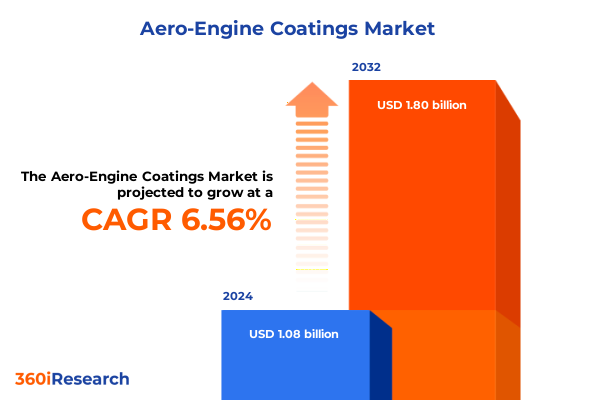

The Aero-Engine Coatings Market size was estimated at USD 1.15 billion in 2025 and expected to reach USD 1.22 billion in 2026, at a CAGR of 6.67% to reach USD 1.80 billion by 2032.

Introduction to Fundamental Catalysts and Emerging Technologies Driving Revolutionary Advances in Aero-Engine Coatings Performance and Durability

Aero-engine coatings have evolved from simple protective barriers into complex multifunctional systems engineered to withstand extreme temperatures, corrosive environments, and mechanical wear. This introduction overviews the confluence of escalating regulatory requirements, intensifying fuel-efficiency targets, and the drive for extended maintenance cycles that have collectively heightened interest in cutting-edge surface treatments. By mitigating oxidation, thermal fatigue, and particulate erosion, modern coatings play a pivotal role in improving engine reliability, reducing downtime, and enabling next-generation turbine designs.

Against this backdrop, material science breakthroughs and process innovations are unlocking new performance thresholds. Nano-scale thermal barrier coatings and advanced high-velocity oxy-fuel sprays complement emerging deposition techniques, delivering tailored microstructures that optimize heat management. Simultaneously, digital process controls and in-line sensing technologies are revolutionizing quality assurance, ensuring uniformity across intricate geometries. These synergistic developments set the stage for a vibrant arena of competition and collaboration, where stakeholders ranging from specialized materials providers to global OEMs are redefining the balance between cost-effectiveness and technical excellence.

Unveiling Major Developments and Paradigm Shifts Redefining the Competitive Terrain and Value Chain Dynamics in Aero-Engine Coatings

The landscape of aero-engine coatings is undergoing a fundamental transformation fueled by a convergence of technological, regulatory, and market forces. Additive manufacturing has enabled novel component geometries, demanding coatings that can adapt to intricate internal passages and conformal surfaces. At the same time, the integration of digital twins and artificial intelligence into deposition processes is elevating control over microstructural properties and enhancing predictive maintenance capabilities.

On the regulatory front, stringent emissions standards and noise-reduction mandates are intensifying pressure on engine designers and materials suppliers to collaborate on coatings that contribute to lower specific fuel consumption and extended overhaul intervals. Moreover, heightened scrutiny of supply chain sustainability is steering raw material sourcing toward recycled alloys and bio-derived process consumables. As a result, partnerships between coating specialists, engine manufacturers, and environmental bodies are spawning new business models centered on circularity.

This paradigm shift is further amplified by the emergence of agile start-ups and research consortia that are challenging legacy practices with open-innovation platforms. In aggregate, these transformative currents are not only redefining performance benchmarks but also reshaping the competitive terrain, compelling established players to reimagine their value propositions and go-to-market strategies.

Examining the Ripple Effects of Newly Imposed United States Tariffs on Raw Materials and Coating Technologies in the Aero-Engine Industry

In 2025, newly imposed tariffs by the United States on critical raw materials and specialized coatings technologies have introduced fresh complexities into cost structures and procurement strategies. By targeting key alloy imports and select thermal spray consumables, these measures have elevated input costs for many downstream suppliers. As a consequence, manufacturers are exploring diversified sourcing options across allied markets to mitigate exposure, including qualifying alternative vendors in lower-tariff jurisdictions.

The upstream impact is equally significant: coating technology innovators face longer lead times for imported components, prompting a reexamination of localized production facilities and strategic stockpiling. To offset the financial burden, some companies are accelerating investments in process automation and material efficiency techniques, thereby squeezing incremental waste out of high-volume operations. Meanwhile, engine OEMs and maintenance providers are renegotiating vendor contracts to redistribute tariff-related surcharges more equitably along the value chain.

Looking ahead, the tariff landscape is likely to remain fluid as trade negotiations progress, requiring agile response frameworks. Stakeholders who proactively model multiple scenarios, engage with policy makers, and cultivate in-region supply alliances will be best positioned to navigate these headwinds while preserving margin integrity and delivery reliability.

Gaining Actionable Perspectives by Dissecting Market Segmentation across Engine Types End Users Materials Applications Coating Types and Technologies

An in-depth segmentation lens reveals how divergent coating requirements manifest across myriad engine configurations, end-use contexts, substrate materials, functional zones, coating chemistries, and deposition techniques. From turbofan, turbojet, turboprop to turboshaft platforms, each engine type exerts unique thermal and mechanical demands that dictate tailored barrier, corrosion-resistant, or wear-resistant formulations. At the same time, the distinction between maintenance-focused MRO providers and original equipment manufacturers drives preference for rapid-cycle repair coatings versus long-life OEM applications.

Material substrate selection further refines coating strategies, as aluminum alloys require different adhesion promoters than nickel-based superalloys, steel, or titanium alloy cores. Irrespective of substrate, the application zone-from the combustion chamber through the compressor sections, nozzles, to the turbine stages-introduces distinct heat flux and erosive challenges that coatings must counteract. Moreover, key coating families ranging from anti-fouling and corrosion protection to thermal barrier and wear resistance offer customizable performance trade-offs.

Underpinning these functional layers are diverse deposition routes such as chemical vapor deposition, physical vapor deposition, and thermal spray. Each technology branch, whether atmospheric or low-pressure CVD, electron beam PVD or magnetron sputtering, and air plasma spray versus high-velocity oxy-fuel, delivers specific microstructures and coating densities. This complex segmentation framework empowers stakeholders to pinpoint optimal solutions along multiple intersecting vectors of engine architecture, operating profile, and lifecycle economics.

This comprehensive research report categorizes the Aero-Engine Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Base Material

- Coating Type

- Technology

- End User

- Application

Exploring Distinct Growth Drivers Challenges and Opportunities across Americas Europe Middle East Africa and Asia Pacific Regions

Regional dynamics in the aero-engine coating arena exhibit significant variation driven by localized regulatory regimes, innovation ecosystems, and maintenance infrastructures. In the Americas, robust defense budgets and a strong commercial fleet backbone continue to underpin demand for advanced thermal barrier and corrosion-resistant coatings, while nearshoring initiatives aim to reduce lead times for critical spare parts. Collaboration between North and South American research institutions is also accelerating the adoption of sustainable binder systems.

Across Europe, the Middle East, and Africa, stringent emissions and noise regulations in Western Europe contrast with rapid fleet expansions in the Gulf region and North Africa. This dichotomy is fueling dual pathways: legacy operators retrofit existing fleets with next-generation wear-resistant overlays, whereas emerging carriers prioritize lightweight thermal barrier solutions to optimize fuel economy. Robust maintenance hubs in Europe also serve as innovation testbeds for digital inspection and recoating workflows.

Meanwhile, the Asia-Pacific region leads in production volume growth, with significant investments in domestic engine assembly and MRO capabilities. China, Japan, South Korea, and India are reinforcing their downstream coating capacities to support indigenous engine programs. Coupled with aggressive capital deployment by Asian coatings conglomerates, this trend is reshaping global supply balances and intensifying competition on both price and technical performance fronts.

This comprehensive research report examines key regions that drive the evolution of the Aero-Engine Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Strategic Partnerships and Competitive Differentiators Shaping the Future of Aero-Engine Coating Solutions Worldwide

An analysis of leading market participants highlights a competitive spectrum ranging from global chemical and materials conglomerates to specialized composite and ceramic coating innovators. Some enterprises have forged strategic alliances with aerospace OEMs to co-develop next-generation high-temperature barrier systems, while others are investing in digitized coating platforms that integrate real-time process monitoring sensors. Joint ventures between established players and nimble start-ups are also proliferating, marrying deep coating expertise with agile software capabilities.

Meanwhile, mergers and acquisitions have redefined competitive positioning, with several large firms acquiring regional coating specialists to broaden their geographical footprint and diversify their product portfolios. These transactions underscore a strategic shift toward vertically integrated value chains, in which suppliers can offer end-to-end solutions from substrate pre-treatment to final inspection. Additionally, a subset of companies is differentiating through sustainability credentials, certifying low-emission spray booths and circular recycling of overspray materials.

In sum, the competitive landscape is characterized by dynamic collaboration, targeted consolidation, and technology-led differentiation. Stakeholders that balance scale with specialization, invest in joint innovation models, and articulate clear sustainability roadmaps will likely emerge as the dominant forces shaping the future of aero-engine coatings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aero-Engine Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&A Thermal Spray Coatings

- Akzo Nobel N.V.

- APS Materials, Inc.

- Axalta Coating Systems, LLC

- BASF SE

- Bodycote PLC

- CASwell Inc.

- Chromalloy Gas Turbine LLC

- Compagnie de Saint-Gobain S.A.

- Curtiss-Wright Corporation

- CVD Equipment Corporation

- DuPont de Nemours, Inc.

- Flame Spray SpA

- General Electric Company

- H.C. Starck Solutions

- Henkel AG & Co. KGaA

- Hentzen Coatings, Inc.

- Honeywell International Inc.

- Howmet Aerospace Inc.

- IHI Ionbond AG

- Indestructible Paint Limited

- Lincotek Group S.p.A.

- MDS Coating Technologies Corp.

- Metallisation Limited

- MTU Aero Engines AG

- OC Oerlikon Corporation AG

- PPG Industries, Inc.

- Praxair S.T. Technology Inc. by Linde PLC

- SilcoTek

- Turbocam Inc.

Strategic Roadmap and Tactical Recommendations for Industry Leaders to Capitalize on Emerging Trends and Navigate Regulatory Complexities in Aero-Engine Coatings

Industry leaders must adopt a multifaceted strategy to harness growth opportunities while mitigating regulatory and supply-chain risks. First, prioritizing the digitalization of coating operations-from AI-driven recipe tuning to automated surface inspections-can deliver immediate gains in process consistency and throughput. Concurrently, establishing dual-sourcing arrangements for critical alloys and consumables will buffer against tariff fluctuations and geopolitical disruptions.

Additionally, forming cross-industry partnerships with engine OEMs, defense agencies, and research consortia can accelerate co-innovation pipelines. By engaging in precompetitive research initiatives focused on advanced ceramic and self-healing coatings, organizations can share development costs and fast-track certification cycles. It is equally vital to align product roadmaps with evolving sustainability mandates, such as low-VOC binder systems and recyclable overspray mitigation, thereby strengthening environmental credentials.

Finally, embedding scenario-based planning into strategic roadmaps-modeling alternative tariff outcomes, raw material price trajectories, and regulatory shifts-will enhance decision-making agility. By continuously recalibrating investment priorities and commercial terms in real-time, stakeholders can stay ahead of emergent market inflection points and secure lasting competitive advantage.

Comprehensive Research Framework and Multi-Stage Methodological Approach Ensuring Data Integrity and Actionable Insights in Aero-Engine Coating Market Analysis

The research framework underpinning this analysis integrates both primary and secondary data to ensure a robust and comprehensive perspective. Primary inputs include in-depth interviews with coating technology architects, procurement leads at major engine manufacturers, MRO executives, and regulatory specialists. These conversations provide granular insights into real-world challenges, investment priorities, and future product performance criteria.

Secondary research encompasses a meticulous review of industry reports, white papers, technical patent filings, and regulatory filings. Overlaying this, an exhaustive vendor profiling exercise evaluates operational footprints, technology roadmaps, and financial disclosures, while an ongoing tracking mechanism monitors mergers and partnership announcements. Data triangulation is achieved through cross-referencing multiple sources and validating findings with subject-matter experts to minimize bias and ensure factual integrity.

Quantitative modeling incorporates both top-down and bottom-up approaches, calibrating market sizing assumptions against detailed end-user feedback and verified shipment data. Throughout the methodology, rigorous quality checkpoints-such as double-blind survey validation and peer review sessions-are employed to uphold the highest standards of accuracy and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aero-Engine Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aero-Engine Coatings Market, by Engine Type

- Aero-Engine Coatings Market, by Base Material

- Aero-Engine Coatings Market, by Coating Type

- Aero-Engine Coatings Market, by Technology

- Aero-Engine Coatings Market, by End User

- Aero-Engine Coatings Market, by Application

- Aero-Engine Coatings Market, by Region

- Aero-Engine Coatings Market, by Group

- Aero-Engine Coatings Market, by Country

- United States Aero-Engine Coatings Market

- China Aero-Engine Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Critical Insights Core Findings and Strategic Imperatives to Guide Stakeholders in the Evolving Aero-Engine Coating Ecosystem

This executive summary encapsulates the multifaceted dynamics shaping the aero-engine coating sector, from disruptive technological inflection points and evolving tariff regimes to the nuanced segmentation intricacies and regional growth divergences. Core findings underscore the imperative of embracing digitalized deposition platforms, diversifying supply chains in response to policy shifts, and forging collaborative innovation ecosystems that span OEMs, suppliers, and regulatory bodies.

Strategic imperatives include aligning R&D investments with sustainability mandates, optimizing multi-vector segmentation strategies to address distinct engine architectures and operating profiles, and maintaining scenario-based readiness for tariff and raw material volatility. Practically, success will hinge on an organization’s ability to integrate real-time data analytics into both process controls and strategic planning, thereby converting market signals into decisive action.

As stakeholders navigate this rapidly evolving landscape, those who assimilate these insights into coherent, agile roadmaps will be best placed to capitalize on emerging opportunities. The resilience and adaptability of coating solutions-coupled with precise alignment to operational demands-will distinguish market leaders and set the performance benchmarks for the next generation of aero-engine technologies.

Take Action Now Secure Your Competitive Edge and Unlock Exclusive Aero-Engine Coating Market Intelligence with Personalized Guidance from Sales Leadership

Act now to secure unparalleled aero-engine coating intelligence tailored for your strategic decision making by connecting with Ketan Rohom, Associate Director of Sales & Marketing, who stands ready to guide you through our comprehensive market analysis offerings. His expertise will ensure you select the report package that aligns perfectly with your organizational objectives, whether you seek deep technical appraisal or high-level strategic insight. Through a personalized consultation, you will gain clarity on how the findings address your technical challenges and growth ambitions.

Don’t miss the opportunity to leverage this carefully curated research to sharpen your competitive edge and inform your next move in the dynamic aero-engine coatings space. Reach out today to Ketan Rohom to arrange a briefing or to request a complimentary executive extract that highlights the most critical data points relevant to your business priorities. The window to act ahead of policy shifts and technological transitions is narrowing, and early access to actionable intelligence is what separates market leaders from followers.

Unlock the full potential of your investment in research by partnering with a trusted advisor who understands both the technical nuances of advanced coatings and the strategic imperatives of a fast-evolving aerospace sector. Contact Ketan Rohom to purchase the full market research report and transform insights into impact.

- How big is the Aero-Engine Coatings Market?

- What is the Aero-Engine Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?