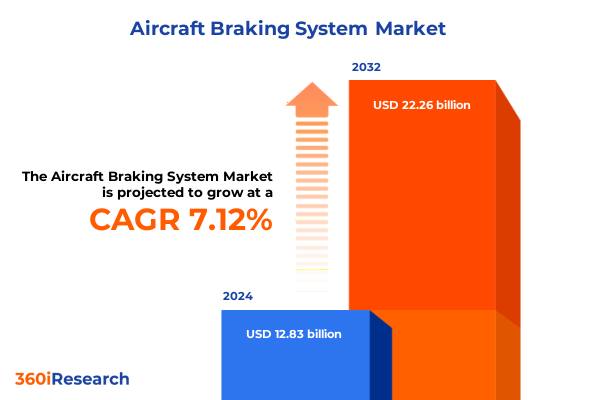

The Aircraft Braking System Market size was estimated at USD 13.77 billion in 2025 and expected to reach USD 14.77 billion in 2026, at a CAGR of 7.77% to reach USD 23.26 billion by 2032.

Pioneering the Future of Aircraft Braking Systems with Unmatched Safety Performance and Cutting-Edge Technological Advancements Across All Fleets

The evolution of aircraft braking systems sits at the heart of modern aviation safety and operational performance. As global fleets expand and aircraft designs advance, the demands on braking technologies have intensified, making robust stopping mechanisms a critical enabler of both everyday airport operations and mission-critical military deployments. In response, industry stakeholders have directed significant innovation efforts towards materials science, system integration, and predictive maintenance, ensuring that braking solutions are lighter, more reliable, and capable of meeting stringent regulatory requirements.

This executive summary provides a concise yet comprehensive overview of the key trends, regulatory influences, and technological breakthroughs shaping the aircraft braking system market. It synthesizes the most pertinent developments-from transformative shifts in brake-by-wire architecture to the strategic implications of recent tariff policies-offering decision-makers a clear roadmap for understanding market dynamics. By articulating deep segmentation and regional insights, the analysis illuminates where opportunities are emerging and where resilience is being tested, thereby equipping leaders with the perspective needed to navigate a rapidly evolving landscape.

Navigating Transformational Shifts in Aircraft Braking Technologies Driving Operational Efficiency Sustainability and Digital Integration Across the Industry

Over the past decade, the aircraft braking sector has undergone a profound transformation driven by the convergence of digitalization, sustainability mandates, and novel material paradigms. Traditional hydraulic assemblies are giving way to electro-hydrostatic and full brake-by-wire configurations that integrate seamlessly with fly-by-wire flight controls, enabling more precise actuation and continuous health monitoring. As a result, maintenance teams are increasingly leveraging onboard sensors and data analytics to predict component wear, schedule timely interventions, and ultimately reduce unscheduled groundings.

Moreover, the industry has witnessed a strategic pivot towards lighter yet more durable materials. Carbon brake discs have long dominated high-performance applications, yet emerging composite and advanced steel alloys are challenging this status quo by offering improved thermal conductivity and reduced environmental footprint. In tandem, additive manufacturing techniques are enabling bespoke brake caliper designs that optimize airflow and cooling, further enhancing system efficiency. Consequently, aircraft operators and OEMs are collaborating closely to pilot these technologies on new and retrofit platforms, thereby accelerating the path from concept to operational deployment.

Evaluating the Cumulative Effects of 2025 United States Tariffs on Aircraft Braking System Supply Chains Production Costs and Strategic Sourcing Decisions

The imposition of additional duties on imported aerospace components in early 2025 has exerted significant pressure on the braking system supply chain. Tariffs targeting high-value carbon assemblies and related subcomponents have not only inflated procurement costs for operators relying on established global suppliers but also prompted a re-evaluation of sourcing strategies. As import duties increase the landed cost of critical parts, OEMs and tier-one manufacturers have begun to explore nearshoring opportunities and diversified vendor portfolios to mitigate the financial impact.

In parallel, end users have revisited inventory management and contract structures to cushion against further tariff volatility. Some carriers are negotiating fixed-price agreements or longer-term supply contracts that lock in current duty rates, while others are accelerating validation of alternative brake disc materials that fall outside the tariff scope. Additionally, strategic partnerships between North American engineering centers and domestic fabrication facilities are emerging as key enablers for reducing lead times and bypassing certain trade restrictions. Consequently, the net effect of these cumulative tariffs is a heightened emphasis on supply chain resilience and material flexibility, reshaping procurement and production roadmaps across the industry.

Unveiling Key Segmentation Insights Based on Material Aircraft Type System Configuration Technology Preferences and Aftermarket Versus OEM Dynamics

When examining the market through the lens of brake material classifications-carbon, composite, and steel-each option reveals distinct performance trade-offs and cost considerations. Carbon brake discs maintain their stronghold among high-end applications due to exceptional heat dissipation and weight advantages, while composites are gaining traction as a balanced alternative for operators seeking mid-range durability and reduced maintenance cycles. Traditional steel assemblies, on the other hand, remain indispensable for certain regional and business aircraft segments where initial cost and simplicity of design are paramount.

Furthermore, the segmentation by aircraft type underscores differentiated requirements between business, commercial, military, and regional platforms. Commercial carriers prioritize high-cycle endurance and compatibility with larger landing gear assemblies, whereas military programs often demand specialized coatings and stealth-compatible materials. Regional operators favor modular nose-wheel and main-wheel systems that can be swapped quickly during tight turnaround schedules. In terms of system configuration, main-wheel braking assemblies account for the bulk of stopping power and heat load management, while nose-wheel systems focus on directional control during taxi and ground maneuvers.

In addition to these mechanical divisions, technology adoption is evolving across conventional hydraulic, electro-hydrostatic, and electro-mechanical architectures. Hydraulic setups continue to serve as the backbone for many legacy fleets, but electro-hydrostatic systems are rapidly becoming the go-to choice for retrofit projects that aim to reduce hydraulic fluid volume and maintenance hazard. Fully electric brake-by-wire solutions, although still emerging, are poised to redefine system redundancy and integration with aircraft health monitoring networks. Finally, the dichotomy of aftermarket versus OEM channels reflects divergent pathways for fleet operators: aftermarket offerings cater to cost-conscious maintenance cycles, while OEM-direct components emphasize certification, warranty coverage, and design optimization.

This comprehensive research report categorizes the Aircraft Braking System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Brake Material

- Aircraft Type

- System Type

- Technology

- Sales Channel

Delivering Regional Perspectives on Aircraft Braking System Adoption and Growth Trends Across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics reveal a tapestry of strategic priorities that influence both adoption rates and innovation trajectories. In the Americas, robust collaboration between major airframe manufacturers and domestic component fabricators has accelerated the deployment of next-generation brake assemblies. Regulatory alignment under the Federal Aviation Administration encourages standardized qualification protocols, enabling faster introduction of novel materials and digital diagnostics tools. Aviation hubs in the United States and Canada also benefit from extensive pilot programs that test advanced cooling methodologies and condition-based maintenance interfaces.

Meanwhile, Europe, the Middle East, and Africa exhibit a pronounced focus on sustainability and lifecycle cost reduction. Airlines and defense agencies in Western Europe have spearheaded initiatives to assess the environmental impact of brake wear particulates, leading to research partnerships with leading universities and materials science laboratories. Gulf carriers and African operators, recognizing their reliance on longer range and heavier aircraft, invest in heat-resistant coatings and improved friction materials that optimize performance in hot and humid climates. Cross-regional consortia are further promoting harmonized standards for brake-by-wire architectures, streamlining certification across EASA and regional regulatory bodies.

In the Asia-Pacific theater, rapid fleet expansion and growing domestic aerospace manufacturing capacity are reshaping the competitive landscape. National champions in China, Japan, and Australia are scaling up production of both conventional hydraulic and electro-hydrostatic systems, while concurrently establishing centers of excellence for composite brake disc development. Moreover, low-cost carriers across Southeast Asia are emerging as testbeds for modular aftermarket solutions that reduce maintenance costs and minimize ground time. Collectively, these regional patterns underscore the importance of localized engineering capabilities and collaborative research ecosystems in driving braking system evolution.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Braking System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aircraft Braking System Manufacturers and Suppliers Showcasing Their Strategic Advances Partnerships Innovations and Market Positioning

A cadre of specialized suppliers and integrated aviation groups dominate the aircraft braking landscape through strategic investments and technological leadership. Established leaders leverage decades of flight-critical know-how to refine manufacturing processes for carbon discs and hydraulic assemblies, while newcomers often focus on niche capabilities such as additive manufacturing or advanced sensor integration. Partnerships between airframe OEMs and subsystem vendors have matured into co-development programs that accelerate certification timelines and enhance design for maintainability.

Several key players have expanded their portfolios through targeted acquisitions, absorbing small technology innovators with proprietary friction materials or digital monitoring platforms. These mergers not only bolster product breadth but also foster cross-pollination of R&D teams, enabling novel braking solutions that combine lightweight alloys with real-time diagnostics. In parallel, a segment of aftermarket specialists has carved out a competitive advantage by offering turnkey support packages that bundle component repair, refurbishment, and upgrade kits in a single contract, addressing the operational imperatives of airlines with high fleet utilization.

Beyond pure manufacturing prowess, leading companies are prioritizing sustainability in their production footprints and supply chains. Initiatives include closed-loop recycling of carbon composite scrap, integration of alternative energy sources at fabrication sites, and adherence to circular economy principles in part lifecycles. As competitive differentiation moves beyond performance metrics alone, these environmental considerations have become integral to supplier selection and partnership negotiations across the aviation value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Braking System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bauer Inc.

- Collins Aerospace Inc.

- Dunlop Aircraft Tyres Ltd.

- Eaton Corporation PLC

- Grove Aircraft Landing Gear Systems Inc.

- Honeywell International Inc.

- Liebherr-International Deutschland GmbH

- Meggitt PLC

- Moog Inc.

- Parker-Hannifin Corporation

- Rapco Fleet Support, Inc.

- Safran Landing Systems SAS

- The Timken Company

Implementing Actionable Recommendations to Strengthen System Resilience Supply Chain Agility Innovation Roadmaps and Regulatory Compliance Strategies

Industry leaders looking to secure a competitive edge must embrace a multifaceted strategy that spans technology, operations, and regulatory engagement. First, allocating resources to advanced materials research will unlock next-generation brake discs with enhanced thermal and wear characteristics, thereby extending maintenance intervals and lowering total lifecycle costs. Concurrently, forging alliances with digital solution providers to integrate predictive analytics and condition-based monitoring can minimize unscheduled groundings and streamline spare parts logistics.

Furthermore, supply chain agility remains paramount in an environment marked by evolving trade policies and fluctuating raw material availability. Organizations should proactively identify alternative sources for proprietary friction materials and consider dual-location manufacturing frameworks to insulate against tariff impacts. In parallel, consolidating supplier evaluation criteria to prioritize environmental certifications and circular economy capabilities will resonate with increasingly stringent sustainability mandates.

Finally, active participation in industry working groups and standards committees will ensure that emerging brake-by-wire and electro-hydrostatic technologies align with global certification requirements. By contributing to the definition of test protocols and safety directives, companies can accelerate time to market while shaping the regulatory landscape in their favor. Taken together, these actions form a cohesive roadmap for leaders intent on driving innovation, resilience, and growth within the aircraft braking system ecosystem.

Outlining Robust Research Methodology Employing Primary Interviews Secondary Data Sources Patent Analysis and Expert Validation to Ensure Integrity and Depth

This research synthesis is grounded in a rigorous methodology combining primary interviews with aviation engineers, maintenance directors, and procurement executives, alongside comprehensive analysis of secondary sources. Our primary engagements involved structured discussions addressing technical requirements, supply chain challenges, and adoption roadblocks for different braking technologies. These interviews were conducted across a diverse set of operators, including commercial airlines, business jet fleets, and defense establishments, ensuring a holistic perspective on market dynamics.

Secondary data sources comprise whitepapers published by regulatory bodies, technical bulletins issued by airframe manufacturers, and peer-reviewed materials science journals exploring novel friction compositions. In addition, patent databases were mined to trace innovation trajectories within electro-mechanical and electro-hydrostatic actuation systems. This patent analysis was supplemented by expert validation workshops, where subject matter experts reviewed preliminary findings and provided context on emerging safety standards, certification pathways, and environmental guidelines.

To ensure the integrity and reliability of insights, data triangulation was employed throughout the process, cross-referencing interview inputs with documented performance benchmarks and regulatory filings. A layered review mechanism, incorporating editorial scrutiny and technical peer review, further refined the analysis. As a result, the conclusions presented herein rest on a solid foundation of primary evidence and authoritative validation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Braking System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Braking System Market, by Brake Material

- Aircraft Braking System Market, by Aircraft Type

- Aircraft Braking System Market, by System Type

- Aircraft Braking System Market, by Technology

- Aircraft Braking System Market, by Sales Channel

- Aircraft Braking System Market, by Region

- Aircraft Braking System Market, by Group

- Aircraft Braking System Market, by Country

- United States Aircraft Braking System Market

- China Aircraft Braking System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights Emphasizing Strategic Imperatives Emerging Opportunities and Critical Considerations Shaping the Future of Aircraft Braking Systems

Drawing together the key themes, it becomes evident that aircraft braking systems are undergoing a period of rapid innovation driven by safety imperatives, sustainability goals, and digital transformation. The interplay of advanced materials, system architectures, and data-enabled maintenance strategies is redefining expectations for performance and reliability. Moreover, the recent tariff environment has underscored the critical importance of supply chain resilience and strategic sourcing.

Regional disparities in regulatory frameworks and fleet compositions continue to shape technology adoption pathways, from the sustainability-focused programs in Europe to the rapid fleet growth in Asia-Pacific and the collaborative certification efforts in the Americas. By leveraging these regional nuances, manufacturers and operators can tailor their strategies to capitalize on localized strengths, whether through modular upgrades, co-development initiatives, or targeted aftermarket services.

Ultimately, companies that proactively integrate advanced materials research with digital capabilities, while maintaining agile sourcing models and active regulatory engagement, will emerge as industry frontrunners. The recommendations outlined herein serve as a practical blueprint for driving both incremental improvements and disruptive breakthroughs, positioning stakeholders to lead the next generation of braking system innovation.

Act Now to Secure Your Customized Aircraft Braking System Market Research Report with Expert Support from Associate Director of Sales and Marketing

Act now to elevate your strategic decision making with a bespoke market research report tailored to your needs and backed by expert guidance from Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. This comprehensive report distills critical insights across material technologies, regional dynamics, and emerging innovations to empower procurement, engineering, and executive teams in optimizing their braking system investments. By partnering directly with Ketan Rohom, you secure access to personalized support in interpreting data, benchmarking against competitors, and formulating actionable strategies that align with your corporate objectives. Reach out today to transform your understanding of the aircraft braking system landscape and gain a competitive advantage that drives long-term value.

- How big is the Aircraft Braking System Market?

- What is the Aircraft Braking System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?