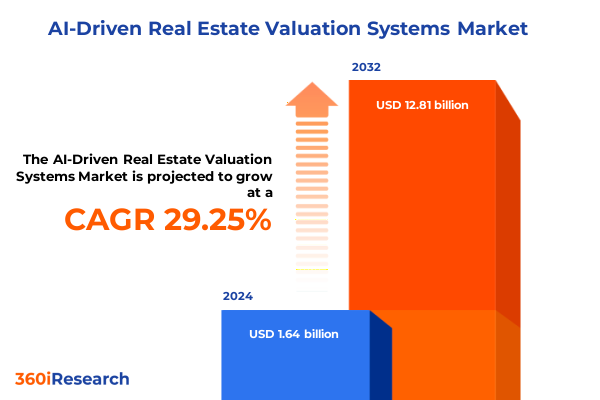

The AI-Driven Real Estate Valuation Systems Market size was estimated at USD 2.10 billion in 2025 and expected to reach USD 2.70 billion in 2026, at a CAGR of 29.42% to reach USD 12.81 billion by 2032.

Setting the Stage for AI-Driven Real Estate Valuation: Unprecedented Precision and Efficiency in Property Assessment through Technological Innovation

In the evolving realm of property assessment, the convergence of artificial intelligence and real estate valuation marks a pivotal inflection point in how stakeholders determine asset worth. For decades, valuation processes have been characterized by manual appraisals, subjective judgment, and fragmented data sources. In contrast, the adoption of AI-driven systems introduces rigorous data integration, algorithmic precision, and rapid processing capabilities that significantly enhance consistency and reduce human error. Against this backdrop, decision makers-from financial institutions and insurers to investors and government bodies-are increasingly seeking automated solutions that align with intensifying regulatory scrutiny, volatile market trends, and the demand for transparent, audit-ready valuations.

This executive summary illuminates the fundamental forces reshaping the valuation landscape, underscores the strategic significance of recent disruptions, and presents a structured road map for leveraging emerging technologies. By examining core shifts such as the rise of deep learning models, the proliferation of real-time data feeds, and the growing importance of explainable AI, readers will gain a holistic understanding of both opportunities and challenges. As a precursor to finer segmentation analyses, regional insights, and company‐level competitive dynamics, this introduction sets the stage for an in-depth exploration of how AI is redefining the art and science of real estate valuation.

Unveiling Disruptive Forces Reshaping Real Estate Valuation: From Computer Vision Breakthroughs to Predictive Analytics Driving Competitive Advantage

The last few years have witnessed transformative advancements that are fundamentally reshaping how real estate valuation is conceived and executed. Breakthroughs in computer vision now allow systems to analyze high-resolution imagery of buildings and surrounding environments, extracting structural details, façade conditions, and even maintenance indicators with unprecedented accuracy. Simultaneously, deep learning networks trained on vast repositories of historical transactions can detect nuanced patterns in market cycles, offering projections that account for seasonality and macroeconomic factors. These capabilities, combined with machine learning algorithms that continuously refine themselves through incoming data streams, enable valuation platforms to learn from evolving trends rather than rely on static rule sets.

Moreover, natural language processing has emerged as a critical enabler for synthesizing unstructured textual data-from zoning regulations and lease agreements to market commentary and social media sentiment-thereby enriching valuation models with qualitative context. Predictive analytics integrates both public records and private data feeds to generate forward-looking insights, guiding strategic investment decisions and risk management frameworks. The integration of edge computing and IoT sensors into built environments further accelerates real-time monitoring of asset performance, enabling dynamic value adjustments based on occupancy rates, energy usage, and even tenant satisfaction.

Transitioning from siloed applications toward holistic, end-to-end platforms, industry participants are forging partnerships with cloud providers to scale compute resources elastically while embedding explainable AI frameworks that satisfy both regulatory expectations and stakeholder demand for transparency. Taken together, these disruptive forces are catalyzing a new era of data-driven valuation that promises to enhance efficiency, strengthen accuracy, and unlock novel opportunities across the real estate ecosystem.

Assessing the Ripple Effects of US Trade Measures on AI-Driven Valuation Systems: Navigating Hardware Cost Inflation and Supply Chain Complexity

In 2025, cumulative US tariffs on imported goods-including high-performance computing hardware, semiconductor components, and sophisticated sensor modules-have introduced both cost pressures and strategic realignments within the AI-driven valuation sector. For solution providers reliant on GPU-optimized servers and specialized imaging sensors, the increased duties on electronics have elevated capital expenditure requirements and prompted renegotiations of supplier contracts. Consequently, many organizations have recalibrated their deployment strategies, shifting from on-premises clusters toward cloud-based environments to convert upfront investments into more predictable operating expenses.

The ramifications extend beyond hardware budgets; supply chain complexities have lengthened lead times for critical components, compelling some firms to diversify manufacturing footprints into Mexico and select Asia–Pacific hubs to mitigate tariff exposure. Cloud service providers have responded to shifting demand patterns with tiered pricing models, explicit cost-pass-throughs, and localized data center expansions to reduce import dependencies. In turn, valuation platforms are recalibrating their pricing structures, introducing usage-based fees and modular service bundles to maintain ROI targets under higher cost bases.

Amid these adjustments, organizations are also leveraging tariff mitigation programs such as bonded warehouses and free trade zone classifications to defer or reduce duties. Strategic procurement teams are exploring component standardization and open-source hardware alternatives to lower overall system complexity. As a result, the 2025 tariff landscape has accelerated a broader industry pivot toward cloud scalability, supply chain resilience, and cost‐efficient architectures-imperatives that will shape competitive positioning in the years ahead.

Decoding Market Segmentation Dynamics across Technology Platforms, Property Categories, Valuation Methodologies, Deployment Models, and End User Applications

A nuanced understanding of the market emerges when examining segmentation across technology, property characteristics, valuation methodologies, deployment, end users, and application. Within technology, computer vision leads initial adoption thanks to its ability to convert visual data into actionable insights, while predictive analytics continues to gain traction by blending macroeconomic indicators with micro-level property metrics. Concurrently, natural language processing is carving out a role in automating document review, and deep learning frameworks are advancing pattern recognition capabilities that underpin more sophisticated algorithms. Machine learning remains the connective tissue that refines these technologies through feedback loops, ensuring models evolve with shifting market dynamics.

When property characteristics are considered, the commercial segment-encompassing office spaces, retail spaces, and warehouses-has been an early beneficiary of AI tools that optimize portfolio valuations. Industrial assets, particularly distribution centers and manufacturing facilities, are leveraging real-time sensor data to enhance cost approach calculations, while residential markets-spanning single-family, multi-family, and condominium categories-are increasingly turning to automated comparative analyses for more timely and consistent assessments. In the realm of valuation methodologies, comparative analysis is being revolutionized through market trend comparison and price-per-square-foot analytics, and cost approaches are becoming more precise via automated construction cost databases. The income approach, too, benefits from AI-powered revenue forecasting modules.

Deployment patterns reveal that cloud-based solutions are favored by high-growth fintechs and platform providers seeking rapid scalability, whereas on-premises configurations persist among institutions prioritizing data sovereignty. Across the end-user landscape, appraisers and valuers are augmenting traditional workflows with AI tools, banks and financial institutions are embedding automated valuations into lending processes, government agencies are streamlining tax assessment, insurers are accelerating claims adjudication, property investors are harnessing portfolio analytics, and real estate agencies are delivering interactive valuation reports. Finally, applications range from commercial property valuation and insurance property valuation to mortgage and lending solutions, market trend and demand analysis, property market forecasting, real estate investment analysis, portfolio management, residential property valuation, and tax assessment. These intersections of segmentation vectors offer a detailed lens to decode market dynamics without reliance on simplistic top-line metrics.

This comprehensive research report categorizes the AI-Driven Real Estate Valuation Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Property Characteristics

- Valuation Methodologies

- Deployment

- End-User

- Application

Uncovering Regional Variations in AI-Driven Real Estate Valuation Adoption: Contrasting Opportunities and Challenges across Americas, EMEA and Asia-Pacific Markets

Regional landscapes for AI-driven valuation exhibit distinct characteristics shaped by regulatory frameworks, data availability, and investment priorities. In the Americas, the United States and Canada have established robust property databases and open-data initiatives, enabling seamless integration of historical transaction records into automated engines. Latin American markets, though less mature, are witnessing emerging proptech ecosystems focused on affordability and green building certifications, demonstrating early signs of rapid digital adoption.

Across Europe, Middle East & Africa, European Union nations are navigating GDPR requirements while pursuing standardized valuation guidelines through pan-European coalitions. The United Kingdom has launched targeted innovation zones for smart city applications, and Germany’s industry bodies are spearheading AI ethics frameworks. In the Middle East, sovereign wealth funds in the UAE and Saudi Arabia are driving large-scale property developments, experimenting with AI to optimize real estate tax regimes. African nations-including South Africa and Kenya-are piloting cloud-based valuation platforms to enhance public sector asset management and attract foreign investment.

In Asia-Pacific, China’s proptech leaders are deploying advanced machine learning models coupled with expansive local data sets, solidifying domestic market leadership. Australia leverages hybrid valuation clouds in mortgage underwriting, while New Zealand explores AI for rural property assessments. India’s burgeoning startup scene is focusing on affordability and inclusive financing platforms, and Japan addresses aging housing stock through predictive maintenance valuations. Southeast Asian governments are integrating AI into smart city master plans, underscoring the strategic role of technology in urban development. These regional nuances underscore the importance of tailored strategies that align with local market maturity, regulatory oversight, and data infrastructure.

This comprehensive research report examines key regions that drive the evolution of the AI-Driven Real Estate Valuation Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders in AI-Driven Real Estate Valuation: Strategic Partnerships, Innovation Portfolios and Competitive Positioning across the Ecosystem

The competitive arena for AI-driven real estate valuation is populated by specialized proptech pioneers, incumbent analytics firms, cloud platform providers, and traditional consultancies adapting to digital imperatives. Leading players such as Zillow have enhanced proprietary Zestimate engines through deep learning architectures and expanded their data partnerships across MLS databases to refine neighborhood-level insights. CoreLogic continues to differentiate itself with a vast repository of property records, integrating predictive analytics modules that cater to institutional clients. Meanwhile, HouseCanary’s hybrid valuation models combine comparative analysis algorithms with forward-looking revenue simulations to deliver multi-scenario forecasts.

In Europe, PriceHubble has secured a stronghold in urban markets by blending geospatial analytics with sociocultural indicators, while emerging startups in Asia-Pacific are collaborating with hyperscale cloud providers to co-develop tailored solutions for diverse housing markets. Major cloud vendors-Microsoft Azure, Amazon Web Services, and Google Cloud-are embedding GPU-enabled services and high-frequency data pipelines directly into their platforms, facilitating seamless deployment of complex AI workflows. Traditional real estate service firms, including CBRE, JLL, and Cushman & Wakefield, are forging strategic alliances or acquiring niche technology companies to internalize AI capabilities and deliver integrated advisory services. Insurance tech players and mortgage service providers are embedding automated valuations into end-to-end processes, accelerating application turnaround times and improving risk models. M&A activity in the space remains vigorous, with larger incumbents acquiring specialized startups to augment their analytic portfolios and broaden geographical reach. This dynamic competitive landscape underscores the imperative for continuous innovation, strategic partnerships, and agile operating models to maintain market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI-Driven Real Estate Valuation Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accurate Group

- Altus Group Limited

- Bowery Valuation, Inc.

- C3.ai, Inc.

- Cherre, Inc.

- Clear Capital, Inc.

- Cloudester

- Compass, Inc.

- CoreLogic

- Daffodil Unthinkable Software Corporation

- eXp World Holdings, Inc.

- HouseCanary, Inc.

- Jones Lang LaSalle

- Lone Wolf Technologies

- Numalis

- Proptech Analytics Inc.

- Quantarium, Inc.

- RealPage Inc.

- Redfin Corporation

- REX Real Estate Inc.

- Skyline AI

- ValueCoders

- Zesty.ai, Inc.

- Zillow Group

- Zonda Group, Inc.

Strategic Imperatives for Stakeholders to Capitalize on AI-Driven Valuation Trends: Integrating Advanced Analytics, Collaborations and Regulatory Alignment

To thrive amid intensifying competition and evolving regulatory expectations, organizations must adopt a set of strategic imperatives that align technology investments with business objectives. First, investing in robust data infrastructure is essential; stakeholders should prioritize the integration of disparate data sources, including IoT sensor streams, public records, and third-party market feeds, to build comprehensive training sets. Equally critical is the implementation of explainable AI frameworks that demystify model outputs and facilitate stakeholder trust, compliance audits, and regulatory reporting.

Fostering strategic partnerships-whether with cloud service providers for scalable compute resources, academic institutions for cutting-edge research, or industry consortia for best-practice development-will accelerate solution development and create pathways for shared innovation. Organizations should pursue a modular solution architecture that enables rapid feature iteration, supports hybrid deployment models, and mitigates the impact of geopolitical trade measures on hardware availability. Engaging with policy makers and regulatory bodies to shape evolving guidelines can ensure alignment with data privacy, consumer protection, and anti-bias mandates while maintaining access to high-quality data.

Workforce upskilling is another imperative; decision makers must invest in cross-functional training programs that equip data scientists, valuation experts, and IT professionals with the skills to collaborate effectively on AI initiatives. Finally, establishing continuous feedback loops with end users-appraisers, underwriters, and investors-will inform iterative improvements, reinforce user adoption, and sustain competitive differentiation. By grounding AI deployments in a clear value proposition, flexible architecture, and collaborative innovation, industry leaders can secure long-term growth and resilience.

Transparent Methodological Framework for AI-Driven Valuation Research: Combining Primary Engagements, Rigorous Data Analysis and Triangulated Validation Techniques

This report harnesses a rigorous, transparent methodology designed to capture both breadth and depth in assessing AI-driven real estate valuation systems. Primary research was conducted through structured interviews with C-level executives, technology architects, and valuation practitioners across diverse regions. An extensive survey complemented these conversations, gathering quantitative feedback from appraisers, financial institution representatives, and government regulators to ensure a balanced perspective.

Secondary research involved systematic reviews of academic literature, technical white papers, regulatory filings, and public data repositories to contextualize market developments. Proprietary datasets and anonymized transaction records were triangulated with third-party databases to validate observed trends. Qualitative insights were further enriched by expert panel roundtables, during which emerging use cases, ethical considerations, and architectural best practices were debated.

Throughout the process, data quality controls-such as cross-validation, outlier analysis, and peer review-were applied to maintain the highest standards of accuracy and objectivity. The resulting framework offers a holistic view of technological advancements, market segmentation, regional variations, and competitive positioning, providing stakeholders with the insights necessary to navigate the complex, rapidly evolving AI-driven valuation landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI-Driven Real Estate Valuation Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI-Driven Real Estate Valuation Systems Market, by Technology

- AI-Driven Real Estate Valuation Systems Market, by Property Characteristics

- AI-Driven Real Estate Valuation Systems Market, by Valuation Methodologies

- AI-Driven Real Estate Valuation Systems Market, by Deployment

- AI-Driven Real Estate Valuation Systems Market, by End-User

- AI-Driven Real Estate Valuation Systems Market, by Application

- AI-Driven Real Estate Valuation Systems Market, by Region

- AI-Driven Real Estate Valuation Systems Market, by Group

- AI-Driven Real Estate Valuation Systems Market, by Country

- United States AI-Driven Real Estate Valuation Systems Market

- China AI-Driven Real Estate Valuation Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Convergence of Technology, Regulation, and Market Drivers: Final Reflections on the Evolution and Future Trajectory of AI-Driven Real Estate Valuation Systems

As AI continues to permeate the real estate valuation ecosystem, the convergence of technology, regulation, and market drivers is ushering in an era characterized by unprecedented precision and adaptability. The maturation of computer vision, deep learning, natural language processing, and predictive analytics has transformed traditional approaches, enabling more consistent, data-driven assessments across diverse property types and geographies. Simultaneously, tariff dynamics and supply chain realignments have accelerated the shift toward cloud-native architectures and modular solution strategies.

Segmentation analyses highlight how different technologies, property categories, and deployment models intersect to create tailored use cases for key stakeholders. Regional insights underscore the necessity of localizing data strategies and regulatory compliance efforts, while competitive profiling reveals a vibrant ecosystem of specialized pioneers and incumbent entities adapting through partnerships and acquisitions. Collectively, these findings illustrate a dynamic landscape where agility, transparency, and collaboration define success.

Looking ahead, organizations that invest in explainable AI, foster cross-sector alliances, and cultivate a culture of continuous innovation will be best positioned to capitalize on emerging opportunities. By integrating customer feedback, maintaining robust data governance, and proactively addressing ethical and regulatory considerations, industry leaders can shape the future of real estate valuation-driving efficiency, enhancing stakeholder trust, and unlocking new avenues for growth.

Engage with Ketan Rohom to Secure Your Comprehensive Market Research Report on AI-Driven Real Estate Valuation and Gain a Competitive Edge in Property Assessment

To explore bespoke insights, strategic analysis, and in‐depth data on AI‐driven real estate valuation tailored to your organization’s goals, engage directly with Ketan Rohom (Associate Director, Sales & Marketing). His expertise and guidance will ensure you receive a comprehensive, actionable report that can drive decision making, streamline property assessment workflows, and position you at the forefront of industry innovation. Reach out today to secure your copy of the complete market research and unlock competitive advantages in property valuation.

- How big is the AI-Driven Real Estate Valuation Systems Market?

- What is the AI-Driven Real Estate Valuation Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?