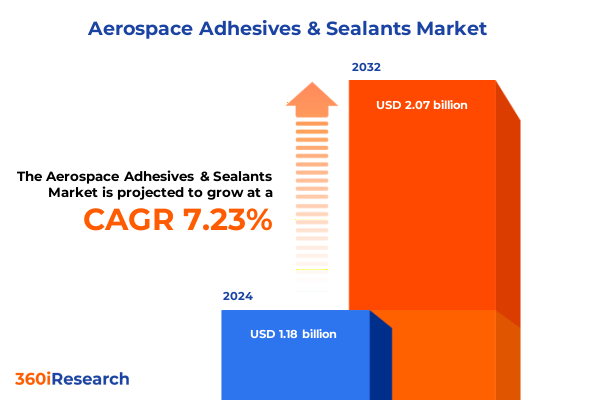

The Aerospace Adhesives & Sealants Market size was estimated at USD 1.27 billion in 2025 and expected to reach USD 1.35 billion in 2026, at a CAGR of 7.28% to reach USD 2.07 billion by 2032.

Forging New Horizons in Aerospace Adhesives and Sealants through Advanced Materials Innovation Regulatory Foresight and Strategic Collaboration

Aerospace adhesives and sealants stand at the forefront of enabling the next generation of high-performance aircraft, satellites, and space vehicles. As engineers and designers push the boundaries of lightweight materials and multifunctional structures, the demand for bonding solutions that combine strength, durability, and environmental resilience has never been greater. Innovations in polymer science, curing technologies, and process automation are redefining how components are joined and sealed, directly influencing safety margins and lifecycle costs.

This intersection of material evolution and manufacturing sophistication presents both significant opportunities and complex challenges for suppliers, original equipment manufacturers, and maintenance providers. Rapid advancements in areas such as thermally conductive adhesives, low-outgassing sealants, and 3D-printable resins create pathways to reduce assembly time and enhance structural performance. However, navigating regulatory compliance, qualification protocols, and certification requirements demands a high level of expertise and coordination across the value chain.

In this executive summary, we delve into the transformative trends shaping the aerospace adhesives and sealants market, assess the ramifications of recent tariff implementations, and uncover segmentation insights that illuminate where value is concentrated. This foundational overview sets the stage for strategic decision making, equipping industry stakeholders with the knowledge necessary to harness emerging technologies, mitigate supply risks, and capture the growth potential that lies ahead.

Navigating the Paradigm Shift in Aerospace Bonding Solutions Accelerated by Sustainability Demands Digitalization and Next-Generation Adhesive Chemistry

The aerospace adhesives and sealants landscape is undergoing a profound metamorphosis driven by sustainability imperatives, digital integration, and the advent of next-generation chemistries. Manufacturers are increasingly adopting bio-derived polymers and low-volatile organic compound formulations to meet stringent environmental regulations and reduce their carbon footprint. Simultaneously, digital twins and in-line process monitoring systems are enabling real-time quality assurance, allowing for predictive maintenance and minimized production waste.

Concurrently, breakthroughs in nanoparticle-enhanced adhesives and microencapsulated sealant technologies are unlocking properties once thought unattainable, such as self-healing bonds and enhanced thermal stability under extreme conditions. These innovations are not only elevating product performance but are also stimulating cross-industry collaboration, with aerospace suppliers partnering with material science specialists and software developers to co-create integrated solutions.

Moreover, the rise of additive manufacturing is reshaping supply chains by enabling on-demand production of customized parts bonded with novel adhesive formulations. As legacy manufacturing paradigms give way to flexible, digital-first workflows, stakeholders must adapt their strategic frameworks to leverage data-driven insights, establish agile sourcing networks, and invest in workforce upskilling to fully capitalize on these transformative shifts.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Aerospace Adhesives and Sealants Supply Chain Economics and Procurement Strategies

The introduction of new tariff schedules by the United States in early 2025 has introduced a cumulative layer of complexity to the aerospace adhesives and sealants ecosystem. Previously seamless cross-border exchanges of specialty polymers and curing agents now face elevated duties, affecting landed costs and inventory strategies. Suppliers have responded by reevaluating their vendor partnerships, seeking near-shore alternatives, and exploring tariff mitigation strategies such as bonded warehousing to preserve margin integrity.

These tariffs have also intensified bilateral negotiations and prompted companies to accelerate localization of critical formulations. By establishing domestic production capabilities or securing long-term fixed-price contracts, stakeholders aim to shield their operations from further volatility. Such efforts not only mitigate risk but also foster deeper integration with local industry clusters, stimulating innovation hubs focused on adhesives and sealants research.

Importantly, the additional duties have spurred end users to scrutinize total cost of ownership rather than unit pricing alone. Maintenance, repair, and overhaul facilities are recalibrating their specification standards to incorporate lifecycle performance data, ensuring that higher upfront material costs are justified by extended service intervals and reduced downtime. In sum, the 2025 tariff measures have catalyzed a strategic realignment across procurement, production, and application domains.

Unlocking Critical Market Dynamics through Deep Product Type Form Form Application and End Use Industry Segmentations in Aerospace Adhesives and Sealants

Deep-diving into the market through product type lenses reveals distinct value drivers within adhesives and sealants. Non structural adhesives, encompassing anaerobic and silicone-based variants, excel in applications requiring flexible bonding and ease of disassembly, such as avionics enclosures and cabin panels. Structural adhesives, including acrylic, epoxy, and polyurethane chemistries, underpin primary load-bearing joints across wings and fuselage assemblies, delivering high shear strength and resistance to extreme environments.

Form segmentation highlights the nuanced roles of film, liquid, paste, and tape. Precut and rolled films enable precise, automated application in high-volume production lines, while one- and two-component liquids offer versatility for complex geometries in repair scenarios. Bulk and cartridge pastes cater to in-field maintenance needs, and double- or single-sided tapes provide rapid bonding solutions for lightweight composite panels with minimal preparation.

Application-based segmentation underscores the criticality of composite joining, sealing, and structural bonding functions. Composite panels, fiber metal laminates, and sandwich panels rely on specialized adhesives for panel-to-frame integration. Sealing challenges in fuel tanks, cabin pressurization, and avionics enclosures demand low-permeability compounds with long-term durability. Structural bonding of empennage, fuselage, and wing assemblies necessitates chemistries that offer both immediate handling strength and fatigue-resistant properties under cyclic loading.

Evaluating end use industries uncovers dynamic demand across commercial aircraft, maintenance repair overhaul, military defense, and spacecraft sectors. Single aisle and wide body jets drive high-volume adhesives consumption, while heavy maintenance operations prioritize rapid-curing sealants that minimize aircraft ground time. Defense platforms, from fixed-wing fighters to unmanned aerial vehicles, require robust materials that withstand harsh operational conditions, whereas spacecraft applications push the envelope of thermal stability and outgassing performance.

This comprehensive research report categorizes the Aerospace Adhesives & Sealants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Technology

- Substrate

- Application

- End Use

- Distribution Channel

Unveiling Regional Performance Trends across Americas Europe Middle East Africa and Asia Pacific for Aerospace Adhesives and Sealants Deployment

Regional dynamics in the aerospace adhesives and sealants market reflect both matured demand centers and rapidly expanding growth corridors. The Americas continue to anchor global consumption through leading OEM clusters, advanced MRO networks, and a burgeoning space launch sector. Stakeholders in this region benefit from proximity to raw material producers and established qualifications infrastructure, yet they must also navigate evolving regulatory frameworks and tariff-induced cost pressures.

Across Europe Middle East and Africa, the confluence of legacy aerospace manufacturing in Western Europe with emerging hub development in the Gulf states creates a unique blend of stable demand and ambitious capacity expansion. Companies in this region are capitalizing on joint ventures and public-private partnerships to develop localized sealant production lines, ensuring supplies for both commercial and defense programs while achieving compliance with REACH and related regulatory regimes.

The Asia Pacific region is experiencing the most accelerated growth trajectory, driven by rising aircraft fleet expansions in China India and Southeast Asia. Localization efforts are underway as domestic airframers and maintenance operators seek to reduce import dependencies. Simultaneously, technology transfer initiatives and collaborative R&D programs are fostering indigenous capabilities in advanced adhesive chemistries, positioning the region not only as a consumer but also as an emerging innovator in aerospace bonding solutions.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Adhesives & Sealants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Alliances Driving Technological Advancement and Competitive Advantage in Aerospace Adhesives and Sealants

Leading players in the aerospace adhesives and sealants landscape are distinguished by their commitment to material science excellence, strategic alliances, and robust quality management systems. Industry frontrunners are investing heavily in collaborative research partnerships with universities and government laboratories to co-develop novel formulations that satisfy next-generation performance requirements. These alliances often extend into joint qualification campaigns alongside OEM customers, expediting adoption cycles.

In parallel, dynamic mergers and acquisitions have reshaped the competitive environment, with specialty chemical companies acquiring niche adhesive manufacturers to broaden their product portfolios. This consolidation trend not only enhances geographic footprint and scale efficiencies but also fosters integrated solutions combining adhesives with thermal interface materials, protective coatings, and acoustic dampening layers.

Furthermore, some market leaders are pioneering digital transformation initiatives, embedding sensors within sealant dispensers and leveraging cloud-based analytics to capture application metrics across production lines and MRO facilities. By harnessing this data, they offer value-added service agreements that optimize inventory management, reduce waste, and assure consistent joint performance across global operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Adhesives & Sealants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel N.V.

- Arkema Group

- AVERY DENNISON CORPORATION

- BASF SE

- Central Tapes & Adhesives Ltd.

- Chemique Adhesives & Sealants Ltd.

- Dow Inc.

- DuPont de Nemours, Inc.

- Dymax Corporation

- General Sealants, Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Huntsman International LLC

- Hylomar Group

- Illinois Tool Works Inc.

- InSpec Solutions by Industrial Technology Systems Ltd.

- Jaco Aerospace

- Kohesi Bond

- L&L Products, Inc.

- Master Bond Inc.

- Momentive Performance Materials Inc. by KCC Corporation

- Parker Hannifin Corporation

- Permabond LLC

- PPG Industries, Inc.

- PPI Adhesive Products Ltd.

- Rogers Corporation by DuPont de Nemours, Inc.

- Solvay S.A.

- Tesa Tapes (India) Private Limited

- Vitrochem Technology Pte Ltd

- Wacker Chemie AG

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Supply Chain Disruptions in Aerospace Bonding Technologies

Industry leaders must embed sustainability as a core pillar of their growth strategies by accelerating the adoption of low-emission adhesive chemistries and circular economy principles. By partnering with material recyclers and bio-based polymer providers, companies can reduce lifecycle environmental impact while differentiating their offerings in an increasingly green-conscious marketplace.

Simultaneously, diversification of supply bases through near-shoring and strategic stockpiling can buffer against tariff volatility and logistical disruptions. Organizations should conduct comprehensive supplier risk assessments that account for geopolitical shifts and raw material price fluctuations, ensuring resilient procurement frameworks that safeguard critical production timelines.

Investment in digital manufacturing capabilities will continue to pay dividends. Piloting digital twin environments and integrating smart dispensing technologies can drive process optimization and quality consistency. As such, upskilling technical workforces in data analytics and automation is essential to fully harness the benefits of these advanced systems.

Finally, forging deeper collaborations with OEMs, MRO operators, and regulatory bodies will be crucial to streamline qualification pathways and accelerate time-to-market for breakthrough formulations. Coordinated cross-sector initiatives can establish standardized testing protocols, reduce duplication of effort, and unlock shared value across the aerospace ecosystem.

Detailing the Rigorous Research Approach Combining Primary Expert Interviews Secondary Industry Data and Triangulated Analytical Frameworks

This report’s methodology is grounded in a multi-tiered research framework that combines exhaustive secondary data gathering with targeted primary investigations. The secondary phase entailed reviewing technical white papers, government regulations, patent filings, and corporate disclosures to map the broader market landscape and identify prevailing trends in materials innovation and regulatory developments.

The primary research component involved structured interviews with senior R&D managers, procurement directors, and certification specialists across OEMs and tier suppliers. These qualitative conversations provided nuanced perspectives on application-specific challenges, emerging performance criteria, and the real-world impact of tariff shifts on sourcing strategies. Interview insights were complemented by quantitative surveys that captured end user prioritization of attributes such as cure time, peel strength, and environmental compliance.

To ensure data validity and minimize bias, findings underwent triangulation through cross-referencing multiple information sources and statistical techniques. Market segmentation definitions were rigorously vetted with industry experts to align product, form, application, and end use categories with on-the-ground realities. Regional analyses incorporated trade flow data and macroeconomic indicators to contextualize growth patterns within the Americas Europe Middle East Africa and Asia Pacific.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Adhesives & Sealants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Adhesives & Sealants Market, by Product Type

- Aerospace Adhesives & Sealants Market, by Form

- Aerospace Adhesives & Sealants Market, by Technology

- Aerospace Adhesives & Sealants Market, by Substrate

- Aerospace Adhesives & Sealants Market, by Application

- Aerospace Adhesives & Sealants Market, by End Use

- Aerospace Adhesives & Sealants Market, by Distribution Channel

- Aerospace Adhesives & Sealants Market, by Region

- Aerospace Adhesives & Sealants Market, by Group

- Aerospace Adhesives & Sealants Market, by Country

- United States Aerospace Adhesives & Sealants Market

- China Aerospace Adhesives & Sealants Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Concluding Perspectives on the Future Trajectory of Aerospace Adhesives and Sealants Shaped by Innovation Sustainability and Evolving Market Dynamics

The aerospace adhesives and sealants sector is poised at a pivotal juncture where innovation, sustainability, and geopolitical factors converge to shape its future trajectory. Material science breakthroughs in self-healing bonds and high-temperature-resistant sealants promise to extend component lifecycles and enhance safety margins, while digital manufacturing technologies offer unprecedented process control and transparency.

Simultaneously, evolving regulatory landscapes and tariff regimes compel stakeholders to adopt agile supply chain strategies and localized production models. The interplay of these forces creates an environment that rewards nimble organizations capable of aligning product development roadmaps with shifting environmental mandates and defense procurement priorities.

Ultimately the path forward demands a delicate balance between cutting-edge innovation and rigorous qualification standards. Stakeholders who cultivate collaborative ecosystems, invest in digital transformation, and maintain a clear focus on sustainability will be best positioned to capitalize on the dynamic growth opportunities within aerospace adhesives and sealants. As this market continues to evolve, the insights presented in this report will serve as a compass guiding strategic decision making and competitive differentiation.

Connect with Ketan Rohom to Secure Comprehensive Aerospace Adhesives and Sealants Market Insights and Propel Your Strategic Decision Making Today

Engaging with the nuanced complexity of the aerospace adhesives and sealants market demands specialized intelligence that aligns with your strategic imperatives. Ketan Rohom, Associate Director of Sales & Marketing, extends a personal invitation to explore how each layer of this comprehensive market research report can inform your product roadmaps, procurement tactics, and innovation pipelines. His extensive experience working alongside leading aerospace OEMs and tier suppliers uniquely positions him to guide you through the actionable insights compiled in this study.

By connecting directly with Ketan, you gain privileged access to tailored consultations that distill global market trends into concrete opportunities for your organization. Whether you seek to refine your regional growth strategy, optimize your material selection processes, or benchmark your competitive positioning against industry frontrunners, Ketan’s expertise will ensure you extract the maximum value from this investment. Seize the advantage of forward-looking data coupled with strategic counsel to accelerate decision making and drive sustained growth in the rapidly evolving aerospace adhesives and sealants sector.

- How big is the Aerospace Adhesives & Sealants Market?

- What is the Aerospace Adhesives & Sealants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?