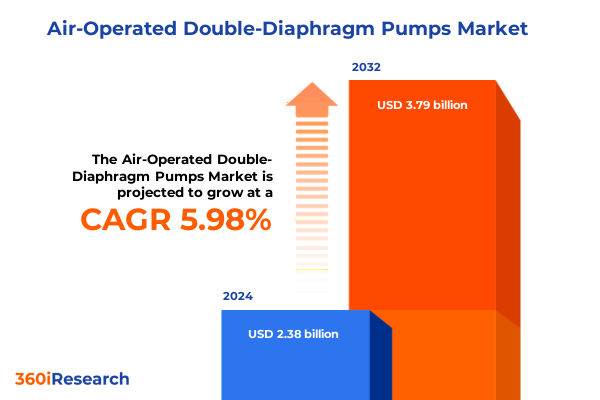

The Air-Operated Double-Diaphragm Pumps Market size was estimated at USD 2.52 billion in 2025 and expected to reach USD 2.67 billion in 2026, at a CAGR of 5.99% to reach USD 3.79 billion by 2032.

Exploring Critical Innovations and Applications of Air-Operated Double-Diaphragm Pumps in Emerging Industrial Sectors and Environmental Compliance Frameworks

The air-operated double-diaphragm pump has emerged as an indispensable solution across a wide spectrum of industrial applications, marrying reliability with versatility through its simple yet robust pneumatic mechanism. As these pumps rely solely on compressed air to drive diaphragms that alternately create suction and discharge, they deliver exceptional performance in handling abrasive, viscous, and chemically aggressive fluids without the need for external power sources. This inherent redundancy of electrical components not only enhances safety in hazardous environments but also simplifies compliance with stringent environmental and safety regulations. Consequently, organizations seeking reliable fluid transfer solutions in chemical manufacturing, food processing, mining operations, oil and gas facilities, pharmaceutical production lines, and water treatment installations are increasingly turning to these pumps. Furthermore, the modular nature of diaphragm configurations enables seamless customization for specific process requirements, ensuring optimal throughput and minimal downtime. As global regulatory frameworks tighten around emissions, effluent management, and workplace safety, the role of air-operated double-diaphragm pumps continues to expand. Their capacity to manage a diverse range of media while complying with evolving standards cements their position as a critical component in the modern industrial landscape. In parallel with advances in material science and manufacturing techniques, these pumps are poised to redefine expectations for durable, high-performance fluid handling solutions.

Examining How Technological Advancements and Sustainability Drives Are Reshaping the Air-Operated Double-Diaphragm Pump Landscape Across Industries

Technological advancement and a heightened emphasis on sustainability have catalyzed transformative shifts in how air-operated double-diaphragm pumps are designed, deployed, and maintained. Today, intelligent monitoring systems equipped with Internet of Things sensors enable real-time tracking of flow rates, pressure fluctuations, and diaphragm wear, thereby facilitating predictive maintenance and minimizing unplanned downtime. Concurrently, additive manufacturing techniques are allowing for rapid prototyping of complex valve bodies and manifold structures, accelerating time-to-market for tailored pump configurations. In addition, the integration of lightweight composite materials and high-performance elastomers has significantly improved energy efficiency by reducing the mass of moving components and enhancing chemical resistance. Sustainability mandates and corporate responsibility initiatives have further driven demand for pumps that reduce air consumption and minimize fugitive emissions. As a result, original equipment manufacturers are increasingly embedding advanced control valves, optimized air manifolds, and low-friction coatings into new pump models to achieve superior performance while adhering to the latest environmental standards. Moreover, these shifts are fostering greater collaboration between pump designers and end users to co-develop solutions that address emerging challenges, such as the handling of microplastics in wastewater or the transfer of bio-based fluids. Taken together, these developments are reshaping expectations around reliability, efficiency, and ecological impact across the pump landscape.

Analyzing the Collective Effects of 2025 United States Tariffs on Supply Chains, Cost Structures, and Competitive Dynamics in the Pump Market

In 2025, United States-imposed tariffs on select raw materials and imported pump components have exerted pervasive effects on supply chains, procurement strategies, and overall cost structures within the air-operated double-diaphragm pump market. Tariffs targeting fluoropolymer resins, stainless steel castings, and specialized elastomers have raised the landed cost of critical diaphragm materials and pump housings, compelling manufacturers to reassess vendor portfolios and explore alternative sourcing options. Consequently, many suppliers have negotiated long-term contracts with domestic resin producers and steel foundries to mitigate exposure to fluctuating import duties, while others have accelerated investments in material substitution research to identify lower-cost elastomer blends without compromising chemical resistance or lifecycle performance. The cumulative impact of these measures has rippled through end-user pricing models, prompting distribution partners to adjust service agreements and maintenance contracts to reflect the new cost baseline. At the same time, localized assembly operations in non-tariff regions have gained traction, as companies seek to reduce lead times and import burdens. However, these strategic pivots have not been without challenges: workforce training, quality assurance protocols, and capital investment cycles have all had to adapt swiftly to sustain product reliability. Ultimately, the combined effects of 2025 tariffs underscore the imperative for resilience in supply chain architecture and a proactive commitment to material innovation across the pump ecosystem.

Unveiling Deep-Dive Insights Across End-User Verticals, Material Choices, Diaphragm Constituents, Pressure and Flow Ratings, and Product Type Variants

A nuanced understanding of end-user application verticals, material composition, diaphragm constituent options, system pressure thresholds, volumetric flow requirements, and product categorization is foundational to navigating the evolving landscape. Insights drawn from the chemical sector reveal that bulk chemical processors favor metallic pump assemblies for high-density slurries, while agrochemical formulators increasingly adopt specialty pumps equipped with PTFE-lined diaphragms to handle corrosive reagents. Within the food and beverage arena, dairy producers prioritize sanitary pump designs with FDA-compliant elastomers, while confectionery manufacturers leverage corrosion-resistant models to transfer syrup and coating solutions efficiently. In the mining domain, coal extraction sites demand heavy-duty units capable of sustaining high-pressure, high-volume operations, whereas metal and mineral processing facilities often require medium-pressure configurations paired with Santoprene diaphragms to manage abrasive slurries. The oil and gas spectrum spans upstream exploration, where robust high-pressure units ensure reliable chemical injection, to downstream refining, where low-pressure, rubber-equipped pumps handle hydrocarbon additives. Pharmaceutical production lines emphasize biocompatibility through smooth-finish standards and polyurethane diaphragms for stringent purity requirements. Simultaneously, water and wastewater applications are distinguished by municipal plants deploying standard pump types for moderate flows, contrasted with industrial treatment sites that utilize above-50-gpm corrosion-resistant variants to process effluent. Material segmentation further delineates the market, as metallic constructions deliver structural integrity for extreme process conditions, and non-metallic options offer enhanced chemical inertness. Pressure range distinctions illustrate that high-pressure models dominate heavy industrial processes, medium-pressure variants address general-purpose transfer applications, and low-pressure units serve metering and sampling tasks. Flow rate segmentation underscores the importance of application-matched capacities, with up-to-25-gpm pumps favored for precise dosing, mid-range units for standard transfer duties, and above-50-gpm configurations for bulk fluid movement. Finally, product type diversification-from corrosion-resistant to standard models-provides targeted solutions aligned with operational demands and regulatory imperatives.

This comprehensive research report categorizes the Air-Operated Double-Diaphragm Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Material

- Flow Rate

- End User

Discerning Regional Performance Indicators and Market Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific for Pump Adoption Trends

Regional dynamics reveal distinct drivers influencing adoption patterns and growth trajectories in the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, infrastructure modernization and stringent environmental regulations have elevated demand for reliable pumps in municipal water treatment and shale gas development projects, while the resurgence of domestic chemical production supports a parallel expansion in industrial-grade units. North American chemical and pharmaceutical processors continue to seek partnerships with manufacturers offering tailored maintenance services and rapid parts availability. Across Latin America, mining investments and agricultural expansion are spurring uptake of robust heavy-duty configurations capable of handling abrasive slurries under fluctuating grid conditions. In the Europe Middle East & Africa arena, regulatory compliance standards such as the EU’s Industrial Emissions Directive and the REACH regulations have underscored the need for chemically inert materials and low-air-consumption designs, prompting European OEMs to lead in innovation for energy-efficient manifolds. Simultaneously, oil and gas developments in the Gulf region are leveraging high-pressure diaphragm pumps for chemical injection and process support, while municipal wastewater projects across Africa are driving demand for cost-effective, standard pump types. Meanwhile, the Asia-Pacific region is characterized by rapid industrialization in China and India, where the expansion of petrochemical complexes, food processing facilities, and mining operations fuels appetite for modular, medium-pressure units with integrated condition-monitoring options. Southeast Asian governments’ investments in water infrastructure and pharmaceutical manufacturing further reinforce the strategic importance of localized manufacturing hubs and aftermarket service footprints.

This comprehensive research report examines key regions that drive the evolution of the Air-Operated Double-Diaphragm Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovators Dominating Technological, Service, and Strategic Frontiers in the Air-Operated Double-Diaphragm Pump Sector

Key corporate players in the air-operated double-diaphragm pump sector have refined their competitive positioning through a blend of strategic partnerships, product innovation, and global footprint expansion. Leading manufacturers have prioritized the integration of smart control valves and adaptive air manifolds in their flagship models, forging alliances with sensor providers to deliver turnkey monitoring solutions that elevate uptime and operational transparency. Concurrently, select innovators have pursued licensing agreements to develop proprietary diaphragm compounds with enhanced resistance to solvents and extreme temperatures, distinguishing their offerings in niche segments such as offshore chemical dosing and biopharma transfer. To reinforce service capabilities, top suppliers have broadened their aftermarket networks, establishing regional centers-of-excellence that provide rapid-response repair, refurbishment, and customization. At the same time, mid-tier specialists have carved out competitive advantages by offering agile, application-specific design services and leveraging lean manufacturing principles to reduce lead times. Cross-industry collaborations are also on the rise, with several pump vendors partnering with OEM equipment integrators to embed diaphragm pumps directly into turnkey processing lines, thereby streamlining procurement and installation. Throughout this competitive landscape, companies that harmonize digital enhancements with domain expertise in materials chemistry and fluid dynamics are emerging as the most influential stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air-Operated Double-Diaphragm Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambica Machine Tools

- Botou Saiken Pumps Co., Ltd.

- China Kemai Industrial Co.,Ltd

- DXP Pacific

- Finish Thompson Inc.

- Graco Inc.

- IDEX Corporation

- Ingersoll Rand Inc.

- JDA Global LLC

- John Brooks Company

- LEWA GmbH

- Numatic Pumps

- Phoenix Pumps, Inc

- PSG Dover Corporation

- Roto Pumps Limited

- Shanghai GL Environmental Technology Co., Ltd.

- Shanghai Shinjo Pump Co ., Ltd.

- SPX FLOW, Inc.

- Tapflo Group

- Unibloc Hygienic Technologies

- Verder International BV

- Warren Rupp, Inc

- Xylem Inc.

- Yamada Corporation

- Zhejiang Yonjou Technology Co., Ltd.

Presenting Strategic Actions and Key Priorities That Industry Stakeholders Must Embrace to Capitalize on Emerging Pump Market Opportunities Amidst Challenges

To capitalize on the momentum shaping the air-operated double-diaphragm pump marketplace, industry stakeholders should prioritize a series of concrete actions. First, securing competitive advantage necessitates investment in IoT-enabled control modules and predictive analytics platforms, which can preempt downtime and optimize energy consumption. At the same time, supply chain resilience must be fortified through strategic diversification of raw material suppliers and the cultivation of domestic partnerships to mitigate tariff impacts. Furthermore, dedicating resources to advanced elastomer research will unlock opportunities to introduce next-generation diaphragm materials that combine durability with chemical compatibility, thereby expanding addressable use cases. In parallel, organizations should deepen their aftermarket service offerings by developing remote diagnostics capabilities and modular maintenance programs to enhance client retention and foster long-term revenue streams. Engaging proactively with regulatory bodies and industry consortia will ensure alignment with emerging environmental and safety standards, while collaborative pilot programs with end users can accelerate the co-creation of tailored solutions. Finally, leadership teams must embrace continuous learning initiatives, equipping technical and sales personnel with the expertise required to articulate complex value propositions and navigate evolving market dynamics. By executing these initiatives in a coordinated manner, companies can translate emerging trends into sustainable growth and operational excellence.

Outlining Rigorous Research Protocols and Analytical Frameworks Employed to Ensure Credibility, Objectivity, and Depth in the Pump Market Study

This comprehensive market study has been shaped by a blend of primary and secondary research methodologies, anchored in rigorous data collection and validation protocols. The research team conducted in-depth interviews with senior executives from end-user organizations across chemical production, food processing, mining operations, oil and gas firms, pharmaceutical manufacturers, and water treatment facilities to capture firsthand insights into evolving application requirements. Complementing these discussions, surveys of leading pump suppliers and material producers provided quantitative perspectives on diaphragm innovations, equipment performance benchmarks, and service model preferences. Secondary sources-including industry journals, regulatory filings, and technical white papers-were meticulously reviewed to establish historical context and track regulatory developments. Data triangulation techniques were employed to harmonize insights from multiple channels, ensuring that conclusions rest on convergent evidence rather than isolated observations. Throughout the study, a cross-functional panel of fluid dynamics experts, materials scientists, and market analysts convened periodically to challenge assumptions, validate analytical frameworks, and refine segmentation hypotheses. This iterative process of peer review and methodological cross-checking underpins the credibility and depth of the findings, delivering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air-Operated Double-Diaphragm Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air-Operated Double-Diaphragm Pumps Market, by Pump Type

- Air-Operated Double-Diaphragm Pumps Market, by Material

- Air-Operated Double-Diaphragm Pumps Market, by Flow Rate

- Air-Operated Double-Diaphragm Pumps Market, by End User

- Air-Operated Double-Diaphragm Pumps Market, by Region

- Air-Operated Double-Diaphragm Pumps Market, by Group

- Air-Operated Double-Diaphragm Pumps Market, by Country

- United States Air-Operated Double-Diaphragm Pumps Market

- China Air-Operated Double-Diaphragm Pumps Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings and Strategic Imperatives to Frame the Future Trajectory and Resilience of the Air-Operated Double-Diaphragm Pump Industry

The synthesis of technological trends, tariff influences, segmentation nuances, and regional dynamics underscores a pivotal moment for the air-operated double-diaphragm pump industry. As digital integration and material innovation continue to redefine performance criteria, the ability to anticipate and adapt to shifting regulatory and economic landscapes will determine market leadership. Companies that marry advanced monitoring capabilities with streamlined aftermarket services will secure elevated levels of customer loyalty, while those that strengthen supply chain resilience through diversified sourcing strategies will be better positioned to weather external shocks. Meanwhile, tailored product configurations that align with the specific demands of diverse end-user environments-from sensitive biopharmaceutical applications to rugged mining operations-will drive differentiation in a crowded marketplace. Regional opportunities in the Americas, Europe Middle East & Africa, and Asia-Pacific each present distinct growth avenues, whether through infrastructure renewal projects, stringent compliance requirements, or rapid industrialization. Together, these insights crystallize a set of strategic imperatives: invest in collaborative innovation, prioritize sustainability and efficiency, and cultivate an agile ecosystem capable of delivering bespoke solutions at speed. By internalizing these imperatives, industry participants can chart a resilient growth trajectory and reinforce the role of air-operated double-diaphragm pumps as indispensable assets in modern process engineering.

Join Ketan Rohom in Securing Comprehensive Market Intelligence and Competitive Edge—Invest in the Definitive Air-Operated Double-Diaphragm Pump Study Today

Ready to transform your strategic approach and unlock unparalleled insights into the air-operated double-diaphragm pump market? Ketan Rohom, Associate Director of Sales & Marketing, invites you to secure the comprehensive report that will empower you with the definitive analysis and guidance you need. Take the next step toward informed decision-making and competitive advantage by partnering directly with Ketan to access tailored intelligence and actionable intelligence for your organization.

- How big is the Air-Operated Double-Diaphragm Pumps Market?

- What is the Air-Operated Double-Diaphragm Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?