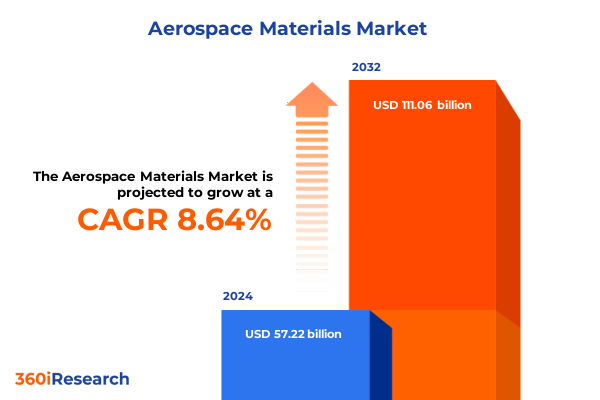

The Aerospace Materials Market size was estimated at USD 62.13 billion in 2025 and expected to reach USD 67.47 billion in 2026, at a CAGR of 8.65% to reach USD 111.06 billion by 2032.

Discovering the Critical Dynamics and Innovations Propelling the Aerospace Materials Sector Toward Sustainable Advancement Amid Complex Global Shifts

The aerospace materials industry stands at a pivotal crossroads where rapid technological advances converging with evolving sustainability mandates are reshaping both production processes and end-use applications. As lightweight composites gain traction alongside next-generation alloys and innovative polymer formulations, stakeholders across the value chain must adapt to maintain competitive advantage. Contextualizing these developments within a dynamic regulatory environment and growing global demand underscores the imperative for organizations to align their R&D and supply chain strategies with emerging market realities.

Over the past decade product performance requirements have become increasingly stringent driven by the pursuit of higher fuel efficiency reduced emissions and enhanced safety margins. In response manufacturers have accelerated the adoption of advanced ceramics for extreme-temperature components while pushing the boundaries of additive manufacturing to achieve complex geometries previously unattainable with conventional methods. Meanwhile, rising defense budgets and renewed space exploration initiatives have intensified demand for specialized materials capable of withstanding harsh operational conditions.

Consequently, aerospace material developers and system integrators are exploring collaborations and strategic partnerships to co-develop solutions that marry material innovation with optimized manufacturing techniques. This introductory section sets the stage for a comprehensive examination of how disruptive technologies, policy shifts and competitive pressures are prompting transformative shifts across material types applications manufacturing processes regionally differentiated markets and leading enterprise strategies.

In-Depth Exploration of Emerging Technological Breakthroughs and Environmental Mandates Revolutionizing Aerospace Materials and Manufacturing Approaches

In recent years the confluence of digitalization electrification and sustainability goals has fundamentally altered the aerospace materials landscape. Digital twins and simulation-driven design are now integral to validating material performance prior to expensive physical prototyping while artificial intelligence systems optimize process parameters in real time. Subsequently, production cycles have become more agile, enabling faster iteration and reduced time to market for new composite formulations and high-performance metal alloys.

Simultaneously new environmental regulations and net-zero emission targets are compelling manufacturers to explore bio-based polymers and recyclable composites that mitigate end-of-life waste streams. This green evolution is complemented by breakthroughs in high-entropy alloys and ceramic matrix composites that offer both reduced weight and exceptional thermal stability. Furthermore, the burgeoning use of directed energy deposition and powder bed fusion technologies is empowering engineers to fabricate bespoke components with minimal material waste, enhancing both resource efficiency and supply chain resilience.

Collectively these technological and environmental drivers are catalyzing a shift from incremental material improvements to more radical innovation cycles. As we delve deeper into the unfolding landscape this section will illuminate the most disruptive trends and their implications for material suppliers OEMs and maintenance providers aiming to secure a leading position in tomorrow’s aerospace ecosystem.

Analyzing How Recent United States Tariff Policies Have Reshaped Supply Chains Sourcing Costs and Strategic Partnerships in Aerospace Materials

United States tariff measures implemented under national security and trade protection statutes have exerted a profound influence on cost structures and supplier relationships within the aerospace materials sector. Section 232 tariffs on aluminum and steel initiated in 2018 have persisted through 2025 and continue to elevate raw material expenditures for domestic producers, prompting many to reevaluate sourcing strategies and inventory management practices. As a result, value chain participants are progressively shifting toward long-term supply agreements with trusted producers outside the affected tariff brackets.

In parallel, the broader trade policy environment has introduced volatility in freight rates and customs clearance timelines, leading firms to diversify logistics routes and invest in nearshoring options. These measures have fostered a geographic reassessment of manufacturing footprints, as companies balance material cost fluctuations against labor rates and lead time considerations. Eventually, the cumulative effect has been a recalibration of supplier portfolios, with greater emphasis on partnerships that deliver consistent quality and predictable pricing, even under changing tariff regimes.

Looking ahead stakeholders must continue to navigate tariff uncertainties by leveraging trade compliance tools, exploring free trade agreements and advocating for industry-specific tariff exclusions. Understanding how these policy shifts reshape competitive dynamics is essential for designing resilient strategies that preserve margins and maintain uninterrupted component flow in a market where agility and foresight are increasingly paramount.

Interpreting Critical Material type Application Manufacturing End Use and Channel Segmentation to Uncover High-Impact Aerospace Materials Niches

Segmentation analysis reveals distinct growth drivers and innovation hotspots across material types applications manufacturing processes end uses and distribution channels in the aerospace realm. Ceramics excel in high-temperature resistance for turbine blades and engine casings, whereas composites such as carbon fiber and glass fiber dominate lightweight airframe structures and interior components that prioritize weight savings without sacrificing durability. Nickel and titanium alloys continue to serve as workhorse metals for critical engine parts, while thermoset polymers and elastomers are essential for vibration damping and structural seals.

When considering applications the empennage and wing assemblies leverage ceramic matrix composites for thermal resilience, while avionics housings incorporate thermoplastics and high-strength metals for protection and weight reduction. Engine components rely on nickel alloys in disc and casing fabrication, and cabin interiors increasingly integrate polymer-based panels and flooring materials for passenger comfort and regulatory compliance. Across manufacturing processes additive manufacturing techniques like directed energy deposition are unlocking design liberties in complex parts, while traditional casting and forming methods persist for high-volume components.

In terms of end use commercial and defense aviation segments demand robust performance and certification traceability, whereas space exploration necessitates materials that endure extreme thermal and radiation environments. Aftermarket channels focus on maintenance repair and overhaul facilitation through ready availability of spare composites and metal alloys, while OEM channels concentrate on tiered supply chain collaboration for precision-engineered components. Understanding these layered segmentation insights is critical for stakeholders seeking to align product portfolios with the most lucrative aerospace niches.

This comprehensive research report categorizes the Aerospace Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Application

- End Use

- Distribution Channel

Illuminating Regional Trends Across Americas Europe Middle East Africa and Asia Pacific Highlighting Distinct Aerospace Materials Dynamics

The aerospace materials sector exhibits pronounced regional differentiation driven by local regulatory frameworks, infrastructure maturity and strategic national priorities. In the Americas, established manufacturing hubs benefit from advanced R&D ecosystems and extensive defense procurement pipelines, fostering early adoption of high-performance composites and additive manufacturing installations. Concurrently, supply chain integration across Mexico, Canada and the United States streamlines cross-border logistics and scale efficiencies for metal alloys and polymer suppliers.

Europe, the Middle East and Africa present a mosaic of market drivers where stringent emissions standards and commitments to green aviation propel demand for recyclable materials and sustainable production methods. Aerospace clusters in Western Europe lead in ceramic matrix composite innovation, while Gulf nations invest heavily in airport infrastructure, stimulating growth in interior components and avionics material supply. Moreover, industrial policy incentives in select EMEA countries are accelerating the localization of critical alloy and fiber production to reduce import dependency.

In Asia-Pacific, dynamic commercial aviation expansion and burgeoning defense budgets underpin robust growth in metals and composite uptake. China’s strategic focus on self-reliance in materials drives domestic alloy development and fiber production capacity, whereas Southeast Asian aerospace facilities increasingly integrate advanced thermoplastics and joining processes. Across all regions collaboration between material innovators and OEMs is intensifying as companies tailor offerings to address divergent certification requirements and operational profiles unique to each geographic market.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Innovations Partnerships and Competitive Positioning of Leading Players Driving the Evolution of Aerospace Materials

Industry leaders are distinguishing themselves through targeted innovation, strategic partnerships and vertical integration efforts aimed at enhancing performance and reducing costs. Key players in composite manufacturing are investing in proprietary resin formulations and fiber architectures that deliver superior strength-to-weight ratios, while metal producers are exploring novel alloying techniques and thermomechanical treatments to achieve unprecedented fatigue resistance in engine components.

Strategic joint ventures between materials developers and OEMs have emerged to fast-track component validation protocols and accelerate certification timelines. By co-locating research facilities near major aerospace hubs companies gain direct feedback on application-specific requirements and can iterate material properties more efficiently. Additionally, MRO-focused consortiums are streamlining spare part availability by leveraging digital inventory management enabled by IoT sensors and predictive analytics.

Furthermore, several leading enterprises have forged alliances with automation and software firms to integrate robotics and AI-driven quality control into production lines. This digital transformation not only enhances consistency across complex multi-material assemblies but also supports real-time traceability critical for compliance with rigorous aerospace standards. Through these strategic initiatives, prominent organizations are positioning themselves at the forefront of tomorrow’s aerospace materials market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Gurit Holding AG

- Hexcel Corporation

- Honeywell Aerospace

- Koninklijke Ten Cate N.V.

- Mitsubishi Chemical Holdings Corporation

- Northrop Grumman

- Owens Corning

- PPG Industries, Inc.

- Safran SA

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Toray Industries, Inc.

Proposing Pragmatic Strategic Initiatives and Collaborative Pathways for Industry Leaders to Navigate Opportunities Challenges and Competitive Pressures

Industry participants should prioritize a balanced innovation portfolio that simultaneously addresses sustainability imperatives and performance excellence. By combining bio-derived polymer research with advanced ceramic composite development, organizations can mitigate environmental impact while maintaining thermal and structural integrity. Moreover, fostering open innovation ecosystems with academic institutions will accelerate breakthrough discoveries and cultivate a talent pipeline equipped to tackle complex material challenges.

In parallel, enterprises must reinforce supply chain resilience by diversifying procurement sources and adopting digital trade compliance platforms. Building nearshore manufacturing capabilities for critical alloys and fibers can shorten lead times and reduce exposure to geopolitical risks. Equally important is the implementation of advanced forecasting tools that leverage machine learning to anticipate material demand fluctuations and proactively manage inventory buffers.

Finally, forging cross-industry alliances with adjacent sectors such as automotive and renewable energy will unlock opportunities to repurpose proven material solutions and scale manufacturing capacities. Collaborative platforms that pool expertise in additive manufacturing, recycling technologies and quality assurance will deliver economies of scale and drive down unit costs. By embracing these strategic pathways industry leaders will not only navigate imminent challenges but also capture emerging growth in the global aerospace materials arena.

Detailing Rigorous Data Collection Analytical Frameworks and Validation Techniques Underpinning Insights into the Aerospace Materials Market Landscape

This research framework was constructed through a multi-tiered methodology combining primary interviews secondary data analysis and advanced analytical modeling. Initially, subject matter experts across material science, aerospace manufacturing and supply chain management were interviewed to glean qualitative insights on innovation trajectories, regulatory impacts and competitive dynamics. These discussions formed the basis for defining key segmentation variables and evaluation metrics.

Subsequently, an extensive review of peer-reviewed journals, industry publications and patent filings provided quantitative evidence of emerging material properties, process capabilities and application breakthroughs. Statistical correlation techniques and cross-referenced validation checks ensured consistency and reliability of data points, while sensitivity analyses highlighted the degree of impact attributable to each market driver.

Finally, the integration of proprietary supply chain databases with customized scenario planning tools enabled the simulation of tariff variations, production scale shifts and regional adoption rates. This rigorous approach ensured that insights are grounded in empirical evidence and reflect real-world operational constraints. Throughout the process, stringent quality assurance protocols including peer reviews and data triangulation were applied to maintain the highest level of accuracy and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Materials Market, by Material Type

- Aerospace Materials Market, by Manufacturing Process

- Aerospace Materials Market, by Application

- Aerospace Materials Market, by End Use

- Aerospace Materials Market, by Distribution Channel

- Aerospace Materials Market, by Region

- Aerospace Materials Market, by Group

- Aerospace Materials Market, by Country

- United States Aerospace Materials Market

- China Aerospace Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Summarizing Core Findings Strategic Imperatives and Future Outlook for Stakeholders in the Dynamic and Complex Aerospace Materials Domain

In reflecting on the multifaceted trends shaping aerospace materials it becomes evident that adaptability and collaboration will define success in the years ahead. Sustained pressure from environmental mandates and cost volatility will continue to drive innovators toward advanced composites, high-performance alloys and sustainable polymers. At the same time, digital transformation in manufacturing and supply chain orchestration will unlock new operational efficiencies and foster closer integration across the value chain.

To thrive amid evolving regulatory frameworks and geopolitical uncertainties, stakeholders must remain vigilant in monitoring policy developments, material breakthroughs and shifting end-use requirements. Embedding agility into both R&D roadmaps and procurement strategies will ensure organizations can pivot swiftly to capture emerging opportunities. Ultimately, those entities that effectively balance technological leadership with resilient supply networks and proactive partnerships will secure long-term competitive advantage in the global aerospace materials arena.

Engage with Ketan Rohom Associate Director Sales Marketing to Access Comprehensive Insights Drive Informed Decisions and Propel Aerospace Materials Success

To gain unparalleled visibility into the latest advancements material innovations and competitive trends shaping the aerospace materials market request your personalized executive briefing from Ketan Rohom Associate Director Sales & Marketing. Leverage expert analysis strategic recommendations and bespoke insights to align your organization’s initiatives with evolving industry demands and maximize return on material investments. Ensure your team is equipped to forge resilient supply chains capitalize on emerging technologies and navigate regulatory landscapes effectively by securing full access to the comprehensive market research report.

Connect directly with Ketan to arrange a tailored walk-through of critical findings discuss specific challenges your organization faces and determine how the report’s actionable intelligence can drive your strategic roadmap forward. Empower your organization to make evidence-based decisions accelerate product development cycles and strengthen competitive positioning in the global aerospace materials arena. Claim your copy today and transform insights into measurable growth.

- How big is the Aerospace Materials Market?

- What is the Aerospace Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?