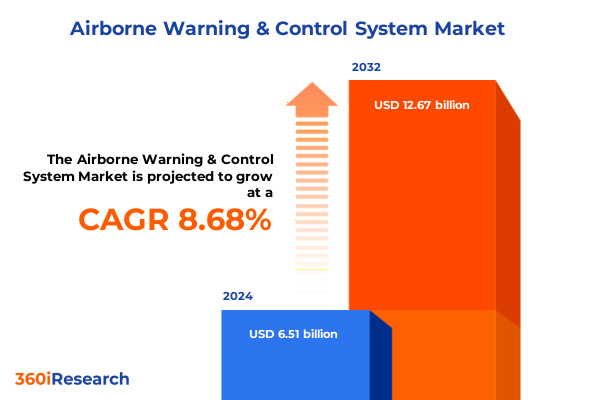

The Airborne Warning & Control System Market size was estimated at USD 7.08 billion in 2025 and expected to reach USD 7.65 billion in 2026, at a CAGR of 8.66% to reach USD 12.67 billion by 2032.

Revolutionizing Airborne Domain Awareness Through Advanced Warning and Control Capabilities in a Dynamic Complex Threat Environment

Airborne Warning and Control Systems have become the cornerstone of modern aerial defense, delivering unparalleled situational awareness and command capabilities across contested operational theaters. Leveraging sophisticated radar arrays, high-speed data links, and integrated command nodes, these airborne platforms extend the sensor fusion envelope far beyond ground-based systems. As geopolitical tensions evolve and multi-domain conflicts intensify, AWACS capabilities play a pivotal role in detecting, tracking, and coordinating responses to aerial and maritime threats at extended ranges.

The legacy of early warning aircraft, born out of Cold War imperatives, has transformed dramatically with the integration of advanced electronics, software-defined systems, and network-centric architectures. Innovations in Active Electronically Scanned Array (AESA) radars and unmanned aerial vehicles have expanded the surveillance footprint while reducing lifecycle costs and operational risks. Today’s platforms must seamlessly interface with both manned and unmanned assets, enabling commanders to achieve real-time battlespace awareness in environments characterized by high-speed engagements and sophisticated electronic warfare countermeasures.

Across multinational coalitions, AWACS platforms facilitate critical command-and-control functions, from coordinating fighter intercepts to managing complex air-refueling operations. Their ability to provide continuous, high-altitude surveillance underpins strategic deterrence, supports humanitarian missions, and ensures secure air corridors in contested regions. Furthermore, rapid data dissemination to joint and allied forces amplifies collective defense postures and enhances interoperability in multinational exercises.

This executive summary delivers a distilled overview of the transformative shifts, segmentation insights, regional dynamics, and strategic recommendations that define the AWACS market. By examining emerging technological trends, policy impacts, and competitive landscapes, this document equips defense planners, procurement officials, and industry stakeholders with the intelligence needed to navigate an increasingly complex and dynamic operating environment.

Strategic Adaptation to Rapidly Evolving Multi-Domain Threats and Data-centric Technological Innovations Shaping the Future of Airborne Surveillance Operations

The Airborne Warning and Control System landscape is undergoing a period of rapid evolution driven by emerging multi-domain threats and disruptive technological breakthroughs. In recent years, the proliferation of hypersonic glide vehicles and stealth platforms has challenged traditional detection paradigms, prompting a shift toward integrated sensor networks that fuse data from airborne, space-based, and ground-based assets. As a result, system architects are prioritizing open-architecture designs that accommodate modular upgrades and seamless integration with allied network nodes.

Concurrently, the ascendancy of unmanned aerial vehicles within the AWACS domain is reshaping mission profiles. Remotely piloted platforms now complement fixed-wing and rotary-wing aircraft, extending surveillance endurance and reducing crew risk in contested regions. Advances in artificial intelligence and machine learning enable onboard signal processing, allowing these systems to autonomously detect and classify targets in real time, thereby alleviating operator workload and accelerating decision cycles.

Another significant trend is the transition from legacy Gallium Arsenide–based radars to Gallium Nitride–enabled Active Electronically Scanned Arrays, which offer higher power density, broader bandwidth, and enhanced electronic attack resistance. This shift not only enhances detection ranges but also supports simultaneous multi-mode operations, such as surveillance and electronic warfare, within a single compact array. Moreover, the emergence of digital engineered materials has improved aerodynamic efficiency and reduced platform weight, contributing to lower fuel consumption and extended on-station times.

As cyber threats intensify, AWACS platforms are embedding hardened architectures with real-time intrusion detection and end-to-end encryption. Secure communications and resilient network protocols ensure system integrity against sophisticated electronic warfare tactics. These transformative shifts underscore the imperative for defense organizations to adopt adaptive procurement strategies that can accommodate continuous innovation, ensuring mission success in an ever-evolving threat environment.

Analyzing the Far-reaching Consequences of 2025 United States Defense Tariffs on the Airborne Warning and Control System Supply Chain and Procurement

In 2025, the imposition of defense-oriented tariffs by the United States has introduced new complexities into the global supply chain for critical AWACS components. Increased duties on imported semiconductors, composite materials, and specialized radome elements have led to elevated acquisition costs for key subsystems. This has prompted both prime contractors and subsystem suppliers to re-evaluate production footprints and material sourcing strategies to mitigate tariff-induced pricing pressures.

Some manufacturers have responded by localizing semiconductor assembly and forging new partnerships with domestic foundries to insulate against external levies. Others are reconfiguring their bill of materials to substitute tariff-exposed components with functionally equivalent alternatives from untaxed supply bases. While these adjustments preserve program schedules, they require rigorous qualification testing to maintain system performance standards and electromagnetic compatibility.

On the procurement side, defense ministries in allied nations have begun negotiating tariff-sharing agreements and offset arrangements, whereby a share of duties is absorbed through industrial participation and technology transfer commitments. These collaborative frameworks aim to preserve affordability while fostering local supply chain resilience and workforce development. In parallel, contract negotiations increasingly include price review clauses linked to tariff fluctuations, providing both suppliers and buyers with cost visibility and risk-sharing mechanisms.

Looking ahead, the cumulative impact of these tariffs underscores the need for strategic supply chain diversification and more agile contract structures. Defense stakeholders are prioritizing dual-sourcing strategies, increased investment in domestic manufacturing, and adaptive logistics planning. By embedding flexibility into program execution and procurement contracts, the AWACS community can minimize tariff-related disruptions and sustain operational readiness.

Unveiling Comprehensive Market Segmentation Insights Across Diverse Platform Types, Radar Variants, Service Offerings, Installation Scenarios, Applications, and End Users

Market segmentation in the AWACS domain reveals nuanced demand drivers and operational priorities across platform types, radar variants, service offerings, installation scenarios, application areas, and end-user groups. When classified by platform, fixed-wing aircraft maintain dominance in long-range surveillance missions, while rotary-wing assets-encompassing both dedicated AWACS helicopters and versatile tiltrotor platforms-excel in border security and littoral operations. At the same time, unmanned aerial vehicles, including large endurance platforms such as the Aksungur UAV and the RQ-4 Global Hawk, are increasingly deployed for persistent, low-risk intelligence collection over denied airspace.

Examining radar categories, Active Electronically Scanned Arrays have emerged as the preferred solution, with next-generation GaN-based systems delivering superior power efficiency and electronic counter-countermeasure performance compared to GaAs-based variants. Mechanically scanned arrays, including traditional rotodome installations and novel tiltrotor-mounted sensors, continue to service legacy fleets, whereas passive electronically scanned arrays-both upgraded digital models and conventional analog designs-offer cost-effective modernization pathways.

Service segmentation underscores the importance of comprehensive lifecycle support. Maintenance, repair, and overhaul efforts at depot and field service levels ensure fleet availability, while targeted modernization initiatives-ranging from hardware replacements to software architecture overhauls-extend platform service lives. Additionally, training programs, comprising both live field exercises and high-fidelity simulator sessions, address operator proficiency in complex, multi-domain environments.

Installation frameworks further distinguish airborne, land-based, and ship-based solutions. Airborne integrations span fixed-wing and rotary-wing platforms, ground stations vary between fixed installations and mobile units, and maritime deployments range from carrier-based surveillance wings to destroyer-mounted sensor suites. Across application focus areas, border monitoring missions-both coastal and terrestrial-share priority with civil search-and-rescue operations over maritime and mountain terrain, while airspace monitoring and maritime surveillance fulfill core military reconnaissance requirements. Finally, the end-user landscape encompasses strategic and tactical air forces, coast guard maritime patrol and rescue commands, homeland security border patrol entities, and naval carrier and shore-based surveillance units. Each segment reflects distinct budgetary cycles, capability requirements, and procurement processes that inform tailored market approaches.

This comprehensive research report categorizes the Airborne Warning & Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Radar Type

- Service Type

- Installation Type

- Application

- End User

Highlighting Key Regional Dynamics Influencing Airborne Warning and Control Deployments in the Americas, Europe Middle East Africa, and Asia-Pacific Theaters

Regional dynamics in the AWACS arena vary significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific theaters, each shaped by unique strategic priorities and procurement policies. In the Americas, modernization programs emphasize replacing aging platforms with next-generation fixed-wing AWACS and augmenting unmanned sensor wings. Collaboration between defense agencies and domestic aerospace industries has accelerated the integration of advanced GaN-based AESA radars, reinforced by joint exercises focused on hemispheric air defense interoperability.

In the Europe, Middle East & Africa region, a diverse threat environment ranging from peer-nation airpower posturing to non-state actor aerial incursions has spurred investment in flexible rotary-wing AWACS and mobile ground stations. Nations in the Gulf and North Africa are procuring tiltrotor-based surveillance platforms to secure vast maritime borders, while NATO members are upgrading legacy rotodomes and pursuing cooperative procurement to achieve economies of scale. Emphasis is placed on cybersecurity-hardened communications and interoperability with space-based missile warning networks.

Asia-Pacific stakeholders are prioritizing maritime domain awareness amid intensifying naval competition in contested waters. Fixed-wing AWACS complemented by long-endurance UAVs are being acquired to monitor expansive oceanic zones, with regional powers also exploring ship-based sensor suites for fleet defense. This theater’s fiscal constraints are leading to innovative leasing arrangements and offset agreements, enabling smaller nations to access advanced airborne surveillance capabilities without prohibitive upfront investments.

These regional insights highlight the interplay between threat perceptions, alliance structures, and industrial capabilities. By aligning procurement strategies with specific geographic requirements and collaborative frameworks, defense planners can optimize asset deployment, enhance coalition interoperability, and maintain persistent awareness across diverse operating environments.

This comprehensive research report examines key regions that drive the evolution of the Airborne Warning & Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Company Movements and Collaborations Driving Innovation and Competitive Advantage in the Airborne Warning and Control System Domain

Leading industry participants are capitalizing on technological convergence and cross-border partnerships to reinforce their positions in the AWACS domain. Major defense primes have accelerated R&D investments into GaN-based radar technologies, digital signal processing architectures, and cyber-resilient communication suites. These efforts are complemented by strategic acquisitions of specialized aerospace electronics firms and targeted joint ventures that expand global manufacturing footprints.

Certain companies have formed consortiums to co-develop modular mission systems capable of rapid configuration changes in the field. By leveraging shared development costs and pooling intellectual property, these collaborations reduce time-to-market for advanced radar payloads and enable scalable production of both manned and unmanned platforms. At the same time, smaller technology providers are forging alliances with prime contractors to integrate specialized subsystems, such as cognitive electronic warfare modules and data fusion engines, enhancing overall system lethality and survivability.

In service lifecycle management, aftermarket specialists are partnering with government logistics agencies to deliver end-to-end maintenance, repair, and overhaul solutions. These agreements often include performance-based availability metrics, incentivizing suppliers to maintain high readiness levels and minimize aircraft downtime. Additionally, digital twin initiatives are gaining traction, providing virtual replicas of airborne platforms for predictive maintenance planning and accelerated qualification of upgrade programs.

Emerging defense integrators in regions such as Southeast Asia and the Middle East are establishing localized assembly lines through industrial participation commitments, securing technology transfer and job creation in host nations. This geographic diversification of production capacity not only mitigates supply chain risks but also fosters long-term customer relationships through co-development and co-production models. Together, these strategic moves are reshaping competitive dynamics and accelerating innovation cycles within the AWACS market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airborne Warning & Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- Bharat Electronics Limited

- Cobham plc

- Dassault Aviation

- Defence Research and Development Organisation

- Elbit Systems Ltd

- Embraer Defense & Security

- General Dynamics Corporation

- HENSOLDT AG

- Hindustan Aeronautics Limited

- Honeywell International Inc

- Israel Aerospace Industries Ltd

- KAI Korea Aerospace Industries

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Electric Corporation

- Northrop Grumman Corporation

- QinetiQ Group plc

- Rafael Advanced Defense Systems Ltd

- RTX Corporation

- Saab AB

- Thales Group

- The Boeing Company

Crafting Actionable Strategies for Industry Leaders to Enhance Resilience, Drive Technological Adoption, and Secure Sustained Growth in AWACS Capabilities

Industry leaders should prioritize the development of modular, open-architecture systems that can accommodate rapid upgrades across radar, communications, and processing capabilities. By designing airborne platforms with standardized interfaces and plug-and-play sensor bays, organizations can reduce upgrade cycle times and minimize integration costs. This flexibility is essential for responding to emergent threats and incorporating next-generation technologies without extensive platform redesigns.

Strengthening supply chain resilience is equally critical. Defense primes and subcontractors should establish multiple sourcing strategies for high-risk components, particularly semiconductors and specialty composites subject to geopolitical constraints. Investing in domestic production partnerships and backup suppliers will mitigate tariff impacts and safeguard program schedules. Moreover, incorporating advanced supply chain analytics can provide real-time visibility into inventory levels and supplier performance, enabling proactive risk management.

Leveraging digital transformation initiatives, such as digital twins and cloud-native data architectures, can enhance predictive maintenance and security monitoring. By collating sensor data from in-service aircraft and applying machine learning algorithms, stakeholders can forecast component failures and optimize maintenance intervals. Simultaneously, embedding artificial intelligence in electronic warfare suites and sensor fusion layers will augment operator decision-making and accelerate target engagement cycles.

Finally, forging collaborative R&D consortia with academia and allied partners will drive down innovation costs and promote interoperability standards. Joint test and evaluation programs can validate emerging capabilities under realistic operational conditions, facilitating quicker transition to fielded systems. By adopting these actionable strategies, industry stakeholders can secure technological superiority, maintain fleet readiness, and capitalize on evolving defense requirements in the AWACS domain.

Detailing Robust Research Methodology Employed for Comprehensive Data Collection, Validation, and Analytical Rigor in the AWACS Market Study

This analysis is grounded in a rigorous multi-layered research methodology combining extensive primary interviews, comprehensive secondary intelligence gathering, and meticulous data triangulation. Primary research involved direct consultations with senior defense procurement officials, platform integrators, avionics engineers, and subject matter experts across North America, Europe, the Middle East, and the Asia-Pacific regions. These expert interviews provided qualitative insights into operational requirements, procurement priorities, and emerging capability gaps.

Secondary research encompassed a thorough review of official defense procurement documents, policy briefs, whitepapers, and technical specifications from leading aerospace and defense agencies. Government tenders and contract award notices were examined to validate program timelines and acquisition frameworks. Additionally, publicly available patent filings and conference proceedings were analyzed to identify technology maturity levels and competitive breakthroughs in radar and sensor integration.

Data triangulation ensured robustness by cross-verifying information from multiple independent sources. Quantitative data on platform deployments, modernization schedules, and service agreements were corroborated with qualitative assessments from industry analysts. This process minimized bias and enhanced the overall validity of segmentation insights, regional dynamics, and competitive company profiles. Methodological transparency is maintained through detailed documentation of interview protocols, source hierarchies, and analysis techniques.

Finally, analytical rigor was upheld by applying scenario-based stress testing of emerging technologies against diverse threat environments. Sensitivity analyses assessed the resilience of various procurement models under tariff fluctuations and supply chain disruptions. The outcome is an impartial, evidence-backed executive summary that empowers stakeholders with actionable intelligence to inform strategic decisions in the AWACS domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airborne Warning & Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airborne Warning & Control System Market, by Platform Type

- Airborne Warning & Control System Market, by Radar Type

- Airborne Warning & Control System Market, by Service Type

- Airborne Warning & Control System Market, by Installation Type

- Airborne Warning & Control System Market, by Application

- Airborne Warning & Control System Market, by End User

- Airborne Warning & Control System Market, by Region

- Airborne Warning & Control System Market, by Group

- Airborne Warning & Control System Market, by Country

- United States Airborne Warning & Control System Market

- China Airborne Warning & Control System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3975 ]

Synthesis of Critical Insights Underscoring the Strategic Imperatives for Advancing Airborne Warning and Control System Effectiveness in Modern Defense

The evolving landscape of AWACS technology underscores the imperative for continuous innovation, strategic flexibility, and integrated coalition operations. As adversaries develop advanced airborne and hypersonic threats, the ability to detect, track, and coordinate responses across multi-domain battlespaces becomes non-negotiable. The transition toward GaN-based AESA radars and unmanned teaming concepts enhances system lethality while reducing long-term sustainment burdens.

Meanwhile, the ripple effects of tariff policies and supply chain constraints highlight the importance of resilient procurement frameworks and diversified sourcing strategies. Defense organizations must adapt contractual structures to share pricing risks and foster domestic capabilities through industrial participation. This approach not only stabilizes program costs but also bolsters sovereign production capacity and workforce development.

Regional insights reveal that tailored acquisition strategies, aligned with specific threat perceptions and alliance commitments, yield the greatest operational effectiveness. Collaborative R&D efforts and shared modernization programs can deliver economies of scale and ensure interoperability among coalition partners. Concurrently, investment in predictive maintenance technologies and digital twin environments will optimize fleet availability and reduce lifecycle costs.

By embracing modularity, open architectures, and strategic partnerships, industry leaders can accelerate capability enhancements and maintain competitive advantage. The strategic imperatives outlined in this summary provide a roadmap for navigating an increasingly complex AWACS ecosystem, ensuring sustained superiority in airborne surveillance and control operations.

Connect with Associate Director Ketan Rohom to Unlock In-Depth Airborne Warning and Control System Market Insights and Acquire the Comprehensive Report Today

For decision-makers seeking deeper insights into the evolving Airborne Warning and Control System landscape, partnering with Ketan Rohom, Associate Director of Sales & Marketing, presents a unique opportunity to access unparalleled expertise and tailored analysis. With a focus on strategic alignment and actionable intelligence, this collaboration ensures that your organization will benefit from in-depth perspectives on platform innovations, radar technologies, service models, and regional dynamics shaping the industry.

Engaging with Ketan Rohom unlocks the full potential of our comprehensive market research report, equipping stakeholders with the knowledge to make informed procurement, investment, and partnership decisions. Through personalized consultations, your team will receive clarity on how to navigate supply chain complexities, leverage emerging technologies, and capitalize on growth opportunities across the Americas, EMEA, and Asia-Pacific theaters.

By securing the complete report, you gain access to detailed company profiles, segmentation analyses, and strategic recommendations designed to fortify your competitive advantage. Don’t miss the chance to transform high-level intelligence into concrete strategies that drive sustained impact in mission-critical airborne surveillance operations. Contact Ketan Rohom today to acquire this definitive resource and take a decisive step towards future-ready AWACS capabilities.

- How big is the Airborne Warning & Control System Market?

- What is the Airborne Warning & Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?