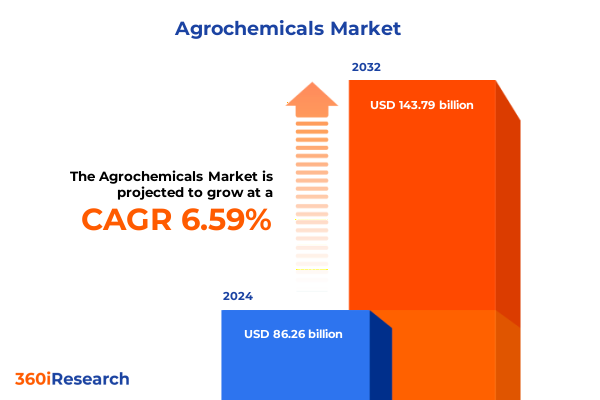

The Agrochemicals Market size was estimated at USD 91.00 billion in 2025 and expected to reach USD 96.02 billion in 2026, at a CAGR of 6.75% to reach USD 143.79 billion by 2032.

Exploring the Foundational Significance of Agrochemicals in Advancing Crop Protection Innovations Amidst Heightened Environmental and Regulatory Expectations

The agrochemical industry stands at the forefront of global food security, tasked with safeguarding crop yields against a backdrop of environmental volatility, regulatory complexity, and mounting consumer demand. As the world population approaches nine billion, stakeholders must navigate a landscape where every incremental advance in crop protection can have profound implications for sustainability and profitability. In this milieu, agrochemicals remain indispensable tools, driving resilience against pests, diseases, and weeds while supporting enhanced productivity across diverse geographies and crop types.

Recent years have witnessed an acceleration in innovation, as companies and research institutions channel investments into next-generation active ingredients, precision application technologies, and eco-friendly formulations. Simultaneously, tightening regulatory frameworks-prompted by public health concerns and environmental imperatives-are reshaping the development pipeline and market entry strategies. Against this complex backdrop, decision-makers require a clear, concise overview of the forces redefining the sector, enabling them to anticipate shifts in supply chains, adjust product portfolios, and forge partnerships that align with evolving stakeholder expectations.

Unpacking the Transformative Shifts Driving the Agrochemical Landscape Through Technological Breakthroughs and Sustainable Practice Integration Worldwide

Over the past decade, the agrochemical sector has undergone transformative shifts as it embraces advanced technologies, new active ingredient classes, and integrated pest-management paradigms. Precision agriculture tools such as drone-based application systems, sensor-driven spray controls, and satellite imagery have increasingly become standard practice, enabling growers to optimize input use, minimize environmental impact, and enhance on-farm profitability. These digital advancements are complemented by breakthroughs in chemistries designed to tackle resistance issues, fostering resilience against evolving pest populations while reducing reliance on broad-spectrum treatments.

Parallel to technological innovation, the rise of sustainable practices has catalyzed the integration of biopesticides alongside traditional chemistries. Regulatory incentives and consumer preferences have accelerated the development of microbial agents, biochemicals derived from plant extracts, and targeted formulations with reduced non-target effects. This shift underscores a broader industry commitment to environmental stewardship, even as companies invest in synthetic molecules with improved safety profiles and crop-specific modes of action. Together, these trends herald a new era of collaboration between agronomists, technology providers, and agrochemical innovators to meet the dual challenge of productivity and sustainability.

Assessing the Cumulative Impact of United States Tariff Implementations in 2025 on Raw Material Costs Supply Chain Dynamics and Competitive Positioning

In 2025, the implementation of revised tariff structures by the United States has exerted considerable pressure on the agrochemical value chain, in particular for active ingredients and intermediates sourced from key manufacturing hubs abroad. Heightened duties on imports from select regions have translated into elevated raw material costs, prompting manufacturers to reassess their supply strategies and negotiate new contracts with alternative suppliers. Many industry participants have responded by diversifying procurement footprints, investing in regional production assets, and pursuing vertical integration to mitigate the risk of sudden tariff escalations.

These measures, however, carry their own challenges. Establishing or expanding production in new jurisdictions demands significant capital outlay, compliance with local regulations, and mastery of emerging logistics frameworks. For smaller players, the burden of navigating complex customs protocols and absorbing margin compression has been especially acute. Large multinationals have leveraged scale advantages to partially offset elevated duties through internal supply chain optimization, though many continue to absorb costs in the short term to preserve market share and uphold service levels. As a result, pricing dynamics within downstream segments such as specialty formulations and crop-specific blends are shifting, underscoring the criticality of agile tariff management and scenario-planning for all stakeholders.

Delivering Deep Segmentation Insights by Product Type Nature Crop Type and Formulation to Illuminate Strategic Opportunities Within the Agrochemicals Market

Delving into product segmentation reveals distinct growth vectors and innovation pockets across fungicides, herbicides, insecticides, and rodenticides. Within the fungicide category, advanced classes such as dithiocarbamates, strobilurins, and triazoles continue to drive enhanced disease control, while herbicide portfolios differentiated by post-emergent and pre-emergent chemistries are evolving to address resistance management through selective and non-selective modes of action. Similarly, the insecticide landscape spans carbamates, neonicotinoids, organophosphates, and pyrethroids, each tailored for specific pest complexes, while rodenticide producers are refining anticoagulant and non-anticoagulant formulations to meet stringent environmental and safety standards.

Beyond product type, the industry’s transition toward nature-based solutions is evident in the expanding role of biopesticides. Biochemicals, microbial agents, and plant extracts increasingly complement synthetic pipelines, reflecting a dual focus on efficacy and ecological compatibility. Similarly, crop segmentation underscores differentiated demand, with cereals and grains commanding robust fungicide and herbicide application rates, fruits and vegetables driving the adoption of targeted insecticides, and oilseeds and pulses favoring integrated solutions that balance yield protection with residue management.

Formulation strategies further illustrate innovation, as stakeholders navigate between dry and liquid formats to optimize field performance. Dustable powders, granules, soluble powders, water-dispersible granules, and wettable powders coexist alongside emulsifiable concentrates, soluble liquids, suspension concentrates, and suspo emulsions. Each formulation class offers unique handling, stability, and application advantages, enabling formulators to tailor products to agronomic requirements, equipment capabilities, and environmental considerations. Together, these segmentation insights provide a multifaceted understanding of where value creation is concentrated and where future investments are likely to yield the greatest return.

This comprehensive research report categorizes the Agrochemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Nature

- Crop Type

- Formulation

- Application

Deciphering Key Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Highlight Growth Drivers and Competitive Disparities

Regional analysis highlights pronounced disparities between the Americas, Europe Middle East and Africa, and Asia Pacific in terms of regulatory frameworks, agronomic priorities, and growth trajectories. In the Americas, robust demand for corn and soybeans underpins sustained herbicide and fungicide consumption, while precision agriculture adoption is among the highest worldwide. The United States’ evolving regulatory environment continues to shape active ingredient approvals and label expansions, creating periodic shifts in product availability and prompting formulators to adapt quickly.

Turning to Europe, Middle East, and Africa, stakeholders contend with a mosaic of regulations driven by the European Green Deal, local legislative bodies, and regional food security imperatives. Farmers in these jurisdictions are increasingly incentivized to reduce synthetic pesticide usage through integrated pest-management programs and CAP reforms, elevating interest in biological alternatives and reduced-risk chemistries. Meanwhile, emerging markets in Africa are experiencing growing investment from multinational and local players seeking to capitalize on rising cereal production and government initiatives to boost food self-sufficiency.

In Asia Pacific, rapid population growth, intensifying land use pressures, and a commitment to modernizing agricultural practices have led to significant increases in agrochemical consumption. China remains a pivotal center for both production and use, with domestic manufacturers scaling up capacities for key intermediates. India and Southeast Asian nations exhibit a growing preference for cost-effective, locally adapted formulations, fostering collaborations between global companies and regional formulators. Consequently, market participants must tailor strategies to accommodate divergent regulatory timelines, infrastructure constraints, and crop-specific treatment preferences across these diverse subregions.

This comprehensive research report examines key regions that drive the evolution of the Agrochemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations Collaborations and Portfolio Diversification Efforts by Leading Agrochemical Companies to Reveal Competitive Differentiators

Leading agrochemical companies are differentiating through targeted investments in research and development, strategic alliances, and portfolio realignment. Major players with extensive synthetic chemistry pipelines are augmenting their offerings with biological solutions, forming joint ventures and licensing agreements with biotech specialists to accelerate market entry. Meanwhile, companies with heritage strengths in microbial and biochemical platforms are scaling up production and refining formulations to compete in broader geographies.

From a strategic perspective, established conglomerates are deepening integration across seeds, traits, and crop protection, offering bundled solutions that promise yield optimization through complementary technologies. Concurrently, specialized firms are carving out niches within high-value segments such as seed treatment, specialty insecticides, and tailored crop-protection packages for premium horticultural markets. This diversification not only spreads risk across multiple vectors but also enables nimble response to emerging regulatory pressures and changing grower preferences.

Moreover, M&A remains a pivotal lever for consolidation and capability acquisition. Recent transactions have centered on biological assets, digital agronomy platforms, and regional formulation assets, often involving collaboration between global multinationals and local champions. This trend underscores the dual mandate of scaling operations while infusing fresh innovation, positioning companies to navigate both the broadened regulatory landscape and the shift toward sustainable, data-driven agriculture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agrochemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADAMA Agricultural Solutions Limited

- AgroFresh Solutions, Inc.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- CF Industries Holdings, Inc.

- Corteva, Inc.

- CVR Partners, LP

- Dow AgroSciences LLC

- Drexel Chemical Company

- DuPont de Nemours, Inc.

- ELS Products Corp

- EuroChem Group

- Gowan Group

- Intrepid Potash, Inc.

- Israel Chemicals Limited

- Mitsui Chemicals Agro, Inc.

- Nufarm Ltd.

- PBI-Gordon Corporation

- SQM SA

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- The Chemical Company

- The Mosaic Company

- UPL Limited

- Yara International ASA

Proposing Actionable Strategic Recommendations for Agrochemical Industry Leaders to Enhance Market Resilience and Drive Sustainable Business Growth

To thrive in a landscape defined by regulatory evolution, supply chain complexity, and sustainability mandates, industry leaders should prioritize a multidimensional approach that integrates R&D, digitalization, and strategic partnerships. It is imperative to intensify research into next-generation active ingredients that address resistance management and reduce environmental footprints, while simultaneously fostering biopesticide pipelines that align with emerging regulations and consumer preferences. Collaborations with academic institutions and specialized biotech firms can accelerate discovery cycles and de-risk development pathways.

At the same time, investing in digital agronomy platforms offers a dual benefit of enhancing customer engagement and generating valuable usage data, which can inform both product optimization and adaptive marketing strategies. Coupled with modular contract manufacturing agreements and geographically diversified supply networks, these digital initiatives enable companies to respond swiftly to tariff fluctuations and logistical disruptions. Furthermore, forging alliances with equipment manufacturers, precision application service providers, and distribution partners will extend reach into underserved markets and bolster service-based revenue streams.

Finally, proactive engagement with regulatory authorities and sustainable agriculture coalitions can help shape policy outcomes and secure preferential treatment for reduced-risk chemistries. By adopting transparent sustainability metrics and publishing progress reports on environmental impact reduction, companies can strengthen their social license to operate and differentiate their brands in an increasingly conscientious marketplace. This holistic strategy will support resilience and competitiveness amid the ongoing transformation of the agrochemical sector.

Detailing the Rigorous Research Methodology Employing Primary Expert Interviews Secondary Data Sources and Robust Analytical Frameworks for Market Validation

The findings and insights presented in this report derive from a robust research methodology combining primary expert interviews, comprehensive secondary data analysis, and rigorous validation protocols. In the primary phase, structured interviews were conducted with R&D heads, regulatory affairs specialists, supply chain executives, and leading agronomists to capture firsthand perspectives on emerging trends, innovation bottlenecks, and market access strategies. These engagements have been instrumental in triangulating qualitative viewpoints with quantitative observations.

For secondary data, a wide spectrum of resources was leveraged, including industry association publications, patent databases, scientific journals, and government regulatory filings. Market intelligence was enriched through comparative analysis of product registrations, licensing announcements, and corporate investor presentations, ensuring a holistic view of competitive dynamics. All data points were cross-verified through multiple sources to mitigate biases and confirm accuracy.

To ensure analytical rigor, the report employs a structured framework incorporating segmentation filters, regional overlays, and scenario stress tests. Key assumptions underpinning tariff impact assessments and supply-chain resilience analyses have been documented and subjected to sensitivity checks. Finally, a peer-review process involving external industry experts and internal stakeholders was undertaken to uphold the report’s objectivity and clarity, delivering a trusted decision-support tool for executives and strategists alike.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agrochemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agrochemicals Market, by Product Type

- Agrochemicals Market, by Nature

- Agrochemicals Market, by Crop Type

- Agrochemicals Market, by Formulation

- Agrochemicals Market, by Application

- Agrochemicals Market, by Region

- Agrochemicals Market, by Group

- Agrochemicals Market, by Country

- United States Agrochemicals Market

- China Agrochemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Consolidating Core Insights and Strategic Imperatives to Guide Stakeholders Toward Informed Decision Making in the Evolving Agrochemicals Sector

In summary, the agrochemical industry is navigating a period of profound change, characterized by mounting regulatory scrutiny, tariff pressures, and a paradigm shift toward sustainable crop protection solutions. Technological advancements in precision application and digital agronomy are unlocking new efficiency frontiers, while growing demand for biopesticides underscores the sector’s commitment to environmental stewardship. At the same time, the 2025 tariff landscape has introduced volatility into supply chains, challenging stakeholders to adopt more agile sourcing and operational models.

Segmentation insights across product types, nature, crop applications, and formulation formats reveal distinct pockets of opportunity and innovation, urging companies to align their strategies with evolving customer expectations and compliance requirements. Regional dynamics further accentuate the need for tailored approaches, from the mature markets of the Americas and EMEA to the high-growth potential of Asia Pacific. Collectively, these forces demand a comprehensive, data-driven roadmap for decision-makers.

This report consolidates critical intelligence on market dynamics, competitive positioning, and actionable strategies, empowering stakeholders to make informed decisions that balance growth aspirations with risk management. As the agrochemical sector steers toward a more sustainable and digital future, organizations equipped with nuanced insights and foresight will be better positioned to seize emerging opportunities and safeguard their competitive edge.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Exclusive Access to the Comprehensive Agrochemical Market Research Report

To gain unparalleled insights and strategic guidance tailored to the agrochemical sector’s evolving dynamics, we invite you to connect directly with Ketan Rohom, Associate Director of Sales and Marketing. Through a brief conversation, you can explore how the comprehensive research report delves into critical trends, segmentation analysis, tariff implications, regional intelligence, and competitive strategies that are shaping the future of crop protection. Engaging with Ketan provides an opportunity to discuss customized data needs, arrange sample excerpts, and secure priority access to the full report’s rich content. Don’t miss this chance to equip your organization with the actionable intelligence required to navigate market challenges and capitalize on emerging opportunities in the agrochemical industry.

- How big is the Agrochemicals Market?

- What is the Agrochemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?