Die Casting Market, by Production Process

- Aluminum Die Casting Market, by Alloy Type

- Aluminum Die Casting Market, by Process Type

- Aluminum Die Casting Market, by End-Use Industry

- Aluminum Die Casting Market, by End-Use Industry

- Aluminum Die Casting Market, by Region

- Aluminum Die Casting Market, by Group

- Aluminum Die Casting Market, by Country

- United States Aluminum Die Casting Market

- China Aluminum Die Casting Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Uncover why innovation, supply chain resilience, and sustainability will define leadership in aluminum die casting into the future

As the aluminum die casting industry continues to adapt to shifting end-use requirements and policy landscapes, stakeholders must embrace agility and innovation. The convergence of lightweight mobility, electronic miniaturization, and sustainability mandates offers a wealth of opportunities for those prepared to invest in process excellence and collaborative partnerships. Moreover, navigating tariff-related disruptions will remain critical, with those securing reliable alloy supply and optimizing domestic production best positioned to gain market share.

Ultimately, success will hinge on the ability to integrate digital monitoring, advanced alloys, and sustainable practices into coherent business strategies. By aligning capital expenditures with segments poised for growth-whether that be structural automotive components, precision electronic housings, or heavy-duty industrial parts-organizations can drive profitability and resilience. The insights presented here serve as a strategic compass, guiding decision-makers toward actions that will define leadership in the modern aluminum die casting landscape.

Take control of your market position today by contacting Ketan Rohom for tailored insights and strategic support

If you are ready to gain a competitive edge in the aluminum die casting industry, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, for a detailed discussion about how this report can support your strategic objectives. Our team will guide you through the key findings, answer your queries, and outline customized solutions to meet your organization’s unique needs. Don’t leave critical market intelligence to chance-contact Ketan Rohom to secure your pathway to informed decision-making and sustained growth in the dynamic aluminum die casting sector.

- How big is the Aluminum Die Casting Market?

- What is the Aluminum Die Casting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?